A body representing North America’s state securities regulators took aim at arguments made by crypto exchange Coinbase in its defense against the SEC.

Cryptocurrency Financial News

A body representing North America’s state securities regulators took aim at arguments made by crypto exchange Coinbase in its defense against the SEC.

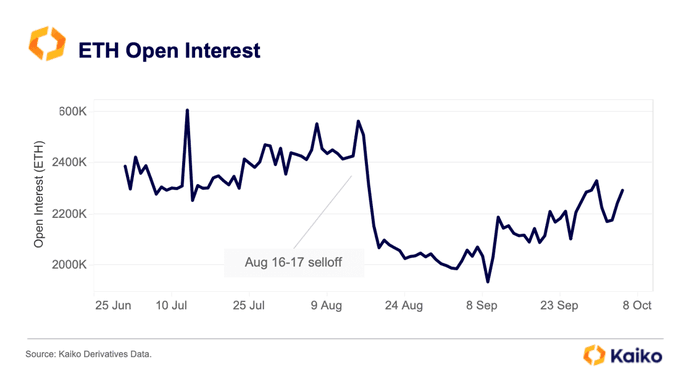

Ethereum prices might be stagnant at spot rates, weaving around the $1,540 and $1,560 zone, looking at technical charts. However, amid this period of consolidation and holders worrying about Ethereum’s prospects, Kaiko notes that the coin’s open interest has been gradually rising since September 2023.

As of October 10, Kaiko observes that there are more than 2.2 million contracts, and the number has been rising steadily over the past few trading weeks. With increasing open interest, it can hint that bulls are in the equation, which may support prices now that prices are under immense pressure.

In crypto trading, open interest is the total number of outstanding derivative contracts of a given coin. Meanwhile, derivatives are contracts that derive value from the underlying asset, in this case, Ethereum. Herein, the total open interest data is accrued from ETH options, futures, and perpetual futures from platforms where traders can use leverage.

There can be different interpretations of open interest depending on the market state. Since open interest includes long and short positions at any time, gauging the directions of how market participants are posting trades can be challenging.

Even so, rising open interest indicates that more traders are opening positions, which can be seen as bullish, especially if prices are expanding. Conversely, falling open interest suggests that traders are exiting, which means waning momentum and bearish sentiment.

Based on this, Ethereum remains in a critical position and support. Notably, the coin is moving sideways with low trading volumes.

From the daily chart, ETH is around the $1,500 and $1,550 primary support. Though buyers appear to be in control, since prices are boxed inside the June to July 2023 trade range, any break below the support zone may trigger more losses.

The general optimism explaining rising open interest could be due to the recent approval of Ethereum Futures exchange-traded funds (ETFs). The United States Securities and Exchange Commission (SEC) approved multiple Ethereum Futures ETFs for the first time.

This decision saw Ethereum prices edge higher in early October. Though prices have since contracted, institutional investors can now find exposure in Ethereum via structured and regulated products approved by the stringent regulator.

It is unclear whether the rising ETH open interest signals strength and if the coin will recover going forward. From the daily chart, ETH has strong liquidation at around the $1,750 level and remains consolidated.

Artist Nelson Saiers’ “Rug Pull” highlighted the victims of crypto rug pulls and perceived SEC inaction in safeguarding investors.

Edward Farina, the founder and CEO of various crypto-focused initiatives, is confident that XRP is a better “investment” in early October than it was before July when the United States Securities and Exchange Commission (SEC) claimed that the coin was an unregistered security.

In a post on October 9, Farina asserted that the coin was declared not a “security,” but was bothered by the fact that prices are at “the same level” as before the July 13 ruling.

XRP, the native coin of the XRP Ledger, a decentralized blockchain that recently supported smart contracts, remains one of the most liquid crypto assets. Looking at price data from CoinMarketCap (CMC), the coin is lodged at fifth in the market cap leaderboard, trailing Bitcoin (BTC), Ethereum (ETH), BNB, and USDT–the stablecoin.

