Cardholders of the hi Debit Mastercard, a partnership between crypto payments application hi and Mastercard, can now spend Metaverse platform Sandbox’s SAND token as a currency in eligible markets.

Sandbox Set For $133 Million Token Unlock, A Bearish Trigger For SAND Price?

Decentralized gaming platform, The Sandbox is set to execute a SAND token release valued at $133.86 million. According to data from TokenUnlocks, Sandbox will release 332.55 million SAND tokens into circulation on August 14, representing 16.16% of the token’s maximum supply.

New SAND Tokens In 2023 To Rise Over 700 Million

With the upcoming SAND release, the total number of new SAND tokens in 2023 is expected to rise to 705.3 million. This latest unlock will add to the 372.75 million SAND released earlier during the last token unlock in February.

Based on more data from Token Unlocks, the newly released tokens will be allocated to various parties, including the Sandbox’s development team, project advisors, strategic and seed investors, and the project’s reserve.

SAND functions as the utility token of the Sandbox metaverse, serving as the platform’s payment medium and governance token. According to its design, SAND is expected to undergo a token unlock every six months until 2025.

Currently, the number of circulating SAND tokens is 2.05 billion, representing 68.6% of SAND’s total supply. With the projected release on August 14, these figures are expected to jump to 2.39 billion and 84.76%, respectively.

Potential Impact of Token Release on SAND’s Price

Token unlocks are common events in the crypto space, usually accompanied by fears of a bearish market. This is because the sudden introduction of massive tokens to the market creates a higher supply-to-demand ratio, which drives down asset prices.

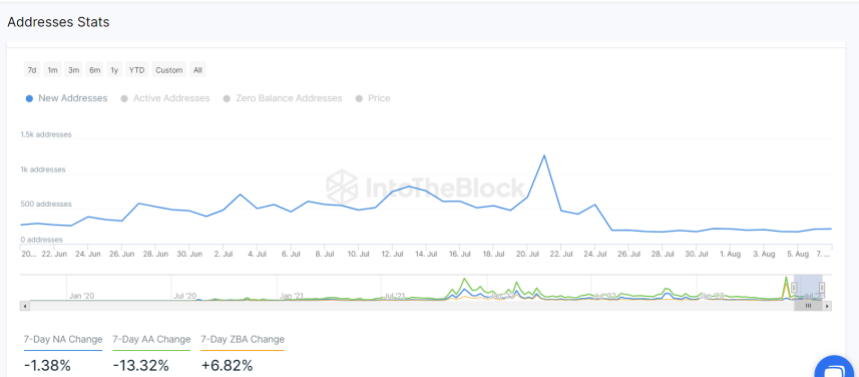

Looking at on-chain data, this is one likely effect of SAND’s upcoming token unlock on its market price due to declining network growth on the Sandbox platform.

Based on data from blockchain analytics firm IntoTheBlock, the number of new addresses on Sandbox is down by 66.87% in the last month, falling from a peak of 649 in July to its current value of 215.

The continuance of this trend means Sandbox may lack the necessary traction to counter the upcoming inflationary pressure, which may ultimately lead to a fall in price.

Related Reading: Aptos (APT) Gains By 10% Ahead Of July Token Release

Following SAND’s last token release on February 14, SAND’s price movement was fairly positive, opening at $0.68 to trade as high as $0.72 and close at $0.71. In the subsequent days, SAND would record more gains, reaching a market value of $0.88 on Feb 20.

While token unlocks are widely expected to precipitate bearish pressure, their effects are still unpredictable. Investors are advised to watch out for major developments on Sandbox regarding network growth and whale movement.

At the time of writing, CoinMarketCap data shows that SAND is trading at $0.40 with a 0.62% gain on the last day. However, the token is down on the weekly chart losing about 2.98% of its value.

Binance Lawsuit Triggers $700M in Withdrawals; Metaverse Tokens Named by SEC Lead Decline

The unprecedented withdrawals only reflect a small amount of Binance’s reserves, according to data from CryptoQuant.

Decentraland (MANA) Leads Crypto Market Gains, Here’s Why

Decentraland (MANA) is currently ahead of the rest of the crypto market after seeing almost double-digit gains in the last day. This incredible recovery comes at a time when the broader crypto market is following in the steps of Bitcoin and shedding most of its first quarter’s gains. So what could be driving the price increase of MANA?

