Deutsche Bank joined Singapore’s tokenization project soon after reiterating skepticism about transparency about the world’s largest stablecoin, Tether.

Cryptocurrency Financial News

Deutsche Bank joined Singapore’s tokenization project soon after reiterating skepticism about transparency about the world’s largest stablecoin, Tether.

The TVL across real-world asset tokenization protocols has surged almost 60% since February, says blockchain analytics firm Messari.

Amid the renewed strength recently displayed by Bitcoin, Michael Van De Poppe, a recognized cryptocurrency analyst and trader has offered an intriguing prediction for BTC, highlighting that the crypto asset is likely to reach the $300,000 threshold in this bull cycle.

Over the past month, the price of Bitcoin has been consolidating and hasn’t been able to sustain its rise beyond its new peak of $73,000. However, things could soon be changing, as Michael Van De Poppe expects the coin to surge immensely in the short term.

His forecast coincides with anticipation around the upcoming Bitcoin Halving expected to take place in less than 12 days, fueling optimism within the crypto community.

According to the expert, the largest cryptocurrency asset by market cap is still experiencing significant resistance. Nonetheless, if Bitcoin manages to break out of this zone, the coin could witness a progression towards new all-time highs in the coming months.

Given that BTC achieved the $70,000 price level ahead of the halving event, Poppe believes that it is likely to surge to unprecedented levels, particularly topping out at $300,000 in this bull run.

The post read:

Bitcoin still facing crucial resistance. If this breaks, then we will be seeing a continuation towards new all-time highs. Bitcoin at $70,000 pre-halving. Likely $300,000 this cycle.

Poppe underscored that the price of Bitcoin returned to $70,000 level over the weekend. As a result, he has pointed out bullish indicators that are presently occurring in the crypto landscape.

The analyst also noted that the strength of the cryptocurrency markets has now exceeded our perceptions, and dips in altcoins represent opportunities for good entries. In addition, BTC’s price action demonstrates the potential to reach a new all-time high pre-halving, and the shift in favor of altcoins is on the horizon.

Poppe is super bullish toward an ‘altcoin season’. However, it is important to note that altcoins’ value has frequently coincided with shifts in Bitcoin’s supremacy. But even though Bitcoin’s dominance is still at its peak prior to the halving, Poppe thinks these coins still have a lot of momentum.

He advocates that a new altcoin season will undoubtedly begin in the upcoming weeks. “We always have one, we have seen Meme coins, Solana (SOL) ecosystem, and AI,” he stated.

The expert’s statement suggests that the Solana ecosystem, AI projects, and meme coins in recent months have led the altcoin market. Thus, Michael Van De Poppe has contended that in the impending alt season, crypto initiatives that prioritize the tokenization of Real-World Assets (RWA), the Ethereum (ETH) ecosystem, and the Decentralized Physical Infrastructure Network (DePIN) are likely to be next, paving the way for alts this cycle.

At the time of writing, the altcoin’s overall market excluding Bitcoin and Ethereum was valued at $753.47 billion. This indicates a 2% increase in the market cap in the past 24 hours.

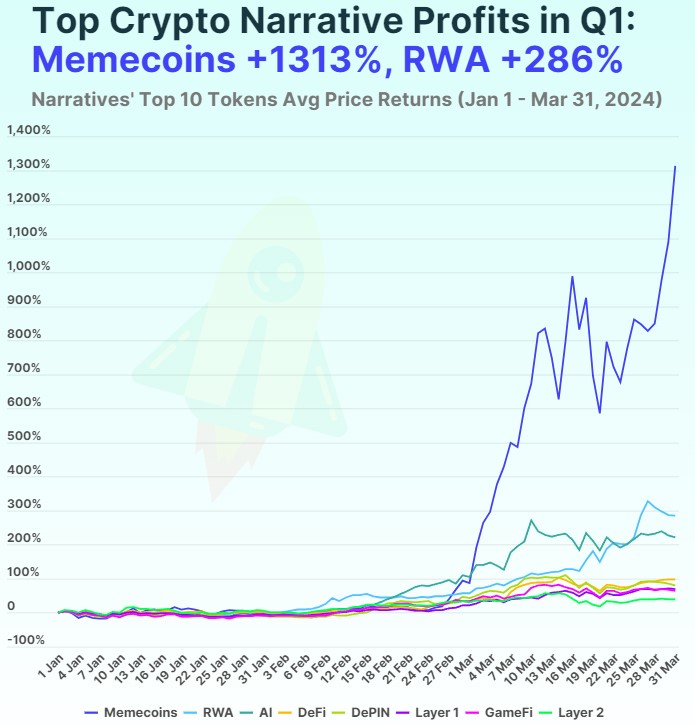

In the first quarter of 2024 (Q1), memecoins emerged as the most profitable crypto narrative, delivering massive average returns of 1312.6% across its top tokens, according to a recent study and report conducted by CoinGecko.

