Bitcoin price looks stuck in the near term, but TON, RNDR, PEPE and AR could surprise traders by making a strong upside move.

Cryptocurrency Financial News

Bitcoin price looks stuck in the near term, but TON, RNDR, PEPE and AR could surprise traders by making a strong upside move.

A brief, three-second mention of Render’s Octane software in an Apple promo video was spotted by traders amid RNDR already witnessing significant price appreciation this week.

Render is on the move. Price statistics show that the coin is on an uptrend, rising by 50% in the last week due to surging trading volume.

The uptick is primarily due to increased whale interest, which appears to be accumulating, moving RNDR from exchanges. At the same time, bulls are finding tailwinds following Apple’s decision to leverage Render in its Octane X rendering software.

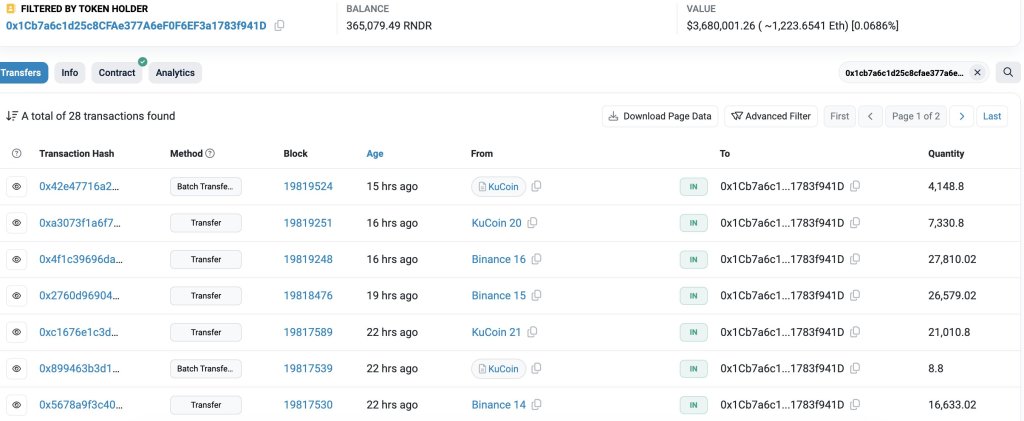

Lookonchain data on May 8 shows that the RNDR leg up follows massive token withdrawals from Binance, one of the leading crypto exchanges. The analytics provider notes that one address, 0x15CF, withdrew 748,898 RNDR tokens (worth approximately $5.3 million) from Binance between April 30 and May.

Of note, Lookonchain analysts note, is that the address boasts of a remarkable track record with RNDR. The whale has profited on RNDR in six out of seven trades, raking over $3.5 million in profits.

Besides this, other withdrawals include 364,586 RNDR (worth over $3.68 million) by 0x1Cb7, who has previously made $480,000 on RNDR. Additionally, another transfer of 181,922 RNDR ( worth over $1.81 million) by 0xCA9C from Binance.

Usually, transfers from centralized exchanges to external, non-custodial protocols or wallets are seen as bullish. This is because on Binance, for instance, RNDR or any other token holder can swap the token for another or cash, essentially liquidating and increasing supply.

This is harder on non-custodial protocols because liquidity is challenging due to the absence of other crypto or fiat ramps.

RNDR prices also rose following news that Apple would feature Render Network in its Octane X software. Octane X is a GPU renderer for macOS users. In a keynote, Apple said this software will empower artists with high rendering capabilities.

Most importantly for RNDR holders, Apple content creators will leverage Render’s decentralized computing power whenever they need to process complex scenes and high-definition animations. By tapping into Render, artists will benefit from faster rendering times and lower costs typically incurred when producing high-quality videos or 3D modeling.

On Apple’s side, integrating Render and easing activity on its iCloud services helps reduce server workload, boosting efficiency. Additionally, analysts said developers might gain access to Render via Apple’s developer tools. Subsequently, they can create more demanding models or files without expensive hardware.

At spot rates, RNDR prices are firm, extending gains. It is up 50% from May lows as bulls target March highs of $13.

