XRP Price Prediction for 2023, 2024, 2025, 2030 and Beyond

XRP has been one of the most controversial cryptocurrencies since its creation by Ripple Labs in 2012. Its close ties to traditional finance have alienated parts of the crypto community. However, it retains a loyal following for its fast and cheap transactions. This XRP price prediction guide examines the coin’s outlook using technical analysis methods.

What is XRP?

XRP is a cryptocurrency created by the Ripple payment network to facilitate fast cross-border payments. Ripple Labs founders Arthur Britto, David Schwartz, and Chris Larsen designed it to overcome Bitcoin’s scalability issues while enabling seamless transfers between different currencies.

Some key features of XRP include:

Speed

Settlement of XRP transactions takes 3-5 seconds, far faster than Bitcoin’s 10+ minutes.

Low cost

XRP transaction fees are a fraction of a penny, making it affordable for micropayments.

Fixed supply

The total supply of 100 billion XRP was created at launch, unlike Bitcoin’s limited issuance schedule.

Bank partnerships

Ripple has partnered with over 300 banks and financial institutions to use XRP for settlement.

Controversies

XRP has been mired in controversy regarding everything from centralization to securities classification.

XRP is designed for use by financial institutions, though it trades publicly on exchanges. Its adoption rate will likely depend significantly on the outcome of Ripple’s ongoing SEC lawsuit.

Factors Influencing XRP Price

Numerous factors impact XRP prices, leading to high volatility:

Ripple Company Developments and XRP Regulatory Status

Ripple’s partnerships, service offerings, and legal issues have significant ramifications for XRP’s price action. For example, the SEC deeming XRP kept the asset from making new all-time highs during the 2020 and 2021 bull market in crypto. Now that Ripple has won the case against the SEC and a US judge deeming XRP not a security, new all-time highs could arrive during the next bullish cycle.

Cryptocurrency Market Trends

Like most altcoins, XRP’s price tends to follow Bitcoin’s price movements overall. When Bitcoin rises or falls sharply, so does XRP. Bitcoin itself has been struggling recently due to the US Federal Reserve raising interest rates.

Mainstream Adoption

XRP gaining transactional adoption from banks and payment providers would establish real-world utility and boost prices. But it faces stiff competition from private blockchains.

Decentralization Efforts

Lessening Ripple Lab’s control over XRP supply and the ledger through further decentralization could enhance XRP’s appeal and value to the crypto community.

Burn Rate

Ripple periodically burns XRP supply to manage circulation. Higher burn rates decrease available XRP which can positively impact prices.

XRP Price History

XRP’s price history has been defined by major announcements, partnerships, and controversies.

2012-2014: The Early Years

XRP traded for a fraction of a penny initially. Prices remained relatively flat between $0.002 to $0.02 till 2017 as Ripple focused on building partnerships rather than exchanges.

2017: Crypto Bubble Peak

As crypto mania peaked in late 2017, XRP saw massive speculative gains, rising from $0.006 in April to an all-time high of $3.84 in January 2018 – an incredible 63,000% return within 9 months!

However, this meteoric rise was fueled by hype rather than fundamentals. XRP came crashing down as Bitcoin collapsed, declining over 90% within a year after the peak.

2018-2020: Building Products

Between 2018-2020, XRP stayed afloat better than most altcoins, trading between $0.20 to $0.60 as Ripple doubled down on establishing real-world utility.

Major developments included:

- Ripple launched On-Demand Liquidity (ODL) allowing financial institutions to use XRP for instant cross-border payments.

- Over 300 banks signed up for RippleNet to connect payment channels globally.

- Remittance firms including MoneyGram began using ODL for transferring funds.

This suggested future adoption could be driven by Ripple’s offerings.

