XRP has shown notable signs of renewed bullish momentum in the market. It bounced back from a significant 11% price drop on April 12th, which took the token to its lowest level of the year at $0.4230.

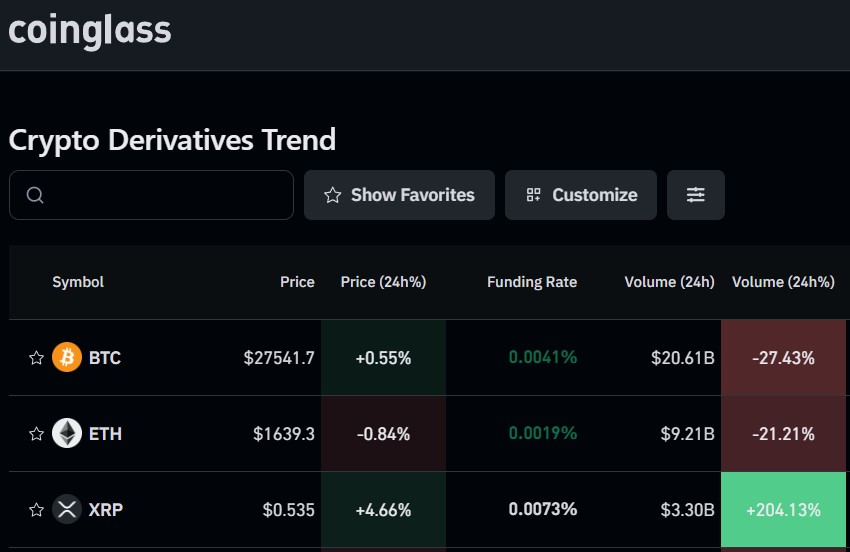

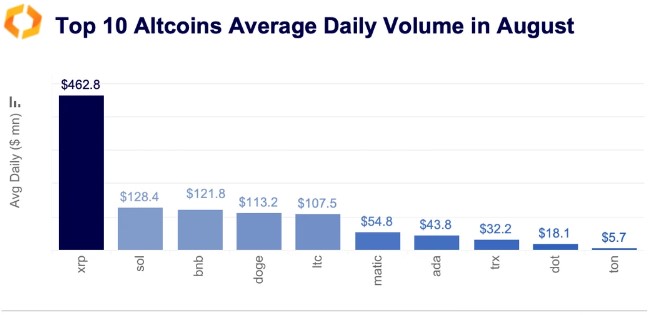

However, last week saw a solid 12% price recovery, with XRP outperforming the other top 10 altcoins in the market, behind only Solana (SOL) and Binance Coin (BNB).

Signs Of A Strong Bullish Trend Ahead For XRP?

On Tuesday, XRP hit a high of $0.5571, demonstrating its bullishness and outperforming its peers. This resurgence was paired with a spike in wallet activity, a positive sign for the token’s overall market sentiment.

According to the network intelligence platform Santiment, the number of wallets holding at least 1 million XRP has steadily increased over the past six weeks, rising by 3.1%. It is now just one wallet away from reaching an all-time high (ATH).

In addition, crypto analyst Ali Martinez reported a notable buying spree among XRP whales, who purchased over 31 million tokens in the past week alone. This has contributed to the cryptocurrency’s price recovery, emphasizing renewed confidence in its uptrend prospects.

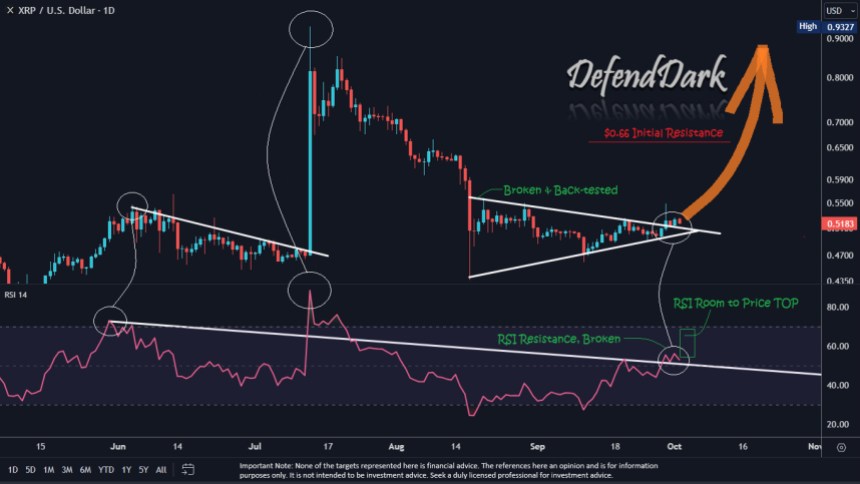

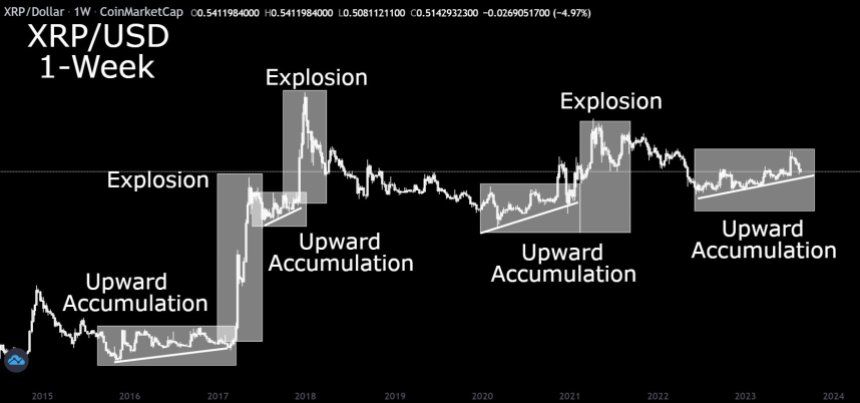

Regarding price action, market analyst Egrag Crypto points out that XRP has formed a double bottom pattern, considered a strong bullish signal. This pattern, combined with the transition of the consolidation zone into a supply zone and the wicking area into a demand and accumulation zone, indicates a promising outlook for the token, according to the analyst.

Egrag Crypto is confident that a significant price spike or “thrust” is imminent, and the analyst has updated his target to $1.4 for XRP.

Critical Resistance Levels To Watch

Despite initial bullish outlooks for XRP, the token has retraced to the $0.5474 price level as of the time of writing, accompanied by a 14% decrease in market capitalization over the past 30 days.

Moreover, as XRP aims to reach higher levels, potential resistance barriers may impede the token’s recovery and the bullish trend. Analyzing the XRP/USD chart below reveals the immediate resistance at $0.5644, which has prevented consolidation above current levels for the past week.

After that, the final obstacle before a retest of the $0.600 zone lies at the $0.5884 level. This level previously served as a support floor for the token, leading to a rebound during the uptrend seen in March, which took XRP to its yearly high of $0.745.

Conversely, monitoring the support levels at $0.52910, $0.5184, and $0.5044 is crucial. If a bearish scenario develops in the coming days, these levels may prevent XRP from falling below $0.500.

Featured image from Shutterstock, chart from TradingView.com