On July 30, a meme coin called BaldBaseBald (BALD) launched on Base Network, Coinbase’s new Layer 2 built on Optimism. The coin referenced Brian Armstrong, Coinbase’s “bald” founder, and quickly became a coordination point for speculators on the frontier chain.

Within two days, the token had reached a market cap of $100 million, with over $25 million in liquidity. However, the token’s meteoric rise turned out to be a classic case of market manipulation, as the deployer behind the token, BaldBaseBald, rug pulled the token and caused its price to plummet by 85%.

Malicious Market Behavior Behind BALD?

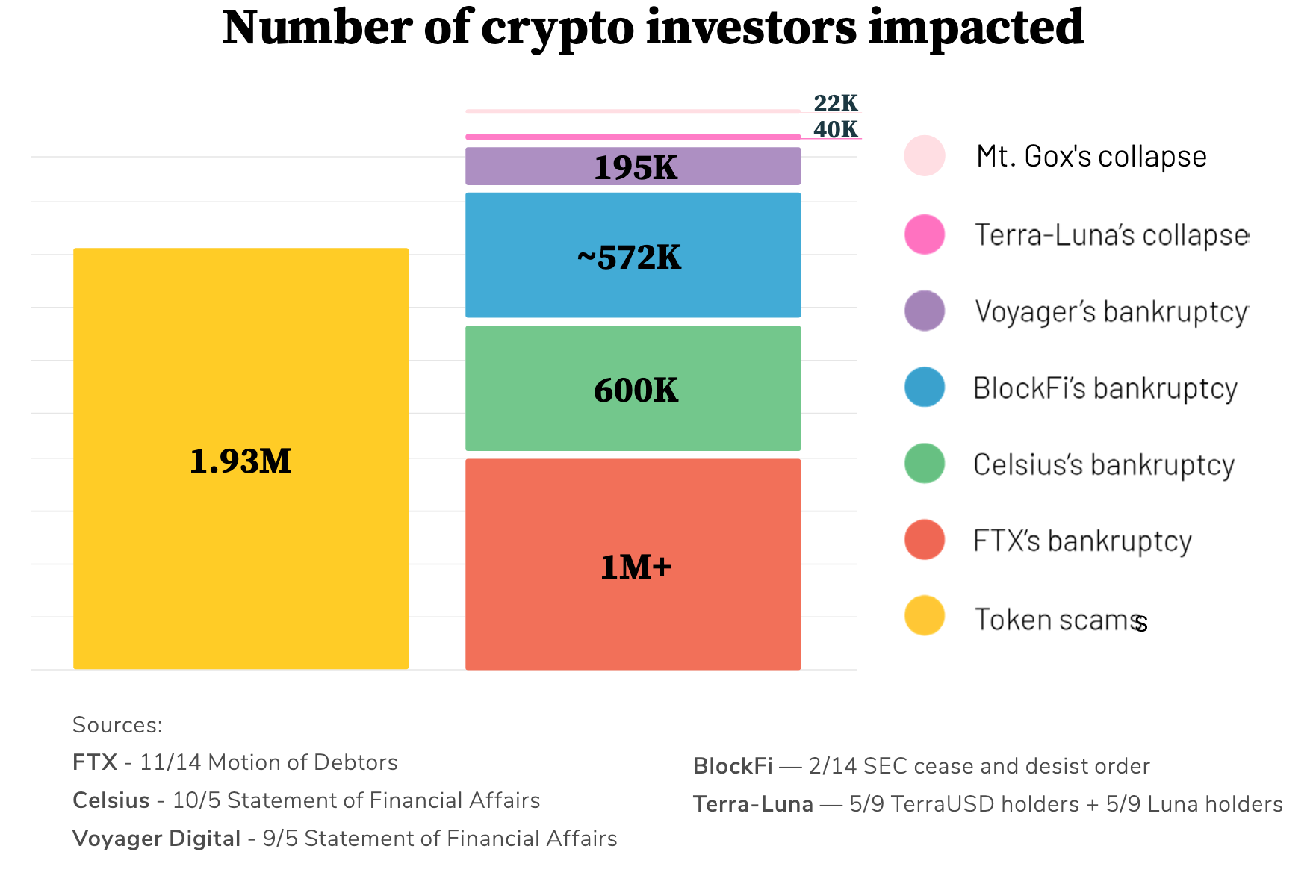

Market researcher Thiccy indexed all the transactions from the Bald deployer and uncovered a story of malicious market behavior. BaldBaseBald added over 6,700 ETH, or over $12.5 million worth of liquidity, to the pool in the first 24 hours, a surprising amount of capital for a meme coin on a new chain.

The deployer’s actions were undoubtedly bullish for speculators, and many people speculated that Brian Armstrong had created the coin to drum up hype. However, as soon as the deployer stopped adding liquidity to the pool, the price stagnated and broke down.

24 hours later, the deployer started bidding on BALD again, causing the price to double. Then, the deployer withdrew over 10.500 Ethereum (ETH), or almost $20 million worth of liquidity, leading to an 85% drop in the token’s value.

Thiccy’s analysis showed that the deployer had made a net profit of 2,789 ETH, or 5.2 million dollars, after adding 6,870 ETH, spending 1,360 ETH buying at an average price of 0.0004, and withdrawing 10,704 ETH.

It was surprising how well-capitalized the actor was and how bold they were in carrying out this apparent manipulative market behavior in the middle of the public light on Coinbase’s compliance chain. Thiccy Concluded:

And with that, the story of BALD has come to a close play stupid games, win stupid prizes. Hopefully we can learn from this as a space this market is rife with market manipulation and unethical shills. Be careful who you trust.

Thiccy advises investors to control their Fear of Missing Out (FOMO) and not risk more than they can afford to lose, as survival is too important in this game.

As for BaldBaseBald has removed the rest of the liquidity, bringing their total Profit and Loss (PnL) to 3,163 ETH, or $5.9 million.

Featured image from iStock, chart from TradingView.com

pic.twitter.com/sTbUwHSzD4

pic.twitter.com/sTbUwHSzD4