Crypto-focused stocks also bounced higher, led by bitcoin miners Riot Platforms and Hut 8.

Crypto Stocks Like MicroStrategy, Coinbase Could Shoot Up if Short Sellers Exit

MicroStrategy and Coinbase’s stock prices could shoot up if short sellers bail out, according to a report by data analytics firm S3 Partners.

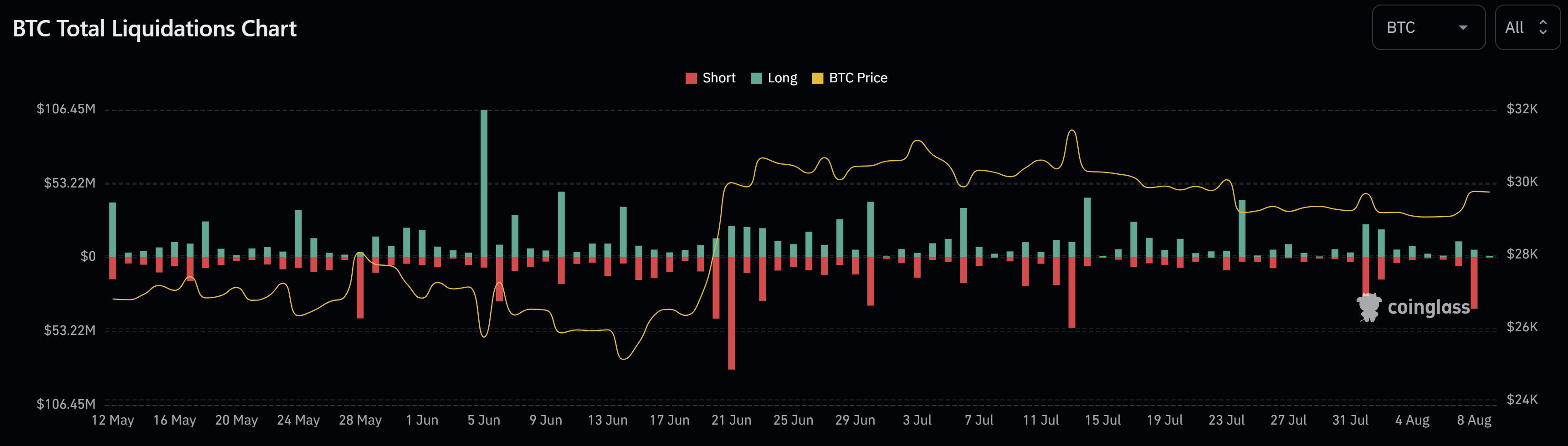

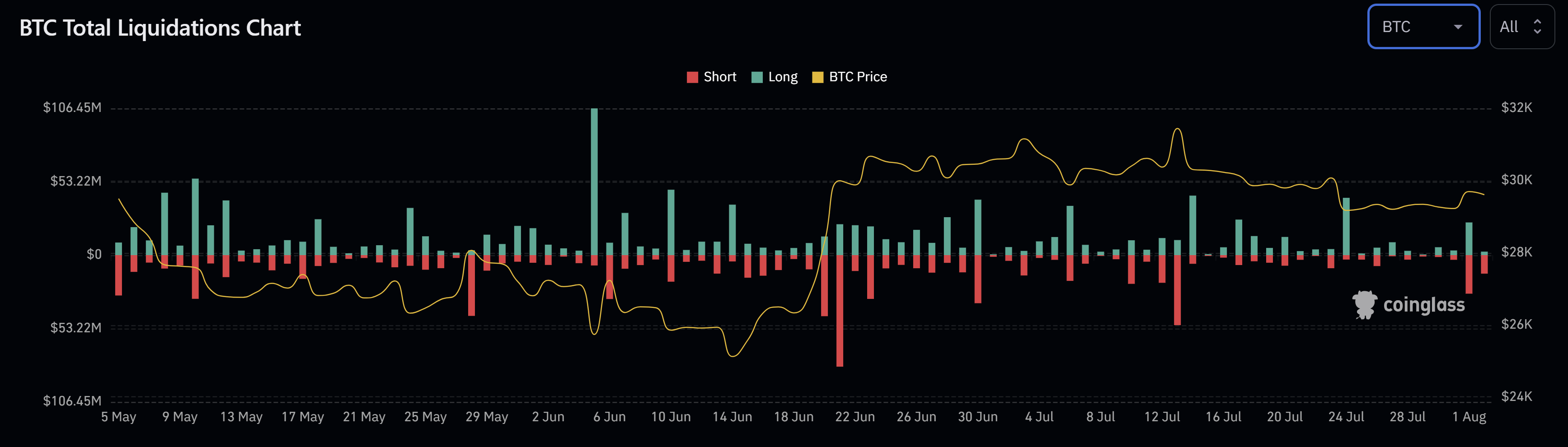

Crypto Price Whipsaw Triggers $256M in Liquidation Losses

This week’s quick plunge and rebound in cryptocurrency prices triggered $256 million in liquidation losses, Coinglass data shows.

Robinhood beats investors’ appeal in GameStop meme stock case

The appeals court judge said Robinhood “had the right” to impose restrictions on meme trade purchases.

Why Is Bitcoin And Crypto Surging Today?

In the last 24 hours, Bitcoin has experienced a 2% surge, pulling the broader crypto market along with it into a bullish trajectory. Leading the charge among altcoins are PEPE with an 8% gain, followed closely by SHIB and HBAR both at 6.3%, TON at 5.6%, SNX at 5.4%, and SOL at 5.3%. The overall crypto market capitalization has swelled to $1.18 trillion(+1.63%), while Bitcoin’s dominance in the market has edged up to 50.63%.

Why Is Bitcoin And Crypto Up Today?

The market’s euphoria was initially triggered by a news piece which was shared by Bloomberg’s Eric Balchunas. He conveyed that insider sources from BlackRock and Invesco suggest that the approval of a Bitcoin ETF is more a question of ‘when’ rather than ‘if’, likely materializing within the next four to six months. The source for this information was Galaxy Digital CEO Mike Novogratz who made these revelations during a recent earnings call.

This news, hinting at the imminent approval of a Bitcoin ETF, sent ripples across the Bitcoin and crypto community, igniting optimism and speculation. Following the news, whale activity has also been a notable driver behind the surge.

