The savvy cryptocurrency trader is up over 15,000 fold on his initial $3,000 Pepe investment in just one month.

Cryptocurrency Financial News

The savvy cryptocurrency trader is up over 15,000 fold on his initial $3,000 Pepe investment in just one month.

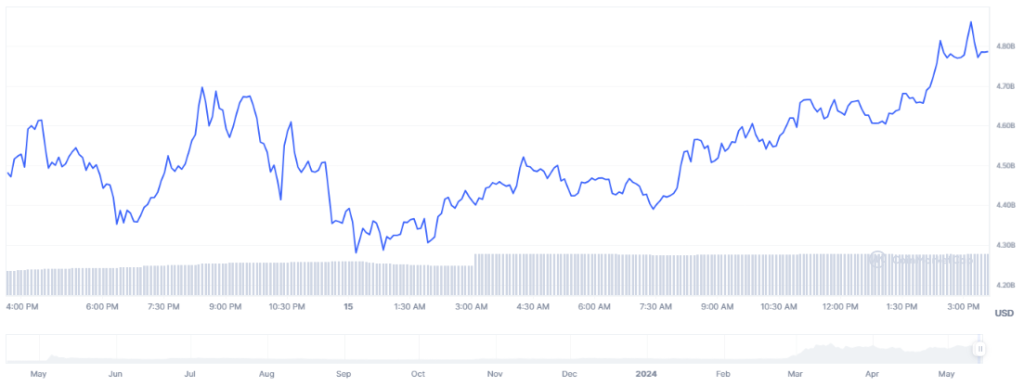

The internet’s resident amphibian is back in the spotlight, but this time Pepe the Frog isn’t gracing troll forums – he’s maneuvering his way to the top of the cryptocurrency charts. PEPE, the meme coin named after the internet legend, is experiencing a historic surge, fueled by a potent mix of nostalgia and retail investor fervor.

PEPE’s recent ascent is nothing short of meteoric. Trading volume has skyrocketed by an impressive 300% in the past 24 hours, with the price reaching an all-time high. This dramatic rise coincides with a resurgence in Gamestop (GME) stock, leading many to believe that the retail investor army of 2021 is back for round two, armed with meme coins as their weapon of choice.

The return of Keith Gill, better known online as “Roaring Kitty,” has acted as a rallying cry for these digital warriors. Gill’s surprise post on his dormant Reddit account sent shockwaves through the market, reigniting the nostalgic flames of the original Gamestop saga. Analysts suggest this nostalgia has spilled over into the crypto market, sparking a full-blown meme coin craze.

PEPE, already experiencing a steady climb since mid-April, has emerged as the unlikely champion of this digital meme menagerie.

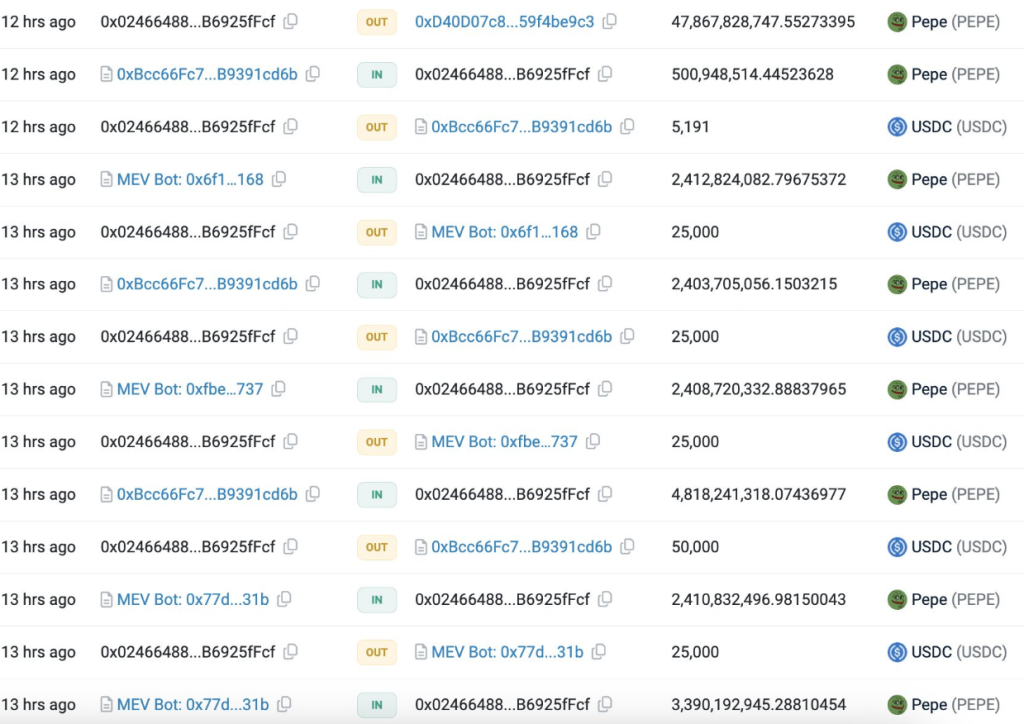

It’s not just the small-time investors driving the PEPE surge. Big money, or “whales” in crypto speak, are also diving headfirst into the frenzy. On-chain data reveals a whale recently splashing out a cool 1.86 million USDC for a whopping 195 billion PEPE tokens. Another whale scooped up a hefty 406 million PEPE, further propelling the price upwards.

