The decentralized crypto exchange (DEX) is facing “inquiries” in the United States stemming from an October 2022 heist, according to posts in the project’s Discord server. Now the DEX’s governing body, called MangoDAO, is voting on whether to appoint a representative who can triage “U.S. regulatory matters” on its behalf.

If a Bitcoin ETF Is Approved, Here’s What May Happen

This week marked the 15th year since the genesis block was mined on Bitcoin and for 10 of those years industry stalwarts pleaded with the SEC to approve a spot bitcoin ETF. So far, the SEC has rejected every spot ETF application, but that may be about to change.

SEC asks court to consider Terraform Labs ruling in Binance case

The commission argued a summary judgment in its favor against Terra provided “further grounds” on which a judge could consider denying a motion to dismiss from Binance.

SEC has been ‘backed into a corner’ on BTC ETF approval — Bloomberg analyst

A go-ahead from the U.S. Securities and Exchange Commission could trigger $10 billion in inflows to Bitcoin ETFs in the first year, says Bloomberg’s James Seyffart.

Grayscale and VanEck latest to register with exchanges for spot Bitcoin ETF shares

Grayscale and VanEck filed registrations to list shares of spot Bitcoin exchange-traded funds on NYSE Arca and the Cboe BZX Exchange, respectively.

Crypto Analyst Predicts Bullish Hammer For XRP In Upcoming Move

In the ever-fluctuating world of cryptocurrencies, crypto analyst CryptoWzrd has expressed an optimistic prediction for XRP, while highlighting a potential bullish hammer for the crypto asset.

A Bullish Hammer For XRP Could Take Place

The cryptocurrency analyst recently took to X (formerly Twitter) to share the projections with the entire crypto market. The analyst predictions were made using the daily technical outlook of XRP.

With a clear observation of the chart, CryptoWzrd noted that XRP could be ready to form a bullish hammer. However, for this pattern to take place, a bullish candle must appear today, January 4.

Following the prediction, CryptoWzrd noted that the XRP/BTC chart is demonstrating strength against the bears. In addition, it has recovered the majority of its loss and ended the day with a promising pin bar.

The analyst was upbeat about XRP’s potential to take control and highlighted that a strong rebound could push the token higher. However, he alluded to the impact of outside variables hindering this rebound, particularly the potential threat of unfavorable SEC news regarding ETFs.

CryptoWzrd’s predictions came amidst a notable disruption in the crypto market that took place yesterday. The disruption saw Bitcoin (BTC) plummeting to about $40,000, while XRP fell to nearly reach the October 2023 lows of $0.50.

After recovering to a level around $0.57, CryptoWzrd anticipates that a rebound from this area could indicate the daily lower high trendlines’s breaking point. As a result of this, the crypto asset could therefore push closer to and over the $0.7300 mark.

In the crypto analyst’s opinion, the strength displayed by the XRP/BTC chart is one major reason behind the optimistic outlook. According to CryptoWzrd, this strength surrounds the positive viewpoint that XRP may orchestrate the bullish rise.

The Analyst’s Thoughts From The Intraday Angle

CryptoWzrd further turned his attention to the intraday chart while anticipating the next move. The expert noted that his “primary attention” will be on the intraday chart today which he will be looking for a scalp.

While acknowledging the volatility that occurred on Wednesday, the analyst has forecasted that it will continue today. However, in spite of the uncertainties, CryptoWzrd has expressed optimism and plans to make another trade.

So far, the expert has stressed that two crucial factors will determine XRP’s final trajectory. These include the path that Bitcoin takes and the fundamental data that could emerge in the coming days.

As of the time of writing, XRP was trading at $0.578, indicating an over 8% decline in the past 24 hours. Meanwhile, its market capitalization is also down by over 8% over the past 24 hours.

Despite the drop in price and market cap, the token’s trading volume appears to have increased significantly over the past day. Data from CoinMarketCap shows that the crypto asset’s trading volume is up by 153.49% as of the time of writing.

Will 2024 Be the Year of the Bitcoin ETF?

Excitement over a spot bitcoin ETF – a regulated financial product that would give institutional and retail investors easier exposure to bitcoin’s price without requiring them to invest directly in the asset – continues to grow.

Bitcoin Price Reclaims $43,000 On Rumor Of ETF Approval Tomorrow

In a strong turnaround from yesterday’s flash crash, the Bitcoin (BTC) price has staged a recovery, breaching the $43,000 mark. This surge comes after yesterday’s intense volatility, where the cryptocurrency giant witnessed an over 11% flash crash following a controversial report from Matrixport.

