Two lawyers for the U.S. Securities and Exchange Commission (SEC) were forced to resign after a federal judge sanctioned the agency last month for committing a “gross abuse of power” while attempting to secure a temporary restraining order against Utah-based crypto company Debt Box, according to a Monday report from Bloomberg.

Ethereum Spot ETFs Approval Skepticism Persists, As ETH Recovers

Ethereum Spot Exchange-Traded Funds (ETFs) approval odds continue to witness notable pessimism as the cryptocurrency space awaits the United States Securities and Exchange Commission’s (SEC) decision on the products scheduled for May.

The expectation surrounding the SEC’s decision highlights how important ETF approval is in terms of giving conventional investors more convenient access to Ethereum’s spot market. Presently, data from Polymarket, the world’s largest prediction market, shows that ETH ETF approval odds have fallen to a mere 11%.

Pessimism Deepens As Ethereum ETFs Remain Uncertain

As the May deadline draws near, doubt and skepticism loom large on the horizon, casting a dark shadow for the products. One of the most recent figures to voice doubts about the SEC’s willingness to approve the exchange-traded products this May is Nate Geraci, the president of ETF Store.

According to Geraci, the regulatory watchdog is eerily silent on Ethereum spot ETFs. He further suggested that the products might not be approved due to the SEC’s significantly lower level of engagement with ETF issuers than in previous interactions.

“Logic says that is correct, but also wonder if SEC learned a lesson from clown show with spot Bitcoin ETFs,” he added. Thus, he has pointed out two possible options for the products, which are either an approval or lawsuit from the Commission.

Commenting on the president’s insights, a pseudonymous X user questioned if there is a possibility that activities are taking place behind closed doors in order to avoid disrupting the pre-launch market. Geraci responded, saying he believes that could be possible, drawing attention to Van Eck CEO Jan Van Eck’s review, which might prove otherwise.

It is worth noting that Van Eck is one of the earliest firms to submit its application for an Ethereum exchange product. Even though the company was the first to file for an application, Jan Van Eck is pessimistic about the approval of the ETPs, saying they will probably be rejected in May.

He stated:

The way the legal process goes is the regulators will give you comments on your application, and that happened for weeks and weeks before the Bitcoin ETFs. And right now, pins are dropping as far as Ethereum is concerned.

In light of this, investors prepare for an unpredictable result while managing market swings and modifying their investment plans in the face of changing regulations.

ETH Price Sees Positive Movement

While Ethereum ETFs might be experiencing negative sentiment, ETH, on the other hand, has witnessed a positive uptick lately. ETH has revisited the $3,000 level again after falling as low as $2,888 during the weekend.

Today, ETH price rose by over 4%, reaching around $3,234, indicating potential for further price recovery. At the time of writing, Ethereum was trading at $3,215, demonstrating an increase of 1.40% in the past day.

Also, the asset’s market cap and trading volume are up by 1.40% and 5.96% in the last 24 hours. Given the anticipated impact of the recently concluded Bitcoin Halving on cryptocurrencies, ETH could be poised for noteworthy moves in the coming months.

