The Securities and Exchange Commission (SEC) has charged SafeMoon and its executive team with perpetrating a fraudulent scheme through an unregistered securities sale.

‘Bruno Brock’, Founder of Oyster Pearl, Gets Four Year Jail Term for Tax Evasion

Elmaani pleaded guilty in April 2023, agreeing that he caused a tax loss of over $5.5 million.

GAO finds controversial SEC guidance is subject to congressional oversight

The SEC’s Staff Accounting Bulletin 121 has been the target of much criticism in the crypto community.

Spot Bitcoin ETF: Here’s The Magic Number To Push BTC Past $40,000

David Lawant, the head of research for FalconX, an institutional crypto trading platform tailored for financial institutions, recently provided an insightful forecast regarding the future of Bitcoin (BTC) prices in light of the anticipated launch of a spot Bitcoin ETF in the United States. Sharing his predictions via X (previously known as Twitter), he articulated the financial variables that might play a decisive role.

Lawant remarked, “The next significant variable to watch in the spot BTC ETF launch saga will be how much AUM these instruments will gather once they launch. I think the market is currently expecting this inflow to be between $500 million and $1.5 billion.”

The Magic Number To Push Bitcoin Price Past $40,000

The crypto community is keenly anticipating a positive nod for a Spot Bitcoin ETF either at the end of 2023 or the beginning of 2024. A crucial date on the calendar is January 10, 2024, which is set as the final deadline for the ARK/21 Shares application, leading the current series of applications.

Undoubtedly, a green signal from regulatory authorities for the spot ETF will be a game-changer for the entire crypto asset class. Lawant highlighted the importance of this development, stating, “It will open room for large pockets of capital that today can’t properly access crypto, such as financial advisors, and bring a stamp of approval from the world’s most prominent capital markets regulator.”

The pressing question, though, is the immediate impact on capital inflow. “The first couple of weeks after launch will be critical to test how much appetite there is for crypto at the moment in these still relatively untapped pools of capital,” Lawant emphasized.

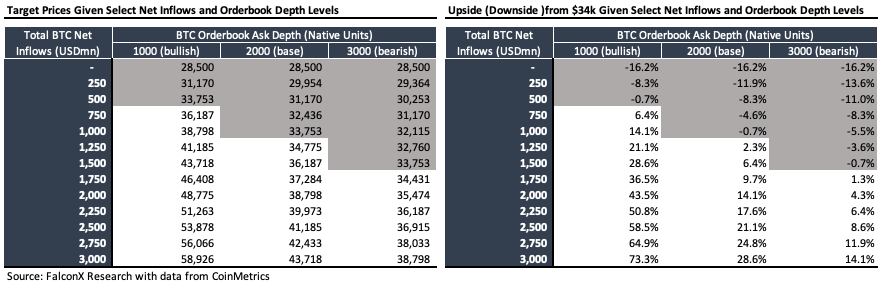

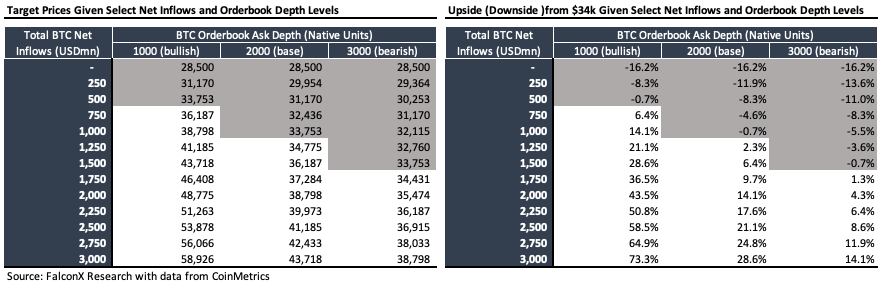

Relying on historical data, Lawant pointed out the stability of the ask side of BTC’s order book, especially for prices situated above the $30,000 mark. This data allows for an approximation of how the inflow of capital might influence the price trajectory of BTC.

