Robinhood Crypto has announced the introduction of a Solana-staking product in Europe, accompanied by a bonus program for new customers.

This development comes as the company faces increased tensions with US regulators, which could potentially lead to legal repercussions. However, the move has propelled Solana’s (SOL) price to surpass the crucial $150 level, indicating a return of bullish momentum in the market.

Solana Staking And Crypto Rewards

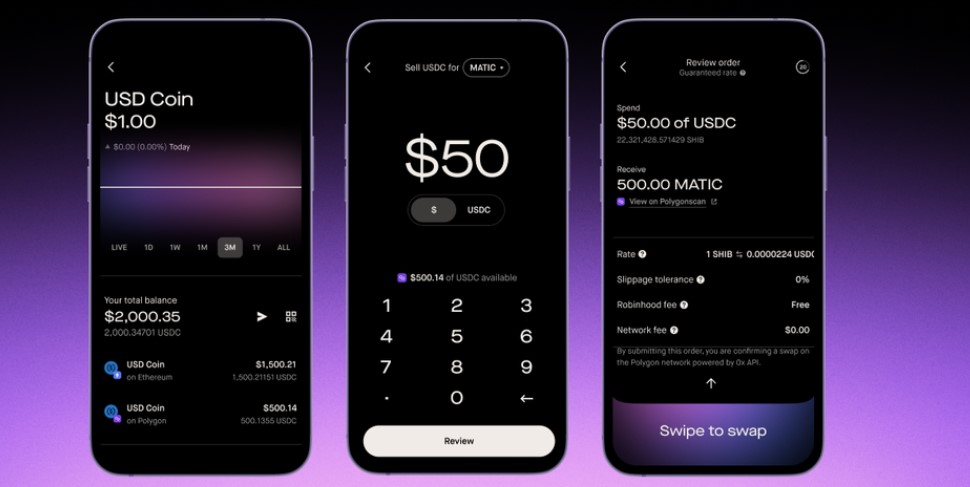

According to the announcement, Robinhood unveiled new features for its European customers. These offerings include staking, localized applications, and crypto rewards.

As part of its expansion, Robinhood has launched its first crypto-staking product exclusively for European customers. Through the platform, users can stake their Solana holdings and earn rewards with the ability to unstake their assets at any time.

Additionally, new customers can receive a 10% bonus on their net purchases during their first 30 days on the platform, with the bonus paid out in Circle’s USDC stablecoin. This initiative aims to attract new users and improve their crypto investing experience.

While Robinhood Crypto expands its offerings in Europe, the company faces regulatory challenges in the United States. The US Securities and Exchange Commission (SEC) has issued a Wells Notice to the exchange, indicating the staff’s recommendation for an enforcement action against the platform.

Robinhood expressed disappointment in the SEC’s decision, emphasizing their efforts to seek regulatory clarity and asserting their belief that the listed assets on their platform are not securities.

Vlad Tenev, the CEO of Robinhood, revealed that the company has held over 16 meetings with the SEC. However, these interactions have been largely unsatisfactory, according to Tenev. He expressed the company’s willingness to engage with the SEC in good faith but noted the regulatory body’s lack of reciprocal efforts.

SOL Bulls Eye $200 As Trading Volume Rises

Solana’s native token, SOL, experienced a significant rebound in the past hour, surging from the $140 zone to its current trading price of $153. This price movement holds key significance for bullish investors as they aim to retest the $200 mark previously surpassed in March.

CoinGecko data further reveals a notable increase in SOL’s trading volume, reaching $2.7 billion in the last 24 hours, representing a 6.6% rise compared to the previous Monday’s trading session.

According to crypto analyst Jesse Olson, Solana has shown strength in its recent price action. Olson notes that Solana successfully hit all four downside targets and exhibited bullish divergence, followed by hitting three upside targets.

The price appears to form a higher low, increasing the probability of reaching “target four,” projected at the $175 mark.

Despite the bullish momentum, SOL faces crucial resistance walls at $157 and $172, which are expected to be significant obstacles toward higher price levels.

On the other hand, the $140 line has served as a key support level for Solana’s price over the past week. SOL’s bullish momentum remains uncertain as it strives to overcome these resistance levels and retest its yearly high of $209.

Featured image from Shutterstock, chart from TradingView.com