He did incalculable harm, but arguing for a sentence longer than 25 years is unfair to the man and the industry he once represented.

BREAKING: Sam Bankman-Fried Sentenced To 25 Years In Prison

In a highly anticipated courtroom verdict, Sam Bankman-Fried, the founder of the collapsed cryptocurrency exchange FTX, has been sentenced to 25 years in prison for defrauding users. US District Judge Lewis Kaplan delivered the judgment during a Lower Manhattan federal courtroom hearing.

FTX Founder Sam Bankman-Fried Sentenced

Judge Kaplan sternly criticized the defense’s argument, labeling it as “misleading, logically flawed, and speculative.” As reported by our sister site, Bitcoinist, Kaplan highlighted Bankman-Fried’s obstruction of justice and witness tampering during his defense, which were significant factors considered in the sentencing decision.

Bankman-Fried expressed remorse in a statement, acknowledging that his series of “selfish” decisions as the leader of FTX had led to the exchange’s downfall. He admitted to having “thrown it all away” and expressed regret that continues to haunt him daily.

Prosecutors had initially sought a maximum sentence of 50 years, while Bankman-Fried’s legal team argued for a maximum of 6 years. In November, Bankman-Fried was found guilty on seven criminal counts, and he has since been held at the Metropolitan Detention Center in Brooklyn.

Life Plans Shattered

Late Tuesday, prosecutors submitted documents containing testimonies from victims, shedding light on the impact of Bankman-Fried’s actions. One victim, whose name was redacted, wrote a letter dated March 15, describing the destruction of their entire life and the emotional toll it had taken on their family.

They emphasized that they had entrusted their funds to FTX as a custodian, not consenting to the risks Bankman-Fried had taken with their money. The victim shared the suffering that had led to depression and even thoughts of suicide.

During the trial, prosecutors revealed that Bankman-Fried had diverted funds from FTX customers, amounting to as much as $8 billion. These funds were allegedly used to finance a wide range of external interests, including political initiatives, speculative investments, and funding the lifestyles of FTX executives.

Featured image from Shutterstock, chart from TradingView.com

BREAKING: Sam Bankman-Fried Sentenced To 25 Years In Prison

In a highly anticipated courtroom verdict, Sam Bankman-Fried, the founder of the collapsed cryptocurrency exchange FTX, has been sentenced to 25 years in prison for defrauding users. US District Judge Lewis Kaplan delivered the judgment during a Lower Manhattan federal courtroom hearing.

FTX Founder Sam Bankman-Fried Sentenced

Judge Kaplan sternly criticized the defense’s argument, labeling it as “misleading, logically flawed, and speculative.” As reported by our sister site, Bitcoinist, Kaplan highlighted Bankman-Fried’s obstruction of justice and witness tampering during his defense, which were significant factors considered in the sentencing decision.

Bankman-Fried expressed remorse in a statement, acknowledging that his series of “selfish” decisions as the leader of FTX had led to the exchange’s downfall. He admitted to having “thrown it all away” and expressed regret that continues to haunt him daily.

Prosecutors had initially sought a maximum sentence of 50 years, while Bankman-Fried’s legal team argued for a maximum of 6 years. In November, Bankman-Fried was found guilty on seven criminal counts, and he has since been held at the Metropolitan Detention Center in Brooklyn.

Life Plans Shattered

Late Tuesday, prosecutors submitted documents containing testimonies from victims, shedding light on the impact of Bankman-Fried’s actions. One victim, whose name was redacted, wrote a letter dated March 15, describing the destruction of their entire life and the emotional toll it had taken on their family.

They emphasized that they had entrusted their funds to FTX as a custodian, not consenting to the risks Bankman-Fried had taken with their money. The victim shared the suffering that had led to depression and even thoughts of suicide.

During the trial, prosecutors revealed that Bankman-Fried had diverted funds from FTX customers, amounting to as much as $8 billion. These funds were allegedly used to finance a wide range of external interests, including political initiatives, speculative investments, and funding the lifestyles of FTX executives.

Featured image from Shutterstock, chart from TradingView.com

LIVE: Sam Bankman-Fried Returns to New York Courthouse for Sentencing in FTX Fraud Case

SBF returned to a federal courthouse in Manhattan for sentencing on Thursday.

