Ripple, one of the financially strongest companies in the entire crypto sector, blends traditional banking and finance with digital assets. This comprehensive analysis addresses the question “What is Ripple?” and looks at its origins, technological advances and products, market dynamics, a potential IPO, and the ongoing legal battle with the US Securities and Exchange Commission (SEC).

[toc]

What Is Ripple?

Ripple occupies a unique niche in the blockchain universe, setting itself apart from typical cryptocurrency projects. Unlike many of its peers aiming to change banking as we know it, Ripple seeks collaboration with the financial system. At its core, Ripple operates on a public database known as the XRP Ledger (XRPL), characterized by transparency and open access.

The Ripple protocol diverges significantly from the likes of Bitcoin as it eschews the concept of mining, where transactions are confirmed and the network is secured by miners. Instead, Ripple relies on validators. These validators play a crucial role in maintaining the network’s integrity. For instance, when a transaction is initiated—say, a user transferring funds to another—the network’s validators must reach a consensus to confirm this transaction.

Notably, most validators are operated by Ripple Labs and its partners. They are responsible for confirming all transactions within the Ripple network. This distinctive system empowers Ripple to execute transactions with remarkable speed and cost-efficiency. However, it also leads to a higher degree of centralization compared to networks like Bitcoin or Ethereum.

Central to Ripple’s functionality is the XRP token, often dubbed as the “bank coin.” It primarily serves as a bridge currency for fiat transactions, embodying the essence of Ripple’s vision to streamline global financial exchanges. The XRP token thrives on the XRP Ledger (XRPL), a manifestation of distributed ledger technology (DLT). This combination of technology and vision positions Ripple as a unique entity in the blockchain space, offering a blend of innovation and pragmatic collaboration with existing financial structures.

Key Aspects Of Ripple And XRP

- No Mining, Only Validators: The XRP Ledger does not employ mining for transaction confirmation or network security. Instead, Ripple relies on validators. These validators are crucial in confirming transactions. Their consensus keeps the network secure and efficient.

- XRP: The XRP token is central to Ripple’s ecosystem. It is pre-mined, meaning its tokens were created before the project’s public launch. Ripple advocates for XRP due to its minimal transaction fees, quick settlement, and scalability, handling up to 1,500 transactions per second.

- XRP Ledger (XRPL): This ledger is key to recording data like balances and transfers. The XRPL facilitates quick settlements, allowing payments in local currency for involved parties, and supports bridging currencies for transactions.

- Unique Node List (UNL): The XRPL operates through a Unique Node List, comprising 35 validators. For a transaction to be recorded, at least 80% of these nodes must agree on its legitimacy.

- RippleNet: Separate from the XRPL, RippleNet is an exclusive network developed by Ripple for payment and exchange. It does not use XRP and offers instant settlement, tracking of cross-border payments, and interaction within a unified framework for financial institutions.

- Ripple’s Use Cases: Ripple envisioned XRP to operate as an alternative to traditional systems like SWIFT, enhancing international payment efficiency. Furthermore, Ripple wants to establish itself as a crypto liquidity provider as well as in the field of Central Bank Digital Currencies (CBDCs).

Unveiling The Origins And History Of Ripple

Ripple’s inception can be traced back to a concept by Ryan Fugger in 2004. He envisioned a decentralized monetary system, Ripplepay, to empower individuals in their financial interactions. This idea laid the groundwork for what would eventually become Ripple.

In 2012, the journey took a significant turn. Jed McCaleb, known for his work on the Mt. Gox exchange, and Chris Larsen, a renowned figure in the fintech sector, approached Fugger. They proposed a digital currency system utilizing the Ripple protocol. This collaboration led to the establishment of OpenCoin.

Later, in 2013, OpenCoin was rebranded to Ripple Labs. It was during this time that Ripple began to solidify its unique approach to the blockchain and cryptocurrency world. Unlike its contemporaries, which focused solely on a decentralized model, Ripple sought to integrate with the existing financial system, particularly targeting the inefficiencies in cross-border payments.

