The human-focused blockchain network will be based on the OP Stack, a framework for building Ethereum-based layer-2 chains.

Worldcoin (WLD) 12% Rally Hits A Snag: Portugal Demands Halt To Biometric Data Collection

In a recent development, Portugal’s data regulator, the National Commission for the Protection of Data, also known as the CNPD, has issued an order to stop Sam Altman’s iris scanning project, Worldcoin, from collecting biometric data for 90 days.

Worldcoin’s Compliance Under Fire

According to a Reuters report, the CNPD’s suspension specifically targets the Worldcoin Foundation, a memberless entity based in the Cayman Islands, described on its website as the sole member and director of World Assets Ltd, a company registered in the British Virgin Islands responsible for issuing Worldcoin tokens to sign-up participants.

The CNPD cited an alleged “high risk” to citizens’ data protection rights as the main reason for its urgent intervention. The regulator expressed concerns about the “unauthorized” collection of data from minors, the lack of information provided to data subjects, and the inability to delete data or withdraw consent.

The halt order also noted that over 300,000 individuals in Portugal had provided their biometric data to Worldcoin, leading to numerous complaints being lodged with the CNPD.

Jannick Preiwisch, the data protection officer at the Worldcoin Foundation, responded to the CNPD’s order by stating that Worldcoin is “fully compliant” with all laws and regulations about biometric data collection and transfer. Preiwisch emphasized the company’s zero-tolerance policy for underage sign-ups and its commitment to addressing any reported incidents.

Worldcoin has recently transitioned to “Personal Custody,” aiming to give users control over their data, including options for deletion and future use. The CNPD’s order to stop data collection is considered temporary, allowing for additional due diligence and analysis of complaints during the ongoing investigation.

Privacy Storm Engulfs Worldcoin

The Regulatory scrutiny of Worldcoin extends beyond Portugal. As NewsBTC reported, Spain’s data protection watchdog issued a three-month ban earlier this month in response to privacy complaints, and Kenya suspended Worldcoin’s operations in August 2023.

Moreover, the Bavarian State Regulatory Authority, acting as the lead authority in southeastern Germany, is currently investigating Worldcoin under European Union data protection rules due to the presence of a German subsidiary owned by Tools For Humanity, the company behind Worldcoin.

As the investigation into Worldcoin’s data collection practices continues, the project faces significant challenges in addressing regulatory concerns and maintaining public trust in its ambitious vision. According to its website, the project claims to have garnered over 4.5 million sign-ups from individuals in 120 countries.

Regulatory Hurdles Fail To Dampen WLD’s Performance

Despite the recent regulatory challenges faced by Worldcoin, the decentralized cryptocurrency has managed to maintain its gains of 12% over the past seven days. After reaching an all-time high (ATH) of $11.95 on March 10, the project’s native token, WLD, experienced a sharp drop to $7.24 but has since recovered.

Currently trading at $9.01, WLD has capitalized on the overall market rebound and its seven-day uptrend, surging by almost 9% in the past 24 hours.

The trading volume for WLD in the last 24 hours is $416,136,329, indicating a significant 65.10% increase compared to the previous day, suggesting renewed interest in the token.

Looking ahead, the $9.5 level is expected to provide the nearest resistance for the WLD token, followed by the $10.14 mark, should the rally continue. On the downside, the $8.36 level is the closest support on the daily chart.

In a potential downtrend, failure to hold this support level could decline toward the $8 mark, with the next significant resistance at $7.93.

Featured image from Shutterstock, chart from TradingView.com

Worldcoin’s WLD Slides as Elon Musk Sues OpenAI

WLD is considered a proxy bet on OpenAI, the Sam Altman-owned artificial intelligence company.

Worldcoin Gains 40%, Hits Record High as AI Tokens Surge on Nvidia

The token was up amid broader optimism surrounding AI spilling over into crypto.

Alameda Research’s Worldcoin Investment Hits All-Time High, Exceeding $50M As WLD Price Climbs

Worldcoin, the digital identity token ERC-20 project on the Ethereum (ETH) blockchain, has garnered significant attention. Its native token, WLD, emerges as the top performer among the top 100 cryptocurrencies by market capitalization.

The token has experienced a remarkable 31% uptrend in just 24 hours and a staggering 217% surge over the past fourteen days. This surge not only marks a new all-time high for WLD but also positively impacts Alameda Research, the now-bankrupt trading arm of the defunct FTX exchange, which holds a substantial stake in Worldcoin.