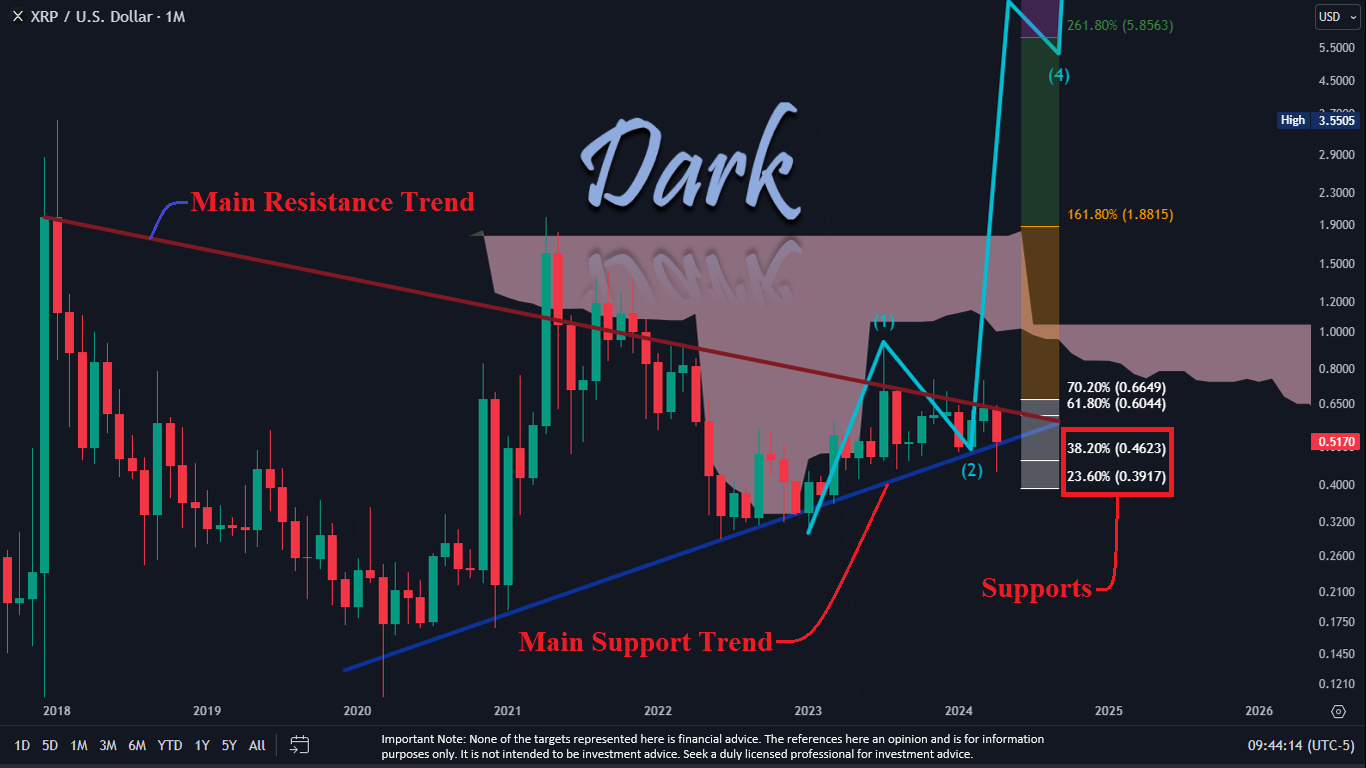

Analyst Outlines XRP Price Scenarios Ahead Of Ripple-SEC Case Update

In a chart analysis shared via X, the crypto analyst Dark Defender provided insight into the potential price movements of XRP ahead of this week’s Ripple-SEC case update. The analysis, conducted on a monthly time frame, reveals that XRP has been holding above a critical support trend marked in blue. With the crypto community’s eyes set on the new Ripple filings expected next week, there’s a mix of anticipation and caution.

XRP Price Enters Potentially Crucial Week

Dark Defender notes that although market news does not typically have a direct correlation with price movements, the “last puzzle piece” pertaining to the Ripple case may add a layer of enthusiasm to the market sentiment surrounding XRP. The question posed is: What could happen if XRP fails to maintain its position above the blue support line?

According to the analysis, if XRP breaks below this blue support line, it will likely approach the two critical Fibonacci retracement levels at $0.4623 (38.2% retracement level) and $0.3917 (23.6% retracement level). These figures are derived from the swing high and low points on the chart, traditionally considered potential support levels where the price could stabilize or bounce back.

