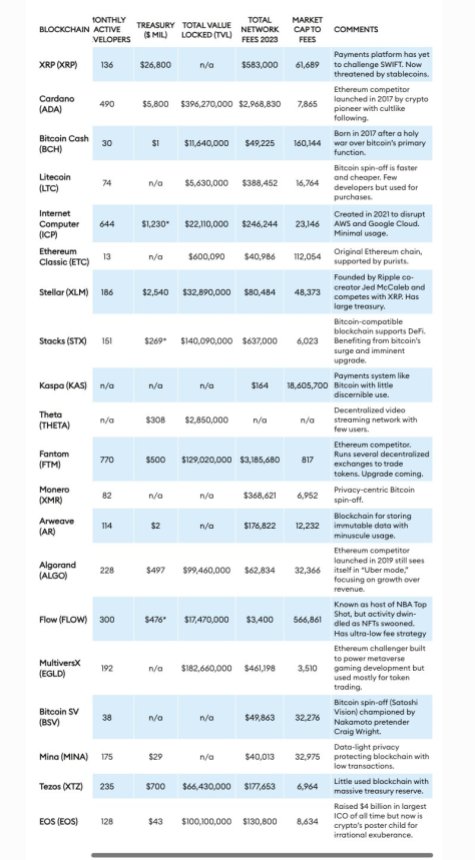

The bullish predictions for the XRP price are back, even with the bulls struggling to push the crypto on a price surge. EGRAG, a cryptocurrency expert, has made one of these positive forecasts, which is that there will be a price spike of tremendous magnitude. According to the analyst’s recent post on social media, XRP could reach the $4 price level over the long term.

Crypto Analyst Predicts 700% Bullish XRP Price Action

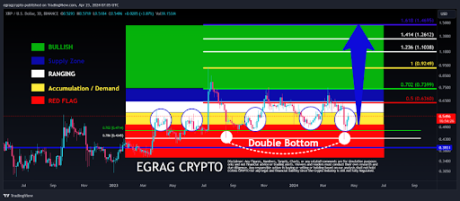

XRP has experienced a small decline in value over the past few days as the entire crypto market consolidates in price action. XRP’s price movement this year has largely left many of its fervent enthusiasts feeling disappointed, particularly considering the fact that it is yet to reach the $1 mark as predicted by many analysts.

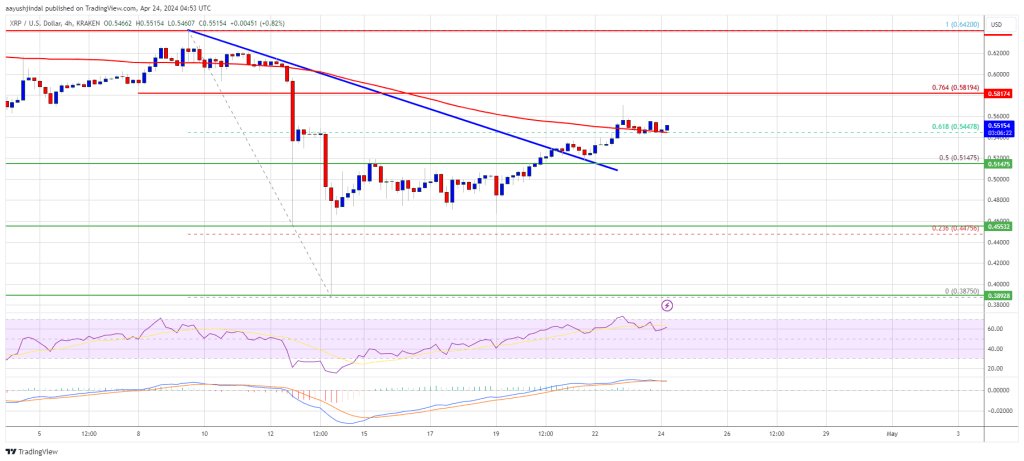

Data from Coinmarketcap shows XRP now finds itself bouncing around at the $0.51 price mark after retesting the $0.435 on April 13. However, according to EGRAG, this is poised to change soon.