Alameda Research’s Stake In Worldcoin Reaches $186 Million

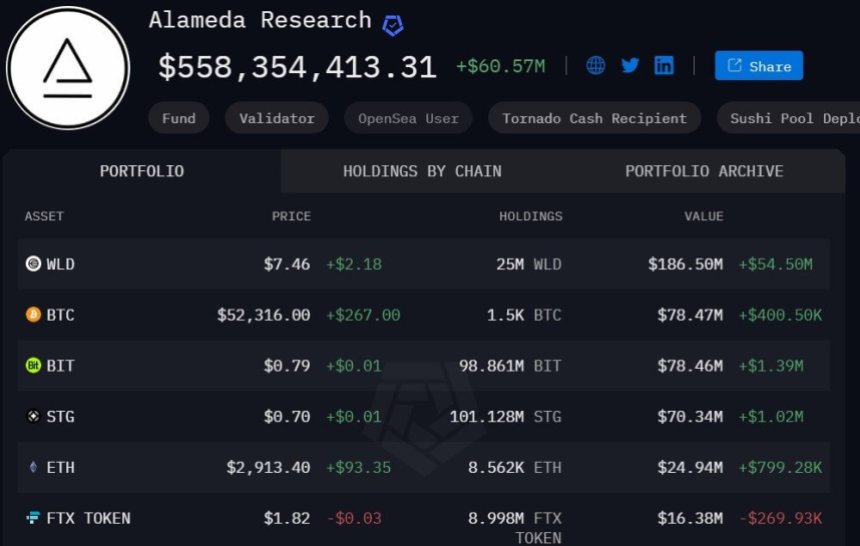

According to on-chain data, Alameda Research, a cryptocurrency trading firm co-founded by Sam Bankman-Fried and Tara Mac Aulay in 2017, has witnessed a surge in its Worldcoin holdings.

As WLD reached a new all-time high of $7.9788 on Monday, the trading firm’s investment in the project surged by $50 million, reaching a new record. Currently, Alameda Research holds 25 million WLD tokens, valued at $186 million, representing 33% of their total portfolio.

This portfolio also includes other digital assets such as Bitcoin (BTC), BitDAO (BIT), Ethereum (ETH), Stargate Finance (STG), and the FTX token FTT.

Whale Activity And AI Hype Drive WLD’s Price Surge

Analysts such as Zameer Attar attribute the WLD price spike to strong whale activity, with one notable whale wallet withdrawing 2.09 million WLD tokens ($5.82 million) from Binance.

This withdrawal caused a 25% surge in the price of Worldcoin, resulting in the whale’s holdings reaching an impressive $8.03 million. Additionally, the launch of OpenAI Sora by Sam Altman, one of the founders of Worldcoin, has triggered bullish action in WLD tokens.

Interestingly, Sora can create videos of up to 60 seconds with highly detailed scenes, complex camera movements, and multiple characters with emotions, which surrounding the hype of artificial intelligence (AI) has spurred investor interest, leading to more bullish sentiment surrounding WLD.

Worldcoin, founded by Sam Altman, Alex Blania, and Max Novendstern, aims to revolutionize the global identity and financial network by creating a public utility known as World ID.

This privacy-preserving identity network enables users to verify their humanness online while maintaining their privacy through zero-knowledge proofs. The project has garnered significant funding, raising over $250 million across various funding rounds from investors, including a16z, Khosla Ventures, Bain Capital Crypto, Blockchain Capital, and Tiger Global.

The combination of whale activity and positive market sentiment surrounding AI technologies has contributed to the considerable surge in Worldcoin’s price.

Featured image from Shutterstock, chart from TradingView.com

Worldcoin (WLD) Gains By 10% Following Singapore Debut

Worldcoin (WLD), the brainchild of OpenAI CEO Sam Altman, has experienced a significant level of positive traction in the past month. Notably, Worldcoin gained by over 50% in mid-December to attain an all-time high of $4.6. Although the token soon fell from these heights trading at $3.35 on December 25, it appears that WLD may be gathering momentum for another bullish breakout.

Singapore Launch, Among Others Spurs Interest In Worldcoin

According to data from CoinMarketCap, Worldcoin has gained by 9.68% in the last seven days, signifying a steady rise in buying pressure from investors in the WLD market.

Using data from IntoTheBlock, popular crypto analyst Ali Martinez has given more insight into this bullish trend. On December 30, he shared via X that the number of WLD whales in possession of 10,000 to 100,000 WLD rose by 16.33% in the last week. Interestingly, this price increase and network growth occurred a few days after Worldcoin announced its expansion into the crypto-friendly nation of Singapore.

#Worldcoin | The number of #WLD whales holding between 10,000 and 100,000 $WLD has increased by 16.33% over the past week! pic.twitter.com/ps9xzcMtVd

— Ali (@ali_charts) December 30, 2023

In a blog post on December 27, the crypto project stated that it had successfully set up physical screening locations in the Asian nation allowing interested users to undergo the World ID verification process and join its growing network.