This guy spent 1.86M $USDC to buy 195B $PEPE 12 hours ago and has now made an unrealized profit of $236K.https://t.co/TSngBKN2yC pic.twitter.com/Oszxx3nIO2

— Lookonchain (@lookonchain) May 14, 2024

But Is It All Golden Memes And Rainbows?

While PEPE’s current trajectory is a dream come true for early adopters, a cautionary tale lurks beneath the frothy surface. Meme coins are notorious for their wild volatility. Their value is often built on hype and fleeting internet trends, not robust financial fundamentals. This means a sudden shift in sentiment could trigger a dramatic price crash, leaving investors holding the Pepe bag.

Related Reading: Bullish On Ethereum: Analyst Predicts Crypto’s Imminent Takeoff

Furthermore, PEPE is a relatively new player in the crypto game, with an uncertain future. Unlike established cryptocurrencies, PEPE lacks a proven track record. Its long-term viability remains a question mark.

Featured image from @GameStopPepe/X, chart from TradingView

PEPE price is up over 10% and outpacing other meme coins. The price could continue to rise toward the $0.0000125 level in the near term.

In the past few sessions, PEPE saw a steady increase above the $0.000010 resistance. It outpaced Bitcoin ,Ethereum, and MEME coins. There was a 10% increase, and the bulls were able to push the price above the $0.0000110 level.

It traded as high as $0.00001148 and is currently consolidating gains. The price is holding gains above the 23.6% Fib retracement level of the upward move from the $0.00000959 swing low to the $0.00001148 high. It is also well above the $0.000011 and the 100-hourly Simple Moving Average.

Immediate resistance is near the $0.0000115 level. There is also a breakout pattern forming with resistance at $0.0000115 on the hourly chart of the PEPE/USD pair.

The first key resistance is near $0.00001155. A close above the $0.00001155 resistance zone could send the price higher. The next key resistance is near $0.000012. If the bulls remain in action above the $0.000012 resistance level, there could be a rally toward the $0.0000125 resistance. Any more gains might send the price toward the $0.0000132 resistance.

If PEPE fails to clear the $0.0000115 resistance zone, it could start a downside correction. Initial support on the downside is near the $0.0000110 level. The next major support is at $0.0000105 or the 50% Fib retracement level of the upward move from the $0.00000959 swing low to the $0.00001148 high.

If there is a downside break and a close below the $0.0000105 level, the price might accelerate lower. In the stated case, the price could even drop below the $0.000010 support zone.

Technical Indicators

Hourly MACD – The MACD for PEPE/USD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for PEPE/USD is now above the 60 level.

Major Support Levels – $0.0000110 and $0.0000105.

Major Resistance Levels – $0.0000115 and $0.0000120.

On Monday, popular internet figure and trader “Roaring Kitty” made a surprise comeback to social media that sent the crypto market into shock and excitement.

His return post was followed by a series of cryptic videos, including catsm, which seemingly fueled a price increase for cat-themed memecoins in the past 24 hours.

Keith Gill, known as “The Roaring Kitty,” returned to social media after a three-year hiatus by posting the popular “leaning forward in the chair” meme.

— Roaring Kitty (@TheRoaringKitty) May 13, 2024

His comeback propelled GameStop’s meme stock (GME) price to rise 201% in the past day, as he was a major player during the 2021 meme stock frenzy.

Alongside the image, the trader shared a series of video edits that also fueled the memecoin market. As reported by News BTC, Wolverine-inspired memecoins soared after featuring the Marvel character in one of his edits.

Other big players in the sector saw green numbers in the following hours, like Pepe (PEPE) and many of the top market cap dog-themed memecoins.

As part of the ripple effect, the largest frog-themed memecoin has flipped Solana (SOL) in its daily trading volume, registering a 238% increase in volume in the past day.

Moreover, smart traders benefited from the surge after buying large token amounts. According to Lookonchain, one whale bought 195 billion PEPE, worth $1.98 million, and had already made $236,000 in unrealized profit a few hours later.

The impact of Roaring Kitty’s return didn’t stop at the dog-themed memecoins. Several images and references to cats were part of the trader’s edits, fueling a 16% surge in the cat-themed sector.

Feline-inspired memecoins have been gaining popularity during this cycle, with tokens like cat in dog word (MEW) and Popcat (POPCAT) joining the top-ten memecoins list in the past month.

One of Roaring Kitty’s edits included a fragment of Florence + The Machine’s song “Dog Days Are Over.” Alongside the video, the trader emphasized the lyrics, “The dog days are over, the dog days are done.”

— Roaring Kitty (@TheRoaringKitty) May 13, 2024

Additionally, he added cat images, seemingly insinuating that a future memecoin rally could be led by cat-themed memecoins instead of the usual dog-themed ones.

Whales Hear The ROAR

Lookonchain reported that, alongside GME, the memecoin Roaring Kitty (KITTY) skyrocketed 13,000%. Other feline-themed tokens, including POPCAT, MichiCoin (MICHI), and Roaring Kitty (ROAR), also saw a significant surge.

Popcat has registered a 24.4% and 276% increase in the one-day and monthly timeframes, while MichiCoin surged 38.9% in the past day and 333.5% since its launch on April 26. Both tokens also saw an 80% increase in the daily trading volume.