Excluding Bitcoin, memecoins were the biggest narrative of this cycle. However, Artificial Intelligence (AI) tokens also performed remarkably during the first quarter of 2024.

The crypto market recovered over the weekend from the May 1st retrace, with AI tokens showing significant gains. As a result, many industry experts think that the sector is poised for a ‘Round 2’ this cycle.

Crypto analysts highlighted AI tokens alongside memecoins as the hottest topic of 2024, responsible for most of the massive gains during this cycle.

According to CoinGecko’s report, AI was one of the three sectors that delivered three-digit returns in Q1. Moreover, the largest AI token by market capitalization, Fetch.ai (FET), saw gains of 378.3% during this period.

As a result, some analysts deem the AI sector to be the next main narrative of the cycle. Trader John Walsh, known as CryptoGodJohn, considers “The future of AI coins preparing round 2.”

Walsh added that the AI season is “extremely obvious” and will go “so much higher” based on the developments in the sectors, including Nvidia earnings, Apple AI, and Microsoft’s $100 billion AI fund.

To this, crypto analyst MacroCRG replied that a massive AI growth “will be obvious in hindsight,” considering that the sector’s market capitalization is “just” $27.3 billion.

AI mcap still just $27B

It will be obvious in hindsight https://t.co/HH0Tb86fNY pic.twitter.com/71qgdwdM1C

— CRG (@MacroCRG) May 6, 2024

According to a MacroCRG post, the AI market cap had increased 8% by Monday morning, and its daily trading volume was around $1.9 billion. On Tuesday, the market cap surged to $27.8 billion, a 2.3% increase from 24 hours ago.

In comparison, memecoins $54.4 billion market cap doubles AI’s. However, its market cap decreased by 2.8% in the last day, with the top ten memecoins showing red numbers in the past 24 hours.

Despite the remarkable performance, some figures think the sector has a more pessimistic future. According to memecoin trader Murad, the developments in the industry will “be replacing more & more jobs every year.” As a result, there will be an increase in “Anxieties and desperate attempts to ‘make it.’”

To the trader, the industry will serve as a push for the memecoins sector, as “Growing AI capabilities will be one of the big forces accelerating the Memecoin Bubble.”

Financial giant Warren Buffett shared a more skeptical view on Saturday. The Co-founder and CEO of Berkshire Hathaway revealed he is not sold yet by artificial intelligence. To the CEO:

We let a genie out of the bottle when we developed nuclear weapons. AI is somewhat similar — it’s part way out of the bottle.

Despite this, Buffet recognized the potential for AI technology to change the world positively.

On The Brink Of A Millionaire Boom

“The AI industry is on the brink of a multi-trillion-dollar boom,” stated Alex Wacy. The analyst believes the reasons behind this are the vast and diverse potential of applications.

Moreover, the expert highlights that interest in the sector has steadily increased over the last year. A crypto and AI combination could potentially “create a market valued in the trillions.”

According to the post, the market is projected to reach nearly $2 trillion by 2030, which suggests that the crypto industry should not overlook it.

Tokens like RNDR showed a remarkable performance over the past week, with the price soaring by 45%. RNDR regained the $10 support zone this week after struggling to retest it over the last month.

In the past 24 hours, the token’s price surged 6.4%, and its daily trading volume increased by 16.8%, with over $455 million being traded.

FET is “a top performing AI coin headed into the Nvidia earnings,” as stated by John Walsh. The trader forecast that the token is “looking for a next leg higher up” after successfully retesting the $2.35 resistance level.

$FET break retest now looking for next leg up higher

FET will be a top performing AI coin headed into the nvidia earnings pic.twitter.com/Agl0eqB9mD

— Johnny (@CryptoGodJohn) May 6, 2024

FET broke above this level over the weekend, rising to $2.5 on Monday and remaining above the $2.40 support zone since.

At writing time, the token is trading at $2.42, representing a 2.4% increase in the last 24 hours and a $22.9% surge in the past week.