Beyond Singapore, Worldcoin also shared that it has registered an increased presence in several nations in the last month. These include Spain, Germany, Chile, and Japan. Notably, in Argentina, the crypto project recorded a national record of over 10,000 World ID verifications in a single day. Apparently, these multiple strides appear to have increased investor confidence in Worldcoin, as indicated in the price action stated above.

WLD Price Prediction

Based on recent developments surrounding Worldcoin, the token seems poised for a major boost in adoption which could translate into a price rise over the next few weeks. Aside from its expansion into new nations, the launch of the World ID 2.0 in mid-December, which introduced integrations with various Apps such as Reddit, Shopify, and Telegram, is also regarded as a positive development by the project’s growing number of users.

Interestingly, Martinez predicts that WLD could soon experience an 80% rally based on chart indicators alone. If this projection proves true, the altcoin could trade as high as $6.30.

However, despite all these indications, it must be noted that Worldcoin remains under heavy regulatory scrutiny in some nations due to privacy concerns in regard to user data.

Worldcoin operations have been actively suspended in Kenya and are under investigation in Germany and the United Kingdom. In fact, the crypto project recently halted its orb verification service in Brazil, France, and India although citing a “limited time access” on the screening orbs provided in these markets.

At the time of writing, WLD trades around $3.73 with a 3.90% gain on the last day. In tandem, The token’s daily trading volume increased by 83.12% and is valued at $197.52 million.

Sam Altman’s Retina-Scanning Orb to Become More Useful with World ID 2.0

Shopify, Minecraft, and Reddit will begin using World ID to identify some users.

Sam Altman’s Retina-Scanning Orb to Become More Useful with World ID 2.0

Shopify, Minecraft, and Reddit will begin using World ID to identify some users.

Sam Altman’s Retina-Scanning Orb to Become More Useful with World ID 2.0

Shopify, Minecraft, and Reddit will begin using World ID to identify some users.

Sam Altman-Backed Crypto Startup Looks To Secure $100 Million For Bitcoin Private Credit Fund

Meanwhile Advisors, a crypto startup backed by the American entrepreneur Sam Altman, has announced plans to raise $100 million for a Bitcoin (BTC) private credit fund.

The fund, known as Meanwhile Private Credit Fund aims to provide institutional investors with access to BTC while targeting an additional 5% yield denominated in the cryptocurrency.

Bitcoin Rally Sparks Launch Of Meanwhile Advisors Fund

According to a report by The Block, Meanwhile Advisors has launched the fund as Bitcoin continues its recent rally, with prices currently falling from the $44,000 level down to the $43,200 mark.

Zac Townsend, the co-founder and CEO of Meanwhile Group, stated that the belief is that Bitcoin will appreciate significantly in the future, and the fund offers investors a unique opportunity to increase their exposure to digital assets.

The Meanwhile BTC Private Credit Fund adopts a single-close, closed-end structure. Participating limited partners (LPs) will contribute US dollars to the fund, which will be immediately converted to Bitcoin following the single close.

Meanwhile will lend this BTC to borrowers to generate the targeted 5% return in Bitcoin. This structure allows LPs to accumulate more Bitcoin if its price appreciates during the fund’s lifecycle without requiring additional principal investment.

Townsend mentioned that the minimum investment amount per LP is $250,000, with no maximum limit. The fund’s investment period spans three years, followed by a four-year harvest period, resulting in a total term of seven years.

However, capital is returned to investors during harvest, meaning a significant portion of the invested capital may be returned well before the seven-year mark.

Innovative Fee Approach?

Per the report, the Meanwhile BTC Private Credit Fund charges a 2% management fee and a 20% carried interest fee, both in Bitcoin. The carried interest fee only applies when the LP’s Bitcoin holdings are increased.

This fee structure ensures that if Bitcoin experiences substantial price appreciation, Meanwhile does not benefit from the price appreciation itself but rather from generating more Bitcoin for the LPs.

Addressing concerns about risk management, Townsend highlighted that the closed structure of the fund eliminates the risk of a “bank run” scenario that can lead to insolvency. Moreover, the fund focuses on making conservative loans to “creditworthy institutional borrowers”, mitigating risks associated with lending to retail investors at higher rates.

The Block also reported that Anchorage Digital serves as the fund’s custodian. Meanwhile Group’s insurance unit has previously launched a Bitcoin-denominated life insurance policy, and Townsend mentioned plans to introduce an accidental death coverage policy in Bitcoin as well.