Rumors Of Apple Metaverse Circulate

The rumors about Apple’s very own metaverse first started circulating on Monday when a Twitter user made a post about it. In the tweet, Idi Wertheimer pointed to the fact that tech giant Apple was allegedly launching its own mixed-reality headset. As a result, Wertheimer believes that metaverse coins are going to start pumping based on this news.

CT is completely oblivious to the fact that Apple is about to launch a mixed reality headset in 3 weeks

Metaverse shitcoins are going to pump so hard it’s not even funny

But you morons keep buying influencer coins

Ok

— Udi Wertheimer

(@udiWertheimer) May 15, 2023

Rumors about Apple working on its own metaverse didn’t just start now as it has since been speculated that the company would build one to compete with Meta’s (formerly Facebook) Oculus series. However, Apple has never confirmed nor denied if it was working on its own metaverse.

Research on our end turned up an article from a website called Tom’s Guide which points toward the tech giant’s plans to enter the virtual and augmented reality space. But instead of the anticipated Apple Glasses, the article refers to an entirely new device which is rumored to be called ‘Reality Pro’.

While Apple fans have waited long for a launch of VR/AR devices, venturing into the sector hasn’t been backed internally from all indications. Previously, executives reportedly vetoed the design team which believed that the device is not yet ready for launch. But it remains to be seen if the company will follow through and launch the device

Decentraland (MANA) Picks Up Steam

With the rumors of Apple launching its own metaverse picking, the price of MANA, one of the largest metaverse projects in the crypto space, has been seeing positive reversals. Despite the low momentum in the market, MANA has been able to rise over 9% in the past day. This recovery has brought the MANA price back above $0.5 and its trading volume surged to $161.4 million during this time as well.

MANA is not the only token to have benefited from the Apple rumors. Another metaverse token The Sandbox (SAND) has been on the rise as well. SAND is up 3.98% in the last 24 hours, enabling it to beat the resistance at the $5.2 level.

It is rumored that Apple’s device will drop at the WWDC 2023 event held later this year. If this happened, then the price of metaverse coins could explode leading up to the event, as well as after it.

MANA Soared 75% This Week, Entering The Top 100

According to CoinMarketCap’s data, Decentraland’s native token, MANA, has gained 17.59% in the last 24 hours, following the stellar performance of metaverse tokens since the start of the new year. MANA is one of the top 100 cryptocurrencies and has grown by 95% in the last month. In addition, it has been in the green for 14 of the previous 16 days.

What Pushed MANA To The Sky?

At the time of writing, MANA is trading at $0.6887. Since last week, the token’s price has increased by approximately 70%, bringing its market capitalization to $1,2 million. As investor opinion in the crypto markets has improved in response to positive macroeconomic news, smaller market cap cryptocurrencies have outperformed their larger competitors.

#mana pump was inevitable, @decentraland is the platform of the future. NOW

pic.twitter.com/x2LLJrCWO1

— jasonx.eth (@DCLjasonx) January 15, 2023

The recent U.S. economic data is also why the increase in MANA price. According to data released last week, US inflation has been trending downward over the past few months. From its all-time high of 9.1% in 2022 down to 6.5% in December of that year, the Bureau of Labor Statistics reports a dramatic decline in the consumer price index (CPI) for the United States.

The U.S. Federal Reserve (Fed) has been hiking interest rates to bring down inflation. This data suggest their efforts are working, and the market is feeling more optimistic as the chances of a monetary policy pivot are increasing, according to their expectations.

According to additional data, MANA is one of the most popular “metaverse” platforms, with roughly 8,000 unique daily users.

Improvements to avatars, profiles, and friend requests have recently been released for Decentraland users. It works toward making the platform more user-friendly. However, it was a time-consuming process before the platform started to recover. These essential factors have led to the price increase and burst in investor interest.

New Year, More About You

A few new features came out today that will help #DCLcitizens connect with each other better than ever—and this is only the beginning!

Highlighting Avatars

New User Profile

Links in Profile

New Friend Request Flow

Differentiated Nametags pic.twitter.com/8cMUXVLpiT

— Decentraland (@decentraland) January 12, 2023

Various tokens used in video games and the metaverse saw dramatic price spikes last week. For example, SAND, The Sandbox’s native, has surged by 33% during the past week, while GALA, the currency of Gala Games, has increased by 31%.

