He pointed out that Gensler had requested an urgent appeal while simultaneously asserting that crypto regulations and rules were clear and must be adhered to by the industry.

Cryptocurrency Financial News

He pointed out that Gensler had requested an urgent appeal while simultaneously asserting that crypto regulations and rules were clear and must be adhered to by the industry.

Emmer intends to introduce an appropriations amendment that will limit the SEC’s utilization of funds for digital asset enforcement until comprehensive rules and regulations are implemented.

The SEC highlighted contradictory conclusions from similar cases, along with other pending decisions as some of the contentious legal issues.

The blockchain-based file-sharing network had indicated it would be winding down after a New Hampshire court ruled in favor of the SEC last November.

Blockchain-based file-sharing and payment network LBRY is planning to pick up the fight against the federal regulator again after losing the battle in November last year.

Ripple Labs chair Chris Larsen commented on the recent cases involving Ripple, Grayscale, and the SEC, arguing it is time for Congress to take the lead on crypto policy.

The two firms currently have a spot Bitcoin exchange-traded fund being reviewed by the SEC, and recently proposed listings of two Ether futures ETFs.

Bitcoin’s current price action leaves much to be desired, but multiple indicators point to what could be a generational buying opportunity for patient investors.

The Ark 21Shares Ethereum ETF is the first attempt to list such a fund in the U.S. that directly invests in ETH, the second largest cryptocurrency by market capitalization.

This week, The Market Report discusses why $22,000 is the next logical step for Bitcoin and why BitMEX co-founder Arthur Hayes claims the bull market started back in March.

“We believe the Trust’s nearly one million investors deserve this fair playing field as quickly as possible,” Grayscale’s lawyers wrote to the regulator.

A lack of network activity and ground lost to competitors could eventually play a role in ETH losing the $1,600 support.

The SEC was last week ordered to review its prior rejection of the conversion of the Grayscale Bitcoin Trust (GBTC), though not necessarily to approve it.

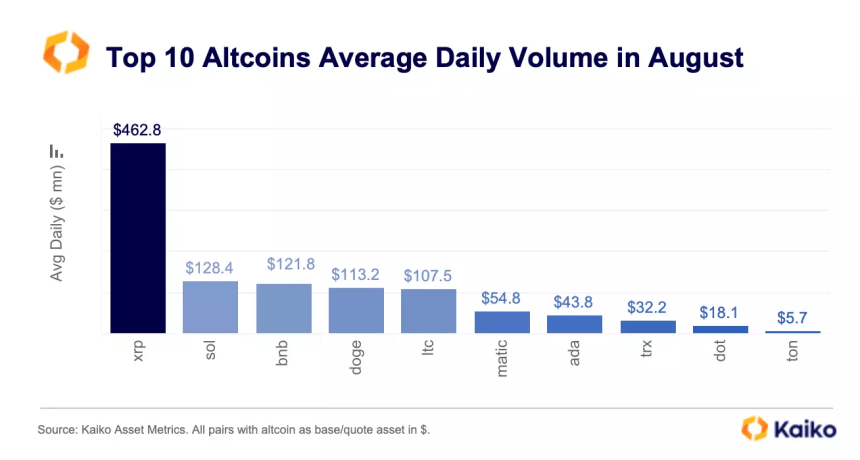

Prominent crypto research firm Kaiko reports that the XRP token recorded impressive trade volume strides across August 2023. This development comes amidst the token poor price performance in the said month.

According to the latest Data Debrief by Kaiko on September 4, the market research firm notes that XRP recorded an average daily trade volume of $462.8 million in August, representing the highest value of that metric in the altcoin market.

Solana (SOL) followed in second place, with a trade volume of $128.4 million. Other altcoins that also experienced a significant average daily trade volume in August included Binance Coin (BNB), Dogecoin (DOGE), and Litecoin (LTC), among others.

As earlier stated, XRP’s surge in trading volume was accompanied by underwhelming market performance. Kaiko notes that the altcoin experienced a 25% price decline in August.

This negative price performance was in much contrast to July, during which XRP had recorded lofty gains following Ripple’s partial victory over the United States Securities and Exchange Commission (SEC).

To explain the contrast between XRP’s negative price performance and its surging trade volume, Kaiko has provided some interesting, in-depth analysis.