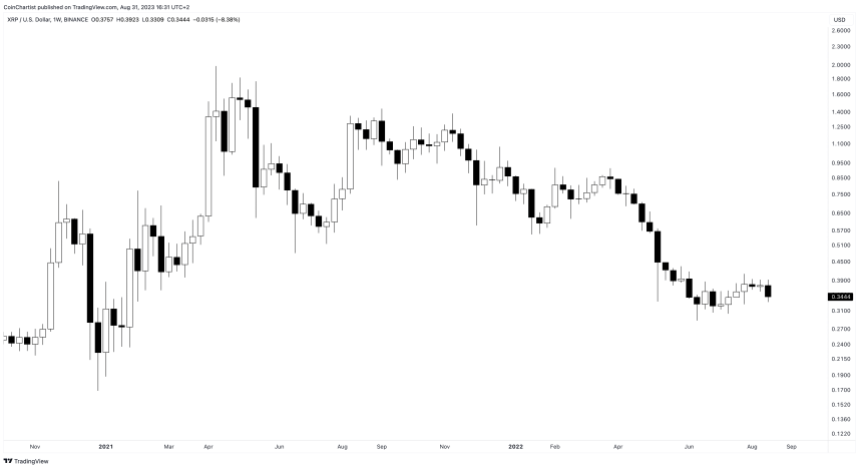

2021 – 2022: Legal Woes and a Bear Market Emerge

After starting 2021 strongly with XRP exceeding $1 again thanks to crypto resurgence, Ripple was hit by an SEC lawsuit in December 2020 alleging XRP was an unregistered security.

Many exchanges delisted XRP while its price collapsed due to negative sentiment. XRP failed to set a new all-time high while Bitcoin, Ethereum, Dogecoin, and several others as a result.

Each of these other cryptocurrencies set a peak during this time, entering a bearish market in 2022. This lowered the chances of XRP making a recovery during the year.

Recent XRP Price Action

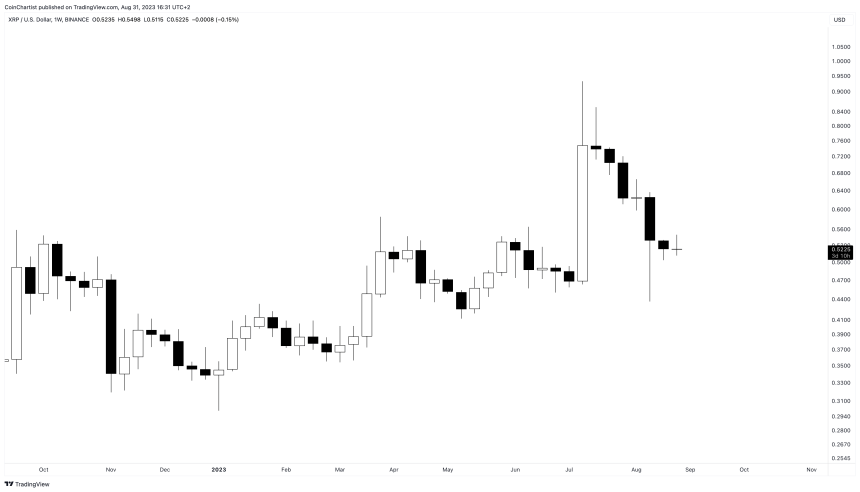

2023 has been a difficult year for most cryptocurrencies, which are only starting to recover from the prolonged crypto winter. XRP, however, has outperformed most cryptocurrencies this year thanks to Ripple winning its legal battle with the SEC.

A US court judge ruled that XRP is not a security when sold to retail investors. This caused several exchanges to relist the asset, and prices spiked from under $0.50 to $1 in 48 hours after the decision. The SEC plans to appeal the decision, which prompted a full retrace of the rally. Now what’s next for XRP price?

Short-Term XRP Price Prediction for 2023

With XRP fully retracing the SEC court case ruling rally, sentiment is back to scared across the crypto market. Combined with other altcoins setting new lows, investors are fearful that the bear market might return.

XRP, however, could be performing a throwback retest of ascending triangle resistance turned support, which is common in financial markets. If support holds, price could ultimately approach over $1 in the next attempt.

Meanwhile, if price were to fall back through the bottom of the ascending triangle pattern, it would indicate failure and lead to a retest of bear market lows.

Medium Term XRP Price Prediction for 2024 – 2025

If XRP can continue with its bullish market, then 2024 and 2025 could see the final move in the first major bull market sequence.