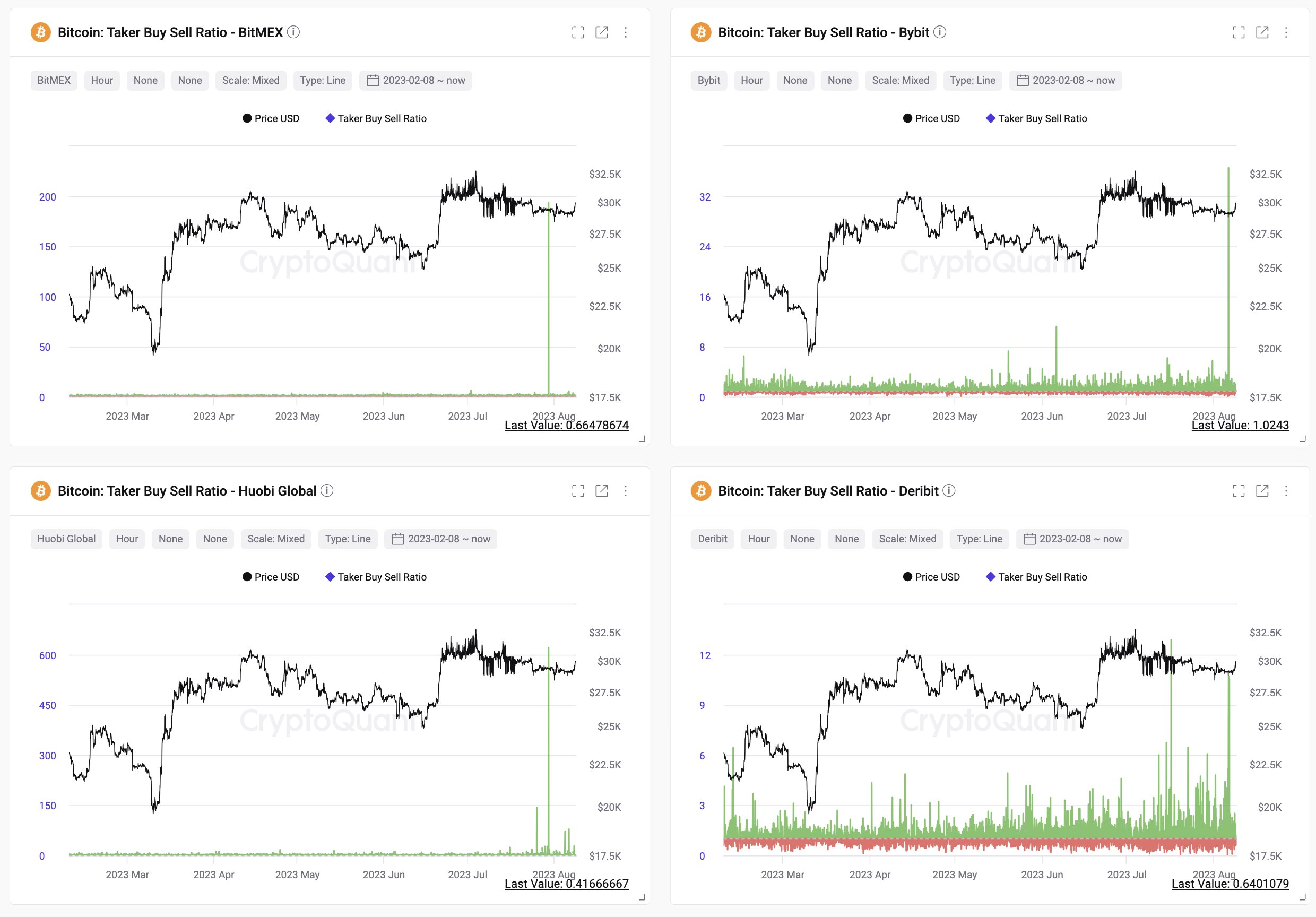

Ki Young Ju, CEO of CryptoQuant, tweeted: “Bitcoin whales opened giga long positions at $29k.” He also shared screenshots of the taker buy sell ratio on BitMEX, ByBit, Deribit and Huobi Global. Each chart shows an extremely high and sudden jump in buying volume, presumably from whales, as Ju said.

Ali Martinez, a renowned analyst, chimed in on the significance of open interest. He pointed out that the Open Interest, which represents the total number of open long and short positions across all crypto derivative exchanges, has reached a remarkable year-to-date peak of $10.086 billion.

This metric is particularly noteworthy given its historically strong correlation with Bitcoin’s price. The recent dip in Bitcoin to $28,700 seems to have presented an opportune moment for traders to adopt a bullish stance, suggesting that Bitcoin’s price might be poised for an upward trajectory