In the context of the current chart, a drop below these levels, particularly if the price closes under $0.3917 for two to three days consecutively, would invalidate the bullish five-wave structure that Dark Defender suggests could propel XRP to a high of $5.85. On the flip side, should XRP reclaim the 61.8% Fibonacci level at $0.6044, it could signify a first step towards a strong upward move.

Between the price range of $0.6649 and $0.3917, any price movement is considered a sideways trend. A breakout above the 70.2% level at $0.6649 would likely confirm a bullish trend, with the analyst highlighting this as a significant threshold for a positive price trajectory. Above this level, XRP would then eye the next Fibonacci extension levels of $1.8815 (161.8% extension) and potentially $5.8563 (261.8% extension), which are ambitiously projected targets.

The chart also highlights a “Main Resistance Trend” line that has capped the price since the peak of early 2018, and the current price action is pinched between this descending resistance and the ascending support trend lines, forming a converging pattern that traders often interpret as a potential breakout signal.

A breakout could be the first bullish indication of a larger rally, with at least one monthly close above the line required. In the past, several attempts at a breakout have failed, and even one monthly close was followed by a fall back below the trendline the following month.

Ripple Vs. SEC: What To Expect This Week

Ripple Labs is gearing up to file its response to the US Securities and Exchange Commission’s (SEC) remedies briefing on April 22, a pivotal moment in their protracted legal battle. This response from Ripple is in reaction to the SEC’s briefing that put forth potential remedies including disgorgement of profits derived from XRP sales and civil penalties. The financial stakes are high, with the SEC calculating fines that could reach around $2 billion, claiming that Ripple engaged in an unregistered securities offering with its XRP sales.

The legal and financial communities expect Ripple to mount a formidable defense against the SEC’s claims. Key to this counter-argument will be undermining the SEC’s assertion of the necessity for disgorgement, given the alleged lack of demonstrable financial harm to XRP purchasers. Furthermore, Ripple is likely to leverage favorable recent legal decisions and regulatory developments, aiming to weaken the SEC’s position.

According to the schedule, Ripple is expected to submit a public redacted version of its opposition brief along with associated declarations and exhibits today, if these materials are devoid of any SEC-designated confidential information. If confidentiality is a concern, Ripple will file the documents under seal and submit a redacted public version by April 24. Following this, the SEC will have the opportunity to reply, with their response anticipated to be filed under seal by May 6.

At press time, XRP traded at $0.53.

Thailand to Block Access to ‘Unauthorized’ Crypto Platforms

Authorities in Thailand have decided to block “unauthorized” crypto platforms to increase the efficiency of law enforcement in solving the problem of online crime, an announcement on Friday last week said.

Coinbase Seeks to Take Core Question in U.S. SEC Case to Higher Court

Coinbase is seeking to rip the bandage off of a legal impasse at the center of the crypto industry’s fight with the U.S. Securities and Exchange Commission (SEC), filing an interim appeal on Friday that would ask a higher federal court to drill into the heart of the regulator’s stance on digital assets, even as the broader SEC case proceeds through the judicial system.

The SEC’s Suit Against Unswap Is an Opening Attack Against DeFi

The DEX received a Wells Notice from the regulator, suggesting an enforcement action is imminent. While we don’t know the nature of the potential charges, the news raises the threat of legal jeopardy for decentralized finance.

Ether Spot ETFs Still Have No More Than 50% Chance of Approval in May: JPMorgan

There will probably be litigation against the SEC after May if ether ETFs aren’t approved, the report said.

CEO Throws Cold Water On May Ethereum ETF Approval – Impact On Price

The much-anticipated arrival of spot Ethereum exchange-traded funds (ETFs) in the US seems to be hitting a snag. Industry leaders are voicing growing concerns about the likelihood of securing regulatory approval from the Securities and Exchange Commission (SEC), with a deafening silence from the agency fueling anxieties.

Jan van Eck, CEO of investment firm VanEck, recently cast a shadow of doubt on the possibility of SEC approval for spot Ether ETFs in May. In a CNBC interview, van Eck expressed his belief that their application would likely be rejected, citing a complete lack of communication from the regulatory body.