Elliott Wave Principle believes that bull markets move in what’s called a motive wave, which is a five-wave upward sequence, where odd numbered moves are in the direction of the primary trend, while even numbered moves move against the trend.

Corrections are typically labeled as ABC, unless the correction is a triangle, in which it is labeled ABCD and E. More complex corrections can evolve over time. Triangles represent the consolidation before the final thrust in a sequence.

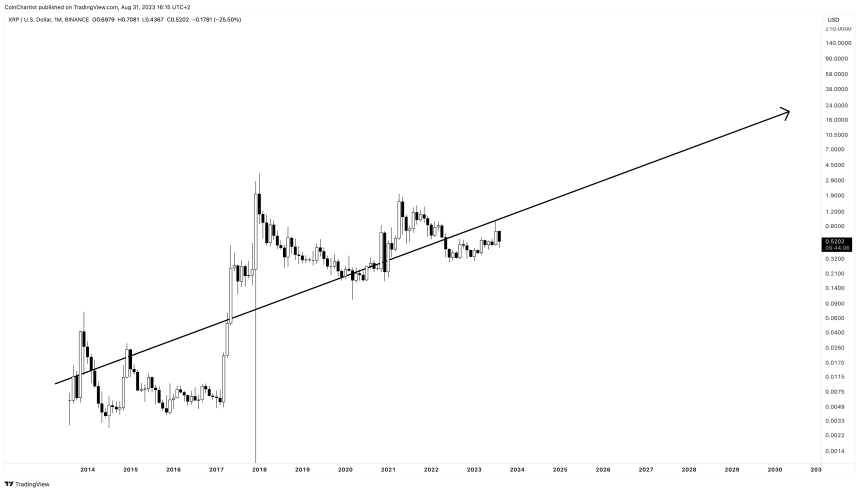

Price projections put XRP above $10, between $14, and $17 depending on momentum and supporting environment.

Long-Term XRP Price Prediction for 2030

XRP’s long term forecast is a lot more difficult to predict using traditional technical analysis techniques. In this case, we’ve chosen to draw a price mean through years of price action in an attempt to project a linear trend line.

Peaks and troughs would occur above and below the mean, providing the potential for mean reversion trades. The trajectory puts XRP upwards of $20 per coin in the future if the mean line is accurate.

XRP Price Prediction FAQs

Let’s look at some commonly asked questions regarding XRP price forecasts:

What was XRP’s lowest price?

During its initial couple years after launch, XRP hit lows between $0.002 to $0.005. Its recent low was $0.24 in July 2022.

What was XRP’s highest price?

XRP’s all-time high was $3.84 reached in January 2018 during the crypto bubble. It also briefly exceeded $3.60 in the same time frame.

How high can XRP realistically go?

Based on its fundamentals and adoption risks, a realistic best-case high for XRP by 2025-2030 is likely in the $10 to $20 range if it gains widespread utility. Reaching triple digits appears very unlikely.

Can XRP’s price crash to zero?

If Ripple suffered an existential threat, XRP could potentially crash below $0.01. But delisting risks have reduced after a US court deemed XRP not a security, making a complete collapse improbable without a catastrophic event.

Why is XRP price volatile?

As a cryptocurrency exposed to speculative trading, XRP experiences high volatility from hype cycles and shifts in investor confidence amplified by its low liquidity relative to larger cryptos.

When will XRP’s price stabilize?

XRP volatility should stabilize and gravitate closer to currency-like fluctuations once it establishes a reliable demand baseline among commercial users and institutions. But this remains dependent on Ripple’s success.

U.S. Court Calls ETH a Commodity While Tossing Investor Suit Against Uniswap

A New York judge declined to “stretch the federal securities laws to cover the conduct alleged” in a proposed class action complaint seeking to hold Uniswap accountable for “scam tokens” issued on the protocol.

SEC Could Prepare Alternative Arguments to Reject Spot Bitcoin ETFs: Berenberg

Coinbase’s potential involvement in spot bitcoin ETFs could serve as part of the SEC’s reconfigured arguments for rejecting the applications, the report said.