According to the research firm, the court ruling in July led to a large demand for XRP by US traders, as was seen in the token’s price movement. Kaiko noted that the XRP average trade size on Coinbase, the largest US crypto exchange, experienced a significant boost, surpassing all top ten altcoins.

However, this massive XRP demand was only present in the US. Kaiko states there was high selling pressure on foreign exchanges, indicating that most investors sold off their tokens to capitalize on XRP’s gains from its court victory.

In particular, Kaiko reported that the South Korean exchanges Upbit and OKX recorded the strongest XRP selling pressure for August.

Kaiko notes that the XRP’s trading volume is higher on foreign markets than on US exchanges. The research firm reported:

Overall, the share of XRP traded on U.S. markets remains lower than on offshore exchanges. XRP is only the sixth most traded altcoin in the U.S. by cumulative trade volume, while it tops the list on offshore markets.

Therefore, the high demand for XRP in the US was overwhelmed by higher selling pressure on the global market, which explains why the XRP market price took a nosedive in August.

At the time of writing, XRP trades at $0.503, having gone up by 0.17% in the last day based on data from CoinMarketCap. However, the fifth-largest cryptocurrency is still in the red zone and is down by 2.28% and 19.70% on the weekly and monthly charts.

Despite BlackRock’s application for a Bitcoin spot ETF, its approval remains uncertain, with the SEC favoring another futures-based Ether ETF.

There have been talks about the US Securities and Exchange Commission (SEC) and Ripple Labs reaching a settlement following the ruling that XRP isn’t a security. Following this, Pro-XRP lawyer John Deaton has stated a key factor that could lead to a settlement between both parties.

In a tweet released on the X (formerly Twitter) platform, Deaton stated that the “only way” the SEC and Ripple can settle this year is if Judge Failla grants Coinbase’s motion to dismiss the SEC’s lawsuit against it.

The lawyer believes that the key is for Judge Failla to find that token sales on an exchange as part of a programmatic sale do not fall under US securities laws. If that happens, the Commission and its chair, Gary Gensler, may have no choice but to “pivot,” according to Deaton.

He further noted that Judge Failla’s ruling may be final as he doubts the Solicitor General would allow an appeal as the case could end up reaching the Supreme Court, which could “strip away” the SEC’s powers and that of other federal agencies.

The SEC had filed a lawsuit against Coinbase, alleging that the biggest crypto exchange in the US was operating as an unregistered securities exchange by offering several cryptocurrencies on its platform without first registering with the SEC.

In response, Coinbase filed a motion to dismiss the case, stating that the regulator was stepping outside its jurisdiction with such an action. The exchange said the token sales weren’t investment contracts but more commodity sales, with “obligations on both sides discharged” once the transaction occurred.

Interestingly, Coinbase cited Judge Torres’ ruling in favor of Ripple that programmatic sales, such as ones on exchanges, didn’t constitute investment contracts.

Going by Deaton’s theory, it is believed that the SEC would want to settle with Ripple if the court ruled that the Commission has no jurisdiction over token sales on exchanges. This is plausible because Judge Failla granting Coinbase’s request represents a setback for the Commission in its case against Ripple.

The SEC argues that Ripple’s programmatic sales constituted an investment contract, making XRP a security. However, a win for Coinbase ultimately makes the programmatic sales argument baseless, and it can no longer further the argument since token sales on exchanges are outside its purview.

Regarding the SEC and Gensler wanting to “pivot,” as mentioned by Deaton, this could mean the Commission solely focusing on Ripple’s sale to institutional investors, which the court ruled constituted an investment contract.

Considering that the regulator still has a long way to go to prove which institutional sales were made to domestic investors (the only ones the SEC has jurisdiction over), it may settle with Ripple rather than prolong a case it may eventually lose.

For the SEC to defend its denial of Grayscale’s proposal to convert GBTC into an ETF, it would have to withdraw its previous approval of futures-based bitcoin ETFs, which is unlikely, the report said.

Lawyers argued the SEC’s grounds for an appeal was based on “dissatisfaction” with a July court decision that the XRP token did not largely qualify as a security.

Ripple made its case to a federal judge for why the U.S. Securities and Exchange Commission shouldn’t be able to appeal her ruling on its programmatic sales of XRP on Friday.