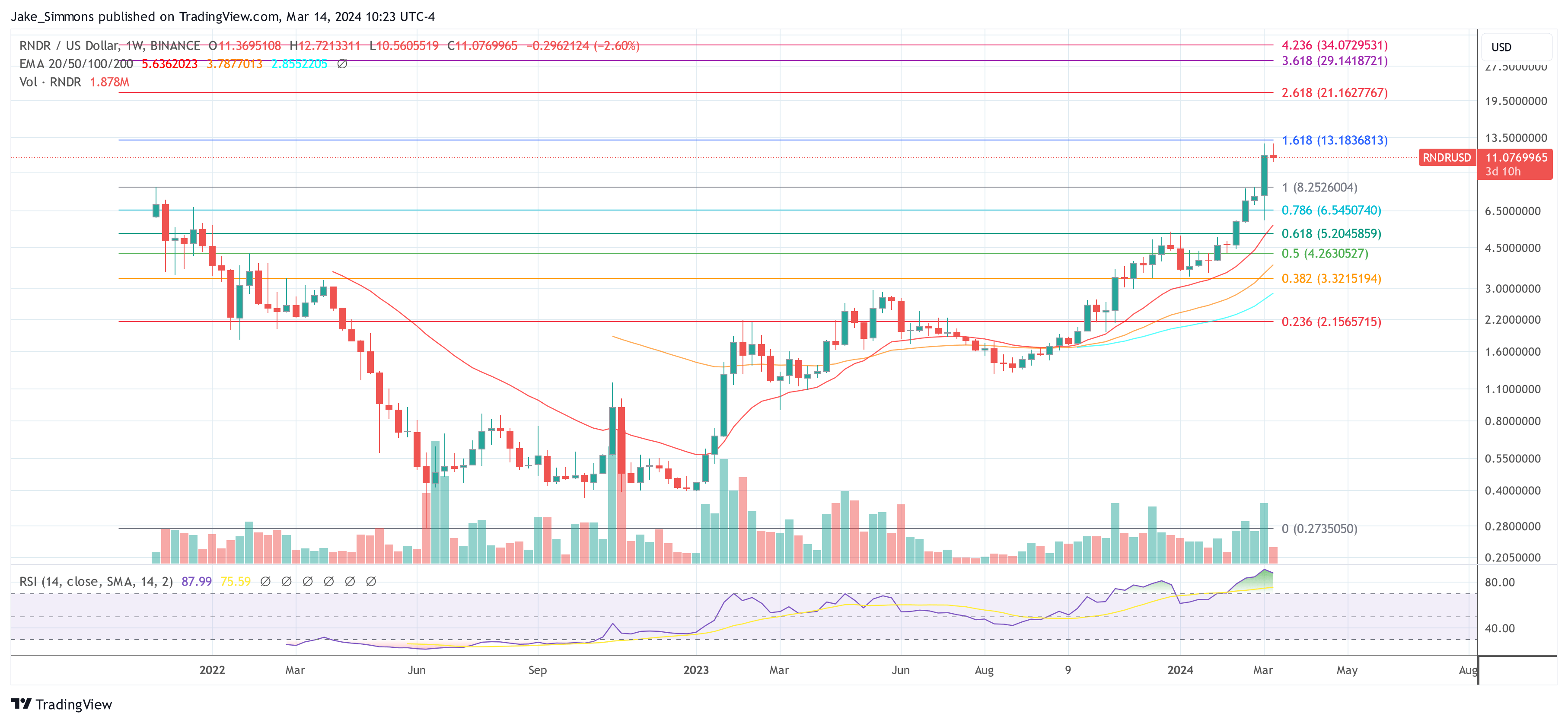

Render (RNDR), the cloud-based rendering network, is stirring excitement in the crypto market with technical indicators and analyst predictions hinting at a substantial price surge in the coming weeks or months.

Technical analysis paints a bullish picture for RNDR. The token has recently broken out of a bullish technical pattern known as the Dragon Pattern, also referred to as the supply line. This breakout historically signifies a potential shift in momentum, with prices likely to trend upwards.

Adding fuel to the fire, analysts are observing the formation of Three Rising Valleys on RNDR’s chart. This pattern suggests a potential market bottom has been established, indicating a reversal from previous downward trends.

Furthermore, a bullish divergence on the four-hour chart hints at weakening selling pressure. In simpler terms, sellers are struggling to push prices down, failing to break below previous lows.

