Polkadot (DOT) has come under the spotlight with crypto analysts laying out bullish narratives for the crypto asset. One of them is crypto expert Michaël van de Poppe, who believes Polkadot could rise to as high as $25 in this bull run.

Polkadot Could Reach $25 On Next Leg Up

Michaël van de Poppe mentioned in an X (formerly Twitter) post that Polkadot’s next rally will see it climb between $20 and $25. He explained that the crypto token has seen a substantial correction in the past months, but it showed enough strength by coming back to pre-rally levels. The analyst further claimed that Polkadot has bottomed, “especially since JAM Whitepaper came out.”

As such, he believes that Polkadot is more than primed for this rally, which could propel it to such heights. The crypto analyst has been a big believer in Polkadot’s potential. He previously included Polkadot in a list of crypto tokens that he believes are undervalued. He claimed that DOT’s valuation was still at a cycle low, which had opened up a “huge opportunity” to invest in it.

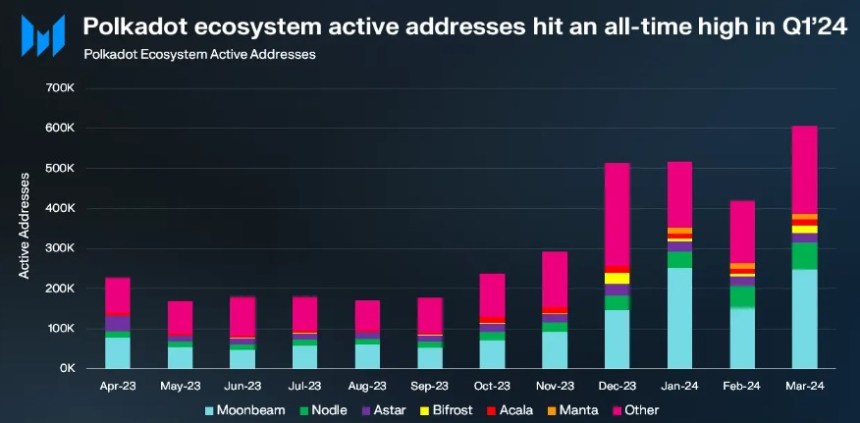

Van de Poppe is very much invested in Polkadot because of its technology. In a previous X post, he highlighted how the JAM (Join-Accumualte Machine) Paper, which ushered in Polkadot 2.0, would revolutionize DOT’s ecosystem. He also claimed that Polkadot is the “second largest blockchain in terms of developers and growth.” Therefore, he expects DOT’s price to complement the team’s efforts soon enough.

Meanwhile, Van de Poppe expects Polkadot to reach as high as $20 in the third quarter of this year. For now, he believes that the $8 and $17 range are crucial resistance levels that the crypto token must break out of to enjoy such a parabolic rally.

A More Bullish Prediction For DOT

Crypto analyst Crypto Thanos offered a more bullish prediction for Polkadot, stating that the crypto token climbing above $50 is “easily achievable” in this bull run. He believes this price is attainable because he expects institutions to get interested in large caps like Polkadot. He also noted Polkadot’s collaboration with Tie, which aims to increase institutional exposure and access.

It is worth noting that Polkadot’s all-time high (ATH) is currently $55, which makes Thanos’ prediction for the crypto token feasible. Crypto tokens are known to usually surpass their ATH in every bull run.

Crypto analyst Captain Faibik provided insights into what to expect from Polkadot in the short term. He predicts the crypto token will record a 35% “bullish rally” soon enough. He said a “major trendline breakout/retest has already been confirmed” for DOT on the four-hour timeframe chart.

At the time of writing, Polkadot is trading at around $7.11, up over 2% in the last 24 hours, according to data from CoinMarketCap.

Witness the economic prowess of the blockchain world

Witness the economic prowess of the blockchain world Delve into the top blockchains by revenue rate in the past 7 days—unveiling the financial leaders shaping the decentralized landscape

Delve into the top blockchains by revenue rate in the past 7 days—unveiling the financial leaders shaping the decentralized landscape In the last 7 days,

In the last 7 days,