Polygon developers are set to launch tools to enable the creation of Ethereum-compatible standalone chains and layer-two protocols.

Cryptocurrency Financial News

Polygon developers are set to launch tools to enable the creation of Ethereum-compatible standalone chains and layer-two protocols.

The funding rate for MATIC and AAVE is currently rewarding traders who are leveraged longs, but it might not last for long.

After one of its most brutal weekends, Bitcoin and most altcoins show signs of recovery in lower time frames. While most are still down by 30% and 40% in the 7-day and 30-day chart, the general sentiment in the market appears to be more bullish as investors see their charts flip from red to green.

Ethereum was probably one of the fastest altcoins to return from under a critical support zone at $1,700. The second cryptocurrency by market cap trades at $2,541 with a 2.6% profit in the daily chart and a 35.6% profit in the monthly chart.

Ethereum will undergo an update to its fee model with hard fork “London”. EIP-1559 will be implemented and ETH will become a deflationary asset. This has strengthened the theory amongst some users that ETH could become a more effective store of value than Bitcoin.

In the weeks before the crash, Ethereum was the only altcoin absorbing institutional interest from BTC-based investment products. In mid-May, while Bitcoin investment products saw outflows estimated at $98 million, Ethereum’s saw a $27 million worth of inflows.

For the first time, the second cryptocurrency by market cap saw more interest from institutions on this metric. CoinShares report stated the following: “that investors have been diversifying out of Bitcoin and into altcoin investment products”. As seen in the chart below, negative price performance in the crypto market has impacted the asset flows in the past week.

Besides Ethereum, Polygon (MATIC) has been the fastest to bounce with a 110% profit in the daily chart and an 81.4% rise against its Bitcoin pair. The project has received more attention from investors since its rebranding and climbed to the top 4 projects by Total Value Locked (TVL), according to data provided by DeFi Pulse.

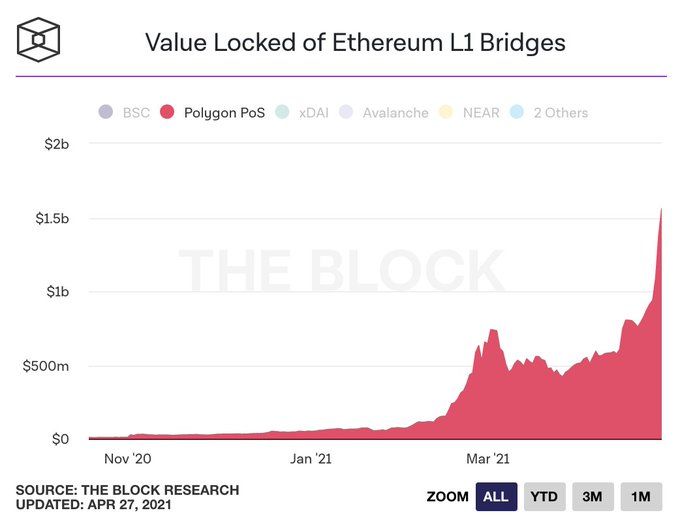

As reported by newsBTC, Polygon was running hot since March 2021, when this blockchain outperformed Binance Smart Chain (BSC), Avalanche, NEAT, and other Ethereum L1 Bridges. With over 100 projects building on top of its solution, Polygon (MATIC) has great potential for further appreciation.

Polkadot (DOT), Solana (SOL), Cardano (ADA), and Binance Coin (BNB) saw great resilience during the crash and seem poised for more profits in the coming months. BNB and the Binance Smart Chain ecosystem has proven that users are eager to participate in low-cost DeFi ecosystems with fast transactions.

Solana and projects, such as Terra (LUNA) and COPE, are meeting this demand. Cardano will launch its smart contract platform, Plutus, and its capacity to attract more users, developers, and projects will be key for its immediate future.

Dog them meme coins have been a “thing” during this stage of the bull run. Dogecoin (DOGE) was amongst the least affected during the crash, according to research firm Messari. The Elon Musk Effect favors this particular coin and will most likely continue to be a major factor in the crypto market and its recovery.

Early in the week, performance by market cap fluctuated around 0, by mid-week shifting into a bloodbath🩸

All top assets finished in double-digit losses, with two the least affected:

+ Cardano $ADA, -13%

+ Dogecoin $DOGE, -26% pic.twitter.com/yiU6tNzbdY— Messari (@MessariCrypto) May 21, 2021

Bitcoin is witnessing aggressive selling but if key support levels hold, ETH, ADA, SOL, and MATIC may lead the market higher.

Solana, Polygon and Harmony all defied the market crash, solidifying gains when traded against Bitcoin and helping protect crypto investor funds.

Dapps are continuing to shine recently. As if the chart wasn’t enough to convince you, $MATIC has been a star performer too. Data released this week from DappRadar shows a substantial uptick in Polygon-based decentralized applications. This follows our piece from just a few weeks ago, highlighting $MATIC’s big rally. Let’s recap some of DappRadar’s findings.

The Polygon Network

The data out from DappRadar shows a number of metrics worth calling out with regards to the second-layer solution to Ethereum. It starts with calling out nearly $1B in value flows through their layer 2. Additionally, the materials note that the top twenty Polygon dapps interacted with more than 75,000 active user wallets in just the past week. Finally, in the past month, Polygon-tracked dapps on DappRadar increased from 61 to 93; 46 of those fall in the DeFi and Exchange categories.