Among the top gainers were the tokens inspired by the trader. The Ethereum-based SOAR skyrocketed over 1162% in hours, going from $0.00024830 to $0.0031338. This surge also represented a massive 3216.8% increase in the weekly timeframe, with a similar daily trading volume increase of 826%.

Per the report, whales took advantage of the momentum and loaded their bags with these tokens. One whale withdrew SOL from Binance and bought 490,400 POPCAT, worth around $235,472.

Another big player, who had previously made 2,170 SOL, about $320,000, on POPCAT, spent another 4,000 SOL, approximately $592,000, to buy POPCAT and MICHI tokens. The whale acquired 587,3830 POPCAT for 2,000 SOL and 626,616 MICHI for the same amount.

Memecoins rally, and PEPE hits a new all-time high shortly after GameStop stock trader Keith Gill posts to his Roaring Kitty X account for the first time in 3 years.

GameStop, the video game retailer that took Wall Street by storm in 2021, has once again become the talk of the town as its share price surges 100%.

Fueling this rally is the return of the influential social media figure Keith Gill’s “Roaring Kitty.” After a long hiatus, Roaring Kitty’s recent activity on social platforms, including an image and video, has ignited excitement among investors and triggered a renewed frenzy for GameStop’s meme stock and the emerging world of memecoins.

The meme-stock phenomenon gained widespread attention in 2021 when cash-rich investors pumped up the stock market and bet against short-selling hedge funds.

Keith Gill’s “TheRoaringKitty” account and the subreddit “WallStreetBets” played a pivotal role in the meme stock frenzy, driving stocks like GameStop and AMC Entertainment to surge over 1,000% by the end of the same year.

While some early investors reaped rich returns, hedge funds such as Gabe Plotkin’s Melvin Capital Management suffered significant losses, leading to closures.

According to Bloomberg, short sellers betting against GameStop initially enjoyed gains in the year’s first four months. Still, the volatile nature of meme stocks quickly erased those paper gains. Per the report, “skeptics” were up an estimated $400 million from January to April before slipping into the red by Monday morning.

The percentage of GameStop shares sold short relative to those available for trading has remained at approximately 24%, a relatively high level for a typical company but significantly lower than the 140% levels witnessed during the 2021 mania.

As GameStop’s shares gained momentum, the cost to bet against the company increased. Recent data from S3 indicates borrowing costs exceeding a 10% annual financing fee range.

Roaring Kitty’s influence extended beyond GameStop, as Wolverine-themed memecoins flooded various blockchains. In response to a social media post featuring a video of Marvel superhero Wolverine, more than 30 new tokens were launched on platforms like Ethereum and Solana, as data by Dextools shows.

Notably, the newly minted “Roaring Wolverine” token on the Ethereum blockchain experienced an astonishing 80% surge within hours of its release.

Furthermore, the memecoin market has witnessed a notable resurgence, with tokens such as Dogecoin (DOGE), Shiba Inu (SHIB), Pepe (PEPE), Dogwifhat (WIF), Floki Inu (FLOKI), and Bonk Inu (BONK) recording significant gains, according to CoinGecko data.

For instance, PEPE, the market leader, surged by 15% in the past 24 hours, complementing its 20% uptrend over the previous week. It reached a new high of $0.00001077 during early Monday trading.

Ultimately, GameStop’s meme stock resurgence, fueled by the return of Roaring Kitty, inflicted substantial losses on short sellers of the meme stock on Monday.

The impact of Roaring Kitty’s social media presence has extended to the memecoin market, with several Wolverine-themed tokens experiencing significant surges.

Featured image from Shutterstock, chart from TradingView.com

Bitcoin price looks stuck in the near term, but TON, RNDR, PEPE and AR could surprise traders by making a strong upside move.

This represents a 15x increase compared to the S&P 500’s year-to-date returns.

The once-booming meme coin Pepe (PEPE) has hit a rough patch, experiencing a price drop of nearly 10% in the past 24 hours. This sudden downturn comes amidst a flurry of questions surrounding massive token withdrawals from a major exchange and the overall future of the meme-inspired cryptocurrency.

Just a few months ago, PEPE was riding high, capturing the attention of crypto enthusiasts with its rapid price surges. However, the tides seem to have turned. The recent price drop has cast a shadow of uncertainty over the meme coin’s future trajectory.

While some might attribute the dip to a typical correction in the volatile cryptocurrency market, recent on-chain data paints a more intriguing picture.

According to Etherscan, a blockchain analytics platform, a massive withdrawal of nearly 1 trillion PEPE tokens, valued at almost $8 million, occurred two days ago. The origin of the transfer remains shrouded in mystery, with a high-security Gnosis Safe Proxy wallet facilitating the movement.

This wasn’t an isolated event either. Data reveals another withdrawal of 322.48 billion PEPE tokens, worth around $2.7 million, from the same shadowy address just a day prior.

The timing of these hefty transactions couldn’t be more perplexing. They coincided with an unexpected 17% surge in PEPE’s price, leading to speculation and fear, or FUD, within the cryptocurrency community.

Theories range from market manipulation tactics to the possibility of unforeseen regulatory crackdowns, causing jitters among investors.