Bloomberg Analysts Raises Approval Chances Of Spot Bitcoin ETF To 75%

Bloomberg senior analysts Eric Balchunas and James Seyffart have raised their approval odds of the first Bitcoin spot exchange-traded fund (ETF) in the United States (US) to 75%.

This development comes after the US District of Columbia Circuit ruled against the US Securities and Exchange Commission (SEC), stamping out the regulator’s denial of Grayscale’s conversion of its Grayscale Bitcoin Trust (GBTC) into a Bitcoin ETF.

Court “Unanimity And Decisiveness” Unexpected, SEC Now In Tight Spot, Analysts Say

According to his X post on August 30, Eric Balchunas explains that the new stance from him and his colleague was based on certain developments in Grayscale’s case against the SEC.

Related Reading: US Bitcoin ETF Approval Could See North America’s ETF Volume Rise To 99.5%

Although the Bloomberg analyst stated that a Gracyscale victory had been factored into their last 65% approval odds of a Bitcoin spot ETF, the court’s “unanimity and decisiveness” in ruling against the SEC was quite unanticipated.

NEW: @JSeyff & I are upping our odds to 75% of spot bitcoin ETFs launching this yr (95% by end of '24). While we factored Grayscale win into our prev 65% odds, the unanimity & decisiveness of ruling was beyond expectations and leaves SEC w "very little wiggle room" via @NYCStein pic.twitter.com/IyEGmWjuHa

— Eric Balchunas (@EricBalchunas) August 30, 2023

Furthermore, Balchunas explains that the SEC now faces a PR loss as Grayscale’s victory received media coverage from top media firms across the country. Combining this situation with the recent court defeat, the commission’s denial of the Bitcoin spot ETF will be “politically untenable.”

In their official report, both Balchunas and Seyffart also highlighted that the SEC’s dilemma worsens as it faces its first deadlines on seven Bitcoin spot ETF applications between September 1 and September 4.

However, following the recent court ruling, the Bloomberg analysts believe the securities regulator will likely give a delayed order.

Finally, if the SEC is somehow able to deny all applications, the analysts state the financial agency will struggle to reject Hashdex’s unique proposal.

On August 25, the Brazillian asset manager filed to introduce a mixture of Bitcoin spot and futures ETF, secured by the Exchange for Physical (EFP) transactions, instead of a surveillance-sharing arrangement (SSA) with a crypto exchange.

Based on all the factors listed above, Balchunas and Seyffart rate the approval chances of a Bitcoin spot ETF in 2023 at 75%, with the potential of these odds rising to 95% at the end of 2024.

Bitcoin Poised For Massive Gains If Spot ETF Gains Approval

Following the influx of Bitcoin spot ETF applications in June, there has been much optimism about the potential effects these trading products could have on the premier cryptocurrency.

A Bitcoin spot ETF tracks the price of BTC, granting investors indirect exposure to the asset without the risks of direct investment in the cryptocurrency itself. According to hedge fund expert Tom Lee, a spot ETF will likely create a high demand-to-supply ratio of the largest crypto asset, pushing its prices of BTC as high as $185,000.

Related Reading: Ethereum ETF Race Gets Hotter As SEC Receives 11 Filings In One Week

The market leader rose by over 7% following Grayscale’s court victory to trade at $27,974.42, according to data from Coingecko. However, BTC soon experienced a price correction, finding support around the $27,000 price zone.

At the time of writing, Bitcoin is trading at 27,229.89 with a 0.9% loss in the last day.

Binance pushes new stablecoin as it confirms plan to cease BUSD support

Paxos has earlier said it will halt support of Binance’s stablecoin by February 2024, now the exchange has said it will also stop support by that time.

Crypto may see second wind in the US as courts ‘rein in the SEC’ — Lawyer

Crypto-focused lawyer Jeremy McLaughlin said the U.S. digital asset industry may re-ignite as the country’s securities regulator racks up court losses.