The Significance Of Ripple XRP In The Ecosystem

XRP, as Ripple’s native cryptocurrency, plays a pivotal role in the Ripple ecosystem. Its significance stems from several unique features and functionalities that it brings to Ripple’s network.

- Bridge Currency: One of the primary uses of XRP is as a bridge currency in international transactions. This role is crucial in RippleNet’s offering of efficient and cost-effective cross-border payment solutions.

- Transaction Efficiency: XRP stands out for its transaction speed and minimal fees. The network can process 1,500 transactions per second, with each transaction costing a minimum of 0.00002 XRP.

- Scalability And Environmental Sustainability: XRP’s pre-mined status means all its tokens were created before the network went live.

- Liquidity Source: XRP serves as a source of liquidity in Ripple’s On-Demand Liquidity product (now Ripple Payments).

- Decentralized Exchange And Cross-Chain Integration: The XRPL DEX, the decentralized exchange on the XRP Ledger, has been operational since 2012. It provides a platform for trading XRP and other cryptocurrencies with minimal fees.

- Legal and Regulatory Challenges: The role of XRP has been subject to scrutiny, especially following the SEC’s lawsuit against Ripple. The lawsuit’s focus on whether XRP should be classified as a security has implications for its use and trading, particularly in the US market.

What Is The Difference Between XRP And Ripple?

Understanding the distinction between XRP and Ripple is crucial for grasping the full scope of what Ripple Labs Inc. offers in the blockchain and cryptocurrency domain.

Ripple – The Company: Ripple refers to the technology company, Ripple Labs Inc., which focuses on creating and managing a global payment network. Founded in 2012, Ripple’s primary mission is to transform the world of financial transactions, making them faster, more secure, and less costly. Ripple develops several blockchain-based products, with RippleNet being its flagship network that facilitates cross-border payments.

XRP – The Cryptocurrency: XRP, on the other hand, is a digital asset or cryptocurrency that operates on the XRP Ledger. It was first developed by Ryan Fugger and later enhanced by Jed Caleb and Chris Larsen – which led to what we now know as XRP.

Use Cases Of Ripple

Ripple and its associated technology offer diverse applications in the financial sector, notably in cross-border payments, crypto liquidity, and central bank digital currencies (CBDCs). Each of these use cases represents a significant advancement in how financial transactions and operations are conducted in the modern era.