This sentiment finds an echo in the words of Eric Balchunas, a Senior Bloomberg ETF analyst, who has significantly downgraded his odds of approval to a mere 35%. Balchunas attributes this pessimism to the ongoing “radio silence” between the SEC and fund issuers.

Nice scoop from @joelight. Def interesting but no change our odds. As we’ve said, need SEC to give comments on the filing documents (the “critical feedback” he mentions) and that still ain’t happening, even in person they offering nothing. Silence is violence. https://t.co/z76KTtdmHU

— Eric Balchunas (@EricBalchunas) April 8, 2024

Ethereum ETF Applications Languish In SEC Limbo

The SEC’s lack of response extends beyond van Eck’s application. Seven other proposals for spot Ether ETFs are currently gathering dust, with no indication of progress. This regulatory purgatory is fueling skepticism among industry commentators. CoinShares CEO Jean-Marie Mognetti believes that approval for any of these applications is unlikely “this side of the year,” further amplifying the prevailing uncertainty.

The current roadblock for Ethereum ETFs stands in stark contrast to the success story of Bitcoin ETFs. The SEC’s green light for Bitcoin ETFs offered a glimmer of hope for the cryptocurrency market. Van Eck highlights the growing interest in Bitcoin as a “maturing asset class,” with significant untapped investor demand.

Notably, VanEck’s own spot Bitcoin ETF, known by the ticker HODL, has witnessed significant inflows since its launch in mid-January, signifying a strong investor appetite for crypto exposure.

Lack Of Clarity Creates Murky Investment Landscape

The lack of interaction from the SEC is a major concern for James Seyffart, another analyst in the field. He emphasizes that “zero comments or interactions from the SEC is a bad sign.” This sentiment suggests a troubling trend in the approval process, further dampening hopes for a swift resolution on the Ethereum ETF front.

Despite the current cloud of uncertainty surrounding Ethereum ETFs, the cryptocurrency market continues to experience growth and gain wider acceptance. This indicates that opportunities for investment diversification in the digital realm are on the rise.

However, until the SEC sheds light on its stance, investors and industry stakeholders will be forced to navigate a landscape fraught with uncertainty and intense regulatory scrutiny.

The path forward for Ethereum ETFs remains shrouded in doubt. The SEC’s silence is deafening, and industry leaders are bracing for potential rejection. With a lack of clear communication and mounting skepticism, investors are left facing a blank wall, waiting for a sign from the SEC.

Featured image from Micoope, chart from TradingView

Uniswap Bloodbath: UNI Price Crashes 16% On SEC Lawsuit Fears

The US Securities and Exchange Commission (SEC) has served a Wells Notice to Uniswap, a leading decentralized exchange (DEX). This pre-enforcement notice, a precursor to potential legal action, triggered a plunge in Uniswap’s native token, UNI.

At the time of writing, UNI was trading at $9.37, down 16.2% in the last 24 hours, data from Coingecko shows. The crypto has also sustained a 15% loss in the last seven days.

Uniswap Whales Seek Safer Shores

The news of the SEC’s looming action acted as a fire alarm for Uniswap’s biggest investors. On-chain data analysts at Lookonchain reported significant market movements, with three large whales shedding a staggering 2.03 million UNI tokens – a cool $20 million vanishing from the Uniswap ecosystem within hours.

The wallets offloaded a combined 1.25 million UNI, potentially profiting by $3.5 million if they sold at current market prices. These tokens, interestingly, originated from a Binance transfer in March 2023, hinting at a potential strategy of holding on the exchange until the regulatory clouds cleared.