Through various inflow scenarios squared against a spectrum of the depth of market scenarios, Lawant deduces that the market is possibly forecasting net inflows ranging between $500 million and $1.5 billion within the initial weeks post-launch.

Drawing conclusions from his analysis, Lawant surmised:

For BTC to establish a new range between the current level and more than $40k, the total net inflows would need to amount to $1.5 billion+. On the other hand, if total net inflows come in below $500 million, we could move back to the $30k level or even below.

However, it’s paramount to note the inherent assumptions in Lawant’s analysis. He admits, “One is that the move from $28.5k to $34.0k was entirely attributed to the market anticipating price-insensitive net inflows from the ETF launch.” This means, among other things, that the current price increase was triggered neither by the correlation with gold nor by the global crises or turmoil in the bond market.

Lawant also highlighted the potential variability in BTC price movement across the order book. Nonetheless, given the stature of issuers like BlackRock, Fidelity, Invesco, and Ark Invest in the SEC queue, the current favorable macroeconomic climate for alternative monetary assets, and prospective improved liquidity conditions, Lawant remains bullish about the potential BTC price rally following the ETF debut. He concluded with, “ceteris paribus I’m still excited about how the BTC price could react to the ETF launch.”

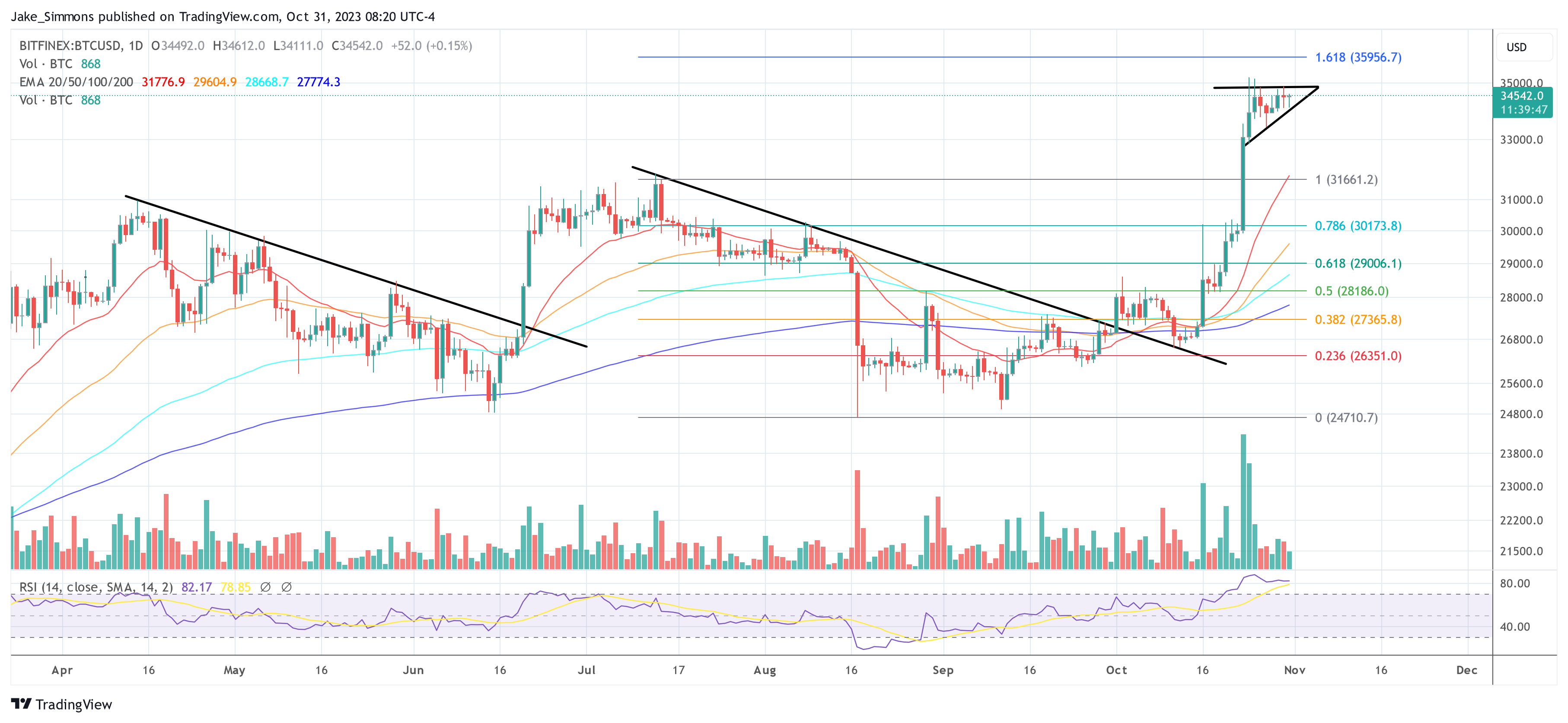

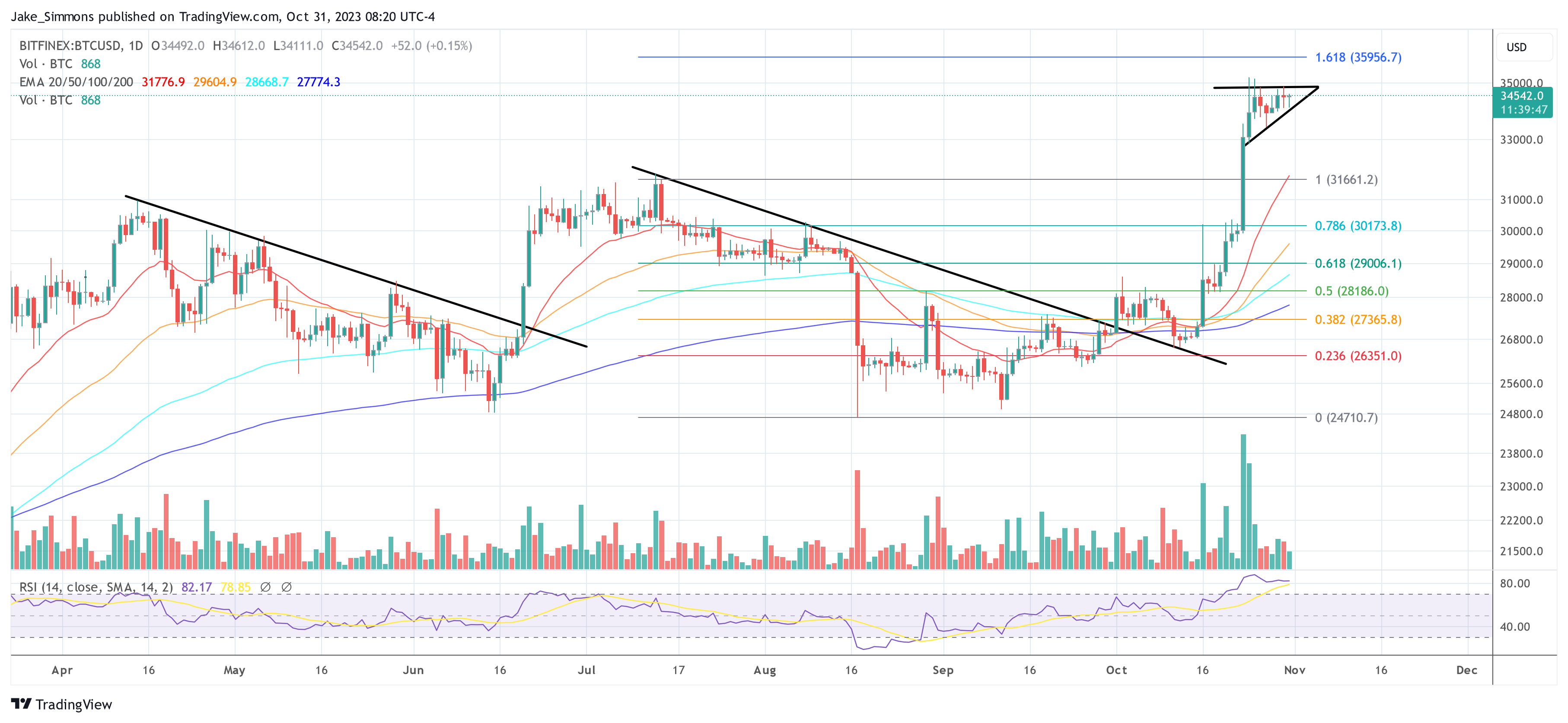

At press time, BTC traded at $34,542.

Spot Bitcoin ETF: Here’s The Magic Number To Push BTC Past $40,000