Community Sentiment: Bullish Despite The Wobble

Interestingly, despite the price drop and surrounding uncertainty, CoinGecko data indicates that the PEPE community remains largely bullish. This unwavering optimism is further bolstered by the influx of 703 new PEPE holders in the past day.

Prominent cryptocurrency figures like renowned analyst David Gokhshtein, who thinks PEPE will continue to be Dogecoin’s major rival in the imminent bull market anticipated later this year, are fanning the bullish flames.

I think you’ll see a crazy battle between $PEPE & $DOGE this meme season.

— David Gokhshtein (@davidgokhshtein) May 6, 2024

Investing In PEPE: Proceed With Caution

Meanwhile, as the community sentiment leans towards optimism, and some experts see significant growth potential, the recent price drop and the enigma surrounding the large token withdrawals highlight the inherent volatility of the cryptocurrency market.

Featured image from KnowYourMeme, chart from TradingView

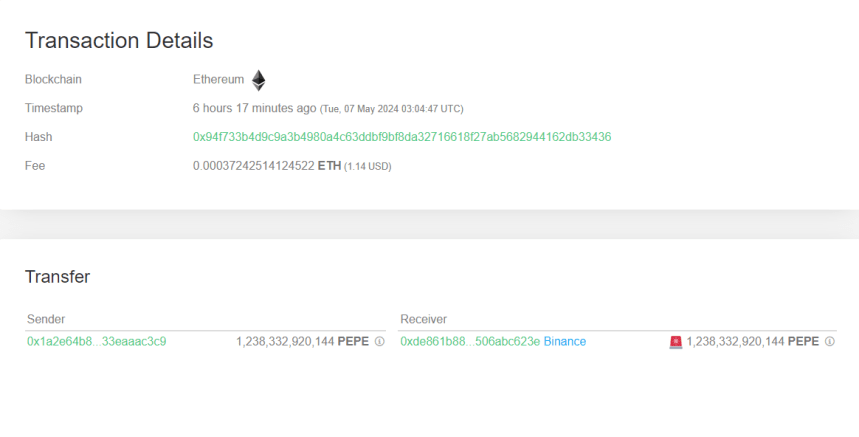

On-chain data shows PEPE whales have moved large amounts of the memecoin during the past day. Here’s where these tokens have been heading.

According to data from the cryptocurrency transaction tracker service Whale Alert, two large PEPE transactions have occurred in the space of a few hours during the past day. Both of these moves are of a scale that’s typically associated to the whales, humongous entities that can carry some influence in the market thanks to their ability to make such large transfers.

Because of their position on the network, their moves can be worth watching, as they may end up reflecting on the price of the cryptocurrency. As for how exactly the asset may be impacted by the transfers of these investors can come down to what they intended to achieve with the moves.

It can be hard to say about any exact motive, but the details of the transactions on the blockhain can sometimes provide hints about the context surrounding it.

Below are the details of the first PEPE whale transfer from the past day:

As is visible, the sending address in the case of this PEPE whale transaction was an unknown wallet, meaning that it was unattached to any known centralized platform like an exchange. Such wallets are usually the investors’ personal, self-custodial addresses.

The receiving address, on the other hand, does have a platform affiliated to it: the cryptocurrency exchange Binance. Thus, it would appear that the whale moved 1,238,332,920,144 PEPE (worth over $10.5 million at the time the transfer went through) from their personal wallet to the custody of the exchange.

Transfers of this type are known as exchange inflows. The investors make exchange inflows whenever they want to make use of one of the services that these platforms provide, which can include selling. As such, exchange inflows can end up being bearish for the price.

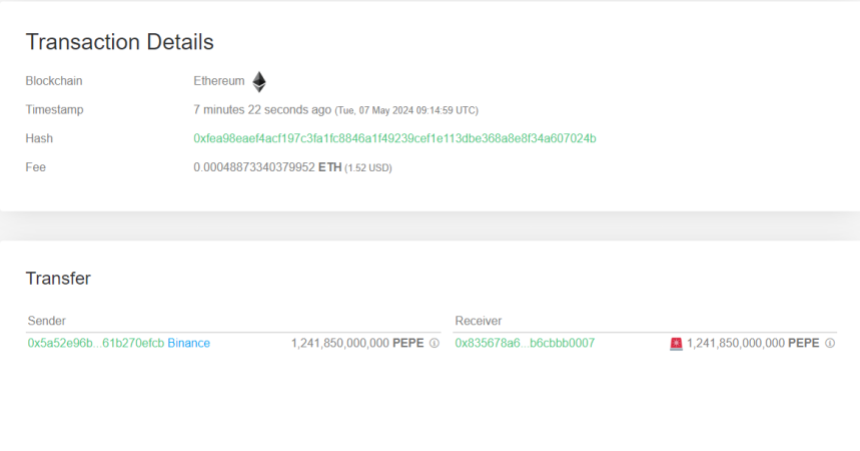

If the whale, in the current case, indeed made the deposit to sell, then PEPE could naturally be negatively impacted, given the large scale of the transaction. Fortunately for the investors of the meme coin, though, the second transaction from today is actually the exact opposite of this transfer; it’s an exchange outflow.

As displayed above, this PEPE whale moved coins from Binance to an unknown wallet through this transaction. Investors generally transfer to personal addresses when they plan to hold in the long term, as it’s safer to do so outside the custody of central entities. Thus, it’s possible this whale plans to HODL these coins.