Another whale liquidated over 472,000 UNI for a quick $4.6 million USDC payout, netting a cool $1.67 million in profit. The fire sale wasn’t limited to these three giants – six other whale-sized wallets collectively moved 316,400 UNI tokens to Binance, valued at roughly $3.15 million. This mass exodus of heavyweight investors exacerbated the downward spiral of UNI’s price, leaving retail investors scrambling to assess the situation.

whitzardflow.eth was liquidated 107,010 $UNI($1M) 1 hour ago.

He bought 262,045 $UNI($3M) from Mar 1 to Mar 13 at $11.42 and deposited it into #Aave, then borrowed $1.8M of stablecoins.

Due to the decrease in $UNI price, he was liquidated 107,010 $UNI($1M) to repay the debt and… pic.twitter.com/6mRg8sL3YE

— Lookonchain (@lookonchain) April 11, 2024

Uniswap Founder Vows To Fight, DeFi Future Uncertain

Uniswap founder Hayden Adams reacted swiftly and fiercely to the SEC’s move. In a fiery statement posted on the X platform, Adams condemned the SEC’s approach, accusing them of prioritizing opaque, legacy financial systems over the interests of consumers.

Today @Uniswap Labs received a Wells notice from the SEC.

I’m not surprised. Just annoyed, disappointed, and ready to fight.

I am confident that the products we offer are legal and that our work is on the right side of history. But it’s been clear for a while that rather than…

— hayden.eth

(@haydenzadams) April 10, 2024

He emphasized the need to defend Uniswap and the broader DeFi industry, underscoring the potential of decentralized finance to revolutionize financial inclusion.

The Wells Notice marks the beginning of what could be a long and arduous legal battle. Adams acknowledged the possibility of a years-long fight, highlighting the immense stakes involved.

The outcome of this clash, he argued, could significantly impact the future trajectory of DeFi and the entire cryptocurrency landscape.

Related Reading: From Hat To Heights: Dogwifhat’s $17 Crypto Leap Electrifies Investors

Crypto Market Braces For Regulatory Storm

Investors are now grappling with the specter of increased regulatory scrutiny for DEXs, a sector that has thrived on its permissionless nature. The uncertainty surrounding Uniswap’s legal status has cast a shadow over investor confidence, raising concerns about the potential devaluation of their holdings.

‘What Are We Waiting for’? SEC Commissioner Hester Peirce Discusses Moving Crypto Regulation Foward

Known for her fiery dissenting opinions, “Crypto Mom” discusses how the SEC operates, why she wants to see crypto thrive and her “Safe Harbor” proposal to allow projects to decentralize.

For Crypto, the Global Regulatory ‘Olympics’ Has Already Begun

What a Judge Said About the SEC’s Suit Against Coinbase

Coinbase and Custodia both lost early and preliminary court fights. The Coinbase loss was more or less expected – companies rarely win much on a motion for judgment at such an early stage – but still pretty enlightening.

The SEC’s Shot Across the Bow on ‘AI Washing’

TRON Foundation, Justin Sun Ask U.S. Court to Dismiss SEC Lawsuit

The TRON Foundation and Justin Sun asked a New York court to dismiss an SEC lawsuit, arguing that the regulator failed to establish that the court has jurisdiction over the foreign defendants.

Coinbase Loses Most of Motion to Dismiss SEC Lawsuit

A federal judge ruled the U.S. Securities and Exchange Commission (SEC) brought enough of a case arguing that Coinbase is operating an unregistered broker, exchange and clearinghouse that its suit against the crypto trading company should move forward.

Ripple Provided Major XRP Price Discounts To Select Investors, SEC Claims

In the XRP lawsuit, the US Securities and Exchange Commission (SEC) filed its motion for remedies and entry of final judgment against Ripple, proposing a suite of penalties that includes injunctive relief, disgorgement of profits, and a notable $2 billion in civil penalties today. But that’s not the whole story as the 210-page document contains some interesting statements and assertions.