This figure far surpassed the returns of other narratives, highlighting the growing popularity and frenzy surrounding memecoins in the cryptocurrency market.

Three newly launched tokens were among the top 10 memecoins by market cap at the end of the quarter: Brett (BRETT), BOOK OF MEME (BOME) and Cat in a dogs world (MEW).

BRETT generated the highest returns since its launch with a gain of 7727.6%, closely followed by dogwifhat (WIF) with a gain of 2721.2% during the quarter. Notably, the memecoin narrative outperformed other crypto narratives by a significant margin.

Compared to the second most profitable narrative, RWA, memecoins were 4.6 times more profitable, and their returns were 33.3 times higher than those of the Layer 2 narrative, which experienced the lowest gains in Q1.

The RWA narrative, which stands for “Real-World Assets“, returned 285.6% in Q1. Although it briefly held the title of the most profitable narrative in early February, memecoins and artificial intelligence-based (AI) tokens outperformed RWA in terms of returns. However, RWA managed to regain its position ahead of the AI narrative by the end of March.

Notable winners in the RWA category included MANTRA (OM) and TokenFi (TOKEN), which posted quarter-to-date (QTD) returns of 1074.4% and 419.7% respectively. XDC Network (XDC) was the only RWA token to decline, falling 15.6% for the quarter.

Artificial intelligence closely followed RWA as the only other narrative to deliver three-digit returns, reaching 222.0% in Q1. All large-cap AI tokens experienced gains, with AIOZ Network (AIOZ) leading the pack at 480.2% and Fetch.ai (FET) following closely at 378.3%.

Even the lowest gainer in the AI category, OriginTrail (TRAC), returned a respectable 74.9% during the quarter, indicating the overall interest in AI-related tokens.

The decentralized finance (DeFi) narrative delivered moderate returns of 98.9% in the first quarter. In late February, DeFi returns were boosted by the Uniswap (UNI) fee switch proposal. DeFi tokens that performed well included Jupiter (JUP) with gains of 125.7%, Maker (MKR) with 121.2%, and The Graph (GRT) with 111.0% QTD.

In contrast, the Layer 1 (L1) narrative delivered relatively lower profitability with 70.0% returns in Q1 2024. While Solana (SOL) garnered attention as a popular memecoin chain, the top-performing large L1 cryptocurrencies were Toncoin (TON) and Bitcoin Cash (BCH) with gains of 131.2% and 130.5%, respectively.

Bitcoin (BTC) achieved a 65.1% gain, reaching new all-time highs, while Ethereum (ETH) posted a more modest 53.9% increase, despite the anticipation surrounding US spot Ethereum ETF applications.

Layer 2 (L2) emerged as the least profitable crypto narrative in Q1, with a relatively lower gain of 39.5%. Established Ethereum L2 solutions underperformed, with Arbitrum (ARB) returning 5.6%, Polygon (MATIC) seeing a 1.2% gain, and Optimism (OP) closing the quarter with a slight decline of 1.2%. However, Stacks (STX) and Mantle (MNT) recorded relatively strong returns of 142.5% and 95.8% QTD, respectively.

As of this writing, Dogecoin (DOGE), the largest memecoin by market capitalization, is trading at $0.1745. Over the past 24 hours, it has experienced a price correction of nearly 7%. In the last month, Dogecoin has shown limited bullish momentum, with a marginal gain of only 0.7% during this time period.

Featured image from Shutterstock, chart from TradingView.com

In an era where the boundaries between traditional finance (TradFi) and crypto continue to blur, the tokenization of real-world assets (RWAs) stands out as one of the hottest trends. This trend, which allows tangible assets like vehicles and real estate to be bought and sold as tokens on a blockchain, promises to revolutionize the efficiency and speed of asset transactions.