Australian Open Metaverse Tournament Back At Decentraland

According to a tweet below, the Australian Open metaverse has returned to Decentraland.

Game, Set, Match!@AOmetaverse has returned to Decentraland!

On the big screens: #AO23 Practice courts, 24/7 Classic matches

New AO Tennis Club, Beach Bar

Rod Laver Tennis Challenge

Daily quests for Wearables

Now-Jan 29

-143, 74 pic.twitter.com/Z3VOICGmOU— Decentraland (@decentraland) January 15, 2023

From January 16-29, 2023, Melbourne Park will host the first round of the 2023 Australian Open, a Grand Slam tennis tournament. This year’s Australian Open will be the 111th in the tournament’s history and the 55th in the Open Era and could contribute to the bullish price action by onboarding new users on MANA.

AOmetaverse and Vegas City, the metaverse’s entertainment platform and the largest commercial zone in Decentraland, have reserved a Twitter spot for January 17 to announce the activation of the Australian Open 2023 for 14 days.

Featured Image from CoinMarketCap, Chart from Tradingview.com

ETH Whales Scoop Up SAND – Up Nearly 80% – For Its Highly Bought Crypto Menu

The Sandbox is one of the leading players in the GameFi space. Its native token SAND is now going down the net of ETH whales as the altcoin rally continues into its third week. According to CoinGecko, the token has gone up by 76% in the past two weeks.

ETH whales are also adding fuel to this fire, accumulating SAND and including the crypto on its top 10 tokens bought in the past 24 hours. Along with the recent release of Game Maker 0.8, The Sandbox ecosystem is expected to continue to be a dominant player in the GameFi space.

JUST IN: $SAND @TheSandboxGame now on top 10 purchased tokens among 100 biggest #ETH whales in the last 24hrs

Check the top 100 whales here: https://t.co/N5qqsCAH8j

(and hodl $BBW to see data for the top 5000!)#SAND #whalestats #babywhale #BBW pic.twitter.com/nWQoR6vWNX

— WhaleStats (tracking crypto whales) (@WhaleStats) January 15, 2023

More Support From ETH Whales

The whale buying spree has effectively pushed the price of SAND up on the broader market market. Looking at the charts, the token is up almost 80% in the past two weeks. This in turn made the token test the $0.7540 price resistance level.

On top of the whale buying spree, the release of Game Maker 0.8 certainly has an effect on the token. According to the development team’s Medium post, this upgrade brought features that were requested by the community in the past.

New multiplayer gameplay features, new lighting and post-processing effects, and the addition of audio and video streaming on the platform will certainly bring more attention to the platform and the GameFi space. With gaming companies noticing the power of Web3 development, platforms like The Sandbox will continue to rise in popularity.

Is SAND Standing On Solid Ground?

As the time of writing, the token is changing hands at $0.7044. With crucial support at $0.5015, this may be enough for SAND to sustain higher highs and higher lows. ETH whales should be careful, however, as a break below the $0.6327 support would delay a possible break above $0.7540.

Bitcoin’s current strong momentum is being reflected by the token in the short to medium term as well. This means that if ever BTC – the world’s biggest crypto asset in terms of market cap – continues its momentous climb to breach the $21,500 resistance, SAND would see gains above $0.8626 which would wipe the losses that occurred when crypto exchange FTX collapsed.

A breakthrough like this would trigger a bigger rally. However, if the rally is met with resistance, investors and traders should consolidate above $0.6327 to support further bullish movement in the coming days and weeks.

Improvements in the macroeconomic situation should also help SAND’s price to secure crucial consolidation levels. With inflation seemingly going down, the ecosystem and SAND would benefit from its high correlation with Bitcoin and Ethereum.

-Featured image: Screen Rant

SAND Experiences Increased Selling, But Traders Should Short At This Level

SAND, the SandBox, has been free-falling since the month of August. The coin has registered a severe decline in demand, which has caused the crypto to lose further value. The asset has pierced through various support levels over the past few months. It lost 2.2% of its value in the last 24 hours.

Over the past week, the coin has depreciated in double digits, which has caused the coin to reach a multi-month low on the chart. The technical outlook displayed that the coin has received very little demand, and the buyers have exited the market.

The consistent fall in demand can be attributed to major market movers faltering on their respective charts. Support from the broader market remains crucial for The Sandbox (SAND) to recover.