#XRPCommunity #SECGov v. #Ripple #XRP The @SECGov has filed its Motion for Remedies and Entry of Final Judgment, its Memorandum of Law in Support of that Motion, and its "Proposed" Judgment.https://t.co/uPlpJ7Tmon

— James K. Filan

(@FilanLaw) March 26, 2024

Did Ripple Favor Select Institutional Investors?

One of the assertions made in the SEC document and pointed out by XRP community lawyer Bill Morgan was a key revelation that Ripple engaged in discriminatory pricing practices, offering substantial discounts on XRP tokens to a select group of institutional investors. This practice, the SEC alleges, created an uneven playing field, benefiting certain “favored” investors at the expense of others.

XRP community lawyer Bill Morgan provided a summary of this aspect, highlighting the potential damage to Ripple’s standing in the eyes of institutional investors. “The SEC’s brief is a possible problem for Ripple beyond this case. The SEC is able to argue that there were two groups of institutional sales investors (it calls them favored and unfavored) and Ripple offered one group significant discounts in XRP price over the other group that did not receive them,” Morgan noted via X (formerly Twitter).

He further delved into the SEC’s claim that such practices harmed the “unfavored” group of investors to the tune of $480 million, a figure based on assumptions that Morgan suggests need thorough examination. “The evidence of causation of this alleged harm seems thin,” he added.

The SEC’s filing goes on to argue that Ripple’s sales tactics, specifically the discounted sales to certain investors, directly contributed to downward pressure on the overall market price of XRP. This point is not just a matter of regulatory compliance but also raises the specter of legal action from those institutional investors who may feel aggrieved by not being privy to the same discounts.

Morgan also touched upon the ramifications of these actions being classified as investment contracts by the SEC, saying, “As these sales to institutions were found to be investment contracts, it means that this offering of discounts to some but not other institutions is the very disclosure according to the SEC that should have, and would have been made to the institutions, if the sales to institutions had been registered.”

He further noted that these claims by the SEC are also not great for the reputation of Ripple. “Not sure this revelation is great for Ripple’s reputation with institutional investors,” Morgan remarked.

Ripple CLO Alderoty Responds

Ripple’s Chief Legal Officer, Stuart Alderoty, also issued a broad response to the SEC’s filing via X, vehemently disputing the narrative presented by the regulatory body. Alderoty stated, “Our response will be filed next month, but as we all have seen time and again, this is a regulator that trades in statements that are false, mischaracterized and designed to mislead.”

He further attacked the SEC for its illegitimate reasoning, stating: “They stayed true to form here. Rather than faithfully apply the law, the SEC remains bent on wanting to punish and intimidate Ripple – and the industry at large. We trust the Court will approach the remedies phase fairly.”

At press time, XRP traded at $0.64365.

Ripple CEO Responds To SEC’s Shocking $2 Billion Demand

In a rather shocking development, the United States Securities and Exchange Commission (SEC) has demanded a $2 billion sanction against Ripple. Responding to the startling demands, Ripple’s Chief Executive Officer (CEO), Brad Garlinghouse has taken a firm stance against the agency’s demands, determined to expose the true nature of the SEC.

Ripple CEO Criticizes SEC’s Demands

Stuart Alderoty, the Chief Legal Officer (CLO) of Ripple recently disclosed in a post on X (formerly Twitter) that the US SEC has petitioned a Judge for $2 billion in fines and penalties against Ripple. According to the Ripple CLO, the SEC is in a relentless pursuit to “punish and intimidate Ripple,” rather than faithfully applying the law.

Challenging the SEC’s $2 billion penalty, Garlinghouse emphasized that the agency has consistently operated beyond the bounds of law in various enforcement actions. He disclosed that Judges have also taken note of the SEC’s actions, previously admonishing the agency for its extensive abuse of power entrusted to it by Congress.

The Ripple CEO also criticized the SEC’s penalty demand, arguing that it lacks precedent and justification, particularly given the absence of any allegations, findings of fraud or recklessness in the case. As a result, Garlinghouse has vowed to expose the SEC for its conduct, emphasizing that Ripple will vigorously respond to the SEC’s action.