Just last week, BlackRock, the world’s largest asset manager, has positioned itself at the forefront of this movement with the launch of a $100 million tokenization fund, which has already attracted over $240 million in investment within its first week.

Larry Fink, CEO of BlackRock, has been vocal about the potential of tokenization, stating that RWAs “could revolutionize, again, finance.” This comment has contributed to a notable surge in the valuation of several RWA crypto tokens in recent weeks. In light of these developments, crypto analysts from Layergg have identified a specific crypto project that they believe could garner significant interest from BlackRock.

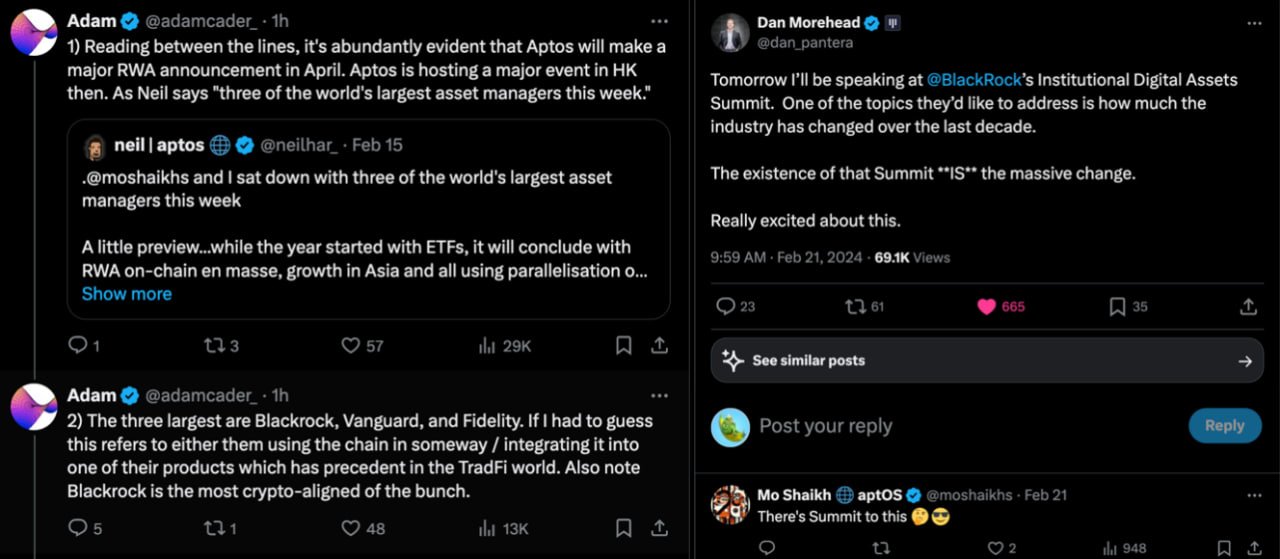

The project in question is Aptos, which has been earmarked for its potential in the RWA space. According to Layergg’s analysis shared on X (formerly Twitter), the narrative surrounding RWA and tokenization, bolstered by BlackRock’s involvement, suggests a nascent yet rapidly growing interest in this sector.

They highlight that mid to low cap RWA projects listed on Binance have performed exceptionally well, indicating a broader market interest spurred by narrative-driven investment strategies. However, the favorite crypto project for BlackRock could be Aptos.