Interestingly, the amount involved in this move, 1,241,850,000,000 PEPE ($10.5 million), is quite similar to the exchange inflow. Given that the same exchange is also involved in both, it’s possible that the same whale may in fact be responsible for the both of them.

Though, since the addresses don’t quite match, it’s still uncertain. Either way, the fact that an equal-sized exchange outflow has occurred mere hours after should be able to balance out any bearish effects arising out of the inflow, at least in theory.

At the time of writing, PEPE is floating around the $0.000008445479 mark, up more than 21% over the past week.

A crypto whale’s transaction involving the third-largest meme coin by market cap, PEPE, has drawn the crypto community’s attention. The magnitude of the transaction, coupled with some other whale transactions, suggests that it may be high time to pay more attention to PEPE.

On-chain analytics platform Spotonchain revealed a wallet (3eAaAC3C9) that had purchased 1.238 trillion PEPE from Binance at an average price of $0.000008424 ($10.4 million). This wallet then proceeded to withdraw the tokens in two transactions. On-chain data shows that the whale withdrew 322.5 billion PEPE in the first transaction and the remaining 915.85 billion PEPE in the second transaction.

At the time of writing, the whale hasn’t moved the tokens, suggesting they may be looking to hold for the long term. Some notable smart traders look to have been accumulating the meme coin lately, most likely in anticipation of significant price moves from it. Spotonchain also recently revealed two whales that had withdrawn 660.7 billion PEPE from Binance and MEXC.

The platform also mentioned another whale that withdrew 322.48 billion PEPE ($2.68 million) from Binance for the first time. More recently, Spotonchain drew the crypto community’s attention to a smart trader who has been profiting from the meme coin since last year. This trader is said to have completed 8 trades and realized a cumulative profit of $917,000.

Seeing how PEPE has performed since the start of the year, these whales’ interest in the meme coin isn’t surprising. Data from CoinMarketCap shows that PEPE has made a year-to-date (YTD) gain of over 500%, and this bullish momentum looks to be far from over. Interestingly, many traders have yet to jump on the the wave, as just over 200,000 persons hold the meme coin.

Crypto analyst Plazma recently suggested that PEPE could soon hit a new all-time high. PEPE’s current ATH is at $0.00001074, with the meme coin trading just 20% below this price level. Crypto analyst Yazan also hinted that meme coin would soon hit a new all-time high, asking his followers if they were ready for this to happen.

PEPE is currently ranked as the thirtieth largest crypto token by market cap and is likely to climb higher if it eventually hits a new ATH. Crypto analyst and trader Murad believes that the meme coin could rise to the top 10 crypto tokens by market cap since he predicted that PEPE could flip Shiba Inu (SHIB) and possibly Dogecoin (DOGE).

At the time of writing, the meme coin is trading at around $0.000008615, down in the last 24 hours, according to data from CoinMarketCap.

The cryptocurrency market may be experiencing a cool down, but one meme coin is refusing to catch a cold. PEPE, a token emblazoned with the internet’s famous frog, has defied recent bearish trends with a surge in price and trading activity. This resilience has fueled speculation of a potential “bullish breakout” in the coming days, with some analysts predicting astronomical gains.

While Bitcoin and Ethereum have taken a breather in recent weeks, PEPE has exhibited surprising strength. Unlike its more established counterparts, PEPE hasn’t succumbed to the broader market chill. In fact, the meme coin has managed to inch up slightly this week and even enjoyed a nearly 10% price jump in the last 24 hours. This resilience has captured the attention of investors and analysts alike.

The newfound bullishness surrounding PEPE is further bolstered by a surge in trading activity. The coin boasts a 24-hour trading volume exceeding a staggering $1.26 billion, placing it firmly in the spotlight. Additionally, PEPE’s market capitalization currently sits at a healthy $3.23 billion, a testament to its growing presence within the crypto landscape.

Technical Analysis Paints A Bullish Picture

Adding fuel to the fire, crypto analyst World Of Charts has identified a bullish flag pattern in PEPE’s recent price action. This technical indicator often precedes a price breakout, suggesting that PEPE might be on the cusp of a significant upward trajectory.

$Pepe#PEPE On Verge Of Another Breakout Formed Bullish Flag & Testing Its Upper Resistance Incase Of Breakout Expecting Another 80-90% Bullish Wave In Coming Days#Crypto pic.twitter.com/f2jtxpOIp3

— World Of Charts (@WorldOfCharts1) May 2, 2024

World Of Charts predicts a potential price surge of 80-90% in the coming days if the coin manages to break free from its current resistance level.

Meme Coin Frenzy: A Double-Edged Sword?

Despite the optimistic outlook, a cloud of caution hangs over PEPE’s future. The coin falls under the category of meme coins, a notorious sector within the cryptocurrency market known for its volatility and often lacking strong fundamental backing.

Unlike established projects with real-world applications, meme coins often rely on community hype and internet trends to propel their value. This can lead to sharp price spikes followed by equally dramatic crashes.

While the prospect of an 80-90% return on investment is undeniably enticing, experts urge potential investors to approach PEPE with a dose of healthy skepticism. The analyst prediction, while optimistic, should not be taken as financial gospel. The cryptocurrency market, especially the meme coin segment, is inherently unpredictable.