David Lawant, the head of research for FalconX, an institutional crypto trading platform tailored for financial institutions, recently provided an insightful forecast regarding the future of Bitcoin (BTC) prices in light of the anticipated launch of a spot Bitcoin ETF in the United States. Sharing his predictions via X (previously known as Twitter), he articulated the financial variables that might play a decisive role.

Lawant remarked, “The next significant variable to watch in the spot BTC ETF launch saga will be how much AUM these instruments will gather once they launch. I think the market is currently expecting this inflow to be between $500 million and $1.5 billion.”

The Magic Number To Push Bitcoin Price Past $40,000

The crypto community is keenly anticipating a positive nod for a Spot Bitcoin ETF either at the end of 2023 or the beginning of 2024. A crucial date on the calendar is January 10, 2024, which is set as the final deadline for the ARK/21 Shares application, leading the current series of applications.

Undoubtedly, a green signal from regulatory authorities for the spot ETF will be a game-changer for the entire crypto asset class. Lawant highlighted the importance of this development, stating, “It will open room for large pockets of capital that today can’t properly access crypto, such as financial advisors, and bring a stamp of approval from the world’s most prominent capital markets regulator.”

The pressing question, though, is the immediate impact on capital inflow. “The first couple of weeks after launch will be critical to test how much appetite there is for crypto at the moment in these still relatively untapped pools of capital,” Lawant emphasized.