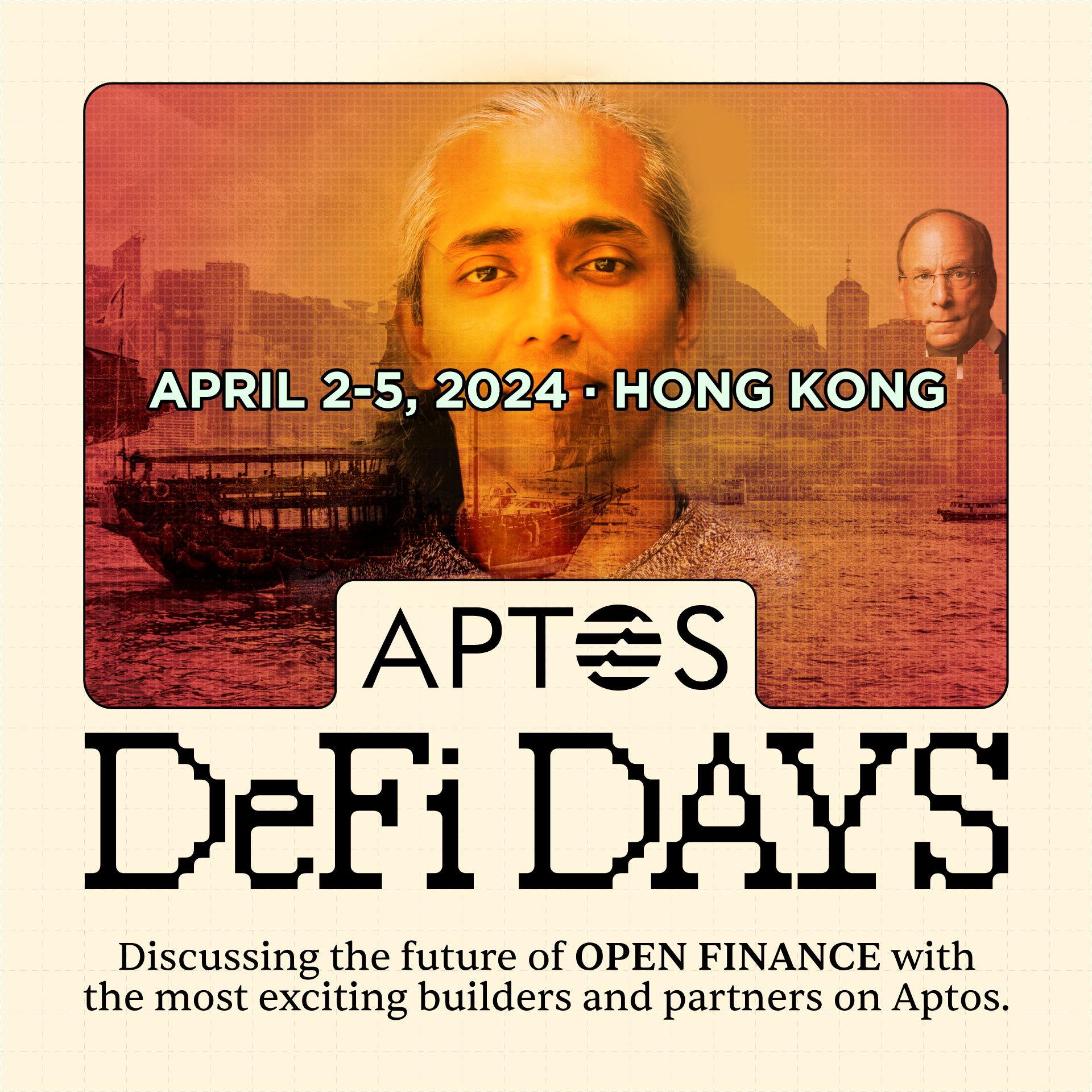

A closer look at Aptos reveals several factors that might make it an attractive partner for BlackRock. Firstly, Aptos is poised to make a significant announcement related to RWA in April, coinciding with the Aptos DeFi DAYS event from April 2 to 5.

This announcement is speculated to involve a partnership with a global asset management firm, potentially BlackRock. “A partnership with a global asset management firm is expected to be announced. It is speculated that this may include BlackRock,” the analysts remarked.

The basis for this speculation includes Aptos CEO Mo Shaikh’s previous tenure at BlackRock, suggesting pre-existing industry connections that could facilitate such a partnership.

Moreover, Aptos founder Mo Shaikh & head of ecosystem at Aptos Labs Neil H hinted at this early on. In mid-February Shaikh revealed via X: “I sat down with three of the world’s largest asset managers this week A little preview…while the year started with ETFs, it will conclude with RWA on-chain en masse, growth in Asia and all using parallelisation on Aptos See you in Hong Kong.”

On February 21, Shaikh also commented on a post on X by Dan Morehead, founder and managing partner at Pantera Capital. Morehead stated, “Tomorrow I’ll be speaking at BlackRock’s Institutional Digital Assets Summit. […] The existence of that Summit **IS** the massive change. Really excited about this.” Mo Shaikh mysteriously commented, “There’s Summit to this.”

Besides that, Adam Cader, founder of Thala Labs recently stated via X that “something is cooking for Aptos. I’m a co-founder of the largest application on the network, and here’s my list of upcoming significant ecosystem wide catalysts.” Cader referenced Shaikh’s statement and added that Blackrock, Vanguard, and Fidelity are the three largest asset managers in the world.

