With zero knowledge (ZK) proofs expected to be a game changer for blockchain scaling, Polygon may be on the brink of a major rally. Taking to X on February 2, crypto market commentator Polynya, asserts that ZK technology is the “endgame” as its “1,000x efficiency upside is irresistible for networks.”

Will “ZK” Technology Be The “End Game”?

This forecast on ZK adoption is massive for Polygon and its native token, MATIC, which has been under significant selling pressure in the past few trading months. As it is, Polygon Labs, the developer of the Ethereum sidechain, has been at the forefront, advocating for the development of ZK scaling solutions.

In 2021, Polygon began assembling a team to develop zkEVM, a technique relying on zero knowledge to scale Ethereum cheaply while being compatible with the EVM. Recent Polygon Labs documentation shows that their zkEVM is in beta and being tested.

However, this hasn’t stopped the team from striking deals with layer-1 protocols interested in harnessing this technology.

In mid-January, NEAR Protocol’s Data Availability (DA) solution was integrated with Polygon’s custom blockchain development kit (CDK). The goal was to make it easier for developers to create ZK rollup solutions suitable for their needs while leveraging NEAR Protocol‘s infrastructure. All this is when ensuring the integration lowers cost and improves performance.

Polygon Labs has also partnered with other platforms, including Immutable–a layer-2 web3 solution for NFTs; Ankr–an infrastructure provider; and QuickSwap–a decentralized exchange (DEX). Most of these platforms plan to operate as layer-2s for Ethereum.

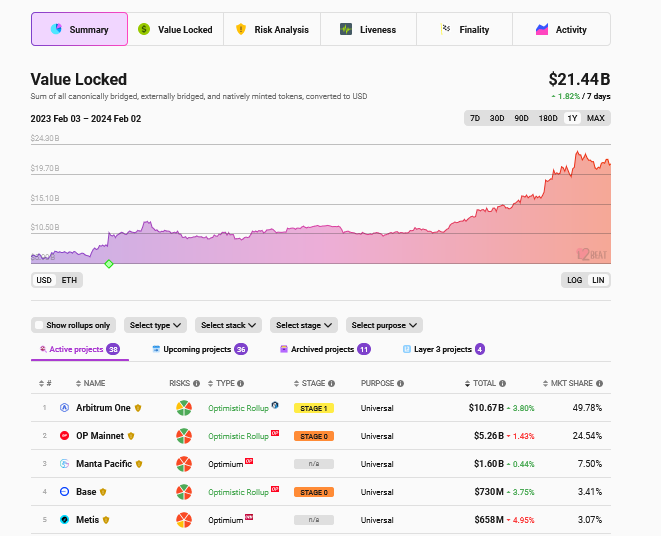

The total value locked (TVL) in layer-2 protocols remains in an uptrend, according to L2Beat. These platforms command over $21 billion. So far, the largest layer-2 protocols, Arbitrum, Optimism, and Base, use Optimistic Rollups.

Is Polygon (MATIC) Ready For $3?

This is a bullish development for Polygon. Moreover, at this pace, it is likely to cement Ethereum, the pioneer layer-1 and smart contract platform, as a dominant settlement layer despite on-chain scaling concerns and relatively high fees.

From a price point perspective, MATIC will likely benefit as more platforms adopt Polygon’s zkEVM solutions. So far, MATIC is stable but firm when writing on February 2. From the daily chart, MATIC has support at around $0.70. On the upper end, the immediate resistance level is at $1.

Spurred by partnerships as more platforms use zkEVM, fundamental developments might drive MATIC even higher in the coming sessions. If MATIC finds momentum, the medium- to long-term target will be $3, or a 2021 high.

pic.twitter.com/pyHtSBMdj4

pic.twitter.com/pyHtSBMdj4