According to crypto intelligence platform Santiment, some altcoins have been enjoying increased attention from investors over the past few days. This comes as the crypto market continues to undergo a positive recovery from its recent slump in the aftermath of the Bitcoin ETF launch.

These Altcoins Show Potential For More Profit: Santiment

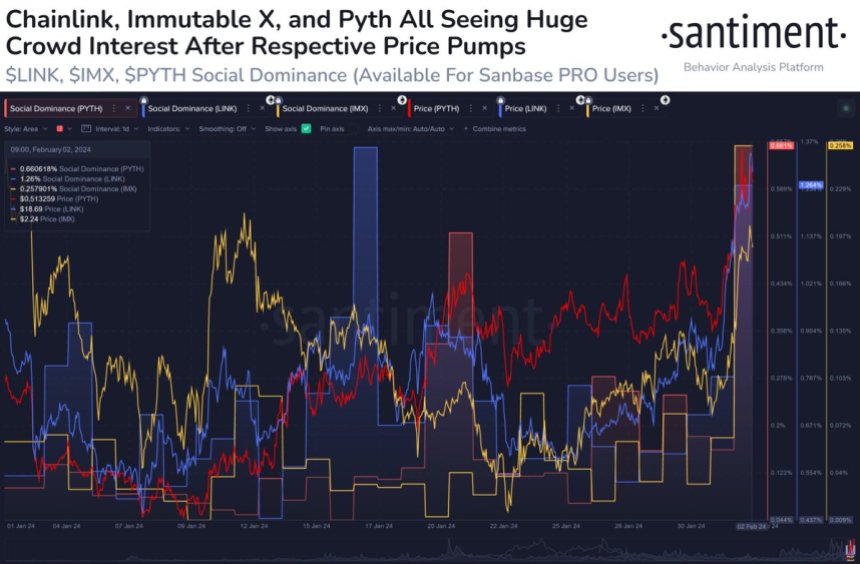

In a post on the X platform, Santiment revealed that three altcoins, including Chainlink (LINK), Immutable X (IMX), and Pyth (PYTH), have become assets of mainstream interest in the past few days.

This revelation is based on their performance in terms of Social Dominance, an indicator that compares the social volume of a particular asset to the combined social volume of the top 100 cryptocurrencies by market capitalization.

As shown in the chart above, the Social Dominance of these three altcoins has seen a notable spike in recent days. Interestingly, Santiment has associated this renewed investor interest in Chainlink, Immutable X, and Pyth, with their market cap growth in the past week.

According to data from Santiment, the valuations of LINK, IMX, and PYTH have increased by 34%, 23%, and 26%, respectively, in the last seven. The on-chain analytics noted that the mainstream crowd discussion around these altcoins will lead to FOMO (fear of missing out) amongst investors.

Santiment further highlighted that this FOMO can trigger high price volatility and increased buying pressure for Chainlink, Immutable X, and Pyth. Ultimately, this can lead to more price gains for the three crypto assets.

Chainlink Price Overview

The price performance of Chainlink in the past week has been the most impressive of the three altcoins highlighted by Santiment. According to data from CoinGecko, LINK’s value has jumped by more than 24% in the past week.

In a week dominated by Bitcoin’s resurgence to above $43,000, Chainlink managed to become one of the biggest gainers in the last seven days. The cryptocurrency’s price registered a positive run to almost as high as $19.

As of this writing, the Chainlink token is valued at $17.69, reflecting a 1.2% price decline in the last 24 hours. The altcoin appears to be witnessing some amount of downward pressure as it is struggling to hold above the $18 level.

Nevertheless, Chainlink continues to lay a strong claim to a spot amongst the top 10 largest cryptocurrencies by market capitalization. With a market cap of over $10 billion, LINK ranks as the 13th-largest asset in the cryptocurrency sector.