“If I had to guess this refers to either them using the chain in some way / integrating it into one of their products which has precedent in the TradFi world. Also note Blackrock is the most crypto-aligned of the bunch,” he said via X.

Crypto Revolution: Will APT Follow AVAX?

But that’s not all. Aptos has been hinted to explore partnerships with other major asset management firms, including Franklin Templeton, which has previously invested in Aptos (tier 3) and planned to utilize its blockchain for money market funds.

Such strategic alliances could position Aptos similarly to how Avalanche benefited from its partnerships in the Project Guardian initiative (JPMorgan and Wisdomtree), experiencing a substantial price increase post-announcement. “Avalanche saw a price increase of more than 4x following the ‘Project Guardian’ news,” Layergg noted.

They concluded, “If a partnership with BlackRock proceeds, more ‘Big partnerships’ will naturally follow.”

At press time, APT traded at $17.59, up 87% over the past five weeks.

Injective Protocol, a decentralized finance-centric platform, has launched TokenStation. In a blog post on March 18, Injective said the solution, deployed on its mainnet, allows users to launch native tokens. With this tool, Injective said it would empower anyone to create their tokens in a low-fee and scalable environment.

The tool was developed by the Injective community and aims to “remove barrier to entry for token creation.” Like the token creation tools on Solana and Ethereum, for example, using TokenStation, part of the blog post won’t require coding experience.

Related Reading: Top Reasons Why The Bitcoin Price Crashed Below $63,000

This makes it easier for individuals and projects to launch on Injective. Beyond token minting, the tool allows token management and integration of tokenomics mechanisms like burning.

The blockchain is launching the TokenStation days after partnering with AltLayer, a platform backed by Binance Labs dedicated to developing roll-up technology for Ethereum. Through this collaboration, the two will build a re-staking security framework for Injective Ethereum Virtual Machine (inEVM) applications.

The recently launched inEVM allows developers to seamlessly build applications leveraging the high scalability and near-zero fees on Injective. Additionally, the inEVM is set to increase composability between WebAssembly (WASM) and EVM environments. Through this unique feature, Injective can bridge the interoperability of Cosmos, the developer activity of Ethereum, and the high scalability of Solana.

In January, Injective Protocol activated the Volan Upgrade, setting the platform’s plans to build a robust real-world tokenization infrastructure into motion. Part of this was the introduction of a Real-World Asset (RWA) module. In this way, institutions can launch regulatory-compliant security tokens.

Additionally, Volan modified INJ tokenomics, making the token progressively deflationary. Burning reduces INJ tokens over time, a measure adopted by other protocols, including BNB and Ethereum.

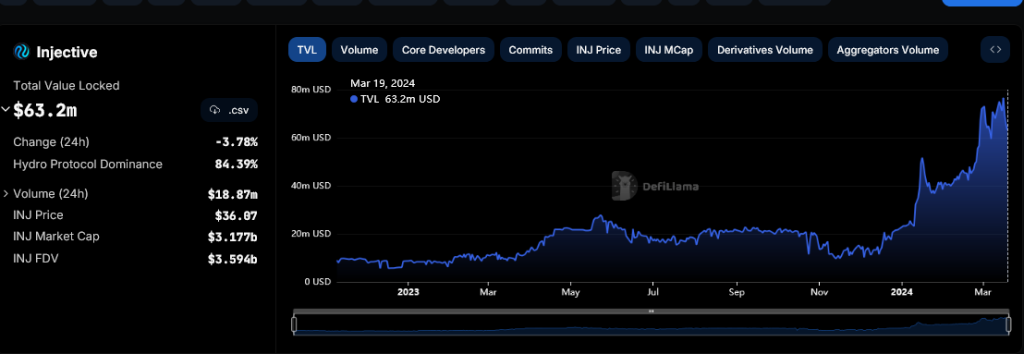

While the upgrade and subsequent partnerships have lifted its prominence in decentralized finance (DeFi), growth has been slower than expected.

So far, DeFiLlama data shows that Injective Protocol commands a total value locked (TVL) of less than $65 million. This is miles behind Solana or Ethereum, two of the world’s most active smart contract platforms where active DeFi protocols also thrive.

