Pepe (PEPE) has recently grabbed the headlines, having hit a new all-time high (ATH) this week. The meme coin has also drawn the attention of crypto whales who have accumulated the crypto token lately. Whales accumulating the meme coin will suggest that now might be a good time to buy PEPE, but that might not be the case.

Crypto Whales Buy 720 Billion PEPE Tokens

On-chain analytics platform Lookonchain recently drew the crypto community’s attention to a whale who purchased 520 billion PEPE from the crypto exchange Binance. This move might, however, have been motivated by the fear of missing out (FOMO), as Lookonchain noted that this trader hasn’t always made the smartest investment moves, having lost $6.1 million so far.

Meanwhile, on-chain data shows another whale who bought over 200 billion PEPE tokens through the trading firm Cumberland. Irrespective of their intention, crypto whales accumulating a crypto token usually paints a bullish outlook for the coin in question. Based on this, crypto investors will usually assume that this is an excellent time to buy the meme coin in expectation of further price surges.

However, this might not be a good time to buy, as data from IntoTheBlock suggests that a price dump may be imminent for PEPE before it makes another move to the upside. The market intelligence platform revealed that 100% of PEPE holders were in profit thanks to the meme coin hitting a new ATH.

Given such development, many of these holders are expected to book profits from their PEPE investment, leading to a wave of sell-offs that could negatively impact the meme coin’s price. Therefore, those looking to invest in PEPE right now may be better off waiting for PEPE to bottom out from this selling pressure before purchasing the meme coin.

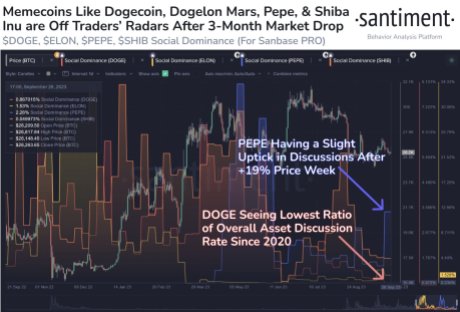

Still Has Enough Bullish Momentum To Go

Crypto analyst and trader Rachid Crypto recently highlighted several factors that suggest that PEPE has yet to reach its peak. The analyst noted that the “mega meme cycle” and altcoin season are yet to begin. These are events that could still spark a further rally in the meme coin’s price.

Furthermore, PEPE is yet to be listed on major crypto trading platforms like Coinbase and Robinhood. That means there is still a lot of liquidity that could flow into the meme coin’s ecosystem. PEPE’s price will likely enjoy an upward trend whenever these trading platforms decide to list the meme coin.

Meanwhile, Rachid Crypto also stated that Ethereum will surpass its ATH, meaning that PEPE’s price will benefit from ETH’s run when this happens. PEPE’s price is known to have some correlation with Ethereum’s and will most likely enjoy a significant rally as Ethereum’s price picks up.

At the time of writing, PEPE is trading at around $0.00001056, down over 5% in the last 24 hours, according to data from CoinMarketCap.

If you are riding the wave of

If you are riding the wave of