Featured image from Pexels, chart from TradingView

Cold Blooded Shiller (@ColdBloodShill), a well-known figure in the crypto analysis community, recently shared a technical analysis of the PEPE/USDT pair on Binance, marking it as one of the most promising charts in the current market landscape. With his analysis, posted to his 272,000 followers on X, he describes the potential movements of PEPE, both bullish and bearish, as it approaches a critical juncture on its trading chart.

The chart, set on a four-hour time frame, details PEPE’s price action and its interaction with significant technical levels. A key focal point of Shiller’s analysis is the resistance-turned-support zone between approximately $0.0000063 and $0.0000062. This level, highlighted in green, previously acted as a strong resistance zone, and its conversion to support suggests a foundational shift in market sentiment towards PEPE.

Moreover, PEPE is currently approaching a crucial resistance marked by a descending trend line in red, indicating a potential breakout point. However, Shiller cautiously notes that while the asset is on the verge of breaking this downtrend, there’s a risk of what he terms a “fakeout.” This scenario could see the price initially breaking above the trend line only to retract back below it, potentially leading to a decline of about 13% towards the established support zone at $0.0047423.

Should this support hold against market volatility—a common challenge in the crypto trading sphere—it may serve as a springboard for PEPE. Shiller speculates a possible rally that could result in a 47.47% increase from the support level, targeting an upper price level of $0.000011. Such a movement would not only confirm the strength of the current support but also signify a strong bullish market phase for PEPE.

The analysis also pays close attention to the Relative Strength Index (RSI) hovering near the 50 mark, a neutral territory that indicates the asset is neither overbought nor oversold. This positioning suggests the potential for significant price movement in either direction, emphasizing the importance of the upcoming potential breakout or fakeout scenario.

Cold Blooded Shiller’s analysis concludes with a nod towards taking a chance on PEPE if it begins to show signs of a firm breakout. His detailed observation and the technical markers he highlights suggest that, despite potential risks, the reward could indeed be substantial should favorable conditions prevail.

“PEPE [is] one of the sexiest looking charts out there right now. Consolidating above it’s former significant level. Does it have the chance for lower and some fuckery with a fakeout? Yes. Is it worth the opportunity shot if it starts to breakout? Absolutely yes,” he stated.

At press time, PEPE was trading at $0.000006976. Thus, the meme coin is approaching the 200-EMA at $0.000006677. If this support does not hold, a retest of the red support zone seems plausible.

The top memecoins are far from previous highs, yet retail investors may view them as fairer opportunities than VC-backed coins with high fully diluted valuations.

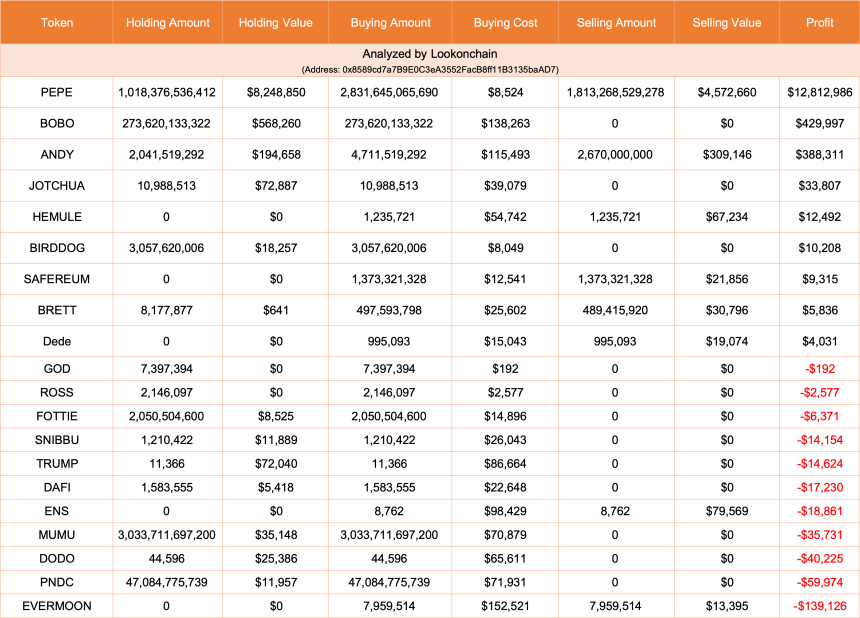

A strategic trader has made the most of his money after making over 1,000x profit with PEPE. Despite the recent frog-themed token slump, the memecoin investor gained millions. Similarly, whales have continued accumulating PEPE while it resumes its upward trajectory.

According to Lookonchain data, a memecoin trader named James Wynn multiplied its PEPE investment by 1,503. Wynn bought the token in its earlier stages, acquiring 2.83 trillion PEPE for $8,524. When the token started gaining momentum, he sold over half his holdings, 1.81 trillion tokens, for $4.57 million.

jwynn.eth(@JamesWynnReal) – A smart trader who made $12.8M(1,503x) on $PEPE.

He also traded $BOBO and $ANDY recently, making another $818K!

1/ Let’s dig into his trades.

pic.twitter.com/2vOkjObVPr

— Lookonchain (@lookonchain) April 24, 2024

After the frog-themed memecoin became a market sensation, the trader’s unrealized profits on his remaining bag exponentially increased. Currently, Wynn holds 1.02 trillion PEPE in three wallets worth $8.25 million.