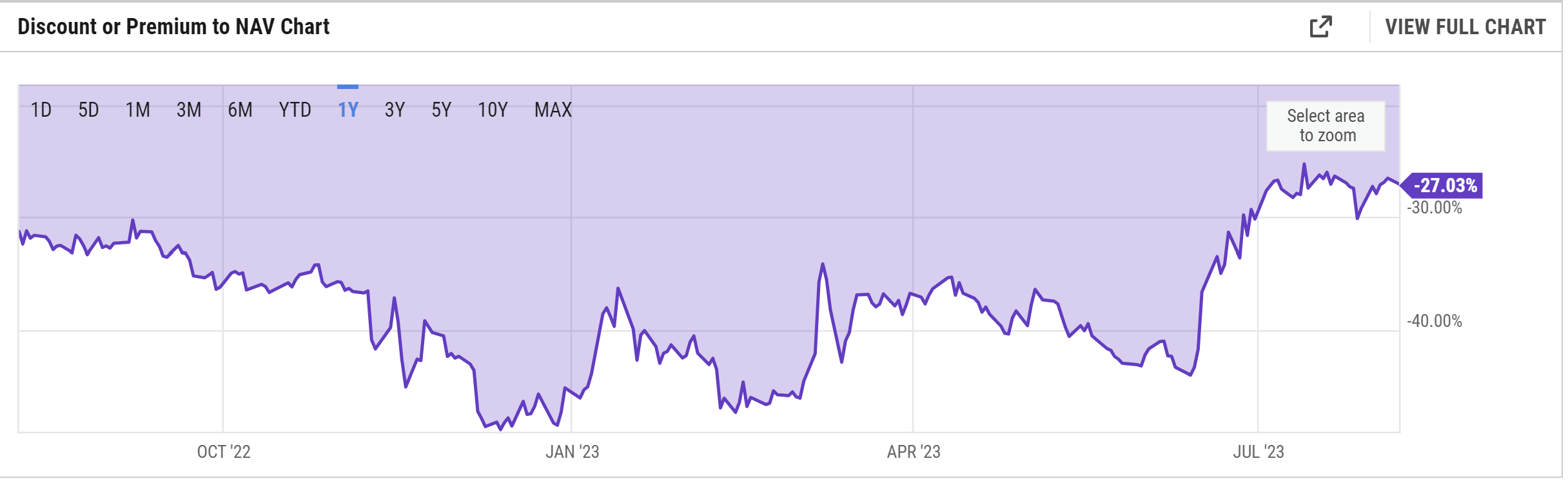

Julio Moreno, from CryptoQuant, noted a sharp rise in Coinbase’s premium, indicating strengthening Bitcoin demand in the US. This observation aligns with the narrowing discount of GBTC, which many see as a proxy of Grayscale’s potential success against the US Securities and Exchange Commission (SEC) in its lawsuit for a spot ETF, but also as an indicator of the likelihood of a Bitcoin Spot ETF being approved. The GBTC discount fell to -27% yesterday.

From a technical market perspective, the euphoria in the market has led to a short squeeze. A total of $37.19 million was liquidated in BTC shorts yesterday, $65.46 million in the overall crypto market. The short liquidations for Bitcoin were the highest since July 13 when the price rose to its yearly high at $31,820.

Nevertheless, it is worth noting that while short-sellers were gradually liquidated while there was a premium on spot markets and funding rates on futures markets were falling. This means that the rise move was primarily driven via the spot markets rather than over-leveraged long positions. Remarkably, whales played a key role.

At press time, the Bitcoin price faced critical resistance between $29,900 and $30,000.

Why Is Bitcoin Price Up Today?

Bitcoin (BTC) saw a significant resurgence over the past few hours after hitting the lowest price since June 21 at $28,641 yesterday. At press time, BTC has experienced a 3.7% hike from its low. In fact, BTC even brushed past the $30,000 mark, indicating a substantial shift in market sentiment. So, the question begs.

Why Is Bitcoin Up Today?

“The entire short build-up of the past couple days just got wiped,” tweeted analyst Byzantine General. Data from Coinglass backs this claim and shows that BTC short positions amounting to $27.8 million were liquidated yesterday, followed by an additional $13.45 million today. This accounts for the most significant short liquidation since July 14, undeniably playing a significant role in the current price movement.

But perhaps the most influential reason for the sudden shift in market sentiment was MicroStrategy’s recent announcement. The company stated that it will conduct stock sales worth $750 million. After the announcement, the Bitcoin community was abuzz with speculation that Michael Saylor might make additional, gigantic BTC purchases.

“As with prior programs, we may use the proceeds for general corporate purposes, which include the purchase of Bitcoin as well as the repurchase or repayment of our outstanding debt,” said Andrew Kang, MicroStrategy’s CFO during a recent earnings call. While it remains unclear if the entire proceeds will be funneled into Bitcoin, the likelihood of a substantial chunk is certain. Directly after this announcement, Bitcoin surged by 1.6% within one hour.

On-chain analysis firm Santiment tweeted: “Bitcoin has breached back above $30k once again, with assistance from the many traders who capitulated during the past week of price declines. Volume is rising to kick off August, & this psychological resistance cross may shift sentiment positive.”