The report suggested a potential rejection by the US Securities and Exchange Commission (SEC) of the much-anticipated spot Exchange Traded Funds (ETFs), triggering the second-largest liquidation of long positions in the past year. Bitcoin’s price plummeted to as low as $41,500.

However, Bitcoin is today stabilizing above $43,000, influenced by a combination of factors. Notably, several experts have disputed the Matrixport report’s validity. Adding to the positive sentiment, a significant SEC related update has caught the market’s attention.

Bitcoin ETF Tomorrow?

According to a report by Fox Business, SEC staff attorneys from the Division of Trading and Markets were engaging in crucial discussions with representatives from major exchanges such as the New York Stock Exchange, Nasdaq, and the Chicago Board Options Exchange on Wednesday. This engagement is significant as it pertains to the approval of several Bitcoin ETF applications.

The meetings are seen as a positive sign that the SEC is nearing approval of some or all of the dozen applications by major money managers and crypto firms for the product. An anonymous source familiar with these developments stated, “While the final decision has not been made, sources close to the proceedings say the SEC could begin notifying issuers of approval on Friday with trading beginning as early as next week.”

Bloomberg ETF analyst James Seyffart commented on Eleanor Terrett’s report from Fox Business via X, stating: “My view is in line with Eleanor Terrett’s reporting. I think the SEC could begin signaling to issuers to expect approvals tho I’m still expecting official approvals Jan 8 – 10. I also think the gap between approval orders and actual trading will be measured in days — not weeks.”

Echoing Seyffart’s views, Eric Balchunas, his colleague at Bloomberg, commented, “Things you prob don’t do if you going to deny or delay. Hearing similar btw, and why why when we see updated (final) 19b-4s roll in that is sign approval imminent as SEC has been doing back and forth w issuers offline to perfect their 19b-4s vs doing numerous refilings a la S-1s.”

Scott Johnsson, a finance lawyer at Davis Polk, weighed in on Balchunas’ statement: “In every past ETF wave, the SEC did not do this. Why? Because (1) this takes up a ton of SEC resources and (2) makes it MUCH harder to successfully survive judicial scrutiny (and after Grayscale, this is like drawing blood from a stone). If you intend to deny, you just deny.”