Cross-Border Payments

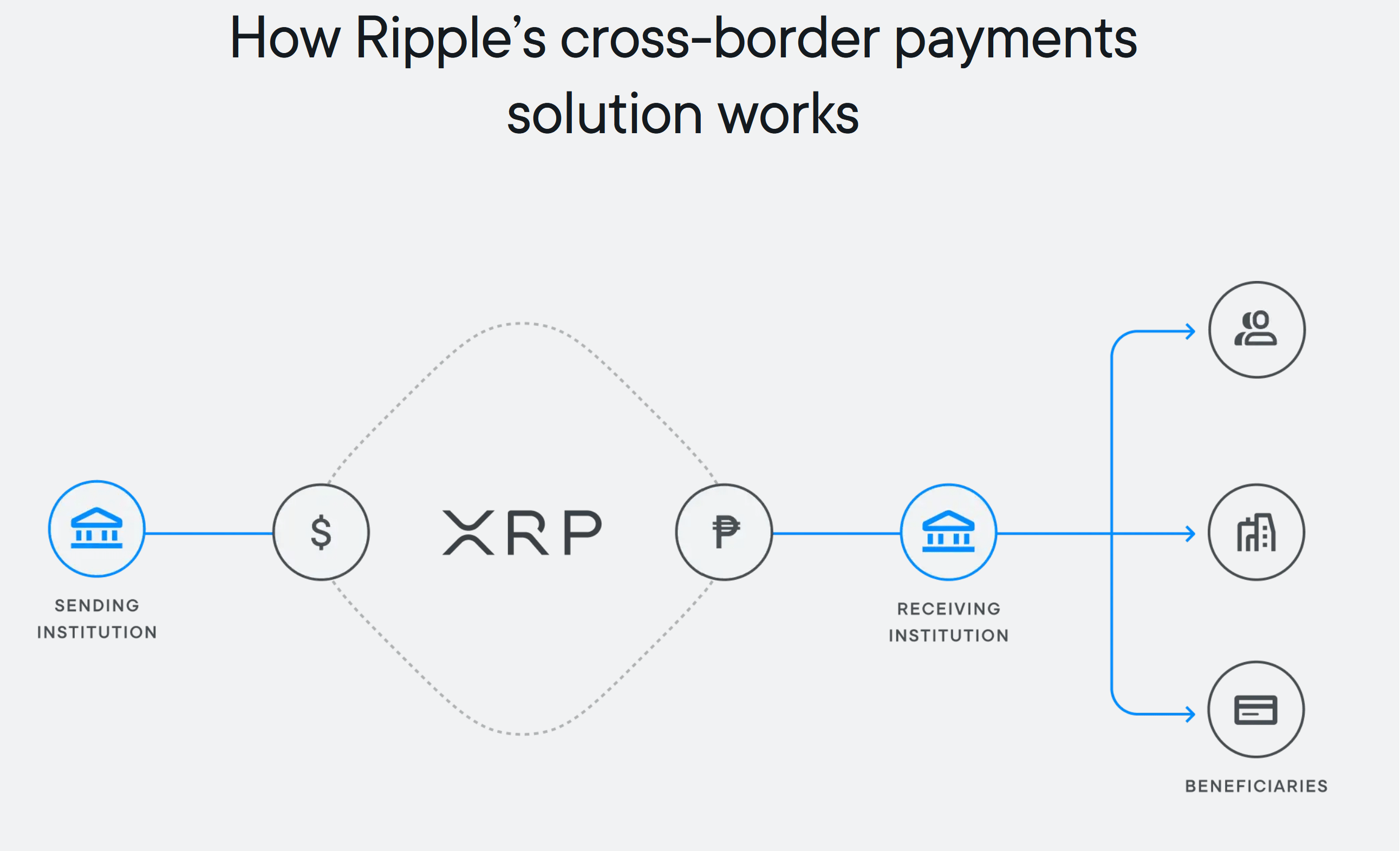

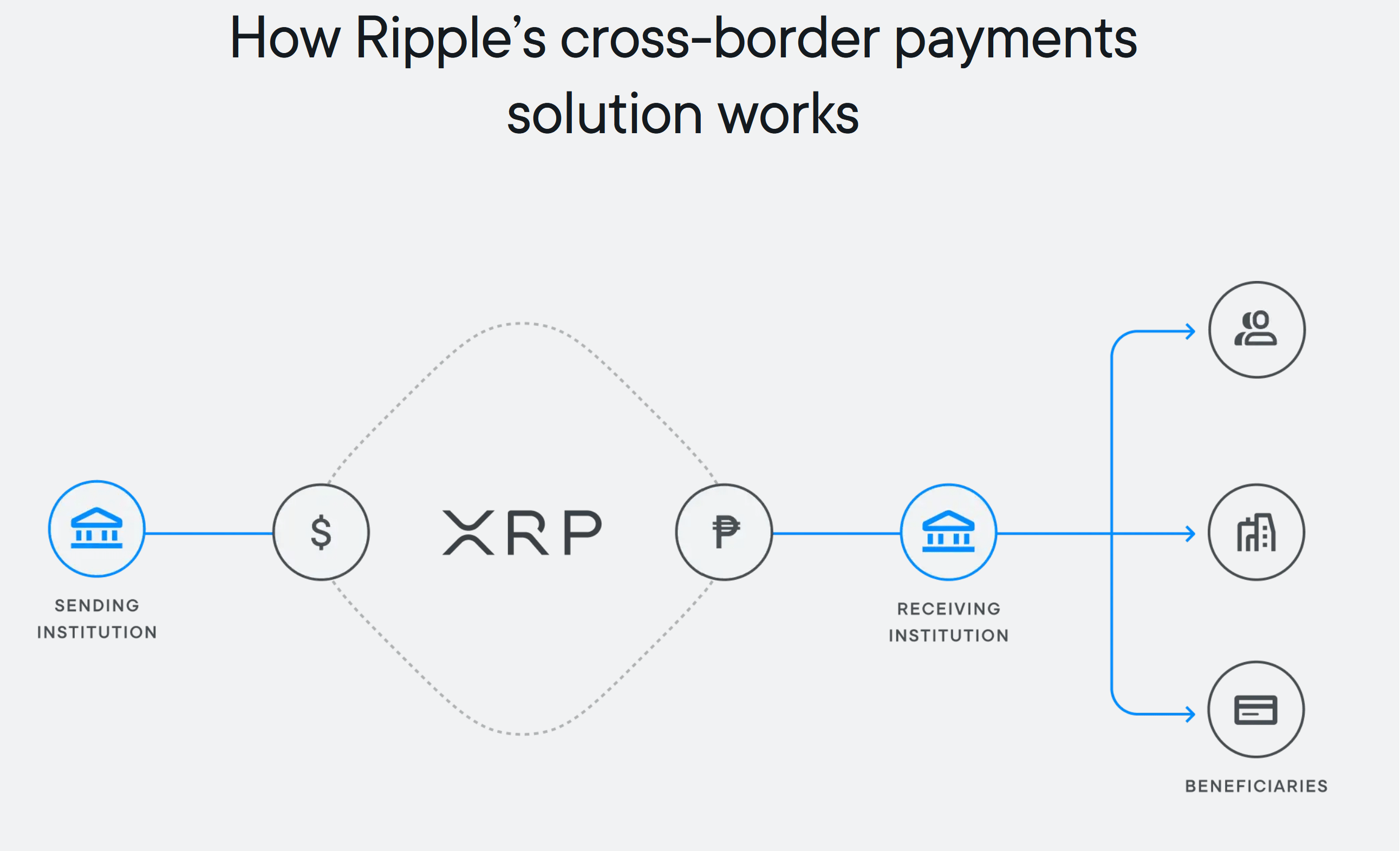

Ripple’s technology, particularly through RippleNet and Ripple Payments, significantly streamlines cross-border payments. Traditional international money transfers are often slow, expensive, and opaque. Ripple addresses these issues by providing a more efficient, transparent, and cost-effective solution.

RippleNet enables rapid transaction settlements and reduces the operational costs associated with cross-border payments, making it an attractive option for banks and other financial institutions. The use of XRP as a bridge currency in Ripple’s On-Demand Liquidity service (new: “Ripple Payments”) further enhances this efficiency by eliminating the need for pre-funding accounts in destination countries, thus freeing up capital and reducing liquidity costs.

Crypto Liquidity (“Liquidity Hub”)