Relying on historical data, Lawant pointed out the stability of the ask side of BTC’s order book, especially for prices situated above the $30,000 mark. This data allows for an approximation of how the inflow of capital might influence the price trajectory of BTC.

Through various inflow scenarios squared against a spectrum of the depth of market scenarios, Lawant deduces that the market is possibly forecasting net inflows ranging between $500 million and $1.5 billion within the initial weeks post-launch.

Drawing conclusions from his analysis, Lawant surmised:

For BTC to establish a new range between the current level and more than $40k, the total net inflows would need to amount to $1.5 billion+. On the other hand, if total net inflows come in below $500 million, we could move back to the $30k level or even below.

However, it’s paramount to note the inherent assumptions in Lawant’s analysis. He admits, “One is that the move from $28.5k to $34.0k was entirely attributed to the market anticipating price-insensitive net inflows from the ETF launch.” This means, among other things, that the current price increase was triggered neither by the correlation with gold nor by the global crises or turmoil in the bond market.

Lawant also highlighted the potential variability in BTC price movement across the order book. Nonetheless, given the stature of issuers like BlackRock, Fidelity, Invesco, and Ark Invest in the SEC queue, the current favorable macroeconomic climate for alternative monetary assets, and prospective improved liquidity conditions, Lawant remains bullish about the potential BTC price rally following the ETF debut. He concluded with, “ceteris paribus I’m still excited about how the BTC price could react to the ETF launch.”