The technical outlook still points to the coin losing further value, which indicates that sellers can liquidate the asset and purchase it when it dips to sell it again when the value rises. The trading volume in Sandbox declined, indicating that the bears were in charge of the market.

SAND Price Analysis: One-Day Chart

The coin was exchanging hands at $0.43 at the time of writing. SAND has been unable to maintain a price above $0.50 since the coin lost the $0.70 price. If The SandBox price stood above the $0.50 level, then there was a chance that the coin could propel the price further.

Presently, the immediate resistance for the asset stands at $0.53. The price of crypto will rally if it breaks above $0.53. Conversely, if the altcoin dips, the first fall would be to $0.40 and then to $0.36.

The zone between the $0.40 and the $0.30 can prove beneficial to traders as that would present a shorting opportunity. The amount of SAND traded in the last session was low, leading to increased sales.

Technical Analysis

SAND did not recover from the declining buying pressure throughout the month of December. The asset was now in the oversold zone.

The Relative Strength Index (RSI) was at the 20 mark, which is undervalued territory. This indicated that the bears were still dominating. Usually, a visit to the oversold zone means that the price will bounce off to the upside.

The asset price fell below the 20-Simple Moving Average (SMA) line, which meant that the sellers were driving the price momentum in the market.

The other technical indicators also pointed towards the coin dipping, confirming that sellers could now benefit.

The Directional Movement Index (DMI) was negative as the -DI line was above the +DI line; the indicator detects the price direction and momentum in the market.

The Average Directional Index (ADX) was slightly above the 20-mark, which meant the price momentum for the asset was still low. The Parabolic SAR indicates the asset trend; the indicator was above the price candlestick, which meant that the coin depicted a downtrend.

Metaverse platforms refute ‘misinformation’ about daily active users

User data from DappRadar consists of metaverse users who have also made an in-game purchase with the project’s native token, but the Decentraland and Sandbox projects disagree with that criteria.

SAND Has Just Been Added On Binance US – Will It Hit $1 In The Coming Days?

SAND is the native token of the Sandbox metaverse and is used to facilitate gameplay transactions such as purchasing digital land and interacting with user-generated content.

- Sandbox started out as collaboration between Pixowl and developer Onimatrix

- Binance listed SAND and is already available for trading on its platform

- The token is responding positively with this development, trading at $0.86 as of press time

Along with the crypto asset and NFT-type LAND tokens, SAND makes it all possible for Sandbox to give its users the best gaming experience.

Released as a mobile game in 2012, Sandbox started out as collaboration between Pixowl and developer Onimatrix.

Six years later, in 2018, Animoca acquired Pixowl and announced intentions to leverage blockchain technology to create a 3D world and take advantage of token economics and user-generated content.

In August of 2020, an Initial Coin Offering (ICO) was held by Sandbox and was able to raise $3 million that was then used in funding its future operations.

SAND Is Now Binance-Listed

Both Binance U.S. and Sandbox has already confirmed that SAND has been listed by the cryptocurrency exchange.

The token responded positively as it showed a considerable price movement. As of this writing, according to tracking from CoinGecko, SAND is trading at $0.8644.

Its current price is higher than its $0.83 closing price on October 4 when the announcement about the listing was made.

With this development, SAND was able to break free from its slump that put it on a downward trend for some time now.

In fact, various indicators such as Awesome Oscillator (AO) and Relative Strength Index (RSI) are signaling a bullish momentum for the Sandbox token.

Rally To The $1 Mark

After this momentous event for the gaming metaverse, crypto enthusiasts are already looking ahead at what will come next for the token.

Daily time frame trend lines indicate a support level of $0.807 as it struggled to surpass the $1.011 resistance marker for the entire duration of September. Because of that failure, SAND’s resistance lowered a bit to $0.90.

Chart: TradingView.com

In the crypto space, the resistance level refers to the point at which an asset’s price has difficulties increasing.

With that being said, a potential rally towards the highly coveted $1 mark could still be jeopardy. However, if SAND is able to move out of its current trading price range, there is a strong possibility that it will hit is target.

One possible thing that can help the asset to realize this goal is the expected growth in buying activity now that it is already Binance-listed and more potential buyers have access to it.

SAND total market cap at $1.29 billion | Featured image from Cryptopolitan, Chart: TradingView.com

Sandbox (SAND) Price Up 76% Since June Courtesy Of Metaverse Hype

The Sandbox (SAND) has been showing bullish signals and rising steadily, recording a 0.5% spike in the market.