BTC Price Remains Ultra Bullish

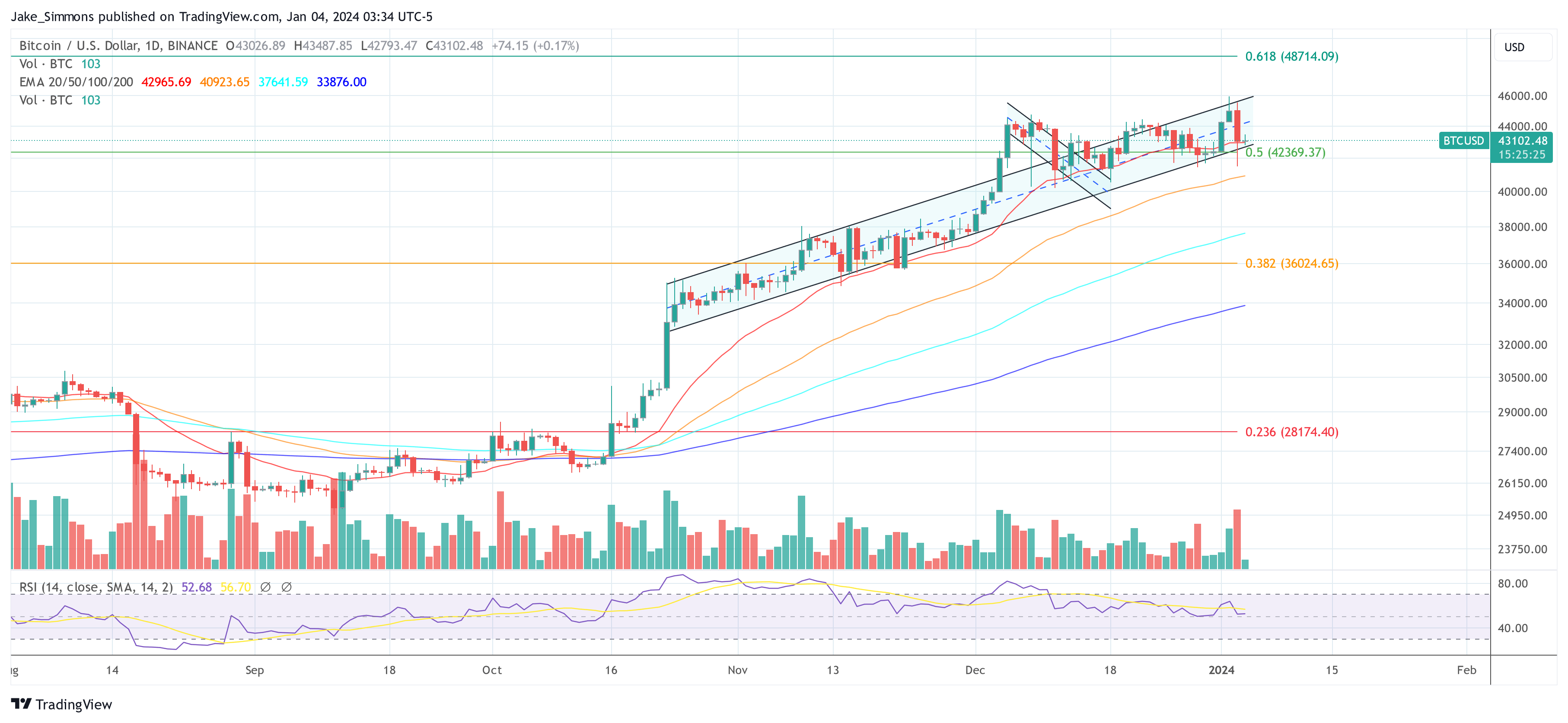

In light of these developments, the cryptocurrency market remains cautiously optimistic, with indicators strongly pointing towards an ETF approval by January 10, potentially even as early as January 5. Notably, the Bitcoin price has closed its daily candle within the uptrend channel, established in mid-October. At press time, BTC traded at $43,102.

Forget The SEC And Bitcoin ETF Approval Drama, Here’s Why Bitcoin Flash Crashed

The recent flash crash of Bitcoin from over $45,500 to as low as $41,100 has sent shockwaves throughout the crypto community, sparking debate over the underlying causes. While some have attributed the crash to unconfirmed rumors that the US Securities and Exchange Commission (SEC) might, after all, not approve Bitcoin ETFs in January, The Wolf Of All Streets on X suggests a different explanation.

Blame The High Funding Rate For The BTC Crash

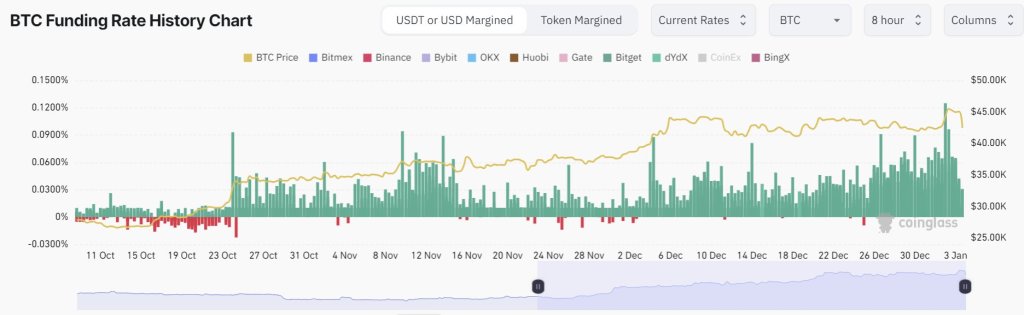

The analyst points to the ultra-high positive funding rate on perpetual futures contracts as the primary culprit. In crypto perpetual trading, the funding rate is a mechanism that adjusts the price of futures contracts to reflect the difference in the spot price of the underlying asset, in this case, Bitcoin.

In recent months, the funding rate, according to Coinglass, had surged to multi-month highs, reaching an annualized rate of 66% on January 2, as The Wolf Of All Streets noted, before today’s crash.

With Bitcoin trending higher, a large influx of long positions on Bitcoin’s perpetual futures contracts drove the funding rate to monthly highs. Expanding Bitcoin prices created an imbalance in the market, with more people paying to be long than short. As a result, when the price of Bitcoin began to decline rapidly, exchanges had to unwind long positions, triggering a wave of liquidation.