The chart shared by the firm shows that yesterday trading volume picked up steam again, rising to the highest level since six weeks. Also, the lowest amount of profit / loss taking in 7 months indicates a capitulation event.

Analyst @52Skew added that the Bitcoin on the Binance spot market experienced a “real spot demand” which he wanted to see for a strong price reaction. “Note the limit bid wall that pushed up price; typical with PvP conditions to force limit chasing. Marked notable liquidity on the orderbook,” the analyst stated.

What’s Next?

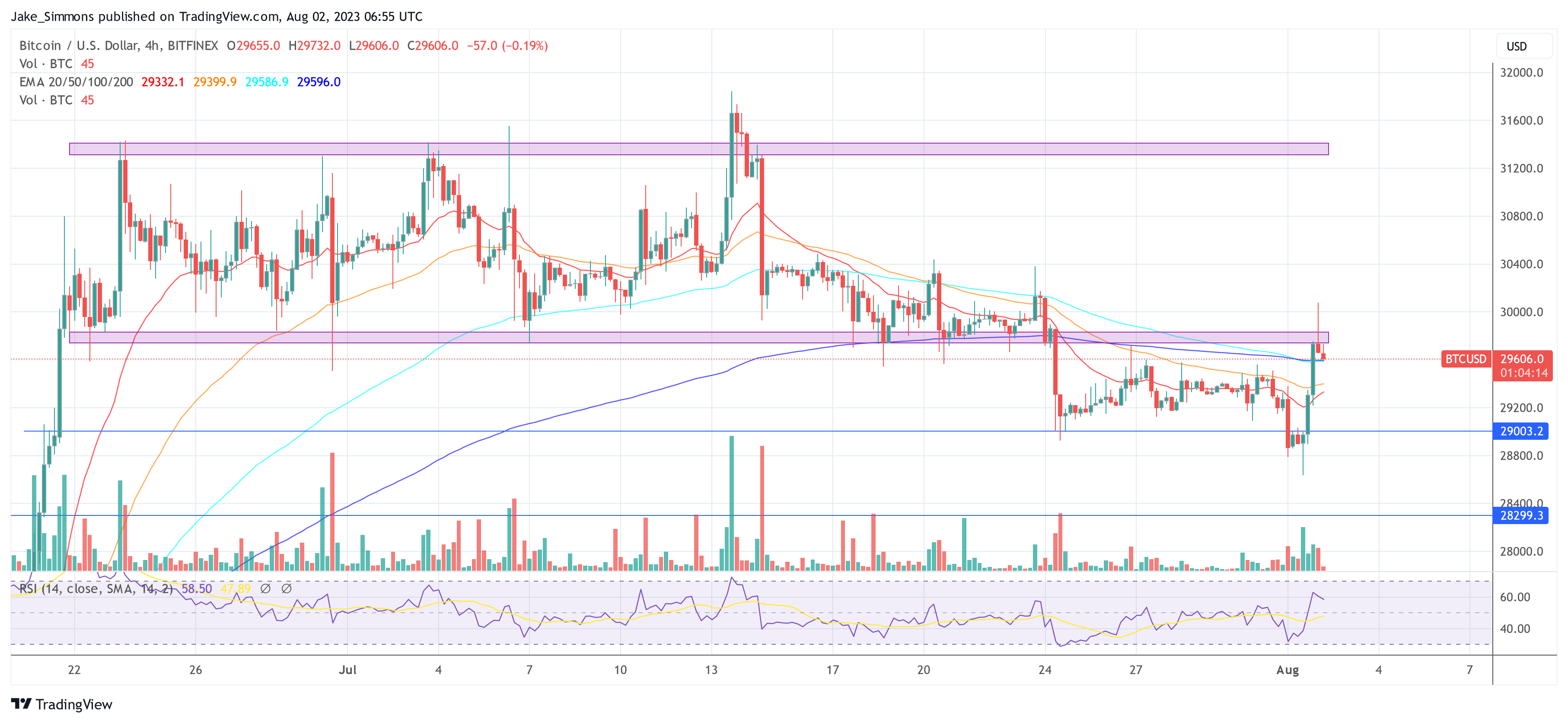

However, he also cautioned that the 4-hour chart is so far looking like a classic Swing Failure Pattern (SFP) into a higher time-frame support / resistance. The Swing Failure Pattern, or SFP, is a type of reversal pattern where traders target stop-losses above a key swing low or below a key swing high to manipulate the price direction by generating enough liquidity.