The trader’s total profits from PEPE total $12.8 million. However, if he had held onto his tokens, the gains would have exceeded $20 million.

Per the blockchain research platform, Wynn’s feat doesn’t end with PEPE. He has also made over $800,000 trading other memecoins over the week. He recently bought five tokens, two of which remain profitable: BOBO and ANDY.

At the time of the report, the trader bought over 273.62 billion BOBO for $138.263, making a profit of $430,000. Similarly, he acquired 4.711 billion ANDY for $115.493, gaining over $338,000.

Nonetheless, not all of Wynn’s trades resulted in success. According to the X post, the trader has a 45% success rate, gaining over $13.7 million with nine memecoins and losing around $350,000 on eleven tokens, including some rug pulls.

As reported by NewsBTC, recent data showed that PEPE’s price decline over the last month has reduced the number of addresses carrying gains. However, this has not stopped whales from accumulating the token.

This week, a whale accumulated 211.6 billion PEPE from Binance, Gateio, and Uniswap. The address bought the tokens at an average of $0.000007291, spending $1.54 million. The buying spree turned profitable as, some hours later, the token’s price increased by 17%.

According to Spot On Chain, the holdings’ worth surged to $1.72 million, making $173,000 in unrealized profits. Other reports suggest that whales have continued accumulating and taking profits from their PEPE holdings.

However, the token’s market activity decreased by 22.1% in the last 24 hours, with a $1.2 billion daily trading volume. PEPE’s market capitalization has also dropped 1.58%.

Despite this, the token has regained its spot as the third largest memecoin by this metric, as dogwifhat (WIF) lost 13.88% of its market cap on the last day. It’s worth noting that WIF flipped PEPE on March 28 after becoming the newest sensation in the crypto market.

As of this writing, PEPE is changing hands for $0.000007821, representing an 11.4% drop in the monthly timeframe. Nonetheless, the token continues recovering, registering a 52.2% surge in the last seven days.

The crypto market saw extra turbulence after Samourai Wallet’s CEO and chief technology officer faced legal action from the U.S. DOJ.

On-chain data shows the percentage of the PEPE investors currently in the green has fallen to 69% after the 26% plunge the memecoin has seen in the past week.

In a new post on X, the market intelligence platform IntoTheBlock has posted an update on how the investor profitability is looking for the memecoin PEPE currently.

The analytics firm’s metric gauges whether a holder is in profit or not by reviewing their address’s on-chain history. Based on when the wallet acquired the coins, the indicator calculates the investor’s average cost basis using the spot price of the asset at the time of those purchases.

If the current spot value of the cryptocurrency is higher than this average cost basis for any address, then that particular investor is carrying net gains currently. IntoTheBlock categorizes such addresses to be “in the money.”

Similarly, investors with a cost basis higher than the latest price are considered “out of the money.” Naturally, the two values being exactly equal would suggest the holder is just breaking even on their investment or is “at the money.”

Now, here is the data shared by the analytics firm that shows how this investor breakdown looks like for PEPE at the moment:

As is visible above, 69% of the total addresses holding PEPE have their cost basis higher than the current spot price of the coin, while 27% are in losses. 4% of the investors are sitting on their cost basis right now.

This profitability ratio isn’t that high, as, for example, 89% of Bitcoin investors are currently in profit, according to IntoTheBlock data. The reason behind the lower profits for the memecoin is that its price has seen a steep drawdown recently.

Historically, the addresses in the green have been more likely to sell to harvest their gains. As such, when the market profit-loss balance is overwhelmingly towards profits, a mass selloff can occur.

Naturally, this means the chances of a top being hit increase with increasing investor profits. However, a low percentage of investors being in profits can be conducive to bottoms forming, as profit-selling exhausts at these levels.

At present, PEPE is neither dominated by green investors nor red ones. In bull runs, however, profitability levels generally remain higher, so any cooldown can help prices rebound.

Thus, the fact that investor profitability has returned to the 69% level for the memecoin could be a sign that a bottom is close if the bullish regime has to continue.

PEPE has returned to the $0.0000050913 mark after having declined more than 26% over the last seven days. The chart below shows the memecoin’s performance over the past month.

An analyst has explained how a PEPE daily close outside of a certain price range could lead its value to go on a rally of 54%.

In a new post on X, analyst Ali discussed the recent trend forming in the PEPE price. According to the analyst, the memecoin is currently forming a symmetrical triangle pattern on its one-day chart.

The “symmetrical triangle” here refers to a pattern in technical analysis (TA) that, as its name suggests, looks like a triangle. In this pattern, there are two lines of interest between which the asset’s price consolidates for a period.

The upper line connects successive tops, while the lower one joins together bottoms. The main feature of the pattern is that these two lines approach each other at a roughly equal and opposite slope (hence the “symmetrical” in the name).

There are other triangle patterns in TA, but those have either differently angled lines (as is the case with wedges) or one line parallel to the time-axis (ascending and descending triangles).

Like other TA patterns that represent a consolidation phase, the lines of the symmetrical triangle also serve as a point of potential reversal for the price. The upper line usually offers resistance (meaning tops can occur), while the lower line may provide support (bottom formation).

When a break takes place from either of these lines, the price may likely see sustained momentum in that direction. This implies that a break above the triangle could be a bullish signal, while one below may be bearish.