Related Reading | Polygon Expands NFT & DeFi Ecosystem With Trace Network

As the DappRadar materials point out, there are a couple sticking points for Polygon that are main drivers for it’s reason emergence: lower gas fees, and fast transactions. It’s not surprising to see Ethereum gas fees slowing motivations for DeFi applications recently. However, unlike other Ethereum-based ecosystems, $MATIC looks to bring other advantages to the table too. Major pitch points include validation system security, scalability by way of joint PoS consensus and Heimdall architecture, and PoS chain Plasma. Major competitors include Polkadot ($DOT), Cosmos ($ATOM), and Avalanche ($AVAX).

Polygon’s leading dapps in DeFi include QuickSwap, Aave, and ParaSwap – Aave made the expansion over to Polygon in March. QuickSwap reported a 210% user increase last week, and a 240% increase in transactions over the same period.

$MATIC has performed exceptionally well during recent times, where many mainstay cryptocurrency’s have seen pullbacks, in what many describe as “DeFi Summer”.

$MATIC has been performing exceptionally well this year | Source: MATIC-USDT on TradingView.com

Projects and platforms continue to assist $MATIC with recent growth. Recent partnerships include Decentraland and Maker, and recent platform support includes Coinbase and Binance. Additionally, the team announced Tether (USDT) and USDC integration in September last year. Other unique engagement has taken place in the network as well, such as COVID-19 test verification used by government officials in India.

It’s not just $MATIC seeing rapid growth, either. DeFi is arguably undergoing a radical transformation, as we highlighted recently.

$MATIC launched in 2017 and moved to mainnet by the end of the year; the network went through the Polygon rebrand just a few months ago. $MATIC has now surpassed a $11B market cap and has cracked the top 25 of top coins per market cap, according to CoinGecko, hitting record-high price and coming close to $2 this week.

Related Reading | How Aave’s Integration With Polygon Will Maximize Users’ Profits

Featured image from Pixabay, Charts from TradingView.com

Timely NewsQuakes deliver market-moving events directly to Markets Pro subscribers, while a record-breaking VORTECS Score coincides with Polygon’s remarkable price action.

Polygon (MATIC) has seen an explosion on the daily chart with a 40.4% rally trading at $0,74. In the weekly and monthly chart, MATIC’s numbers are equally impressive with a 118% and 114% bull-run. Most of the profits seem to have been recording over the past three months.

Previously knows as Matic Network, the project was rebranded Polygon at the end of February. A second-layer solution for Ethereum. The project seeks to be a version of Polkadot on this blockchain and create an interoperable sidechains ecosystem with high scalability.

In parallel with its price rally, Polygon has seen a major explosion in its total value locked (TVL). Data from DeFi Pulse records a $1.12 billion with a 32.6% increase in 24-hours. The protocol has 126.400 ETH locked with 19.600 added in the past day.

As the chart below shows, MATIC went parabolic in TVL by mid-April 2021. Although it had a setback during the subsequent days, the protocol’s TVL has picked up a bullish momentum and keeps aiming for all-time highs.

Additional data from The Block Research shared via their Twitter handle indicates that Polygon’s PoS has seen more increase in value locked than Binance Smart Chain, xDAI, Avalanche, NEAR, and others. The report attributes Polygon’s rise to an “incentive program effort”.

Polygon’s team revealed at the beginning of last week a continuation of their “DeFi Summer”. Therefore, users were offered over $5 million in liquidity mining rewards for the Curve Polygon markets.

Polygon’s ecosystem appears to be growing with over 100 DeFi projects building on the solution. Its cooperation with Curve protocol is to “meet” the demand for “deep liquidity” stablecoins trading pairs. The team said:

This 5mn$ liquidity rewards program is part of the #DeFiForAll campaign on Polygon! We look forward to growing and expanding the DeFi ecosystem on Polygon along with Ethereum’s top DeFi protocols.

According to data from Cryptoyieldinfo, Polygon’s native token could “do a BNB”, in reference to this other token recent rally. With $1.1 billion in Aave and $100 million in Curve locked in over a week, MATIC could reach a $2 to $8 target if demand for the token continues to rise.

Anonymous trader Hsaka is more conservative when predicting a possible price target for MATIC, but still sees a long of upside potential for the token. The trader said the following:

Sidechain debate is trivial. As of now, $MATIC is the most accessible liquid puntable token that represents the $ETH scaling narrative. With Curve and Aave already rolling out support, that mindshare is only going to increase. $1.

mStable has launched its savings account, stablecoin, and swap services on Polygon to reduce fees.

Polygon claims yet another victory in the scaling wars with Decentraland

Two DeFi heavyweights will be integrating the one-time Ethereum competitor

Whopping gas fees shouldn’t limit DeFi to five-figure portfolios, said Aave founder Stani Kulechov.

Polygon is building a Layer 2 aggregator for sidechains, rollups and even whole blockchains in a bid to fix Ethereum’s transaction limitations.

Polygon is building a Layer 2 aggregator for sidechains, rollups and even whole blockchains in a bid to fix Ethereum’s transaction limitations.