At press time, BTC traded at $34,542.

Crypto asset manager Valkyrie amends spot Bitcoin ETF filing

With the latest spot BTC ETF amendments by Valkyrie and VanEck joining at least six others to make similar changes, some five other spot Bitcoin ETF filings are yet to be amended.

Analyst Predicts A Mega Bull Run If Bitcoin Breaks $36,000

Crypto and Bitcoin traders should prepare for another sharp leg up, especially if the coin breaks above the $35,750 to $36,000 resistance wall this week. According to an X user, Alex Thorn, the Head of Firmwide Research, the $250 zone between those prices is a crucial liquidation barrier that derivatives traders closely watch.

If bulls have the upper hand and push above the upper limit of the belt, prices could rip higher this week primarily because of the resulting demand in the spot market.

Is Bitcoin Ready For Another Rally?

Thorn compares the current setup evolving in the Bitcoin chart to the events last week, which saw the coin explode. At spot rates, Bitcoin is stable but trending around 2023 highs, with buyers expecting more gains as market sentiment improves.

Though most users are looking at the United States Securities and Exchange Commission (SEC) and the potential approval of a spot Bitcoin Exchange-Traded Fund (ETF) as a trigger for the next leg up, Thorn is closely tracking events in the Bitcoin trading scene, specifically, the derivatives market. In the analyst’s assessment, options traders will be the primary drivers of the next bull run.

Why $36,000 Is A Key Price Level To Watch

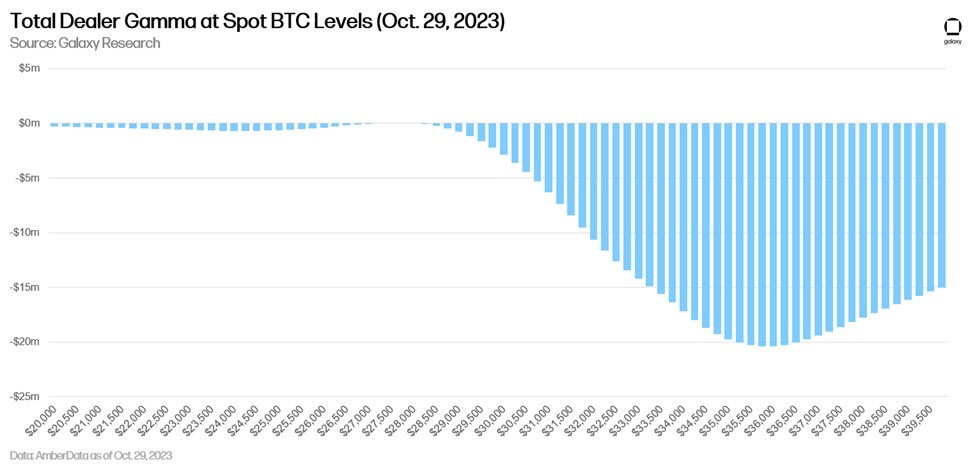

Based on the analyst’s assessment, once Bitcoin breaks the $35,750 to $36,000 zone, “options dealers will need to buy $20m in spot BTC for every 1% upside move,” driving prices higher. The reason dealers have to buy or sell Bitcoin at the spot market depends on whether they are “short or long gamma.”

The objective, when this happens, is to stay “delta neutral.” The decision to buy at the spot market comes after a “gamma squeeze,” which, as Thorn notes, lifted prices last week.

Technically, a gamma squeeze arises when there is a spike in call (or buy) options being purchased, forcing options dealers, most of whom are market makers, to buy the underlying asset, in this case, Bitcoin, to hedge their positions and stay “delta neutral.” Going by trends and the current setup, especially in the daily chart, this could happen.

Looking at other metrics, Thorn noticed a divergence in supply held by speculators and long-term holders, opining that on-chain liquidity could be dwindling. However, on the bright side, the Z-Score ratio of market price to realized price shows that Bitcoin is in a “healthy” position.