Bitcoin To $185,000 if Spot ETF Is Approved: Expert

If the United States Securities and Exchange Commission (SEC) ends up approving a spot Bitcoin exchange-traded fund (ETF) anytime in the coming days or weeks, one expert is confident BTC prices will explode more than 6x to $185,000.

As of August 30, BTC is changing hands below $30,000 but remains firm.

Bitcoin To $185,000?

In a recent CNBC interview, Tom Lee, who regularly comments on Bitcoin prices, said a spot ETF will mop up all daily supply of the world’s most valuable cryptocurrency, creating an “imbalance” that will inevitably drive prices higher. Based on this, demand will significantly outstrip supply, driving prices to $185,000 or higher.

Bitcoin remains the world’s largest cryptocurrency by market cap despite the sharp contraction throughout the past 20 months.

At peaks, BTC surged to over $69,000 only for sentiment to shift in 2022, triggering a sell-off that saw prices declined more than half, bottoming up from below $16,000 in November 2022.

While prices have since recovered, surging over 50% from November 2022 lows to peaking at over $31,000 in late July 2023, the crypto and Bitcoin communities have their eyes on the SEC.

The stringent regulator has been adamant, dismissing previous applications for a complex ETF derivative directly tracking Bitcoin prices. While the SEC has approved a Bitcoin Futures ETF that tracks an index aggregating prices from multiple regulated exchanges, the nascent industry demands an spot BTC ETF.

SEC Likely To Approve Spot ETF?

Following August 29’s court ruling that supported Grayscale’s assertion that robust measures are in place for their Bitcoin spot ETF to be free from market manipulation, the community has been ecstatic. The ruling was a loss for the SEC, but the court didn’t mention or guide the regulator in approving a Bitcoin ETF.

Nonetheless, following the sharp expansion of Bitcoin prices from around $25,800 to as high as $28,000, there is a section of optimists who believe the SEC has little wiggling space and have no option but to greenlight a Bitcoin ETF in the coming weeks if not months.

On August 30, Eric Balchunas and James Seyffart, two of Bloomberg’s senior ETF analysts, increased their odds of the SEC approving a spot ETF in 2023 to 75% (up from 65%). If it doesn’t get approved this year, they estimate that the regulator will likely allow entities to create this product next year since their probability is 95%.

Their confidence stems from the fact that the “unanimity and decisiveness” of the recent court ruling in the SEC versus Grayscale case was “beyond expectations and leaves SEC with “very little wiggle room.” Moreover, in their assessment, the SEC has suffered a “PR” loss since the ruling was widely covered.

Uniswap lawsuit judge calls Ether a commodity in dismissal order

United States District Court Judge Katherine Polk Failla is also the judge overseeing the SEC’s lawsuit against crypto exchange Coinbase.

Trump NFTs back in demand, SEC says NFT sales are unregistered securities: Nifty Newsletter

Trump NFT prices spiked after the former U.S. president’s mugshot in police custody was released.

GBTC Shares See Volumes Climb To 2-Year High Amid Grayscale’s Victory Lap

On August 29, the US Court of Appeals ruled in favor of Grayscale in its legal battle against the US Securities and Exchange Commission (SEC). Following this, Grayscale’s GBTC shares trading volume significantly increased, climbing to a 2-year high in the process.

GBTC Shares See 17% Increase

According to data from Yahoo Finance, GBTC’s share price had opened at $17.66 on the day and closed at $20.56, rising by almost 17% from the previous day. Furthermore, the fund saw its busiest day in over a year, with over 19 million GBTC shares changing hands. This volume jump marked the fund’s highest in over two years.

These figures aren’t surprising, considering that Grayscale’s victory presents a bullish outlook for the fund. Furthermore, Grayscale’s GBTC is one step closer to being converted into a Spot Bitcoin ETF, so many investors may want to get in on the fund at a discounted price.

GBTC currently operates as a closed-end fund and has seen a discount as high as 48.89% of its net asset value (NAV) in December 2022. This discount has been reduced to about 18% following the court’s ruling in favor of Grayscale. However, some still believe this gap could close further, especially if Grayscale’s ETF application were approved.