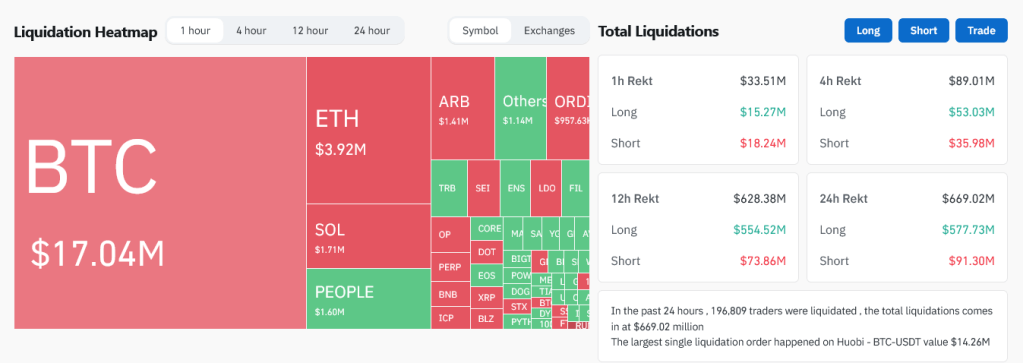

As of January 3, records from Coinglass show that over $669 million were liquidated. Most of these positions were long, at around $577 million, with only approximately $91 million being shorts. Overall, OKX closed the most positions with $292 million longs closed. Binance, Huobi, and Bybit also closed many long positions.

Will Bitcoin Degens Arrest The Sell-Off?

According to The Wolf Of All Streets, the recent flash crash was not a natural market event but an intentional move orchestrated by “degens.” Based on the analyst, the unusually high funding rate as of early January 3 created a situation where long positions, amplified by leverage, had to be liquidated for equilibrium to be reinstated in the Bitcoin market.

The analyst’s comments echo those of other market observers who have warned of the potential for blow-ups in the perpetual futures market due to the high leverage and funding rates involved. These warnings have become more significant in light of the recent flash crash.

How prices will react going forward is unclear. However, what’s clear is that bears appear to be in control in the short term. The recent sell-off is at the back of high trading volume that may see the coin track lower, towards $38,000 or lower, in the coming sessions.

Bitcoin ETF Looks Very Likely Given These Bureaucratic SEC Steps

We see a 98% chance of approval in the next couple of weeks and the high likelihood of a Bitcoin rally to follow.

Bitcoin Crashes To $41,500 As ETF Approval Hangs In Balance: Experts

As the January 10 deadline for the US Securities and Exchange Commission (SEC) to decide on a series of spot Bitcoin Exchange-Traded Funds (ETFs) approaches, the market is rife with speculation.

Initially, there was a strong consensus for approval, but recent expert analyses suggest a possible change in course. Meanwhile, the Bitcoin price has crashed by 6.5% in 20 minutes, dropping from $44,400 to $41,500.

1. Bloomberg’s Insight: A Matter of Timing, Not Denial

Bloomberg’s ETF expert, Eric Balchunas, assessed a mere 10% chance of the ETFs not being approved, primarily due to the SEC requiring additional time to review the proposals. This perspective is critical because it implies that the SEC is not outright opposed to the idea of a spot Bitcoin ETF, but is cautious in its approach.

Related Reading: Bitcoin ETF: SEC May Notify Approved Issuers To Launch Very Soon – Here’s When

Balchunas commented, “I would say if we don’t see it in the next two weeks, it’s more because they need more time,” indicating that a delay in approval should not be interpreted as a final rejection.

His colleague, James Seyffart, provided further insights, noting, “Still looking for potential approval orders in that Jan 8 to Jan 10 window. […] We’re focused on these 11 spot Bitcoin ETF filers […] Expecting most of these N/A’s to be filled over the next ~week,” highlighting the dynamic nature of the situation.

2. Matrixport’s Pessimistic Outlook: A Delay To Q2 2024

Matrixport offers a more cautious outlook, anticipating that the SEC’s approval of Bitcoin ETFs might be deferred until the second quarter of 2024. This analysis hinges on a combination of regulatory challenges and the prevailing political climate under SEC Chair Gary Gensler‘s leadership.

The report states, “The leadership of the SEC’s five-person voting Commissioners, predominantly Democrats, influences the decision-making process. With Chair Gensler’s cautious stance on crypto in the US, it seems unlikely that he would endorse the approval of Bitcoin Spot ETFs in the near term.”

