After a very dull performance over the majority of 2023, the Polygon PoS chain managed to gather considerable pace and demonstrate notable strength in the latter part of the year.

Data indicates that, in addition to the remarkable price performance of MATIC, the Polygon network’s native token, there was a lot of excitement surrounding Polygon’s NFT ecosystem in December of the previous year.

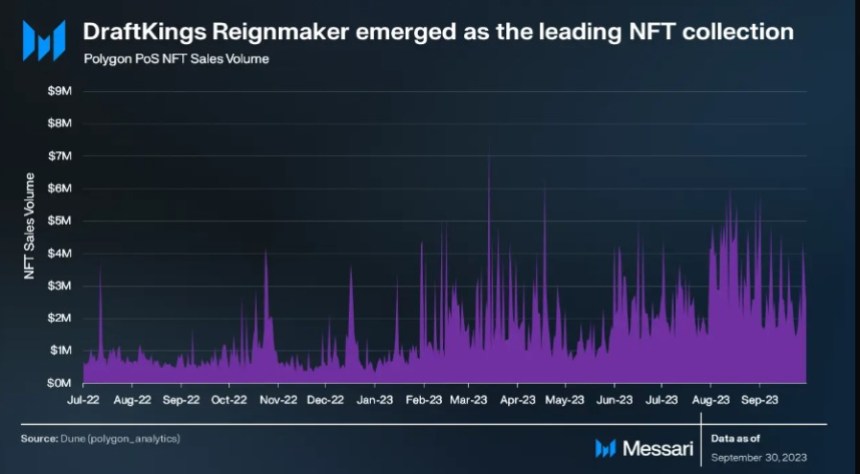

Polygon NFT Surge: Sales Volume Peaks

An increase in the overall number of NFT deals and an upward trend in NFT sales volume, especially during the past seven weeks, are indicators of this expansion.

On December 6, 2023, the spike peaked for six months, ranking the Layer-2 scaling solution third in terms of NFT sales volume, after Ethereum and Bitcoin.

NEW:

Polygon NFT sales volume is surging to levels not seen in over 6 months. pic.twitter.com/M4iWtRTDOe

— Today In Polygon (@TodayInPolygon) January 5, 2024

Polygon has sold nearly $10 million in a single day, according to CryptoSlam data. This is more than twice as much as Solana, which sold a little over $4.1 million.

Flippening began when Solana’s sales volume fell more than 17% in a day, whereas Polygon NFT sales volume increased by 42%.

Today In Polygon, a popular X (formerly Twitter) handle, recently tweeted about blockchain’s rise in the NFT market.

According to the post, Polygon’s NFT sales volume was rising to levels not observed for more than half a year. This episode suggested a renewed interest in MATIC NFTs, which in the upcoming months may have a more significant effect on the ecosystem.

NEW: Polygon NFT sales volume has reached $47M in the month of December.

This is the highest monthly volume since February 2023. pic.twitter.com/tD6F8L6c2u

— Today In Polygon (@TodayInPolygon) December 31, 2023

Based on DappRadar statistics, the top Polygon NFTs during the previous 30 days were Genesis WildPas, Collect Trump, The Sandbox, and Gas Hero Coupon NFTs.

In addition, Polygon’s wash sales total is larger than Solana’s, coming in at $858,631 versus $175,493.

The entire sales volume, which includes both normal and wash sales, is $10,845,385 for Polygon NFTs and $4,292,160 overall.

MATIC Up Amidst Market Complexity

While this was going on, the token’s price chart turned green, encouraging MATIC bulls to pick up their game. MATIC has increased by more than 3% in the last day alone, according to CoinMarketCap.

With a market valuation of more than $8 billion, it was trading at $0.83 at the time of writing.

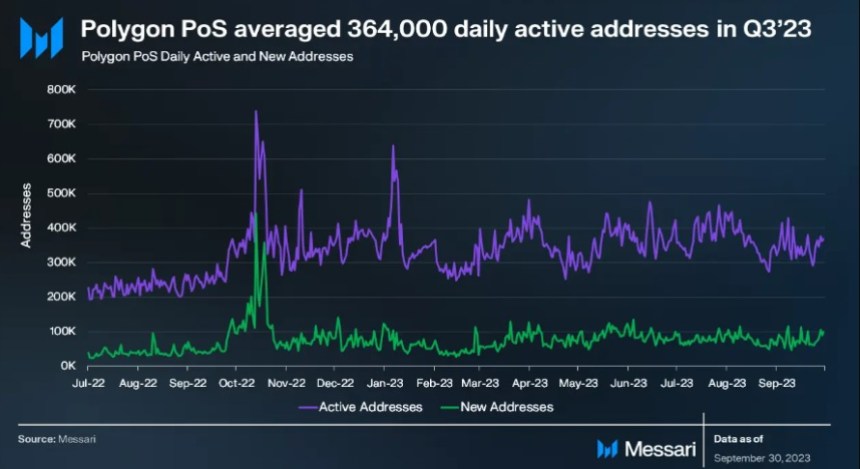

Even with these encouraging indicators, certain areas displayed unfavorable patterns, such as a decline in the graph of unique addresses and a drop in the quantity of transactions after a peak on December 25, 2023.

These inconsistent tendencies highlight the intricate mechanisms at work within the Polygon NFT ecosystem, despite the fact that the cryptocurrency market is infamously volatile.

Featured image from Freepik