Nevertheless, the market appears to be brimming with anticipation. As per @DaanCrypto: “If price starts ranging here I’d look for another sweep of the lows and consolidation there. $28.5 & 29.5K are the areas of interest.” Meanwhile, a break above the resistance zone at the monthly and weekly open between $29,236 and $29,300 would validate a bullish scenario where the price targets $30,000.

At press time, BTC wasn’t able to reclaim the red resistance zone and was trading at $29,606.

Bitcoin’s Rally to $28K Causes the Largest Short Squeeze This Month

The price surge liquidated some $34 million of short positions in the past 24 hours, the most this month, CoinGlass data shows.

Ripe for the squeeze? Bitcoin mining stocks remain under attack from short sellers

BTC price has struggled for nearly a month, but Bitcoin miners revenue is up, calling into question the logic of short sellers betting against mining stocks.

Bitcoin, Ethereum Open Interest Suggests A Squeeze Is Coming

The two largest cryptocurrencies by market cap, Bitcoin and Ethereum, have seen a significant rise in their open interest in the last couple of weeks. This comes even when the market is seeing struggling prices and investors have begun to take more conservative positions in the market. The drastic increase in the open interest across these two cryptocurrencies could have some significant implications for the crypto market as a whole.

Ethereum Spikes With Bitcoin

Bitcoin open interest has been on the rise over the last couple of weeks, which has led to some interesting forecasts for the digital asset, and now, Ethereum has begun following the same trend. Over the last week, the Ethereum open interest relative to market cap had surged alongside that of bitcoin.

Both digital assets had actually hit new all-time highs in this regard, beating June 2022 levels. Bitcoin had risen to 3.21% while Ethereum had peaked at about 4.24% during the same time period. So ETH is seeing even more extreme figures compared to bitcoin.

To put this in perspective, the open interest to market cap ratio of ETH compared to BTC since 2019 has always sat at around 0.46%, representing a fairly small margin. However, this had changed in the last two years and the gap is ever-widening.

BTC and ETH open interest reach new ATH | Source: Arcane Research

The Ethereum Merge had been the main reason behind this spike. Since interest in the second-largest cryptocurrency had peaked as the upgrade drew closer, institutional investors had begun to set up shop in Ethereum, leading to the wide gap that is now being observed.

Short Squeeze Incoming?

A spike in open interest, especially one that hits all-time high levels, has always had massive implications for the crypto market, even if just in the short term. The current levels suggest that derivatives in both digital assets are very high at the moment, leading to extreme leverage levels.

BTC price settles above $19,000 | Source: BTCUSD on TradingView.com

With such high levels, it is important to keep in mind that while a short squeeze is more likely, it could go either way. Eventually, the leverage levels will begin to wind down, which is when the squeezes are expected to happen. Whatever way they swing in the end, the implications will be just as brutal for the market.

Large market volatility and instability will be the order of the day when this happens. For investors, this is a time to take fewer risks to avoid being caught in this meltdown. The established bear trends and such extreme levels of leverage can be a recipe for disaster.

Featured image from CoinDesk, charts from Arcane Research and TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…

Bitcoin Perpetual Open Interest Suggests Short Squeeze Led To Crash

The Bitcoin crash of last week was a brutal one for the market. It saw the digital asset lose its footing from where it had been trending just below $30,000 to crash to the mid $17,000s before a recovery had begun. With the new week, the market had started to emerge into the green. But as bitcoin struggles to hold above $20,000, the question remains what had triggered such a crash.