As of October 30, Bitcoin is within a bullish breakout formation, with traders bullish. Whether the uptrend remains depends on whether buyers follow through, pushing the coin above recent highs, away from the breakout level at around $32,000.

Do Kwon and Terraform Labs ask judge to toss SEC’s lawsuit

Do Kwon, the co-founder now-collapsed Terraform ecosystem maintains he and his firm did not skirt U.S. securities laws.

Bitcoin To $3 Million Is “A 100X From Today”, And You Are Still Early: Crypto Advocate

Luke Bryoles, a Bitcoin advocate who thinks the world’s most valuable network will save people’s energy, is bullish. On October 30, Bryoles said the coin could rally to $3 million, and all it needs is to be “100X from today.” For this reason, the crypto supporter thinks users engaging with the coin are “still early.”

Is This The BTC Road To $3 Million?

The Bitcoin defender said the coin has “indescribable future value,” especially compared to other centralized finance (CeFi) market metrics like market capitalization. Bitcoin is changing hands at around 2023 highs, trading above the $34,500 level, with traders and coin holders expecting more gains.

The expansion of last week saw the coin extend gains, lifting higher above the $32,000 level recorded in July. Considering the associated trading volume and resulting activity following the BTC jump, more supporters expect another rally in the next few sessions.

Bitcoin is down 50% from the November 2021 peak, when prices surged to approximately $70,000. However, the coin has more than doubled after dropping to as low as $16,000 in November 2022. At spot rates, BTC has more than 100% from 2022 lows, emerging as “one of the top-performing assets.”

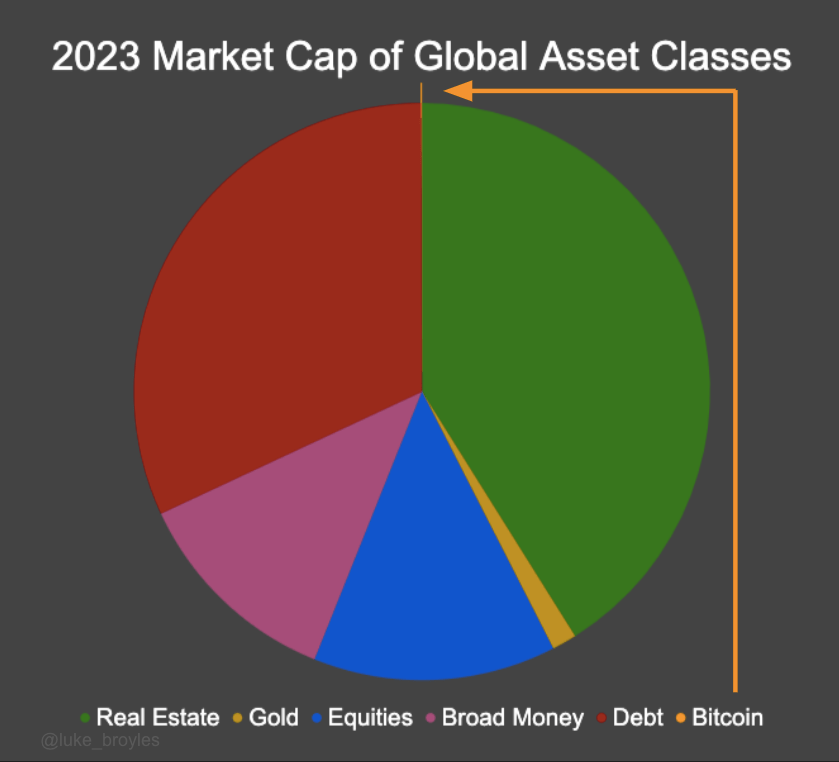

This stellar performance, Bryoles adds, is despite Bitcoin maintaining a market cap of around $500 billion in 2023 while remaining “TINY in comparison to the world’s largest asset classes,” most of which include debt, equities, and gold.