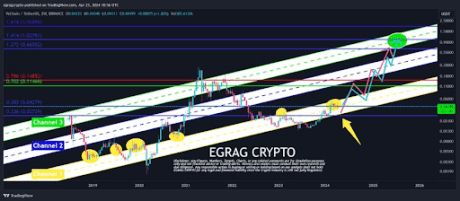

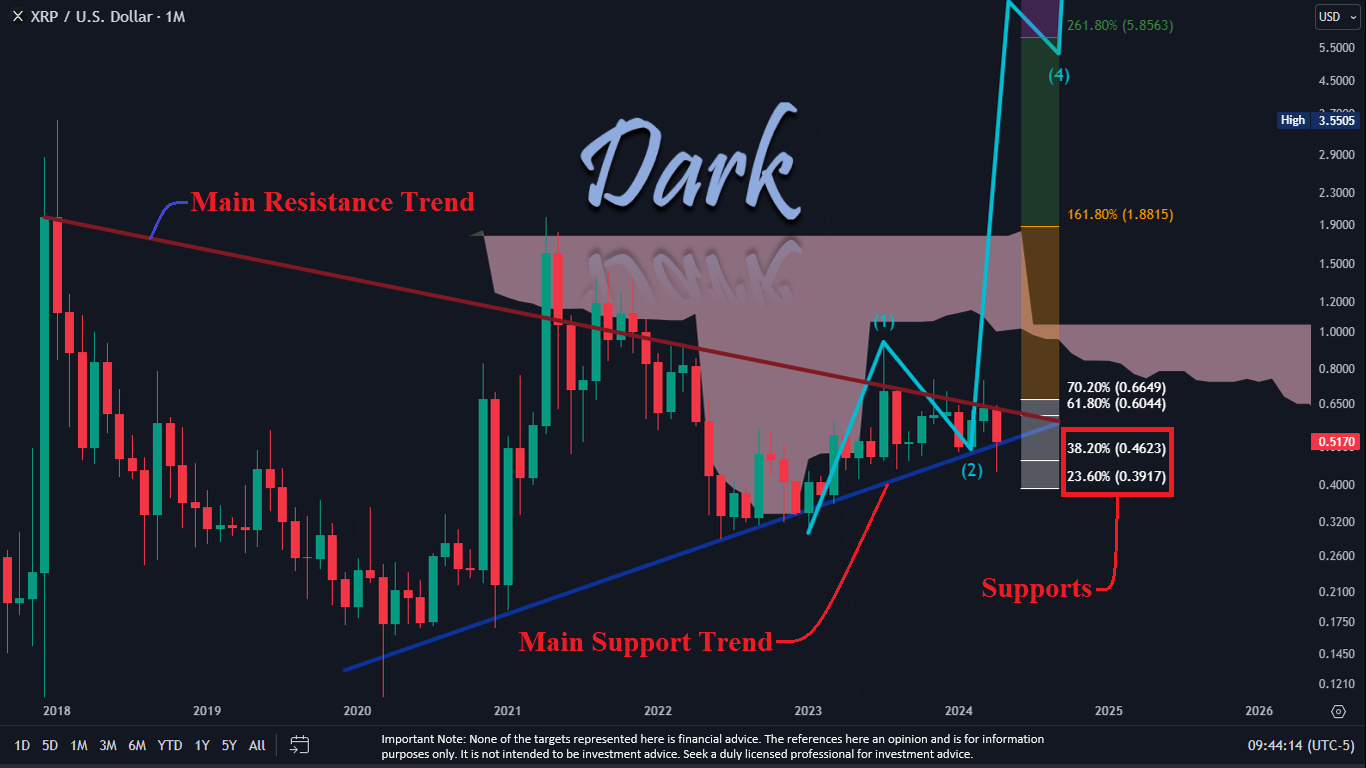

EGRAG, known for this very bullish stance on XRP, recently noted in his analysis that the current XRP price movement mimics the 2021 move which saw it breaking as high as $1.8. According to his analysis, EGRAG divided the price outlook into two sections blue and yellow, each depicting mirror images of 2021 price movement.

#XRP Imitating 2021 – Move:

Blue Section: The current trajectory suggests a possible reach of $1.4 by June-July, a key target. The price range between ($1.2 – $1.8) is a plausible target.

Yellow Section: Aiming for $4 is feasible if we follow a similar path to 2021.… pic.twitter.com/BMUJSbb5GQ

— EGRAG CRYPTO (@egragcrypto) April 25, 2024

The blue section is more of a narrow price trajectory which suggests that XRP could reach $1.4 by June or July, with a price range between $1.2 to $1.8. Meanwhile, the yellow section is a more bullish price trajectory. According to the analyst, XRP could reach the $4 price level by June or July if it follows the yellow section of 2021’s movement. Interestingly, a surge to the $4 price level would put the price of XRP at a new all-time high.

What’s Next For XRP?

EGRAG is one of the many crypto analysts who are still bullish on XRP’s price trajectory. His long-term price projection for XRP is $27, which he believes is still viable. At the time of writing, XRP is trading at $0.5148, down by 16.8% in the past 30 days.

This means in order to reach $4 in July, the bulls will have to push the crypto on a 677% increase in less than three months. Although the volatile nature of cryptocurrencies suggests this price run is possible, current market dynamics point to modest XRP price gains at best.

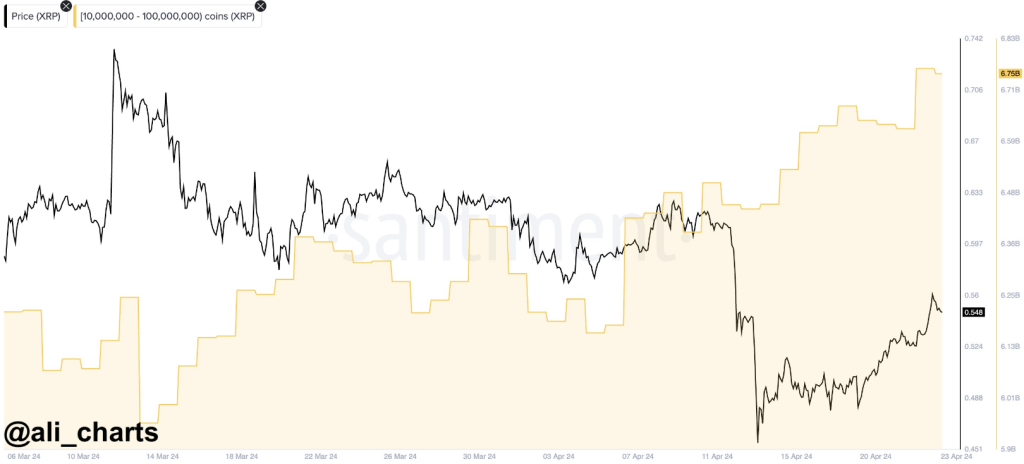

On the other hand, on-chain metrics have revealed that a bullish sentiment might be returning to XRP. Notably, the amount of XRP wallets holding at least 1 million coins has been surging recently, which could be a signal of a coming price surge.

The price of

The price of

MARKS (@JavonTM1)

MARKS (@JavonTM1)