- Sandbox price on an uptrend; rises by 76%

- SAND price trades upwards; depicting a long-term bullish trend

- Sandbox is bullish due to an increased investor and influencer interest

The market has seen aggressive strides in the past couple of weeks which is forecasted to be long-term. According to CoinMarketCap, The Sandbox (SAND) is down by 3.1% or at $1.30 as of this writing.

SAND Blows Past 75% On Influence Boost

SAND was seen to spike by 76% since June 19. The growth is brought about largely by the influence of metaverse platforms like Sandbox which has generated a great deal of interest from popular influencers and personalities online as well as a huge part of blockchain users who continuously support these platforms.

For instance, famous socialite Paris Hilton has a Malibu mansion on Sandbox and is organizing events for fans that allow everyone to interact virtually with her. Hilton’s partnership with Sandbox has generated a lot of attention for SAND and also the metaverse events she has in store for her solid fans on Sandbox.

SAND’s price growth is mainly triggered by its wide expansion internationally and in other markets. Additionally, Sandbox is also said to begin partnerships with local businesses for a pop-up atelier. These developments have propelled SAND’s prices way up as investors are now excited with the evolution of the metaverse industry and want to be a part of the metamorphosis.

On the recent chart, the market has registered small gains which are said to be a perpetuation of the sideways market that has been lingering for the past couple of weeks. SAND is seen to continue with its current trading direction or the sideways market in the next trading sessions with prices that could potentially trade below $1.49.

On the other hand, if the prices hover above the key resistance of $1.49, this will indicate the continuation of a bull run.

What Is The Sandbox?

The Sandbox (SAND) is an interactive virtual Ethereum-based world that enables players to create, build, explore, socialize, trade, and monetize digital assets and game experiences.

The platform is powered by SAND, its native currency, which is utilized for interactions and transactions made in the virtual world. The Sandbox provides players with a safe gaming landscape that keeps players secure from crypto market volatility and crashes.

While the Sandbox has been criticized a lot of times as it heavily relies on cryptocurrencies which are highly volatile, the platform remains to be one of the most popular and trusted projects in the GameFi space.

SAND total market cap at $1.6 billion on the daily chart | Source: TradingView.com

Featured image from Yahoo Finance, Chart from TradingView.com

Metaverse housing bubble bursting? Virtual land prices crash 85% amid waning interest

The virtual real estate market is crashing despite a McKinsey report predicting a $5 trillion market by 2030.

Preference For Ripple XRP Surges Among BSC Whales

There has been a long ongoing lawsuit between Ripple (XRP) and the United States Securities and Exchange Commission (SEC). Throughout the case, Ripple’s native token, XRP, has not seen any progressive growth. This stagnation in its price move has lingered even before the emergence of the extreme crypto winter.

But things seem to be taking a dramatic twist for XRP recently. With the ruling of the case, the price of XRP is positively waking. Also, the crypto coin is gradually becoming the leading choice for most BSC whales.

Related Reading | Bitcoin Funding Rate Turns Highly Positive, Long Squeeze In The Making?

XRP has shown more stability amid the collapse in the broader crypto space. It’s among the rare tokens that have not demonstrated a massive swing in value. Within 30 days, the XRP price has displayed a 1% marginal increase. This impressive trend is quite the opposite of the king of crypto Bitcoin. The price of BTC has dipped by almost 10% within the same period.

WhaleStats showed that XRP has suddenly risen as one of the most used smart contract tokens. It noted that this trend has persisted over the last 24 hours among the 1,000 and 500 BSC whales. Also, the record from the firm displayed that the top 2,000 huge investors on BSC hold large XRP tokens worth about $15.09 million.

Following the announcement of the long-running lawsuit between Ripple and SEC, the hike in the whale activities for XRP heightened.

XRP trends upwards on the daily chart | Source: TradingView.com

Through Judge Netburn’s pronouncement, the court has denied SEC’s assertions over Himan’s ETH speech. Also, the commission received the court’s mandate to produce all relevant internal documents.

The court order stated that the commission is expected to submit the two proposed redactions to enable in-camera review by the court. Ripple’s attorney noted that the SEC could appeal the court’s decision to Judge Torres. Also, the SEC could demand up to one or two weeks as an extension for filing the objection.