Big Win For The Crypto Community

Grayscale had filed a lawsuit following the SEC’s refusal to grant its application to convert its GBTC fund into a Spot Bitcoin ETF.

Grayscale argued that the SEC acted arbitrarily and capriciously by not giving it the same regulatory treatment the Commission did to the Teucrium Bitcoin Futures Fund and the Valkyrie XBTO Bitcoin Futures Fund.

The fund stated that it deserved the same treatment as the Bitcoin futures fund because the prices of both Spot and Futures Bitcoin ETFs were “99.9%” correlated, so they posed the same risk regarding fraud and manipulation.

The court adopted Grayscale’s argument and agreed that the SEC had not provided sufficient reason for denying Grayscale’s application while approving the Bitcoin futures funds.

With this ruling, the SEC’s primary reason for not approving a Spot Bitcoin no longer carries weight, as the Commission can no longer deny applications solely because the Spot Bitcoin market has no regulated market of significant size.

The court already found both funds (spot and futures) to be similar, so these exchanges’ surveillance sharing agreements with the Chicago Mercantile Exchange (CME) should be sufficient to deter manipulation in either the spot or futures market.

While it remains to be seen what step the SEC will take regarding the Court of Appeal’s ruling, there is an increased likelihood that the Commission will have to approve the pending Spot Bitcoin ETF applications except if it can find another reason to deny these proposals.

Bitcoin Average Trade Size Jumps to Highest Level Since June After Grayscale Ruling

The increase in average trade size could suggest large traders are more active, said research firm Kaiko.

Coinbase stock surges after favorable federal ruling for Grayscale

In the final moments of the trading session on Tuesday, Aug.29, the value of COIN stood at $85.13 per share, a jump of 15% over the previous day’s close.

First Mover Americas: Bitcoin Rallies on Grayscale Court Win Over SEC

The latest price moves in bitcoin (BTC) and crypto markets in context for August 30, 2023. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets.

Will Evergrande’s collapse have a silver lining for crypto?

This week, The Market Report discusses Grayscale’s victory against the SEC, the impact of Evergrande’s bankruptcy, and what happened to the 16 trillion PEPE tokens reportedly stolen.

Grayscale Victory Against SEC Clears Path for Spot Bitcoin ETFs: Bernstein

The ruling increases the likelihood the SEC might approve all bitcoin spot ETF applications together, the report said.

Renowned Economist Explains Why Grayscale’s Win Is Not Good For Bitcoin Price

One of the major highlights of Grayscale’s victory over the US Securities and Exchange Commission (SEC) was its positive effect on Bitcoin’s price. However, renowned economist Peter Schiff has explained why Grayscale’s win may not be good for Bitcoin in the long run.

A GBTC ETF ‘Bearish’ For Bitcoin

Schiff tweeted that the GBTC fund becoming a spot ETF (Exchange-traded Fund) is “actually bearish” for the flagship cryptocurrency as he said this move could potentially increase Bitcoin’s “tradable supply.”

If approved, investors in the GBTC fund will now be able to redeem their Bitcoin, which Schiff has highlighted is bad for Bitcoin’s price and the market as GBTC will have to sell BTC into the market, thereby increasing the tradable supply.

Schiff’s concern probably stems from the fact that GBTC reportedly owns over 3% of Bitcoin’s circulating supply, so a sell-off due to redemptions could significantly impact the market, causing Bitcoin’s price to reduce.

However, other X (formerly Twitter) users quickly pointed out that other ETF applications will likely be approved alongside Grayscale’s application. As such, there will be enough demand to balance out the increase in supply that could result from Grayscale’s redemptions.

Grayscale had applied to the SEC to convert its GBTC fund into a Spot Bitcoin ETF. However, the regulator rejected the application, leading Grayscale to file a lawsuit against the SEC, stating that the Commission acted arbitrarily and capriciously in its disapproval order.

Following the Appeal court’s ruling in favor of Grayscale, the SEC now has to review the asset manager’s application again with the possibility of an approval higher this time. This is because Grayscale has been able to establish before the court that it should enjoy the same treatment given to Bitcoin Futures ETF which the Commission has had no problem approving.