Meanwhile, INJ prices, although relatively higher, are under pressure, as seen in the candlestick arrangement in the daily chart. INJ is down 30% from 2024 highs, slipping and following Bitcoin. However, the coin is within a broader consolidation. Resistance and support levels are around $44 and $30, respectively.

Among the top 10 cryptocurrencies this week, Avalanche (AVAX) is in the lead after rising by more than 60% in the last seven days. Its price has risen to $36, placing it in the top 10 digital assets in terms of market capitalization.

AVAX prices have been trending higher, which has helped many holders realize gains. The general attitude has not changed notwithstanding this rise in the proportion of holders in profit.

More than half of Avalanche holders kept their assets at a profit, according to recent data from IntoTheBlock. Based on its data, around 70% of holders have experienced financial success.

Due to this week’s outstanding results, there has been a substantial trade volume, which is a crucial indicator that the uptrend will hold. Notably, it has also propelled the altcoin past its initial lower high, which happened in August 2022 during the bear market’s accumulation phase.

For almost three weeks, the price of Avalanche token fluctuated within a narrow range of $20 to $24, suggesting a lack of strong buying and selling pressure in the market.

AVAX recently gained traction and had a 15% gain; as a result, the price broke through its important resistance level. The coin saw another 15% surge when the price was hovering at its resistance level of $28.

Many causes, all closely related to major developments in its ecology, are responsible for Avalanche’s steady climb. The platform’s rally is a result of its strategic concentration on two intriguing crypto narratives: gaming and real-world assets (RWAs).

RWA tokenization drives Avalanche’s growth!

@avax stands out, doubling in value over the last fortnight and rocketing up by 166% in a month.

But what’s fueling this meteoric rise?

Insights from @wacy_time1 shed light on this surge

—————————

1/ RWA Tokenization – The… pic.twitter.com/sRld3NTvJ7

— Unit Network (@theunitnetwork) December 4, 2023

Recently, Unit Network, a crypto analyst, provided an explanation of RWAs on Avalanche. According to Bernstein’s forecast, $3 trillion worth of RWAs will be tokenized over the course of the next five years, and Avalanche is leading the charge in order to meet market demand.

Unit Network observed that major banks using Avalanche and its subnets to create RWA solutions include Bank of America, Citi, and JP Morgan.

Meanwhile, Avalanche has continuously maintained a volume above $1 billion, according to Santiment’s data. An examination of the volume trend revealed a price and volume growth that increased simultaneously, indicating a strong and steady movement.

From a technical perspective, the coin’s MACD is showing a notable increase in the histogram, which suggests that there is more buying than selling pressure in the market. In addition, the chart’s averages display a rapid increase, indicating that the price will likely continue to grow in the days to come.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Shutterstock

Among the top 10 cryptocurrencies this week, Avalanche (AVAX) is in the lead after rising by more than 60% in the last seven days. Its price has risen to $36, placing it in the top 10 digital assets in terms of market capitalization.

AVAX prices have been trending higher, which has helped many holders realize gains. The general attitude has not changed notwithstanding this rise in the proportion of holders in profit.

More than half of Avalanche holders kept their assets at a profit, according to recent data from IntoTheBlock. Based on its data, around 70% of holders have experienced financial success.

Due to this week’s outstanding results, there has been a substantial trade volume, which is a crucial indicator that the uptrend will hold. Notably, it has also propelled the altcoin past its initial lower high, which happened in August 2022 during the bear market’s accumulation phase.

For almost three weeks, the price of Avalanche token fluctuated within a narrow range of $20 to $24, suggesting a lack of strong buying and selling pressure in the market.

AVAX recently gained traction and had a 15% gain; as a result, the price broke through its important resistance level. The coin saw another 15% surge when the price was hovering at its resistance level of $28.

Many causes, all closely related to major developments in its ecology, are responsible for Avalanche’s steady climb. The platform’s rally is a result of its strategic concentration on two intriguing crypto narratives: gaming and real-world assets (RWAs).

RWA tokenization drives Avalanche’s growth!

@avax stands out, doubling in value over the last fortnight and rocketing up by 166% in a month.

But what’s fueling this meteoric rise?

Insights from @wacy_time1 shed light on this surge

—————————

1/ RWA Tokenization – The… pic.twitter.com/sRld3NTvJ7

— Unit Network (@theunitnetwork) December 4, 2023

Recently, Unit Network, a crypto analyst, provided an explanation of RWAs on Avalanche. According to Bernstein’s forecast, $3 trillion worth of RWAs will be tokenized over the course of the next five years, and Avalanche is leading the charge in order to meet market demand.