The firm further explains that despite the ongoing interactions between ETF applicants and the SEC, resulting in multiple reapplications, there remains a fundamental requirement unmet that is crucial for the SEC’s approval. This requirement, although unspecified in the report, is suggested to be a significant compliance or regulatory hurdle that could be addressed by the second quarter of 2024.

The potential delay or rejection of the ETFs, according to Matrixport, could have a notable impact on Bitcoin’s market value. They predict a possible 20% correction, with prices potentially falling to the $36,000 range.

Furthermore, Matrixport suggests that such an outcome could lead to a swift unwinding of market positions, particularly the $5.1 billion in additional perpetual long Bitcoin futures.

The report advises traders to consider hedging their positions if no approval news emerges by January 5, 2024, suggesting the purchase of $40,000 strike puts for the end of January or even shorting Bitcoin through options.

3. Greeks Live’s Analysis: Decreasing Confidence

Greeks Live, focusing on crypto options trades, has observed a shift in market sentiment, with a decreased likelihood of the ETF’s passage. They report a significant decline in the ATM option IV for the week and below 65% for the January 12 expiration, indicating reduced market expectations for the ETF approval.

The report notes, “Current month puts are now cheaper, and block trades are starting to see active put buying, with options market data suggesting that institutional investors are not very bullish on the ETF market.”

A possible delay or rejection of Bitcoin ETFs carries significant market implications. The anticipation of ETF approval has been a major driving force in recent market dynamics, leading to increased investments. A decision against the ETFs could result in a rapid unwinding of these positions, potentially causing a sharp decrease in Bitcoin prices.

At press time, BTC had already recovered some of its losses and was trading at $42,450. This means that the price has once again returned to the upward trend channel in the 1-day chart that was established in mid-October last year.

Bitcoin Spot ETF Proposals to Be Rejected by SEC: Matrixport

“SEC Chair Gensler is not embracing crypto in the U.S., and it might even be a very long shot to expect that he would vote to approve bitcoin spot ETFs,” Matrixport said.

Bitcoin At $45,000 Is Mispriced, Will Race For ETF Fees Push Prices To Record Highs?

Most analysts are optimistic that the impending launch of spot Bitcoin exchange-traded funds (ETFs) in the U.S. could propel the coin to new heights, way above the $69,000 mark registered in November 2021.

Andrew Kang, co-founder of Mechanism Capital, believes that Bitcoin at $45,000 is still grossly undervalued. This is given the anticipated influx of institutional investment from ETFs, and the effort issuers will put into marketing their products as they aim to accrue billions in fees in the months ahead.

Learning From Gold And Quest For Fees

Kang points to gold ETFs, which hold over $120 billion in assets under management (AUM) and generate an estimated $720 million in annual fees for their issuers. ETF issuers will charge a management fee to cover the costs associated with operating the ETF, including custody of coins and trading. Additionally, a fee will be charged through the bid-ask spread whenever Bitcoin is traded.

When trading and management fees are stacked, Bitcoin issuers could generate billions of dollars yearly, especially if trading volume is high. By Kang’s estimation, Bitcoin ETF issuers might generate between $10-20 billion in annual fees.

However, this is subject to dominance. After the Securities and Exchange Commission (SEC) approves multiple spot ETFs, issuers, including BlackRock and Fidelity, are expected to wage an aggressive battle for market share.

The goal for issuers is not only to ensure that funds spent on advertising yield, but for every dollar spent, more is generated into the future. This is critical because investors are less likely to switch once they choose an ETF, making early dominance crucial for long-term revenue generation.

Is Bitcoin Ready For A 10X?

According to observers, issuers will promote Bitcoin at every opportunity. This is why ChainlinkGod while responding to Kang’s post on X, thinks Bitcoin will also likely track 10X in the sessions ahead since all issuers are “inherently long” on Bitcoin.

Looking at price charts, Bitcoin continues to edge higher, recently rising to as high as $45,800, according to price data. At this pace, BTC bulls extended gains of 2023. This will be as the community expects the SEC to approve the first Bitcoin ETFs. Even so, it is unclear when the agency will greenlight this product immediately.

BTC has critical support at around the $44,000 zone, marking 2023 highs. If bulls maintain prices above this line, the odds of the coin rising to $50,000 in a buy trend continuation pattern will likely increase.

Bitcoin ETF: SEC May Notify Approved Issuers To Launch Very Soon – Here’s When

According to a recent report from Reuters, the US Securities and Exchange Commission (SEC) may notify the asset managers looking to launch a spot Bitcoin ETF (exchange-traded fund) if their applications have been approved as soon as next week.

