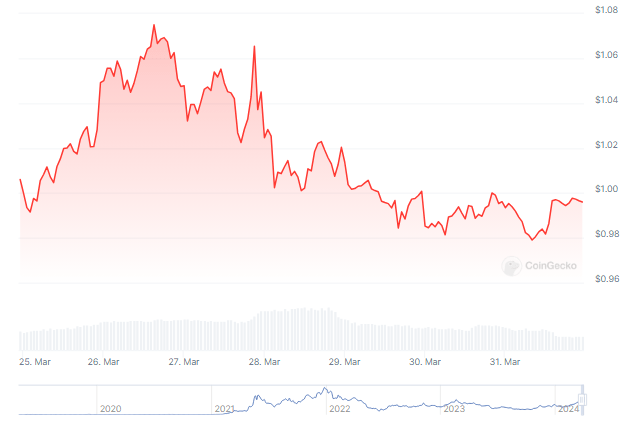

Polygon (MATIC), the high-speed scaling solution for Ethereum, has been on a rollercoaster ride this month. After a brutal price correction that saw MATIC tumble over 20%, a recent 24-hour surge has injected a dose of optimism into the market. But is this a sign of a full recovery, or a temporary reprieve before further decline?

Polygon’s Price Plunge: A Reality Check

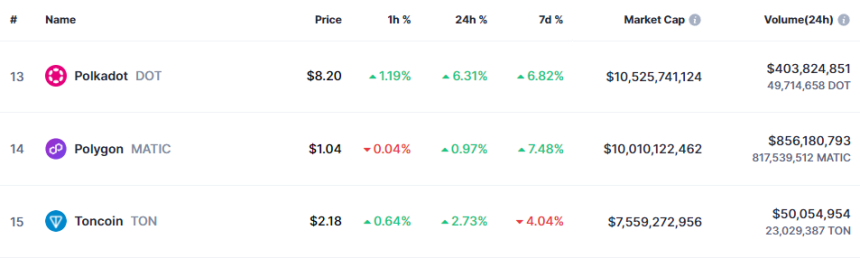

CoinMarketCap data paints a sobering picture. MATIC has been steadily dropping down the ranks of the top 20 cryptocurrencies, currently sitting at number 18. This decline coincides with a significant price drop, with MATIC losing over a quarter of its value in the last 30 days.

Analysts like World of Charts point to the descending channel pattern on MATIC’s daily chart, a classic indicator of a bearish trend. For a true price recovery, MATIC needs to overcome a crucial hurdle: the $0.77 resistance level. A breakout above this point could trigger a significant bull run to the $1 dollar level, but the climb won’t be easy.

$Matic#Matic Still Nothing Has Changed Consolidating In Descending Channel Successful Breakout Can Lead Massive Bullish Wave In Coming Days https://t.co/RBiSg4kaGb pic.twitter.com/fUwIbyW2hA

— World Of Charts (@WorldOfCharts1) April 27, 2024

Pulse On Investor Sentiment

The past 24 hours have offered a glimmer of hope for Polygon bulls. The token price surged by 5%, briefly eclipsing the $0.74 mark. This uptick coincides with an improvement in the MVRV ratio, which suggests a rise in the number of profitable MATIC investors.

Additionally, the bullish crossover on the MACD indicator hints at a potential increase in buying pressure. However, beneath the surface, some concerning trends remain.

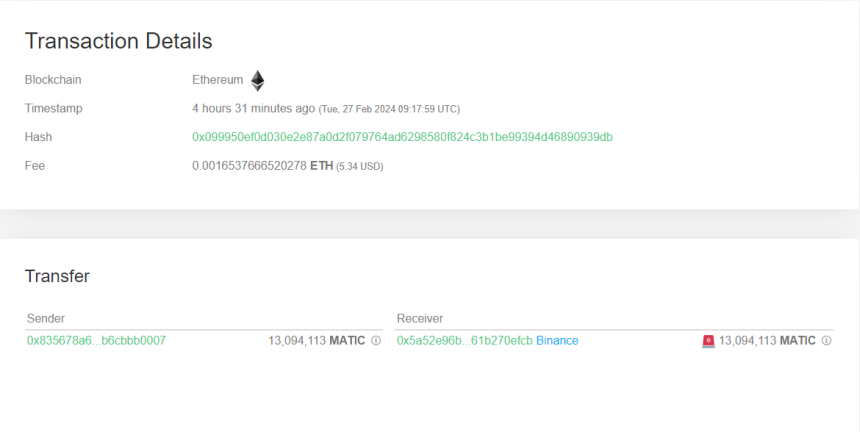

Despite the recent price uptick, data suggests substantial selling pressure on Polygon. The exchange inflow has increased significantly, indicating investors moving tokens onto exchanges, often a precursor to selling. This trend is further corroborated by a rise in MATIC’s supply on exchanges, while the supply held outside of exchanges has dwindled.

Technical Indicators Paint A Mixed Picture

While the MACD offers a glimmer of hope, other technical indicators remain bearish. The Bollinger Bands suggest reduced volatility, which can be a sign of consolidation before a breakout or a further price drop. Both the Money Flow Index (MFI) and Chaikin Money Flow (CMF) have registered downticks, potentially signaling the end of the short-lived bull rally.

Polygon’s Path Forward

While the technical outlook for Polygon remains uncertain, a complete reversal isn’t out of the question. Continued positive developments within the Polygon ecosystem, coupled with broader market recovery, could propel MATIC upwards.

However, overcoming the selling pressure and technical resistance levels will be crucial for a sustained bull run. Investors should exercise caution and closely monitor market developments before making any investment decisions.

Featured image from Pexels, chart from TradingView