$RENDER – It’s looking bullish in my opinion.

Here is why

• Dragon pattern aka the supply line which broke out already.

• Potential 3 rising valleys in the making while we established a potential bottom.

• 4 hour bullish divergence which means that sellers had a hard… pic.twitter.com/jMBzXWyG81

— Doji

(@SatsDoji) April 25, 2024

DoJi, a prominent crypto analyst, sees these technical indicators as a recipe for a price surge. Based on his analysis of the Three Rising Valleys, DoJi has set a price target of around $13 for RNDR. He even goes as far as suggesting a price explosion beyond $20 if historical price movements repeat themselves.

According to DoJi, surpassing a key resistance level of $9.20 could be the catalyst that ignites this bullish momentum.

In the previous half-year, RNDR’s value rose by an astounding 250%. The pattern of impulsive and corrective moves in the price fluctuation points to a turbulent market.

Forecasting the price trajectory of RNDR in the future offers both cautious and optimistic options. There is expected to be resistance at $10.90 and a larger barrier at $13.30.

If the price drops, $6.18 or even lower, $3.79, may provide support. RNDR network adoption rate and general market trends could drive price fluctuations, but long-term indications like the 100-day average point to a possible stabilization around $8.92.

Analyst Chimes In With Optimistic Predictions

Meanwhile, DoJi isn’t the only crypto expert bullish on RNDR. Inspector Crypto, another well-respected analyst, has identified a bullish Inverse Head and Shoulders Pattern on RNDR’s chart. This pattern typically precedes a price increase, and Inspector Crypto has projected a target range of $14-$16 for RNDR based on this pattern.

$RNDR | Inverse Head and Shoulders pattern target: $14-$16#RENDER #Solana #Bitcoin #AltCoinSeason2024 #Bullrun2024 #ADA #Xrp #AKT pic.twitter.com/VRO8gcTAiH

— Inspector Crypto

(@1nspector_G) April 26, 2024

The combined optimism from DoJi and Inspector Crypto reflects a broader sentiment of anticipation surrounding RNDR. While the token has experienced a slight dip in price recently, many analysts are closely monitoring its performance, waiting for the upswing signal.

Featured image from Pexels, chart from TradingView

Render Network founder Jules Urbach is slated to speak at the upcoming NVIDIA GTC 2024 conference in just 4 days, potentially boosting the price prospects for the RNDR token. Scheduled for March 18th, NVIDIA’s GTC is heralded as the paramount event of the year for aficionados of AI and GPU computing, marking a year filled with rapid developments in generative AI technologies and the rise of decentralized AI networks.

Since the last GTC, NVIDIA has unveiled numerous groundbreaking advancements in AI, launching their high-performance HGX H200 GPU line, releasing new open-access Large Language Models (LLMs), and introducing Tensor Core AI acceleration into the popular RTX line of GPUs.

This year, the conference will spotlight the Blackwell HPC chip architecture, anticipated to succeed the Hopper H200 GPU accelerators, and explore the nexus of immersive media and spatial computing, emphasizing the integration of the Open 3D standard OpenUSD with generative AI.

Jules Urbach’s return to the GTC stage for a live presentation, his first since before the COVID-19 pandemic, is particularly noteworthy since he’s the only crypto founder invited to speak at this prestigious event. Having been a staple at GTC since 2010, Urbach’s insights into GPU technologies have been pivotal.

[1/3] In prep for @NVIDIA #GTC24, take a minute to revisit this highlight where Jensen Huang discusses the impact of ChatGPT, Stable Diffusion, Dall-e, and Midjourney on the world of Generative AI at last year's GTC23:https://t.co/H8f21tRPex

— The Render Network (@rendernetwork) March 14, 2024

Scheduled to present on March 20th, Urbach will deliver a talk titled “The Future of Rendering: Real-Time Ray Tracing, AI, Holographic Displays, and the Blockchain.” This presentation is set to offer an updated vision for the future of generative AI, spatial media, and decentralized GPU computing technologies. A focal point of the discussion will be on the convergence of decentralized computing, generative AI, and holographic technology, as demonstrated in The Archive—an immersive spatial experience produced on the Render Network for Apple Vision Pro.