Ripple XRP Gets More Listing of Pairs

In a new development, the Bitrue crypto exchange is offering its support to Ripple XRP tokens. According to the exchange’s statement, it would list up to 10 XRP pairs on its platform for customers. In addition, the exchange stated that its pair would be on crypto SAND, MANA, AAVE, BTTC, ALGO, AR, APE, CHZ, HBAR, and DENT.

Related Reading | Market Update: MATIC, UNI And AAVE Outperforms While Bitcoin Strugles To Hold Above $20k

Data from reporting source highlighted that XRP is currently trading at $0.35 at the time of writing. With a trading volume of about %1.11 billion. Ripple XRP still maintains its market cap, which is more than $15.22 billion.

Featured image from Pexels, charts from TradingView.com

Sandbox (SAND) Having A Blast With 12% Spike In 24 Hours

Sandbox (SAND) was one of the most active cryptocurrencies on Thursday, with values increasing by as much as 14 percent. After reaching a low of $1.13 on Wednesday, the SAND/USD pair reached a session high of $1.28 earlier today.

The token reached its highest level since June 25 and drew closer to a crucial resistance level as a result. During the same timeframe, the market capitalization of the token increased by 15 percent. It was valued at $1.58 billion as of press time, according to data from Coingecko.

Suggested Reading | ATOM Rises To Multi-Week High, Daily RSI Shows Bullish Pattern

Major Indicators Showing Positive Values

According to Santiment statistics, SAND’s major indicators improved over the past day, with the exchange flow balance exhibiting a positive value of $1,411,000.

In the previous 24 hours, significantly more SAND tokens were supplied to exchanges than were withdrawn. In such circumstances, a further price increase is anticipated.

Based on the chart, this resistance is located at $1.35 and has not been breached since late May, when prices were trading near $1.50.

To not only reach this ceiling, but perhaps surpass it, the 14-day relative strength index would need to surpass its own barrier. As of Thursday at midday, the SAND RSI is tracking at 57.50, which is just below the level of resistance at 58.

Crypto total market cap at $901 billion on the daily chart | Source: TradingView.com

Coinbase Merge Pushes SAND Price Up

This week’s news that The Sandbox has successfully merged with Coinbase Wallet and enabled LAND deployment on Polygon has provided a much-needed push to the price of metaverse currencies, causing a 20 percent increase.

Since the announcement, the price of SAND has peaked at $1.17 before declining. In comparison, its 24-hour minimum price was $0.95. Investors in SAND will hope that the positive news will cause the price to rise over $1.30, which will signal to the larger market that SAND is on a bullish run that may be sustainable.

Suggested Reading | Ethereum Gains 10% In 24 Hours – Is ETH Set To Rally Further?

At the time of writing, significant accumulation of the SAND token was occurring, as the Money Flow Index (MFI) was at 74.47. The position of these key indications suggest considerable purchasing pressure within the previous 24 hours.

Several crypto assets contributed to a 5 percent increase in the capitalization of the global cryptocurrency market over the past 24 hours. SAND was among the major assets to have a price increase during this timeframe.

Featured image from DataDrivenInvestor, chart from TradingView.com

Nifty news: Sandbox LAND on Polygon, ETH gain a tax loss and more…

An NFT trader pulled off a supposed tax write-off “masterclass” by booking a 74.2 ETH profit at a $52,000 loss, and print-on-demand firm Pixels.com has rolled out NFT merch support.

Sandbox (SAND) Blows Up 20% Over Last 24 Hours Following ‘Takeover’ Rumors

Sandbox has become one of the most important Metaverse cryptocurrencies to keep an eye on this year.

Sandbox (SAND) is currently selling at $1.31, an increase of 20% based on data from CoinMarketCap.

The rally occurs just days after Microsoft and Meta, among other technology giants, announced the founding of the so-called “Metaverse Standards Forum.”

Other facets of virtual reality are also being researched, as the Sandbox environment has expanded into much more than a gaming platform.

Suggested Reading | Storj (STORJ) – A Relatively Unheard Crypto – Leads Gainers With 30% Rally

Sandbox (SAND) Lights Up 7 Straight Green Candles

As shown on the SAND chart, the daily time frame chart obtained seven consecutive green candles.

Near the $1.11 mark, the SAND price confronts severe supply pressure, with intraday trading volume reaching $386 million, suggesting a 3.22 percent decline.