When writing, the leading cryptocurrency in the market is trading at $43,200, marking a decrease of nearly 2% within the last 24 hours. This decline follows an unsuccessful attempt to solidify its position above the significant $44,000 milestone.

Nevertheless, Bitcoin has managed to maintain a 14% increase over the past seven days and is currently holding strong at the support level of $43,000, as it sets its sights on achieving a new annual peak.

Featured image from iStock, chart from TradingView.com

Sam Altman-Backed Meanwhile Group Starts Bitcoin Private Credit Fund for Institutional Investors

The fund, offered by the startup’s investment management arm, Meanwhile Advisors, aims to attract institutional investors with a 5% yield.

Sam Altman returns as OpenAI CEO as Microsoft gets board seat

Sam Altman addressed his employees in a company memo on Nov. 29, marking his official return to the top leadership position at OpenAI.

The Protocol: CZ’s out, Altman’s in, and Kraken’s Sued

In this week’s edition of The Protocol newsletter, we share a few trends stand out to close 2023: the proliferation of Ethereum layer-2 networks, the ascendancy of zero-knowledge cryptography and the appearance of tokens, smart contracts and now file hosting on the Bitcoin blockchain.

Polymarket Traders Betting on Sam Altman’s Fate Have Become Bipolar

24 hours ago, prediction markets were almost certain that Altman wouldn’t be back as OpenAI’s CEO. Now the market’s answer to that question has changed twice.

FTX-Backed Anthropic’s CEO Declined OpenAI’s Merger Offer: The Information

FTX-backed artificial intelligence company Anthropic’s CEO and co-founder Dario Amodei declined an offer from OpenAI’s board of directors to merge, according to a news report.

Does Worldcoin Need a Reevaluation? Understanding Sam Altman’s Crypto-AI-UBI Experiment

OpenAI staff tells board to resign after Sam Altman ousting: Report

505 out of 700 employees reportedly signed a letter stating that the board has undermined the company’s mission by firing Altman.

Sam Altman’s Worldcoin Token Makes Headlines With 24% Surge Amid OpenAI Drama

The narrative around Sam Altman and OpenAI seems to have had a major impact on the value of WLD, the token that Worldcoin, a cryptocurrency that Altman co-founded, is issuing.

As the drama surrounding Sam Altman’s dismissal from OpenAI and possible reinstatement continues to captivate the crypto space, the Worldcoin digital token has been one of the most unpredictable in the cryptocurrency market as of late.

As of today, the trading price of Worldcoin (WLD) has reached $2.43, indicating that the cryptocurrency has made a strong recovery. In comparison to the previous 24 hours, this is a significant gain of 19%, with an impressive 24% rally in the last week, data from crypto price aggregator Coingecko shows.

Worldcoin’s Unpredictable Market Behavior Amid Altman’s Controversy

From a high of $2.50 on November 16, WLD started to weaken as digital asset markets backpedaled the next day, with Altman’s dismissal only making the decline worse. In the hours following his departure, the token dipped to $1.85 according to statistics compiled by CoinGecko.

As artificial intelligence (AI) develops at a rapid pace, Worldcoin is working on a digital identity network that will collect retina scans to verify users’ identities.

The project’s orbs collect users’ retina scans, and in return, they give users WLD tokens as a compensation for giving their biometric data.

Events at OpenAI, which Altman acted as a go-between for Worldcoin and, by extension, WLD, continue to impact WLD price, even though the two projects are unrelated.

With a market value of approximately $280 million, the token holds the 160th position in the crypto market, as reported by CoinGecko on Monday.

The surge in the token’s value is intricately linked to the news surrounding Altman and the uncertainties arising from his removal at OpenAI, according to Richard Galvin, co-founder at Digital Asset Capital Management.

Altman As The Face Of Worldcoin: Impact On Investor Appeal

As events unfolded, the token experienced a rebound, gaining momentum as it became evident that there was no significant negative event fueling the board’s decision.

Digital asset platform VDX’s head of research in Hong Kong, Greta Yuan, predicted that WLD will experience additional volatility in the coming weeks.

Altman is the face of Worldcoin, so depending on how this drama plays out in the next few days, the token may fluctuate, but its appeal to investors will not diminish, Yuan said.

Meanwhile, even though OpenAI’s stock dropped to $2.04 over the weekend after the announcement of Altman’s resignation as chief executive, the company’s efforts to reassign his role as CEO helped propel the stock back up.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Business Wire

Former Twitch CEO Emmett Shear Appointed as New OpenAI Chief

OpenAI ousted Sam Altman as its chief last week after the board said it no longer had confidence in his ability to lead the company.

Sam Altman, Former OpenAI CEO, Lands at Microsoft

Altman and other departed OpenAI staff will join a new advanced AI research team at the software giant.