Unit Network observed that major banks using Avalanche and its subnets to create RWA solutions include Bank of America, Citi, and JP Morgan.

Meanwhile, Avalanche has continuously maintained a volume above $1 billion, according to Santiment’s data. An examination of the volume trend revealed a price and volume growth that increased simultaneously, indicating a strong and steady movement.

From a technical perspective, the coin’s MACD is showing a notable increase in the histogram, which suggests that there is more buying than selling pressure in the market. In addition, the chart’s averages display a rapid increase, indicating that the price will likely continue to grow in the days to come.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Shutterstock

The ALT2611 tokenized Tether bond from Bitfinex has only managed to raise 15% of its target two weeks after launch.

LINK token continues to strengthen as professional traders and enterprise solution clients enter Chainlink’s ecosystem.

Real-world assets (RWAs) are emerging as one of the next mega trends in the crypto space, and according to a recent study by K33 Research, Chainlink could profit in a big way from this trend. In a recent study, the research firm projected that LINK would be the “safest bet” to capitalize on this impending boom. This sentiment reflects the broader industry outlook, especially given BlackRock CEO Larry Fink’s earlier comments in May where he noted the potential of tokenization in securities.

“The next generation for markets, the next generation for securities, will be tokenization of securities,” remarked Larry Fink during a New York Times DealBook event. He further elucidated that tokenization, which is the creation of a digital representation of an asset on a blockchain, would facilitate “instantaneous settlement” and notably reduce transactional fees.

The growing interest in the tokenization of RWAs, which includes traditional financial instruments like private equity, credit, and bonds, has paved the way for the increasing valuation of LINK. Tokenization is no longer a buzzword but a mechanism to optimize financial transactions by reducing costs, streamlining operations, and enhancing transparency and accessibility.

David Zimmerman, an analyst at K33 Research, mentioned, “If we wish to have exposure to the RWA narrative and avoid being sidelined when it takes off, LINK is the safest bet.”

Global financial institutions and emerging cryptocurrency platforms are gearing up to leverage this trend. A testament to this is JPMorgan’s recent announcement about its first live blockchain-based collateral settlement transaction, which involved industry giants BlackRock and Barclays.

Chainlink, as a project, has strategically positioned itself in this domain, acting as a bridge between blockchains and the external world. The project’s unique system of oracles and an expansive list of partnerships emphasize its pivotal role.

“Chainlink, with its system of oracles and wide partnerships, is well-positioned to connect blockchains with real-world data, making it a strong player in the RWA narrative,” stated renowned crypto analyst Scott Melker, echoing Zimmerman’s insights.

Zimmerman further opined that while Chainlink might not record the highest gains in this RWA movement, its robust infrastructure and pivotal role in the ecosystem make it one of the most well-placed projects to harness the potential benefits.

Despite the undeniable potential and traction that RWAs have gained, Zimmerman highlighted potential challenges in realizing their full potential. Yet, the prevailing narrative’s allure is so compelling that we might witness “an isolated RWA crypto bubble” even before its tangible real-world impacts become ubiquitous.

Zimmerman’s advice to potential investors is to be patient. The recommendation is to wait for the token to hit the long-term support level of around $5.70 before diving into long positions.

The Chainlink price has been trading within a descending trend channel since June last year. Even the recent hype around the partnership with Swift and the SmartCon was not enough to push LINK out of the trend channel. In total, LINK has been rejected at the upper trendline six times, last on October 1.

A bullish sign at the moment is that Chainlink is holding above the 50% Fibonacci retracement at $7.19 despite the sharp correction in the broader crypto market. If this holds over the next few days, LINK could attempt a retest towards the upper resistance line.

If the support breaks, K33 Research’s scenario could come true and Chainlink could fall below the $6 price again. Thus, the support is instrumental in determining whether Chainlink is currently a buy or sell.

Stellar’s pre-announcements may have caused traders to create multiple scenarios for potential XLM developments, but their impact on the XLM price could be short-lived.

CFTC Commissioner Caroline Pham said recent court opinions around digital assets and securities are a first step to crypto regulatory clarity.

Messari research shows MakerDAO has experienced its first quarter of net income loss since 2020 following a huge fall in loan demand and few liquidations.