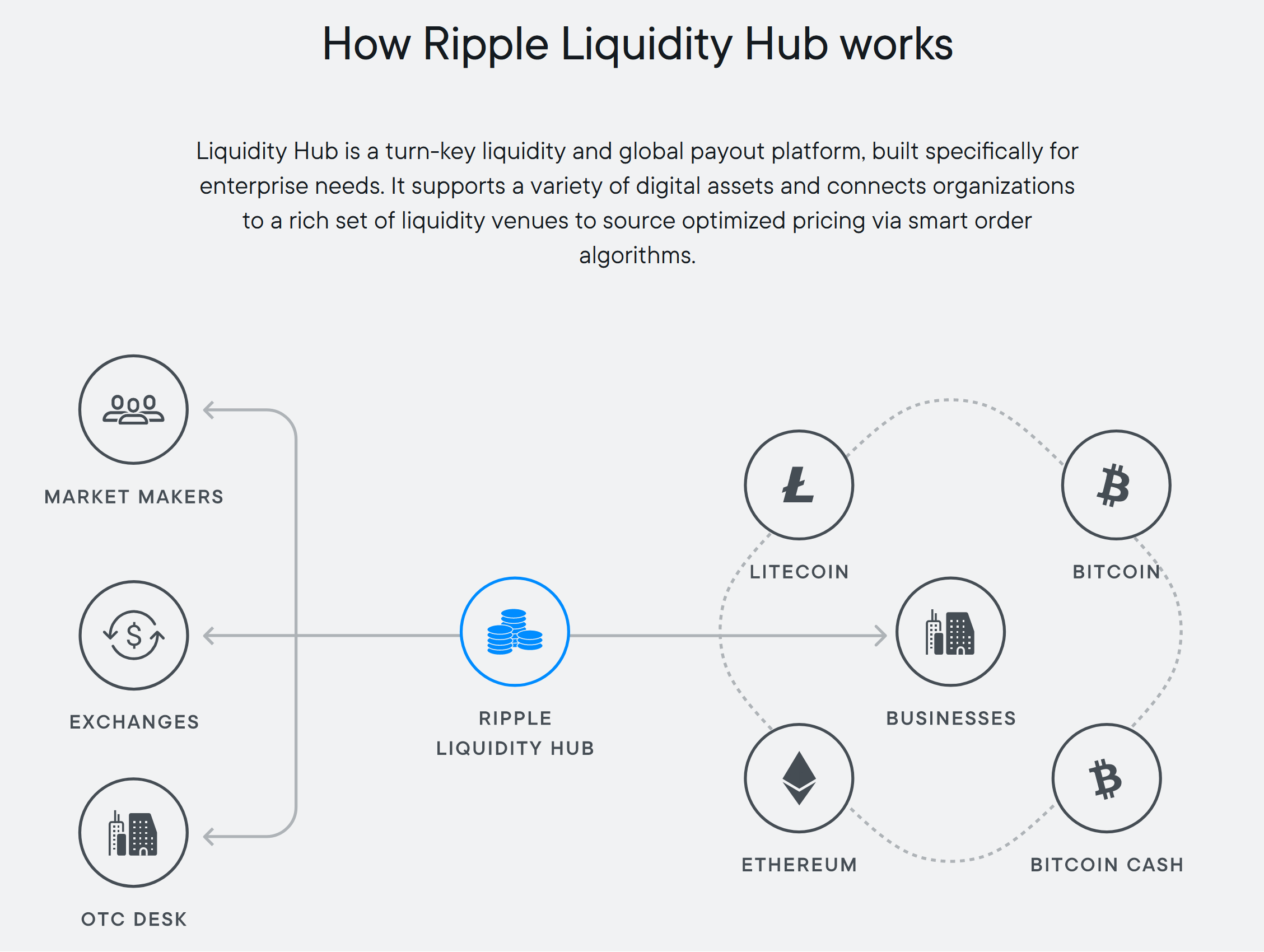

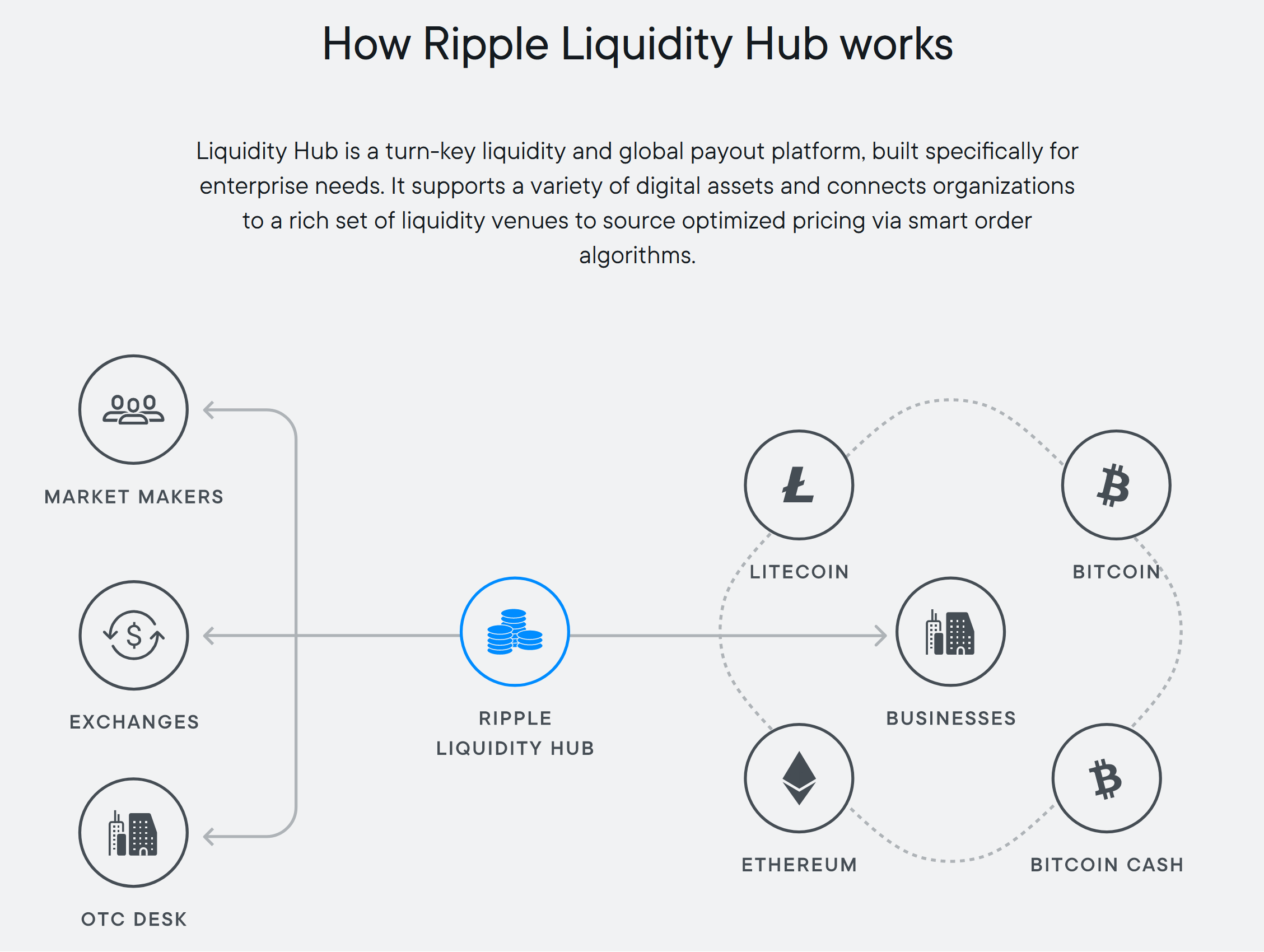

The Ripple Liquidity Hub serves as a groundbreaking platform for businesses to manage their crypto liquidity needs effectively. Designed primarily for financial institutions and other enterprises, it provides a streamlined way to buy, sell, and hold digital assets.

A key aspect of the Ripple Liquidity Hub is its ability to offer optimized crypto liquidity. It achieves this by accessing aggregated liquidity pools from various sources, such as exchanges and over-the-counter desks. This ensures that businesses can obtain the best possible prices for digital assets across a range of venues.

Furthermore, the platform simplifies digital asset management for enterprises. It comes equipped with an enterprise-level dashboard that facilitates the efficient management, trading, and reporting of digital assets. This feature is particularly beneficial for businesses looking to streamline their crypto portfolio management.

One of the most innovative aspects of the Ripple Liquidity Hub is its expansion of access to capital. The platform removes the need for businesses to hold pre-funded capital positions with multiple liquidity venues, thanks to its post-trade settlement feature. This aspect significantly enhances capital efficiency for enterprises.