Recapping FTX Founder Sam Bankman-Fried’s Trial

Sam Bankman-Fried was convicted last year. Here’s how his trial came together.

How Sam Bankman-Fried’s Sentencing Hearing May Play Out

Sam Bankman-Fried will find out this week if he is potentially facing decades in prison. Judge Lewis Kaplan is set to sentence him for his conviction last year on two fraud charges and five conspiracy charges tied to the operation and collapse of FTX.

U.S. Government’s Legal Precedents Don’t Support Lengthy Prison Term, Bankman-Fried’s Defense Argues

Sam Bankman-Fried’s lawyers have pushed back against the U.S. government’s sentencing memo which makes the case for why it thinks the former FTX CEO should be handed a sentence in the range of 40-50 years, a court filing on Wednesday shows.

FTX Was Down to Last 105 Bitcoins When Bankruptcy Rescue Crew Arrived: John Ray

John J. Ray III Fires Back Against SBF’s ‘Delusional’ Claims Customers Lost No Money in FTX Collapse

Does Sam Bankman-Fried Deserve 50 Years in Prison?

The stage is set for a federal judge to determine how long Sam Bankman-Fried may spend in prison. The U.S. Department of Justice and defense attorneys have now both filed their arguments, as well as statements from FTX creditors (from the prosecution) and Bankman-Fried’s family and friends (from the defense).

DOJ’s Proposed 50-Year Sentence for Sam Bankman-Fried ‘Disturbing,’ FTX Founder’s Lawyers Say

Sam Bankman-Fried’s defense team pushed back against what it called the “disturbing” sentencing memorandum filed by the Department of Justice last week in a new letter, saying the DOJ was making the FTX founder out to be someone he was not.

FTX Users Describe ‘Emotional Toll’ From Bankruptcy in Letters to Judge Ahead of Sam Bankman-Fried’s Sentencing

The Department of Justice filed dozens of victim impact statements from FTX creditors Monday ahead of Bankman-Fried’s sentencing next week. These victims hail from around the world, with the letters describing their FTX holdings and the effect FTX’s bankruptcy had on their lives.

Sam Bankman-Fried Should Spend 40-50 Years in Prison, DOJ Says

Prosecutors recommended that a federal judge sentence FTX founder and former CEO Sam Bankman-Fried to at least 40 and as many as 50 years in prison for his conviction on fraud and conspiracy charges tied to the collapse of what was once one of the world’s largest crypto exchanges.

Sam Bankman-Fried Doesn’t Want to Go to Prison for 100 Years

Sam Bankman-Fried’s new legal team filed his sentencing memo, alongside 29 different character references and other supporting documents, arguing he shouldn’t face a lengthy prison term after his conviction last November on two fraud and five conspiracy charges.

Sam Bankman-Fried Asks Court to Cut Prison Time to 63-78 Months

Former FTX boss Sam Bankman-Fried (SBF), found guilty of fraud last year and due to be sentenced next month, has asked the court for a ‘just’ sentence of 63 to 78 months, according to a court filing submitted Tuesday.

FTX Estate Can Sell Near 8% Stake in AI StartUp Anthropic, Court Rules

The FTX bankruptcy estate has been granted approval to sell its stake in artificial intelligence (AI) startup Anthropic, court filings from Thursday show.

Sam Bankman-Fried Replaces Lawyers Ahead of Sentencing

Sam Bankman-Fried replaced his former lawyers, Mark Cohen and Christian Everdale, as he’s headed into sentencing negotiations.

Alameda Research’s Worldcoin Investment Hits All-Time High, Exceeding $50M As WLD Price Climbs

Worldcoin, the digital identity token ERC-20 project on the Ethereum (ETH) blockchain, has garnered significant attention. Its native token, WLD, emerges as the top performer among the top 100 cryptocurrencies by market capitalization.

The token has experienced a remarkable 31% uptrend in just 24 hours and a staggering 217% surge over the past fourteen days. This surge not only marks a new all-time high for WLD but also positively impacts Alameda Research, the now-bankrupt trading arm of the defunct FTX exchange, which holds a substantial stake in Worldcoin.