Notably, Alderoty has disclosed that the company’s legal team will be addressing the SEC’s demands in a filing scheduled for next month. Offering his perspective on the SEC, the Ripple CLO characterized the agency as one “that trades in statements that are false, mischaracterized and designed to mislead.”

SEC Actions Hurt XRP Holders The Most

In its lawsuit against Ripple, the US SEC accused the payment company of violating securities laws by selling XRP in unregistered securities offering to investors in the US. According to the agency, the company and its executives had allegedly failed to protect its investors, depriving them of adequate disclosures of XRP.

However, members of the Ripple community argue that the SEC’s enforcement actions against Ripple have not protected investors but caused even deeper challenges and financial losses for XRP holders.

A popular XRP enthusiast, identified as XRPCryptoWolf has asserted that it should be the SEC, not Ripple, paying billions to XRP holders.

“The SEC asking for $2 billion in fines and penalties is ridiculous when they’re the ones who financially hurt XRP holders the most. The SEC owes XRP holders tens of billions of dollars,” he stated.

The XRP community member disclosed that after the SEC announced its lawsuit against Ripple, approximately $15 billion was wiped out from XRP’s market capitalization, and the token was also delisted from major exchanges. As a result of the lawsuit’s significant impact on XRP’s value, millions of XRP holders experienced financial losses.

Analyst Warns Of Bitcoin Pre-Halving Retrace Echoing Troubling 2020 Trend

Rekt Capital, a cryptocurrency expert and enthusiast, has identified a similar pattern between the recent Bitcoin pre-halving retrace and the one that took place in 2020 before the crypto asset witnessed an upsurge to its previous all-time high.

Bitcoin Pullback Is Almost Identical With 2020 Pre-Halving Retrace

Bitcoin, the largest cryptocurrency asset, is presently demonstrating momentum, rising over $70,000 and recovering from a recent downward trend. Following the recovery, Rekt Capital believes that the pullback might be over, citing a similarity to the 2020 pre-halving retrace.

Given the uncertainty of the crypto market, the analyst is not sure if the recent upsurge marks the end of the pre-halving retrace. However, if that is the case, then Bitcoin would have nearly matched the pre-halving correction from 2020.

According to the analyst, the digital asset has recorded a pullback of over 18% in this cycle. Meanwhile, in the 2020 cycle, it retraced by over 19%, suggesting the potential of the asset mirroring the 2020 movement this cycle.

A further dive into the correction made by the analyst reveals that Bitcoin has been trapped inside the Weekly range (black-black) ever since it retraced by over 18%. Both the upside-wicking 2021 peak and the candle-bodied 2021 peak combine to create the weekly range that Rekt Capital has indicated.

Thus, he claims that BTC reclaiming the $69,200 ‘range high’ as support, which has already played out, could signal the conclusion of the recent decline. In addition, this demonstrates that Bitcoin is poised to move over its weekly range and soar higher.

With the 2024 Bitcoin halving drawing closer, the cryptocurrency is having difficulty in reclaiming its most recent peak of $73,000. However, there are rumors that today’s increase could mean the pre-halving decline is coming to an end.

Considered Catalysts For BTC’s Strength This Cycle

As of the time of writing, BTC has rebounded to around $70,806, indicating a daily increase of over 5%. Its market cap and trading volume are also showing strength, rising by 5.49% and 47.82%, respectively, in the past day.

One of the main drivers of Bitcoin’s growth this cycle is thought to have been the approval of spot BTC ETFs in January 2024. With the acceptance of the product, investors now have a convenient way to profit from Bitcoin’s value without actually owning any of it.

Since then, the crypto asset has witnessed increased adoption from industry leaders and a massive inflow of capital, propelling its price as well. The BTC price has increased from $46,000 to a peak of $73,000 since the ETFs were approved by the US Securities and Exchange Commission (SEC).