At this level, the coin is one of the most liquid and has managed to shake off bear pressure since the SEC lodged a lawsuit against some of Ripple’s top brass, including Brad Garlinghouse. In the lawsuit filed in late 2020, the agency said Ripple conducted an illegal crowdfund, raising over $1 billion by selling unregistered securities. With the allegations, XRP prices fell by 78%, crashing from around $0.77 to $0.17 in days.

XRP found reprieve in 2021 when it shook off losses, rallying to as high as $1.95 despite the ongoing lawsuit where Ripple lawyers defended the company against claims put forward by the regulator. Prices fell in 2022, reversing gains before stabilizing in the better half 2023.

In July, XRP prices rose sharply, briefly reaching $0.92 before cooling off, peeling back all gains in mid-August. Prices have stabilized, but bears wiped gains from the rally induced on July 13 when a United States court ruled that XRP is not a security when sold to the general public on an exchange. Still, it is when sold to institutional investors.

In early October 2023, Judge Analisa Torres barred the SEC from appealing the decision made in July, stating that there was no “substantial ground for difference of opinion.” The trial is not set for April 2024.

Following the Judge’s decision barring the agency from appealing, XRP prices have been relatively firm but at pre-July 2023 levels. Farina believes that XRP ought to be higher at spot rates, a reason why the market “makes absolute zero sense and price manipulation is real.”

Whether XRP prices are manipulated or not is not clear at spot rates. However, the broader crypto market, including Bitcoin and Ethereum, is suppressed, having cooled off from July 2023 highs.

Daniel Maeda with Brazil’s CVM said during Rio Innovation Week the regulator plans to explore a regulatory sandbox for use cases of tokenization potentially starting in 2024.

The SEC filed a lawsuit against Ripple in December 2020 for using XRP to raise funds, which the commission claimed was a violation of securities laws.

The civil trial of the US Securities and Exchange Commission’s (SEC) case against Ripple and its top executives, Brad Garlinghouse and Chris Larsen, is set to commence on April 23, 2024. However, the Founder of Dizer Capital, Yasin Mobarak, believes that the SEC will withdraw its charges against Garlinghouse and Larsen before then.

In a tweet shared on his X (formerly Twitter) platform, Mobarak stated that the reason for his prediction is that it is not in the SEC’s interest to have “a trial where their corruption can be exposed.” He further stated that the Commission’s “agenda” is bigger than these two executives.

Prediction: The SEC will withdraw charges against @bgarlinghouse and @chrislarsensf .

It is not in their interest to have a trial where their corruption can be exposed, not to mention their agenda is far bigger than just these two executives. The longer $XRP solidifies the…

— Yassin Mobarak

(@Dizer_YM) October 4, 2023

Garlinghouse and Larsen were joined as co-defendants when the SEC filed a lawsuit against Ripple in December 2020. The Commission alleged that the executives structured and promoted the XRP sales to finance the company’s business. Additionally, it accused both individuals of effecting “personal unregistered sales of XRP totaling approximately $600 million.”

Mobarak shares similar sentiments with pro-XRP legal expert Fred Rispoli, who stated that the SEC is unlikely to pursue a trial against them and outlined reasons for his assertion. One of the reasons he gave was that the SEC would not want a situation where its credibility is questioned, which he believes could happen if someone like the former SEC Director Bill Hinman was called to testify.

The SEC filing a motion for an interlocutory appeal was considered by many as a means to prolong the trial unnecessarily, which Judge Analisa Torres had reasoned in her order. Following the denial of this appeal, Mobarak believes that the SEC will now move to end this case quickly so it can appeal to the Court of Appeals and “continue to sustain this cloud of uncertainty on the whole industry.”

In response to Mobarak’s tweet, another X user mentioned that it would be surprising if the SEC decided to drop the charges against Ripple’s executives “without some incentive from Ripple given to them.” Such an incentive would likely relate to the crypto firm agreeing to a form of settlement.

This is something that Rispoli had suggested when he said that the SEC didn’t intend to maintain a suit against Garlinghouse and Larsen but simply wanted to pressure the company into a “weak settlement.”

However, it is unlikely that Ripple is willing to reach any form of settlement with the Commission as Ripple’s President Monica Lang asserted that her company intends to see the case “all the way through.”

Moreso, there is no reason why Ripple should be willing to settle, considering that they already scored two major victories against the SEC and seem to have the upper hand now.

