A crypto analyst has predicted a substantial bullish surge for the the XRP price in the future. According to the analyst, XRP is gearing up for a substantial increase to $33.5 from an initial price of $0.50. He expects the price of the cryptocurrency to explode by 6600% in this current market cycle.

Analyst Forecasts Exponential Rise In XRP Price

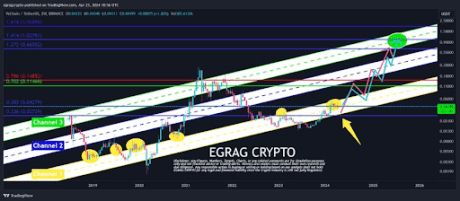

In a recent X (formerly Twitter) post, a crypto analyst identified as ‘Egrag Crypto,’ revealed a series of bullish price targets for XRP in the near future. The analyst focused his predictions on a technical analysis called “the Line of Hestia.”

Related Reading: US Mega Banks JP Morgan And Wells Fargo Unveil Bitcoin Exposure As BTC Drops To $60,000

Egrag Crypto’s latest findings suggest that XRP could rise to $33.5 if it touches the Line of Hestia, a technical indicator featuring an ascending trend line which signals a potential upsurge for the price of a cryptocurrency. According to the analyst, “Historical data indicates that every time the XRP price touches the “Line of Hestia,” it experiences significant price pumps.”

This implies that there may be a correlation between XRP’s bullish price movements and the ascending trend line. Egrag Crypto also revealed that following this historical pattern, XRP has witnessed pumps ranging from 6600%,1444%, 100%, 80%, and 171%.

Given the established trend, Egrag Crypto predicts XRP’s ascent to new all-time highs. He calculated the average percentage increase of XRP’s price each time it touched the Line of Hestia, dividing the sum by the total number of occurrences, which is five.

Using this data, the crypto analyst estimates that if XRP were to experience a 6600% increase, its future price would be $33.50. Similarly, he calculated new prices for XRP based on the previous percentages.

It’s important to note that the price of XRP, at the time of writing, is trading at $0.5. The cryptocurrency has been recording considerable declines over the past year, consolidating around the $0.5 price mark for months. According to CoinMarketCap, XRP has also recorded a 7.35% decrease over the past seven days and a 0.08% decline in the last 24 hours.

Although Egrag Crypto has remained optimistic about XRP’s future price, other crypto community members have expressed skepticism over the analyst’s ambitious forecast. A few community members have denied the prediction, emphasizing that the cryptocurrency’s surge to $33.5 during this cycle was highly unlikely.

Possible Price Correction Ahead Of Projected Surge

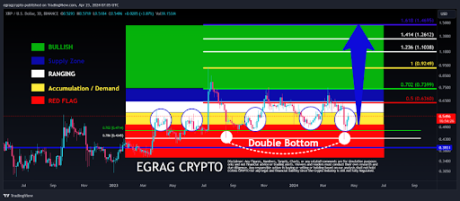

In one of his most recent X posts, Egrag Crypto disclosed that XRP could witness a major price correction before experiencing a significant rally. The analyst has urged crypto investors to remain cautious of the cryptocurrency unless the XRP/BTC ratio closes above the $0.00010 threshold.

Related Reading: Is The Bitcoin Bottom In? Buy The Dip Sentiment Erodes Amid Drop Toward $60,000

Egrag Crypto anticipates a potential 45% decline for XRP/BTC, emphasizing that this substantial price drop could indicate a bottom between $0.0000055 and $0.0000077. However, he also disclosed that overcoming resistance at $0.00001 would be crucial for a rebound in XRP.

Blue Section: The current trajectory suggests a possible reach of $1.4 by June-July, a key target. The price range between ($1.2 – $1.8) is a plausible target.

Blue Section: The current trajectory suggests a possible reach of $1.4 by June-July, a key target. The price range between ($1.2 – $1.8) is a plausible target. Yellow Section: Aiming for $4 is feasible if we follow a similar path to 2021.…

Yellow Section: Aiming for $4 is feasible if we follow a similar path to 2021.…