Another catalyst considered to have impacted the coin’s price is the anticipation surrounding the upcoming Bitcoin Halving set to occur in April. In the past, these kinds of events have led to notable price upticks. Due to this, investors will shift their attention to BTC to position themselves for significant gains following the halving event.

SEC Seeks $1.95B Fine in Final Judgment Against Ripple

The U.S. Securities and Exchange Commission (SEC) has asked a New York judge to impose a nearly $2 billion judgment against Ripple Labs, according to court filings.

Ethereum’s Rocky Road To $4,000: Will SEC Hurdles Derail Its Bullish Journey?

Ethereum (ETH) stands at a crucial juncture, with its eyes set on the $4,000 price mark. Amid this ambitious pursuit, the digital asset faces a significant challenge that could influence its trajectory: scrutiny from the US Securities and Exchange Commission (SEC).

Despite this potential regulatory hurdle, some analysts remain optimistic about Ethereum’s prospects. A detailed analysis by Captain Faibik, a market watcher, highlighted a bullish pattern in ETH’s four-hour candlestick chart, suggesting that the $4,000 threshold is within reach.

Ethereum Eyes $4,000 Milestone

This optimism stems from a descending wedge pattern observed by Faibik, indicating an end to Ethereum’s consolidation phase and signaling a possible price breakout. The technical analysis paints a promising picture for Ethereum, suggesting that the asset could reclaim its lost valuation.

$ETH #Ethereum Descending Broadening Wedge Upside Breakout is Confirmed on the 4hrs timeframe Chart..

$4,000 incoming

https://t.co/qrKE5jiXon pic.twitter.com/MLIXefVsd8

— Captain Faibik (@CryptoFaibik) March 25, 2024

However, the recent market conditions have posed challenges for Ethereum, with the asset experiencing a more than 15% drop over two weeks, further exacerbated by the broader Bitcoin market correction.

This decline saw ETH trading below the $3,500 mark, with a significant dip to $3,070 on March 20, amid reports of the SEC’s increasing interest in classifying Ethereum as a security.

Particularly, reports indicate that the commission has been seeking financial records from US companies engaged with the Ethereum Foundation, intensifying the debate over Ethereum’s classification. Such regulatory scrutiny casts a shadow over Ethereum’s path to $4,000, introducing uncertainty into its future.

ETF analyst James Seyffart suggests that the SEC’s stance could lead to the denial of spot Ethereum ETF applications by May 23, 2024. He cites a lack of engagement on Ethereum specifics, contrasting with the approach taken for Bitcoin ETFs.

My cautiously optimistic attitude for ETH ETFs has changed from recent months. We now believe these will ultimately be denied May 23rd for this round. The SEC hasn’t engaged with issuers on Ethereum specifics. Exact opposite of #Bitcoin ETFs this fall. https://t.co/TyAzAOrAC5

— James Seyffart (@JSeyff) March 19, 2024

Ethereum’s Network Activity: A Silver Lining

Despite these challenges, Ethereum’s network has witnessed notable growth, with increases in daily active users and transaction volumes signaling a bullish outlook for the cryptocurrency. An upsurge in network activity typically indicates heightened demand, a positive sign for Ethereum’s price potential.

From January 3, the number of daily active Ethereum addresses surged by over 46%, coinciding with a significant price rally. This increased activity and price appreciation period highlights Ethereum’s resilience and potential for growth, even in the face of regulatory uncertainties.

As Ethereum navigates through these regulatory and market challenges, the coming weeks will be critical in determining its ability to breach the $4,000 mark. The juxtaposition of technical bullish signals against the backdrop of SEC scrutiny presents a complex scenario for ETH.

However, the strength of its network and the increasing user engagement offer a glimmer of hope for Ethereum enthusiasts and investors.

Featured image from Unsplash, Chart from TradingView