In its commitment to interoperability and the inclusion of various digital assets, the Ripple Liquidity Hub initially supports a diverse range of digital assets including BTC, ETH, LTC, ETC, BCH, and XRP, with the availability varying by geography. Ripple plans to further expand its offerings, demonstrating its commitment to fostering an inclusive and competitive crypto market.

Central Bank Digital Currency

Ripple’s engagement in the development of Central Bank Digital Currencies (CBDCs) is a significant move towards modernizing the financial ecosystem. Ripple has launched a dedicated platform for CBDCs, aiming to provide a seamless end-to-end solution for central banks, governments, and financial institutions to issue and manage their own digital currencies.

Ripple’s CBDC platform is designed to address multiple use cases, including both wholesale and retail CBDCs, as well as issuing stablecoins. The platform’s capabilities extend to end-user wallets, allowing users to securely hold digital currencies and make payments for goods and services, similar to other banking apps. This includes functionality for offline transactions and non-smartphone use cases, broadening the accessibility of digital currencies.

Notably, Ripple has been recognized as a leader in the CBDC space, topping competitive leaderboards by Juniper Research and CB Insights for its CBDC technology.

Ripple’s involvement in CBDC pilot projects across various nations showcases its commitment to supporting the development and implementation of digital currencies at the national level. Remarkably, the company has partnered with several countries, including Palau, Bhutan, and Montenegro, to explore and develop their respective CBDCs / stablecoins.

What Is RippleNet?

RippleNet is a distributed network developed by Ripple, designed to facilitate real-time, cross-border transactions. As a peer-to-peer distributed application, it maintains a virtual ledger that emulates the roles of Nostro and Vostro accounts commonly used in international banking.

RippleNet is known for its two primary layers: a bi-directional messaging layer and a settlement layer. The messaging layer handles the communication of transactions, while the settlement layer ensures the final transfer of funds.

It operates within a cloud environment hosted by Ripple, which substantially lowers technical infrastructure costs for its users. It integrates with financial institutions’ middleware through API operations, effectively replicating funding into RippleNet virtual accounts.

Importantly, RippleNet is SOC 2 certified, ensuring high standards of security, availability, confidentiality, and privacy. It improves the cross-border payment experience by offering efficient messaging, optimized settlement, and unique liquidity solutions.

RippleNet’s clientele includes a diverse range of sectors, including traditional remitters, digital remitters, FX brokers, payment service companies, and banks (encompassing global tier-1 banks, multi-country regional banks, local banks, and digital banks), as well as multinational businesses.

What Is Ripple’s On-Demand Liquidity (New: Ripple Payments)?

Ripple’s On-Demand Liquidity (ODL), now known as “Ripple Payments,” is a liquidity management solution that facilitates instant and efficient cross-border money transfers without requiring pre-funding in the destination market. It utilizes XRP as a bridge currency to source liquidity on demand, enabling real-time fund movement.

The evolution of ODL has led to significant improvements in efficiency and user experience. Initially, the product required payments to be originated in fiat currency, converted to XRP, and then again converted to fiat currency in the destination country. The refined Ripple Payments allows customers to send XRP for cross-border payments directly through a crypto wallet, leveraging the wallet to source XRP on demand.

This reduces friction in the payment flow and provides greater flexibility and choice to customers. It also streamlines the onboarding process for new partners and currencies, enabling multiple currencies through a single wallet.

The adoption of Ripple Payment has grown, with innovative companies like FlashFX using it to support payments in new currencies like GBP and EUR, which were not previously supported. This expansion is part of Ripple’s broader global momentum, especially in regions like Southeast Asia, where there is significant growth due to progressive crypto regulations and the presence of innovative companies. Companies like Novatti and Tranglo, for instance, play a vital role in the network as fiat on and off-ramps.