Source: Tradingview

Friday night’s bulls blasted over the 10-day horizontal boundary, propelling the price of SAND cryptocurrency well above the bearish’ critical hedging level of $0.90.

The recent bottom of the SAND token, on the other hand, has served as a significant support level for the bulls.

The Sandbox is an Ethereum-based game in which players can purchase parcels of virtual land. Occasionally, the value of these virtual properties may reach millions of dollars, and everyone could profit greatly if the metaverse becomes as successful as many anticipate.

The ‘Metaverse Standards Forum’

Meanwhile, the Sandbox could be on the crosshair of an established tech company planning a takeover, based on rumors circulating on social media.

The declared objective of the Metaverse Standards Forum, which was unveiled on Wednesday and is comprised of Sony and Alibaba, is to foster coordination and cooperation among the hundreds of enterprises competing for position on the enormous metaverse landscape.

Suggested Reading | Top 5 Cryptos Taking A Major Beating In The Ongoing Market Mayhem

Reuters quotes Nvidia executive Neil Trevett, who is chairing the MSF, as saying any company, including those in the crypto industry, can join the group.

A property in Sandbox was recently acquired by HSBC, one of the world’s top banks. HSBC’s interest in Sandbox metaverse lands indicatesthat they appreciate its significance.

SAND total market cap at $1.76 billion on the weekend chart | Source: TradingView.com

Meta Eyeing Sandbox Buyout?

On Sunday, The Sandbox co-founder and COO Sebastien Borget replied to Messari on Twitter if Meta purchasing a virtual world like The Sandbox Game makes him “bullish.”

Borget’s response was brief and unequivocal:

“This will never happen.”

Many Web3 community members remain dubious. Animoca Brands’ founder and executive chairman, Yat Siu, has previously referred to Meta’s goals as “digital colonialism.”

Animoca Brands is a $5 billion software and venture capital firm responsible for a variety of metaverse projects, including The Sandbox.

Danny Greene, general manager of the Meebits DAO, stated to a crypto news outlet that customers will ultimately battle for a decentralized future and that “these are companies that represent shareholders.”

Featured image from Smart Valor, chart from TradingView.com

The Sandbox (SAND) Blows Up 20% After Collab With Major Entertainment Firm

The Sandbox native token, SAND, jumped from eight-month lows following Friday’s announcement of a collaboration between the metaverse and Lionsgate Studios.

As a result of the news, SAND surged as high as 20% to $0.9715, before reversing course to trade at $0.8647. The move helped SAND overcome a seven-day losing run in the face of gloom in the bear market.

Lionsgate is one of the biggest private studios in the United States, and it owns Rambo, Hellboy, and The Expendables, all of which will soon be featured in The Sandbox.

all hell breaks loose. lionsgate has entered @thesandboxgame pic.twitter.com/c1QcA2x3Y6

— Lionsgate (@Lionsgate) June 15, 2022

Suggested Reading | Bitcoin At $20K Could Be ‘New Bottom,’ Commodity Expert Suggests, And Here’s Why

The Sandbox (SAND) Soars 3.78%

At the time of writing, SAND was trading at 0.873, up 3.78 percent from its daily high of $0.9753. The 24-hour trading volume on the Sandbox was $269.75 million.

As of Friday, the circulating supply of SAND is 1.25 billion and the maximum supply is 3 billion.

Based on their increased production in the horror and action domains, the metaverse has devised a comprehensive transition plan, and Lionsgate will contribute to adapting its characters and captivating stories to web3-compatible platforms.

The Sandbox is a play-to-earn blockchain game that enables users to create a digital world on the Ethereum blockchain using non-fungible tokens.

The Sandbox allows players to create their own avatars to access the different games and destinations available. On the blockchain, it is the DeFi version of Minecraft.

Lionsgate is one of the biggest private entertainment studios in the United States. Image: Deadline.

SAND is an ERC20 utility token that enables the purchase and sale of LANDS and ASSETS within The Sandbox’s metaverse. It is also The Sandbox DAO’s governance token.

The Sandbox Guns For Over $4 Billion Valuation

The Sandbox, which is owned by blockchain gaming behemoth Animoca Brands, reportedly seeks to attract funds at a valuation of more than $4 billion.

The Sandbox reports that this deal will make Lionsgate the first major Hollywood studio to enter the metaverse.