The crypto community can anticipate Urbach sharing milestones achieved by Render Network, including technological advancements and significant projects completed using the platform. These achievements highlight the network’s capacity for professional-grade rendering tasks. Furthermore, Urbach’s presentation could outline the future roadmap of Render Network, detailing upcoming features, technological enhancements, and expansion plans that promise to revolutionize the rendering landscape.

“This year’s presentation promises to build on an iconic 2013 keynote presentation with NVIDIA Founder and CEO Jensen Huang where Jules unveiled the first cloud GPU rendering pipeline,” the Render Network team said in a recent blog post.

“I think it will be one of my most relevant GTC talks, and a reflection of the next paradigm shift we are entering for distributed GPU systems, on par with the first one back in 2013 — when I took the stage with Jensen to announce Render’s centralized precursor (ORC) and then launched with AWS,” Urbach stated looking ahead.

Potential partnerships with NVIDIA and other industry giants could be an explosive topic of discussion, given NVIDIA’s leadership in GPU technology and AI. Such collaborations could further enhance Render Network’s capabilities, and importantly, boost the RNDR price massively.

Ahead of the event, increased attention on AI crypto tokens, particularly RNDR, is to be expected. This is likely to be accompanied by a “buy the rumor of an extended partnership” sentiment that will drive up prices. Ultimately, the decisive factor will be whether the Render founder can present a groundbreaking new partnership or whether it will be a “sell the news” event.

If so, RNDR will most likely be able to reach a new all-time high. At the time of writing, RNDR was trading at $11.07, just below the all-time high of $ 12.71 set last Saturday, March 9.

Bitcoin’s recent rally toward $40,000 could further fuel traders’ bullish sentiment for KAS, RUNE, MNT and RNDR.

Bitcoin looks ready to start a relief rally and this could trigger interest in MKR, AAVE, RUNE and RNDR.

Render (RNDR) has been on an upward trajectory, recording some of the biggest profits in the crypto market this past week. This show of strength by the metaverse cryptocurrency coincides with a busy week dominated by the bulls.

However, it appears that the RNDR price increase is not a result of general market sentiment. So, what could be driving up the value of Render?

After a period of sideways movement, the price of RNDR has chosen to go upward to become one of the biggest gainers this past week. According to CoinGecko data, this coin has ballooned by more than 32% in the last seven days.

It is worth noting that most of this price increase happened in two days – on the 17th and 18th of May. In an almost vertical rise, RNDR surged in value by more than 20% on Wednesday, May 17. This price rise is understood to be a reaction to the news of Apple launching its VR headset.

RNDR, the utility token of the Render Network, didn’t have a great market performance in 2022, sinking as low as $0.325 at some point in the year. However, the cryptocurrency has been on an excellent recovery, gaining nearly 500% since the turn of 2023.

As of this writing, the RNDR token changes hands at $2.36, with a 2.8% price increase in the past 24 hours. That said, price data reveals that the coin has not made any significant movement since Thursday, consolidating around the $2.50 price level.

As earlier mentioned, the price surge experienced by RNDR in the past week was primarily due to the rumors of Apple launching its highly-anticipated VR headset next month. In fact, most metaverse tokens, including MANA, ICP, SAND, etc., enjoyed a bullish run as a result of the news.

#Metaverse tokens are on the rise this week amid rumors about Apple's new AR/VR headset

Got your eyes of any of these coins?https://t.co/bHqPPKWLk7 pic.twitter.com/FPl0854ZPa

— CoinGecko (@coingecko) May 18, 2023

The Render Network offers decentralized GPU-based rendering solutions. Meanwhile, RNDR is the utility token used to pay for motion graphics, animation, and VFX rendering on the network. The RNDR token basically powers all products released by the network’s parent company.

And, with the recent release of Render’s OctaneX app on M1 and M2 iPads, there is speculation that the developers of the new VR headset will use the Render network. OctaneX is an app that offers real-time, photo-realistic 3D rendering in M1 and M2 iPads.

Considering this potential development, there is rising demand for the RNDR token – and we are very likely to see a further increase in its price.