Ripple and its executives will also have it at the back of their mind that the crypto community is looking to this case for clarity, as any judgment will likely set a precedent for how the crypto industry should be regulated.

Bitcoin started the week with an uptick in investor sentiment, but there are three major factors preventing BTC price from recapturing the $30,000 level.

The regulator has asked a federal judge to deny Coinbase’s motion to dismiss its lawsuit, claiming the exchange knew the cryptocurrencies it sold were securities under the Howey test.

“To distract from the fatal flaws in its legal arguments, Coinbase cries foul and seeks to blame the SEC for its current legal predicament,” the SEC said in a Tuesday court filing.

CFTC chair Rostin Behnam told an audience at the Financial Industry Association Expo about the agency’s activity in the crypto space and its need for modern legislation.

A pro-XRP lawyer has highlighted more casualties and negative impacts the regulatory authority has inflicted on XRP and its investors as well as individuals and businesses associated with the cryptocurrency.

So while Ripple has stated it has lost over $200 million in its fight against the US SEC, it seems that is not the only loss that has been incurred in the drawn-out battle.

John E. Deaton, a pro-XRP lawyer has taken to X (formerly Twitter) to publicly admonish the United States Securities and Exchange Commission (SEC) for its series of legal actions and enforcements against XRP, the native token of Ripple Labs.

Deaton has been a strong advocate for XRP since its fight against the US SEC began in 2020, and the cryptocurrency enthusiast and lawyer has actively participated in the community, airing out his views in defense of the cryptocurrency and its value as a global payment asset.

In a recent post, Deaton stated that the US SEC has negatively affected thousands of XRP investors and users and these people have been protesting against the SEC’s actions toward the ecosystem for three years.

“The SEC harmed a lot of innocent people in the process. 75K investors, users, developers, and small businesses have been screaming the above for 3 years,” Deaton stated.

According to a civil filing, the SEC has destroyed more than $15 billion worth of assets owned by innocent holders of XRP who had acquired the token on secondary marketplaces.

RealClearPolicy (RCPC), an American policy website, recently published an article titled “The SEC is not King” on Thursday, September 30.

In an X repost, Deaton acknowledged the article which highlighted significant aspects of the Ripple and SEC legal case from when the regulatory body filed a lawsuit against the crypto firm earlier in 2020, alleging that Ripple was selling unregistered security offerings.

Ripple had aggressively defended itself against the SEC and achieved a partial victory after Judge Analisa Torres ruled in favor of Ripple and rejected the SEC’s allegations that sales of XRP tokens on exchanges are security sales.

In a possible attempt to salvage its reputation and also gain the upper hand against XRP, the SEC filed an interlocutory appeal to reevaluate the Judge’s ruling and its case against the token. In light of this, Deaton published a blog post titled “The Irony of Interlocutory Appeal” last week, castigating the SEC’s appeal scheme to potentially delay the litigation.

The US SEC has also been struck by a blow that may put a dent in its case with XRP. The defense team of Ripple recently exposed a pile of internal SEC documents and secret positions about the token which could significantly undermine the SEC’s argument that XRP should be treated as a security.

This recent development has thrown a curveball in the ongoing legal battle between the US SEC and XRP, raising questions about the SEC’s intentions for the crypto industry and its method of handling cryptocurrencies.

The latest delays came two weeks before the second deadline for many applicants.

Grayscale has filed an application with the U.S. SEC to convert its Ethereum Trust to a spot Ethereum ETF.

The regulator alleged in a court filing that the firm had entered into contracts with clients that violated auditor independence rules.

Paradigm claimed the SEC is attempting to use the allegations in its complaint to alter the law without adhering to the established rulemaking process.

Bloomberg analyst Eric Balchunas speculated that the SEC may have pressured Valkyrie to halt ETH futures contract purchases until the ETF was officially approved.

Bloomberg analyst Eric Balchunas speculated that the SEC may have pressured Valkyrie to halt ETH futures contract purchases until the ETF was officially approved.

Bloomberg analyst Eric Balchunas speculated that the SEC may have pressured Valkyrie to halt ETH futures contract purchases until the ETF was officially approved.