To support the hyperbolic prediction, the supporter pointed to the low Bitcoin adoption level of “0.05% and 0.5%.” An eventual increase to 10% means there will be 100X users, easily driving the coin to $3 million, though even this remains a “misleadingly pessimistic prediction,” according to Bryoles.

At this valuation, the analyst added that the coin’s market cap will be “unfathomable.” Even so, all that is required is “4% of the global adult population to demand 1 million sats to exhaust exchanges.”

Bitcoin Finds Support And Opposition: Will Bulls Win?

Bitcoin remains the world’s most valuable crypto asset. At the same time, the United States Securities and Exchange Commission (SEC) might authorize the first spot Bitcoin Exchange-Traded Fund (ETF). Analysts expect this to drive prices towards the 2021 high at around $69,000.

Meanwhile, Federal Reserve’s Jerome Powell and SEC’s Gary Gensler think the coin is a “speculative asset.” These sentiments have also been shared by Senator Elizabeth Warren, who once said, “Bitcoin is a scam.”

Gary Gensler’s Bitcoin ETF position is ‘inconsistent’… says Gary Gensler

During a panel at the 2019 MIT Bitcoin Expo, Gensler called out the securities regulator for its ‘inconsistent’ approach to spot Bitcoin ETF approvals.

VanEck amends application for spot Bitcoin ETF

VanEck joins the group of asset managers updating applications for a spot Bitcoin ETF in the United States.

Ripple’s CEO criticizes former SEC Chair Jay Clayton’s comments

The former SEC Chair emphasized that regulatory agencies should introduce regulations and legal cases they believe will successfully withstand judicial scrutiny.

Ripple exec and XRP community back SEC commissioner’s LBRY lawsuit dissent

Stuart Alderoty thanked Hester Peirce and suggested it might be time to submit an amicus brief.

Hester Peirce speaks out against LBRY enforcement action: ‘The market could have decided’

The SEC commissioner said the regulator’s actions “forced a group of entrepreneurs to abandon what they built,” with LBRY announcing in October it planned to wind down operations.

SEC Demands $700 Million Settlement From Ripple, Pro-XRP Lawyer Reveals Next Steps

The US Securities and Exchange Securities Commission (SEC) and Ripple Labs are expected to proceed to finalize a settlement following the official dismissal of the former’s claims against Ripple’s CEO Brad Garlinghouse and its co-founder Chris Larsen. In line with that, pro-XRP legal expert John Deaton has revealed how the settlement will play out.

A Settlement Isn’t Going To Be Straightforward

In a post shared on his X (formerly Twitter) platform, Deaton mentioned that he doesn’t believe “there has been a single serious conversation regarding settlement” between the SEC and Ripple alongside its executives. He said that the Commission is “pissed and embarrassed and wants $770M” as a fine for Ripple’s violation of securities laws.

He further noted that the penalty phase isn’t as straightforward as some may think, as it is “like a second case” but one that requires more depositions, interrogatories, requests for the production of documents, emails, bank statements, contracts, and ODL transactions.

The process is also made more difficult as while the SEC is insistent on a $770 million fine, Ripple wants to “drastically reduce” the figure, as Deaton stated. To achieve this, Ripple will be looking to exclude the ODL transactions, which the SEC may claim are under institutional sales that violated securities laws.

Deaton also alluded to the SEC’s case against the decentralized content-sharing platform LBRY, which took “eight months of additional litigation” before the Judge ordered that the platform pay a fine of $111,614 to the Commission. That case was also not straightforward as both parties had to file multiple briefs again, and depositions were taken.

How The SEC’s Case Against Ripple Could Play Out

As to when a final judgment could come from Judge Analisa Torres, Deaton doesn’t foresee one until late summer “at the earliest.” With that in mind, he mentioned that it could take a full year before the SEC (or even Ripple) gets the chance to file an appeal in this case.