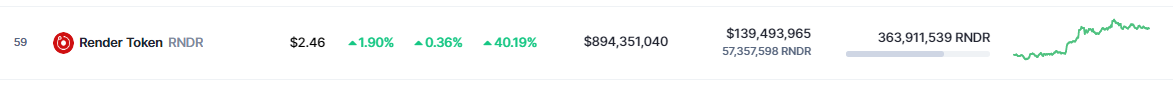

Among the top gainers on Sunday, CoinMarketCap shows that Render (RNDR) has achieved a 41% growth over the past week. The crypto actually dominated the roster of the day’s leading coins.

Render (RNDR) has been among the top performing crypto assets in the last few weeks. Render allows owners of the increasingly powerful graphics processing units (GPUs) industry to deliver computing power during periods of low demand.

The Render (RNDR) Network is a blockchain-powered, decentralized, high-performance, distributed-computing platform. It was developed to help businesses in the film, animation, gaming, and architecture industries complete complicated rendering projects quickly and affordably.

To fulfill the need of large-scale rendering projects, the RNDR Network offers a scalable and decentralized solution by letting users leverage underutilized GPU capacity from other network participants to speed up their rendering processes.

The RNDR coin is the in-network currency that may be exchanged for computer power, staked for network rewards, and used to elect leaders. In sum, the RNDR Network utilizes blockchain technology and distributed computing in an effort to completely overhaul the rendering process.

It’s no surprise that Render has been getting a lot of attention lately, what with the proliferation of the metaverse and the growing need for rendering services in a wide range of enterprises. So, the recent uptick in RNDR should not come as a surprise: widespread consensus among the rendering community to get ready for the inevitable increase in demand.

Render debuted in 2017 and spent the first half of 2018 in private sale. Render takes advantage of Ethereum’s built-in security features when uploading and transferring nodes to operators, as the network is based on the Ethereum blockchain.

RNDR Rallies Strong

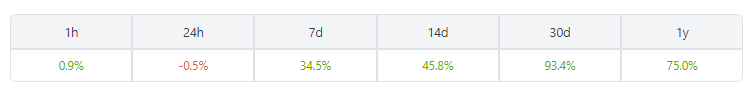

At the time of writing, RNDR was trading at $2.47, up 41% in the last week. Over the course of a two-week timeframe, the token has rallied 46%, while maintaining a solid 93% increase in the monthly period, data from crypto market tracker Coingecko shows.

Render Network Proposal 002 and Render Network Proposal 003 have both recently been given the green light by the Render project’s governance section.

The goal of RNP-002 is to allow for more users to take part in the network’s decentralized infrastructure by adding more Layer 1s.

Final Results:

• RNP-002: 4.8M RNDR to approve and has met minimum quorum for final vote at 99.26% approvalhttps://t.co/czVyrEuS3s

• RNP-003: 4.7M RNDR to approve and has met minimum quorum for final vote at 99.90% approvalhttps://t.co/BT5Y3WnhL3

— Render Network | RNDR (@RenderToken) April 26, 2023

To integrate the Solana network into its services, RNDR holders voted overwhelmingly in favor of the idea.

On the other hand, RNP-003, which was also accepted by the Render Network community with a two-thirds majority, concerns itself with the accumulation and distribution of project funds.

The objective is to provide the organization with the tools and infrastructure it needs to carry out its objectives. It can then focus on its mission and the expansion of the network.

-Featured image from Invezz

Kaspa (KAS), Injective (INJ), and Render (RNDR) are bucking against the general crypto market trend after sustaining gains over the last day. This follows a bearish movement that occurred after Bitcoin reclaimed the $29,000 level. A flash crash sent the pioneer cryptocurrency back to $27,500 and the crypto market tumbled along with it. However, not all altcoins in the space followed this as three assets have continued to see gains.

In the hours that followed Bitcoin’s decline, Kaspa (KAS) was one of the cryptocurrencies that were able to shake off the bears with ease. In the last day, the altcoin is up over 10% and was able to reclaim the $0.03 level before experiencing some resistance and correcting back down.