SEC To Notify Applicants Of Its Decision By Next Week: Reuters

On Saturday, December 30, Reuters reported that the SEC may notify the 14 Bitcoin ETF applicants if their applications will be approved by Tuesday or Wednesday next week. This move would come ahead of the January 10 deadline for the agency to decide whether or not to green-light the ETF application by Ark Invest and 21Shares.

Citing people familiar with the process, Reuters highlighted that asset managers that met their end-of-the-year filing revision deadlines may be able to launch by January 10, 2024. Some of the firms that recently updated their Bitcoin ETF filings with the SEC include Black Rock, Van Eck, Bitwise, WisdomTree, Invesco, Valkyrie, and Fidelity.

Notably, Fidelity Investments revealed more information and technical details about its potential ETF product in its S-1 form update. The asset management firm hopes to beat fellow applicants in winning investors over by proposing the lowest sponsor fee at 0.39%.

Invesco announced a 0.59% rate while offering a fee waiver on the first $5 billion in assets within the first six months after launch. Meanwhile, BlackRock, the world’s largest asset manager and a frontrunner in the Bitcoin ETF race, unveiled Jane Street Capital and JP Morgan Securities as its authorized participants in its updated application.

From the latest development, it seems the SEC is looking to wrap up the Bitcoin ETF chapter as soon as the new year arrives. Nonetheless, Reuters’ latest report adds optimism to the possibility of the agency approving several ETF applications by January 10.

How Bitcoin ETF Approval Could Impact Price

There have been wide speculations on the possible effects of the ETF approval on the Bitcoin asset. Options platform Greeks.live has offered insight into the potential impact of the exchange-traded fund on the value of the premier cryptocurrency.

There is news in the market that the SEC will pass the Bitcoin Spot ETF application as early as next Tuesday, but there was little volatility across the major term IVs and the price.Looking at the options data, Jan12 options IV, which is strongly correlated to the ETF, fell… pic.twitter.com/f1B4ZPC05d

— Greeks.live (@GreeksLive) December 31, 2023

Using options data, Greeks.live believes that the market has priced the potential approval of the Bitcoin ETF, and it may not yield greater returns for the asset. This means that the market has already factored in this information, and any positive development might not lead to significant price movement.

According to the platform, this reasoning is based on the little volatility observed across the major term implied volatilities (IVs) and the price of Bitcoin. For context, implied volatility reflects the market’s expectation of how much an asset will move in the future.

However, options IV on January 12, which is believed to be strongly correlated to the Bitcoin ETF, decreased rather than increased. This lack of volatility and decrease in implied volatility of options suggests that there may not be a substantial impact on the Bitcoin price, even with significant news on the horizon.

As of this writing, Bitcoin is valued at $42,154, reflecting a mere 0.4% in the past day. The price of BTC has increased by more than 150% this year, partly due to the anticipation of a Bitcoin spot ETF.

Invesco, Fidelity, BlackRock, Others Dot Their Bureaucratic I’s as Likely SEC Action on Spot Bitcoin ETF Looms

What to Expect From Bitcoin in 2024

Expectations that U.S. regulators will approve spot bitcoin ETFs next year are driving prices higher. History suggests we might see a slowdown as we approach the halving in April 2024, says Path Crypto’s David Liang.

Hashdex Names BitGo as Bitcoin ETF Custodian as Applicants Continue SEC Meetings

Would-be bitcoin exchange-traded fund (ETF) issuer Hashdex changed its paperwork Friday, naming BitGo as its bitcoin custodian and changing the name of its Bitcoin Futures ETF to the Hashdex Bitcoin ETF as it – and other companies – continue to hope for an approval for the U.S.’s first spot bitcoin ETF early in the new year.

SEC Blasts ‘Purportedly Decentralized’ DAOs in $1.7M Settlement with BarnBridge

BarnBridge failed to register its structured crypto product with the SEC, regulators alleged.

SEC Chair Gary Gensler: ‘Far Too Many Frauds and Bankruptcies’

Earlier this month, I had the opportunity to speak with U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler, recognized by CoinDesk as one of the most influential figures in the crypto industry over the past year, about how he views his agency’s role in the digital asset world.

South Korea’s Financial Regulations Chief to Meet SEC Chairman Gensler Next Month: Report

The two aim to strengthen cooperation on crypto regulations before South Korea’s new crypto laws go into effect next year.