The SEC’s Next Steps

Legal expert Jake Chervinsky also chimed in to state that the court delivered a “huge embarrassment” for the SEC. As to the next steps that the regulator might take, Chervinsky highlighted four theories.

Firstly, he believes the SEC could just pick another reason to deny Grayscale’s proposal, which could lead to another long-running legal battle between both parties. Apparently, the court had ruled that the Commission didn’t provide sufficient reason to deny Grayscale’s application as it faulted the “significant market” test size as wrong.

His second theory is that the SEC will choose to abide by the court’s decision and use that as an excuse to drop its “anti-ETF position.”

Furthermore, the legal expert noted that the SEC may have no choice but to approve the pending ETF applications as there is “political pressure” on the SEC. According to him, the world’s largest asset manager, BlackRock, and its CEO, Larry Fink, are lobbying for their application to be approved.

Lastly, Chervinsky believes that the SEC’s Chair Gary Gensler could use this to spin the anti-crypto narrative by approving these ETFs to show that the Commission is willing to approve products that abode by their regulations.

GBTC Bitcoin ‘discount’ may be gone by 2024 as share price gains 17%

GBTC shares trading at a lower implied value to BTC price may soon be a thing of the past, a new prediction says.

Grayscale’s Win Breathes Life Into Litecoin, Post-Halving Rally On?

In a refreshing ruling on August 29, the United States District of Columbia Court of Appeals said the stringent Securities and Exchange Commission (SEC) was, after all, wrong in denying Grayscale to convert their over-the-counter (OTC) Bitcoin Trust (GBTC) into a Bitcoin spot exchange-traded fund (ETF).

The regulator had previously barred the conversion of the GBTC to an ETF, citing an alleged absence of measures to prevent price manipulation, forcing Grayscale to sue. Before this ruling, the presiding judge said SEC needed to elaborate on why they denied Grayscale’s application.

Litecoin Rebounds

Following today’s court statement, Bitcoin prices soared, and the aftermath of this pump has positively impacted Litecoin. As it is, BTC is up roughly 10%, sharply rebounding from around $25,800 support recorded last week. Meanwhile, LTC, the bitcoin “silver,” is up 7% when writing, aiming to reverse losses of August 17.

Litecoin is changing hands at around $70, with a noticeable increment in trading volumes. Typically, in crypto trading, a spike in volumes, regardless of trend direction, can point to engagement and provide a “hint” of traders’ sentiment.

With rising volumes and expanding prices, it could suggest that bulls are positioning themselves for even more gains in the sessions ahead. Meanwhile, sharp losses with increasing volumes may mean bears are unloading, and prices may drop.

Post-Halving Rally On?

The expansion in LTC trading volumes, as visible in the daily chart, could translate to a possible bottom for the digital asset that has been under pressure in the past few sessions. To illustrate, LTC is down 26% in August 2023 alone. This dump is despite news of the Litecoin network halving its miner rewards to 6.25 LTC in early August.

In crypto, halving events has historically been associated with fresh cycles of increasing demand for the underlying coin. For Bitcoin, past performances indicate that the coin tends to rally months after the halving event. Meanwhile, in Litecoin, it has been mixed, but spot prices are generally higher than in 2019 when it halved.

With Grayscale igniting demand in Bitcoin and other proof-of-work altcoins like Litecoin, it is yet to be seen whether bulls will build on this and push prices, especially of LTC, higher. LTC prices are currently trending inside the August 17 bear candlestick.

Technically, this is bearish from volume analysis. A sharp reversal and rally, ideally above $75, peeling back August 17 losses, might catalyze more demand, potentially setting the base for a relieving post-halving rally.

If this is the case, August 17’s losses could be the climactic end of the leg down as LTC establishes a triple bottom at around the $60 and $65 support zone. Previously, LTC found support in this region in March 2023 and December 2022.

Crypto community jubilant over Grayscale decision, but uncertainty remains

The court’s decision that the SEC has to consider Grayscale’s Bitcoin spot ETF application is good news for crypto but maybe not as impactful as some hoped.