The symmetrical triangle may be viewed as a phase of the market in which the bulls and bears are at a standstill, hence why the price is ranging sideways. During a break, one of these wins out, and price action follows in that direction.

Naturally, as the lines converge towards a center point in this pattern, a breakout becomes increasingly probable the closer to the apex of the triangle the asset’s price gets.

Now, here is the chart shared by Ali that highlights the symmetrical triangle pattern that PEPE has been trading inside recently:

As is visible in the graph, the 1-day price of PEPE has been approaching the triangle’s apex recently, implying that a break in a direction may be coming for the memecoin.

“Watch out for a daily close outside of the $0.00000793 – $0.00000664 range, which could lead to a 54% move for PEPE,” explains the analyst. Given the pattern that has been forming, it now remains to be seen how the asset’s price will play out from here.

At the time of writing, PEPE is trading around $0.000006868072, up 3% over the past week.

The crypto exchange’s off-shore arm will open perpetuals market for the popular meme coin on April 18.

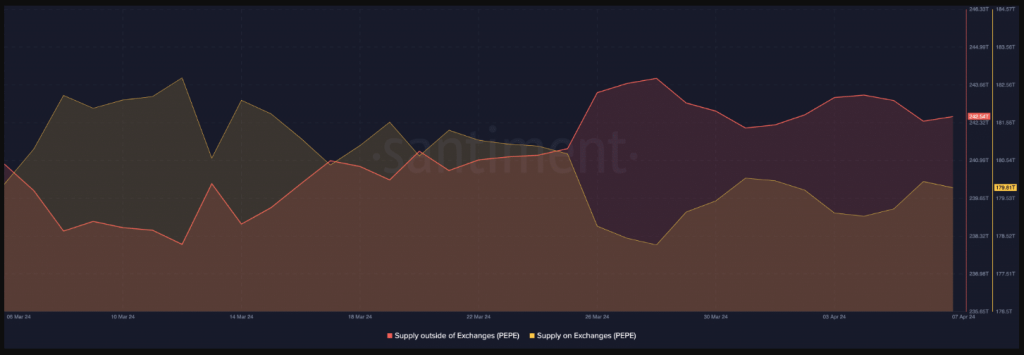

The world of memecoins continues to be a rollercoaster ride, and Pepe (PEPE) is no exception. Recent on-chain data reveals a surge in tokens moving out of exchanges, potentially signaling a bullish sentiment among investors. However, conflicting indicators cast a shadow of doubt on the sustainability of this upward trend.

A significant development for PEPE is the movement of a large number of tokens away from exchanges. According to Santiment, a blockchain analytics platform, the supply of PEPE outside exchanges reached a staggering 243 trillion on April 7th. This sharp rise compared to March 12th indicates a potential decrease in selling pressure.

Further bolstering the bullish case for PEPE is the recent price increase. Over the last 24 hours, the memecoin has experienced a nearly 10% surge, suggesting a potential recovery from a recent slump.

In addition to the observed price fluctuations and projected price range for Pepe, it’s worth noting the significant increase in trading volume surrounding the cryptocurrency. This surge in trading activity not only reflects a heightened level of engagement within the Pepe community but also suggests growing interest from external investors and traders.

The uptick in trading volume serves as a key indicator of market sentiment and could potentially serve as a catalyst for further price gains. Historically, increased trading activity has been associated with periods of price appreciation, as it signals a greater level of market participation and liquidity. In turn, this heightened liquidity can attract new buyers to the market, further bolstering demand and potentially driving prices higher.

Investor Sentiment Tells A Different Narrative

However, not all signs point towards a clear path to success for PEPE. While the token movements suggest some bullishness, a crucial metric paints a contrasting picture. The Weighted Sentiment, which reflects investor sentiment towards PEPE, has recently declined.

This could indicate a weakening of investor confidence and potentially foreshadow a decrease in demand for the memecoin. If this metric continues to fall, it could invalidate the current bullish bias surrounding PEPE, making a significant price hike less likely.

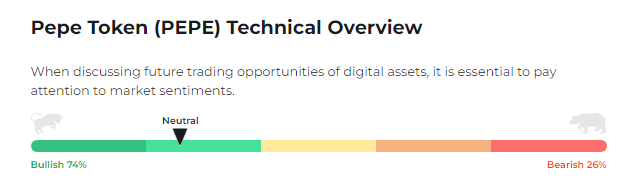

Quick Technical Overview

On a brighter note, PEPE shows strong bullish momentum with a 74/26 split favoring positive sentiment. This aligns with the recent price increase and suggests continued investor optimism.

However, it’s crucial to monitor social media chatter and news articles for any potential shifts in sentiment that could impact price movement. While the current outlook is positive, remaining vigilant is key in this volatile market.

PEPE Price Prediction

Meanwhile, amidst the volatility of the cryptocurrency market, Pepe’s price fluctuations have captured the attention of crypto experts, prompting projections for its trajectory in April 2024. Analyses indicate an anticipated average PEPE rate of $0.0000140 during this period, reflecting both the potential for growth and the inherent uncertainty within the market.

While these projections offer insights into the expected average price, it’s essential to acknowledge the range of possibilities. Experts suggest that Pepe’s minimum and maximum prices in April 2024 could vary significantly, with estimates ranging from 0.00000745 to 0.00000745.

Featured image from Pexels, chart from TradingView