Ripple’s Potential IPO And Price Predictions

Ripple’s potential Initial Public Offering (IPO) has been a topic of significant interest within the cryptocurrency and financial communities. While Ripple has not officially announced plans for an IPO, there are vivid speculations surrounding this possibility.

In a recent analysis, Wall Street expert Linda Jones suggested that Ripple’s pre-IPO shares could potentially rise by 2,000%. She pointed out that the current valuation of Ripple’s pre-IPO shares on Linqto stands at $35 per share. This translates to a $5.7 billion valuation.

Jones emphasized the significance of the company’s substantial holdings in XRP, with 42 billion XRP in escrow. They could contribute to an aggregate worth of approximately $107 billion, far exceeding its current valuation on Linqto. This analysis considers the potential resolution of the legal battle with the SEC and its impact on XRP’s price, indicating optimism about Ripple’s future IPO valuation.

Ripple Vs. The SEC: A Comprehensive Overview

As of early 2024, Ripple Labs has achieved several notable victories against the United States Securities and Exchange Commission (SEC). Here are the key developments:

- Summary Judgment Win For Ripple (July 13, 2023): Ripple Labs achieved a partial victory in its legal battle with the SEC. The US District Court for the Southern District of New York ruled that XRP sales on exchanges and through algorithms did not constitute investment contracts. Consequently, these sales are not subject to federal securities laws. However, the court found Ripple’s direct institutional sales in violation of these laws. It deemed them unregistered offers and sales of investment contracts.

- Denial Of SEC’s Interlocutory Appeal (October 3, 2023): The SEC’s attempt to appeal the summary judgment loss was denied by Judge Torres. This marked a significant setback for the regulator and underlined Ripple’s strengthening position in the lawsuit.

- SEC Drops Claims Against Ripple Executives (October 19, 2023): The SEC withdrew its charges against executives Brad Garlinghouse and Christian Larsen. This decision narrowed the lawsuit’s focus solely on Ripple Labs.

- Pending Trial and Remedies Phase: The trial, set to occur between April and June 2024, will be critical for Ripple Labs. The main focus will be on the institutional sales of XRP worth $770 million, which were deemed unregistered securities sales. The remedies phase will determine the penalties for these sales, with the SEC potentially seeking the entire amount as fines.

For a more in-depth look at the XRP lawsuit, read our dedicated article.

FAQ: What Is Ripple

What Is Ripple?

Ripple is a technology company that specializes in digital payment protocols and currency exchange networks. Its real-time gross settlement system and the cryptocurrency XRP are well-known features.

Will Ripple Replace SWIFT?

Ripple, while focused on enhancing global financial transactions, is not set to fully replace SWIFT. However, the company’s faster and more cost-effective solutions offer a competitive alternative.

What Distinguishes XRP From Other Cryptocurrencies?

XRP stands out among cryptocurrencies like Bitcoin and Ethereum due to its high speed and low transaction costs. This makes it particularly suited for rapid cross-border payments.

Will Ripple Go Public?

Ripple plans to consider going public once it resolves its legal battle with the SEC. The potential IPO would depend on the outcome of the lawsuit and market conditions.

Is Ripple Stock Worth Anything?

Currently, Ripple is a private company, so it does not have publicly traded stock. An assessment of the company’s value can only occur if it undergoes an IPO and becomes a public company.

Is XRP The Same As Bitcoin?

No, XRP and Bitcoin are different. Bitcoin is a decentralized digital currency without a central bank, operating on a peer-to-peer network. Ripple uses XRP for its payment technology and is renowned for its rapid transaction processing times.

Does Ripple Have A Good Future?

Ripple’s future is subject to various factors. These include the outcome of its lawsuit with the SEC, market adoption, and overall cryptocurrency market trends. Its focus on payment solutions presents potential growth opportunities.

Who Invented Ripple?

Chris Larsen and Jed McCaleb co-founded Ripple. They founded the company, initially known as Opencoin, in 2012 before renaming it to Ripple.

(@FilanLaw)

(@FilanLaw)