One reason behind the impressive movement has been the announcement that the cryptocurrency would be getting listed on its very first exchange in the United States. The Uphold digital asset trading platform is listing the altcoin for trading on Thursday, April 27, and the news of this listing saw the trading volume of the cryptocurrency rise over 82%, leading to its surge in price.

KAS has also seen multiple exchange listings this month with LBank and Bitget also listing the digital asset for trading in the last week.

Injective (INJ) protocol has been behind Kaspa (KAS) when it comes to gains. Over the last 24 hours, the cryptocurrency has rallied around 9%, making it one of the best performers for this time period. This gain has brought the digital asset’s price to about $8.85, clearing the dreaded resistance at $8.8.

INJ’s gains for the last month have also risen to 139% on the 30-day chart. Its trading volume has seen a 51% increase as well and is now sitting at $332 million.

Render (RNDR) Maintains Considerable Gains

Render (RNDR) has seen the lowest gains of the bunch but that does not mean that the altcoin has done poorly by any measure. With over 6% gains in a 24-hour period, RNDR has emerged as one of the only cryptocurrencies to be seeing green during these uncertain times.

Just like the others, the altcoin is also doing well on the 7-day and 30-day charts. It is up 10.43% in the last week and 99.99% on the monthly chart. Its trading volume is also up as well with an 81.34% increase in one day.

What’s Driving These Gains?

Besides Kaspa’s listing on the Uphold exchange, there seems to be no apparent reason why the other coins are pumping. It mostly comes to some leftover momentum from the initial market pump on Wednesday that pushed Bitcoin above $29,800.

For now, these altcoins have been able to hold their gains and remain in the green. If the market were to pick up once again, then there is a high possibility that these cryptocurrencies will continue to see upside.

Render (RNDR) is one of the biggest gaining coins this week. According to CoinGecko, the token is up 11% in the last 24 hours, and 22% in the last week. With Bitcoin and Ethereum experiencing a strong bullish sentiment, RNDR might experience a bigger upside in the medium to long term.

After a tough start this week, the market is finally showing signs of vigor. According to CoinGecko, the total market cap of crypto rose nearly 3% since yesterday, flipping sentiment from bearish to bullish.

Despite this, macroeconomic uncertainty will still be a major driving force for the bears. With this week being jam-packed with new data that would affect investor sentiment, investors should stay cautious of the current market situation.

Render has been on a roll recently as on-chain developments continue. RNP-002, the proposal to move the Render network to the Solana blockchain, has concluded last week. With Render’s help, Solana’s NFT space will benefit greatly as Render helps in the quick generation of digital assets.

“This rendered in 5 min at 1500 samples on the #RenderNetwork.. Would have taken my computer 3 hours or more (dual 3090).”

– Rowan While @rowanwhile• Made in #C4D and #Octane

pic.twitter.com/uFiyHRWhGf

— Render Network | RNDR (@RenderToken) April 20, 2023

RNP-003 has also concluded with an overall positive vote by the community. Titled “Resource Acquisition and Allocation for Core Team and Grants”, the proposal aims to push decentralization on the network. According to their blog post regarding the proposal, it is an important step as this would push Render from being run by a core team to being run by the community.

Despite the positive developments for the network, fears surrounding the banking system were renewed as First Republic Bank and senior officials of the Federal Deposit Insurance Corp. revealed that they are considering downgrading their scoring of the bank. This would block the bank from receiving loans from the FDIC, further adding stress to the banking system.

Although other regional banks released their financials that reassured the market, First Republic’s results dampened investor sentiment as banking fears were magnified.

However, Geoff Kendrick, the head of digital assets research at Standard Chartered, believes that the crypto winter has finally ended along with a $100k Bitcoin prediction by the end of 2024. If this ever happens, Render is on the right path for higher highs.

The bulls seem to be active in the $2 support range which is crucial. This invigorates investors and traders to defend this support level at all costs as a bearish break on the $2 level could spell disaster for RNDR.

Targeting $2.35 in the short to medium term would also be beneficial as this would open up the road toward higher highs.

-Featured image from The Coin Republic

The crypto trading firm sees NFTs becoming more intertwined with brand IP, while Web3 apps with “real world utility” gain traction.