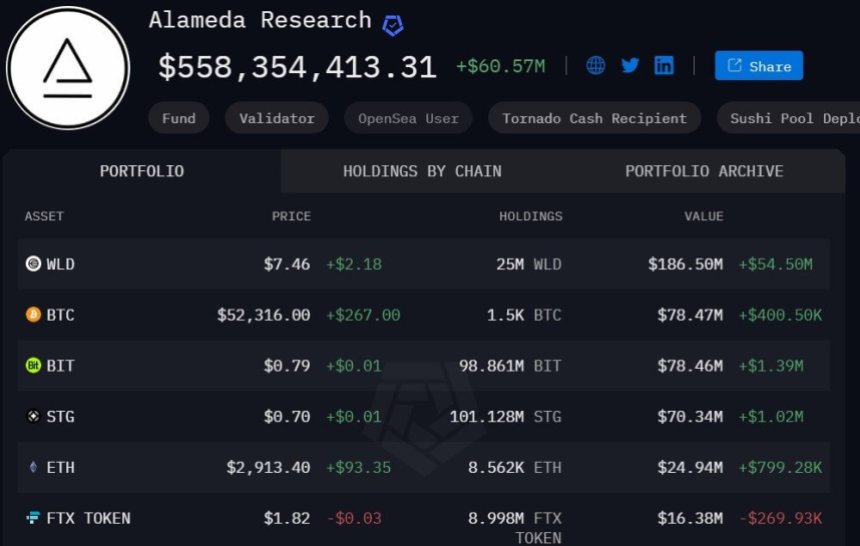

Alameda Research’s Stake In Worldcoin Reaches $186 Million

According to on-chain data, Alameda Research, a cryptocurrency trading firm co-founded by Sam Bankman-Fried and Tara Mac Aulay in 2017, has witnessed a surge in its Worldcoin holdings.

As WLD reached a new all-time high of $7.9788 on Monday, the trading firm’s investment in the project surged by $50 million, reaching a new record. Currently, Alameda Research holds 25 million WLD tokens, valued at $186 million, representing 33% of their total portfolio.

This portfolio also includes other digital assets such as Bitcoin (BTC), BitDAO (BIT), Ethereum (ETH), Stargate Finance (STG), and the FTX token FTT.

Whale Activity And AI Hype Drive WLD’s Price Surge

Analysts such as Zameer Attar attribute the WLD price spike to strong whale activity, with one notable whale wallet withdrawing 2.09 million WLD tokens ($5.82 million) from Binance.

This withdrawal caused a 25% surge in the price of Worldcoin, resulting in the whale’s holdings reaching an impressive $8.03 million. Additionally, the launch of OpenAI Sora by Sam Altman, one of the founders of Worldcoin, has triggered bullish action in WLD tokens.

Interestingly, Sora can create videos of up to 60 seconds with highly detailed scenes, complex camera movements, and multiple characters with emotions, which surrounding the hype of artificial intelligence (AI) has spurred investor interest, leading to more bullish sentiment surrounding WLD.

Worldcoin, founded by Sam Altman, Alex Blania, and Max Novendstern, aims to revolutionize the global identity and financial network by creating a public utility known as World ID.

This privacy-preserving identity network enables users to verify their humanness online while maintaining their privacy through zero-knowledge proofs. The project has garnered significant funding, raising over $250 million across various funding rounds from investors, including a16z, Khosla Ventures, Bain Capital Crypto, Blockchain Capital, and Tiger Global.

The combination of whale activity and positive market sentiment surrounding AI technologies has contributed to the considerable surge in Worldcoin’s price.

Featured image from Shutterstock, chart from TradingView.com

That FTX Super Bowl Ad? ‘Like an Idiot, I Did It,’ Larry David Says

Sam Bankman-Fried’s cryptocurrency exchange infamously collapsed months after the commercial.

Sam Bankman-Fried’s Parents Ask Court to Dismiss FTX’s Lawsuit Seeking to Recover Funds

Joseph Bankman and Barbara Fried, the parents of Sam Bankman-Fried, have asked a court to dismiss a lawsuit by the bankrupt cryptocurrency exchange FTX seeking to recover funds it alleges were fraudulently transferred.