The lawyer once again mentioned the role that Coinbase’s Motion To Dismiss (MTD) could play in this case and a potential settlement. He said that the SEC “will be forced to pivot its anti-crypto agenda and then work out a possible settlement with Ripple” if Judge Failla grants the motion.

However, a settlement is unlikely if the crypto exchange were to lose its MTD. Coinbase is asking the judge to dismiss the SEC’s case against it, arguing that the Commission doesn’t have jurisdiction over its activities. Hearing of Coinbase’s oral argument is slated for January 17, 2024, with a ruling likely to come within 60 to 120 days after.

Gary Gensler teases details of SEC’s $5B take from enforcement actions, shades crypto

Gensler revealed that the SEC took 780 enforcement actions, including 500 standalone cases, and distributed $930 million to harmed investors.

Pro-Ripple lawyer predicts prolonged legal battle, hints at settlement factors

John Deaton says there has not been “a single serious conversation” about a potential settlement between Ripple, Brad Garlinghouse, Chris Larsen and the SEC.

SEC’s Gensler Won’t Say What’s Next With Bitcoin ETFs After Grayscale Loss

BlackRock fined $2.5M by SEC for incorrect investment disclosure

The SEC’s charges for the world’s largest asset manager came on the same day as a DTCC listing of its spot Bitcoin ETF was spotted; however, a spokesperson from DTCC confirmed that the listing has been there since August.

Pro-XRP Legal Expert Shares Expectations If SEC Wins Appeal Against Ripple

Pro-XRP legal expert Fred Rispoli has shared some expectations following Judge Analisa Torres’ order, where she officially dismissed the US Securities and Exchange Commission’s (SEC) claims against Ripple’s executives Brad Garlinghouse and Chris Larsen.

SEC Can Still Bring Claims Against Ripple’s Executives

In a post shared on his X (formerly Twitter) platform, Rispoli noted that the SEC could still file another lawsuit against Garlinghouse and Larsen if they were to appeal Judge Torres’ ruling on the programmatic sales and other distributions and get a judgment in their favor.

His assumption is based on the fact that the Judge’s latest order showed that the SEC only dismissed the claims against them with respect to the institutional sales, as the Commission had alleged that both Garlinghouse and Larsen aided and abetted Ripple Labs in violating securities laws with respect to the crypto company’s offers and sales of XRP.

However, he stated that any action would only be restricted to the programmatic sales and other distributions since the dismissal with respect to the institutional sales was with prejudice, meaning a claim cannot be brought again regarding that particular matter.

In July, Judge Torres also ruled that the institutional sales were investment contracts, which amounted to them being securities. In line with this, the SEC and Ripple will move to settle on the latter’s violation of securities laws, with the firm expected to pay a particular amount as a fine for its violation of the act.

Will The SEC Appeal Judge’s XRP Decision?

As to whether the SEC will appeal Judge Torres’ ruling on the programmatic sales and other distributions, Rispoli seemed to suggest that that was unlikely as the SEC was more focused on crunching the numbers (probably the monies Ripple will pay as fine) and “wrap this one up for good.”

In a subsequent post, he also mentioned that there was the possibility that they received assurances from the SEC to not file an appeal as one would expect that Garlinghouse and Larsen’s “high-powered attorneys” would have asked that the SEC dismissed all the claims, including the ones relating to the programmatic sales and other distributions.

Interestingly, Rispoli had once predicted the likely outcome of this case as he had stated that the SEC was unlikely to drag Ripple’s executives through a trial and that they had only brought forward the claims against them in order to force Ripple into a “weak settlement position.”

The SEC is also unlikely to appeal, going by pro-XRP legal expert John Deaton’s comments when he suggested that the ETH Gate saga may have forced the SEC into what Ripple’s Chief Legal Officer Stuart Alderoty has described as a “surrender.”