This will not be The Sandbox’s first significant partnership, as it has already hosted material from Snoop Dogg, The Smurfs, and Adidas and sold LAND to financial institutions such as HSBC.

SAND total market cap at $1.06 billion on the daily chart | Source: TradingView.com

Crypto & Metaverse Going Stronger Despite Market Turmoil

Lionsgate’s Executive Vice President and Global Head of Live, Interactive, and Location-Based Entertainment, Jenefer Brown, commented on the innovative partnership:

“We’re thrilled by the new possibilities our strategic relationship with The Sandbox will offer our community.”

The bulk of cryptocurrencies have not been left behind as crypto markets continue to undergo a precipitous downturn.

In fact, cryptocurrencies with metaverse support, such as The Sandbox and Decentraland, have been in a stronger position as Metaverse and NFTs continue to gain popularity.

Suggested Reading | Ethereum Drops Below $950 On Uniswap Overnight – Here’s Why

Featured image from Actu Crypto.info, chart from TradingView.com

The Sandbox (SAND) metaverse token gains 40% after Snoop Dogg, Warner Music partnership

SAND’s 40% rally follows a two-month-long correction that wiped out nearly 70% of the token’s market valuation.

Which Cryptocurrencies Suffered The Worse Collapse Since All-Time Highs?

Cryptocurrencies all across the market have been suffering major downside since the crash. The crypto market saw a couple of hundred billions shaved off its market cap following this. Bitcoin, Ethereum, and others have all seen their value decline significantly in the space of a week. However, in all of this, some digital assets have been hit harder than others. This report takes a look at those cryptocurrencies.

Metaverse Tokens Take A Hit

The crypto market’s recent decline has been characterized by bloody streets. As expected, bitcoin’s 52% decline from its all-time high has dragged down other digital assets with it. Ethereum, the second largest cryptocurrency by market cap, is down 54% from its own all-time high. While these cryptocurrencies have seen major downsides, others have managed even more dips since then.

Related Reading | Market Sentiment Crumbles As Sell-Offs Drags Bitcoin To $33,000

Metaverse tokens which made a big splash when social media giant Facebook announced it was rebranding to Meta and entering the metaverse space, have borne some of the largest weight from the crash. These tokens which rallied to multiple all-time highs in the last couple of months have declined as high as 68% from their all-time highs.

Metaverse tokens take some of the biggest hit | Source: Arcane Research

MANA, SAND, and AXIE are some of the most popular metaverse tokens and have grown a lot in price in accordance with their popularity. However, with the market crash, they have not been able to hold up well. All of these tokens have lost over 68% since they hit their all-time highs. All three met averse tokens are down, trading at $2.27, $3.27, and $52.66 respectively.

What About Layer 1 Cryptocurrencies?

Layer 1 cryptocurrencies also took a major hit but have seen a more varied performance when compared to the metaverse tokens. Heavy hitter like Solana (SOL) and Cardano (ADA) were some of the hardest hit Layer 1 cryptocurrencies, both of them going the way of the metaverse tokens with over 68% losses since their various all-time highs. Other lesser known Layer 1 tokens have a different story though.

Related Reading | Ethereum Leaves ETH 2.0 In The Past In New Roadmap Rebrand

FTM, ONE, ATOM, and Near, popularly referred to as the FOAN, made a splash while others were suffering. Each one of these cryptocurrencies have managed to outperform the market in a time where altcoins are dumping in response to bitcoin’s decline.

A look at decentralized finance (DeFi) paints a sadder story. This space that has brought finance products closer to the average investor saw some of the highest declines. Tokens from this space have recorded as high as 80% decline since their all-time highs.

The crypto market has managed to hold up against the crash but not before losing substantial value. In total, the crypto market is now down 50% from its all-time high. It now sits at $1.686 trillion at the time of this writing.

Crypto market cap crumbles to $1.6 trillion | Source: Crypto Total Market Cap on TradingView.com

Featured image from Bitcoin Magazine, charts from Arcane Research and TradingView.com

Sandbox token SAND rallies 260% in November ahead of play-to-earn metaverse launch

Nevertheless, signs of a bearish divergence between SAND’s price and momentum may hamper its ongoing upside momentum.

Seeing red? FUD that! Here’s what you should have bought instead of Bitcoin last week

Where Bitcoin leads, altcoins usually follow — but the smartest crypto traders manage to turn BTC dips into buying opportunities.