A Short Squeeze

The bitcoin open interest in perps had been up over the last couple of weeks. This has continued to be the case through the market crash and the subsequent recovery. However, the open interest levels, mainly the rise and falls, leading up to and during the bitcoin crash have all of the makings of a short squeeze.

Related Reading | By The Numbers: The Worst Bitcoin Bear Markets Ever

On Wednesday, the open interest in bitcoin perps had eventually peaked at a new all-time high of 335,000 BTC after a week of unpredictable movements. This was when bitcoin had declined below $21,000. As the price of the digital asset had begun its recovery, the open interest in perps had quickly declined. Movements like these are associated with a short squeeze, which was the same in the case. One that preceded another crash during the weekend.

Open interest remains elevated | Source: Arcane Research

The same was the case over the weekend. The open interest in perps had once again surged, to 325,000 BTC this time, after erratic movement when the price declined to the mid $17,000s. Another decline in the open interest has since been recorded as the price of BTC has recovered, albeit slower this time around.

Bitcoin Perps Trading At A Discount

Bitcoin perps are still trading at a discount compared to the spot prices. This is no surprise given that the bitcoin funding rates have stayed neutral to below neutral even through the crash and the massive sell-offs. Additionally, there has been nothing significant that has happened in regards to the bitcoin perps through the crash and eventual recovery,

Funding rates below neutral | Source: Arcane Research

Interestingly, the funding rates have now remained below neutral with the price of BTC struggling above $20,000. One place where funding rates have had the most impact has been on Deribit. Since it is rumored to be closely intertwined with Three Arrows Capital (3AC), the decline in funding rates triggered insolvency fears and rumors tied to the crash of 3AC.

Related Reading | Bitcoin Miner Liquidations Threaten Bitcoin’s Recovery

However, it is important to note that Deribit has assured the public that it remains financially healthy even if the 3AC debts were forfeited. As the market has begun to move on from last week’s crash, the funding rates have begun to stabilize, although they remain slightly below neutral.

BTC declines to mid-$20,000s | Source: BTCUSD on TradingView.com

Featured image from CNN International, charts from Arcane Research and TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…

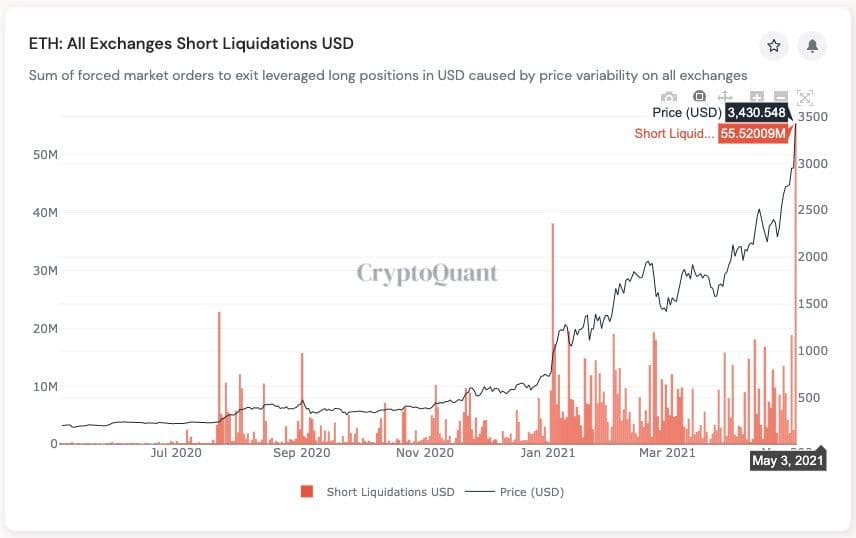

Epic Ethereum Short Squeeze Pushes Rally To New ATH

For the last few days, Ethereum has been adding incredible returns for investors. According to CoinMarketCap, on Monday, ETH added over 16% pushing the coin to a new record of slightly over $3,450. At the time of writing, the coin was trading at around $3,470, a gain of 9.43% over the last 24 hours.

Ethereum Short Squeeze Is Responsible For The Rally

A short squeeze refers to when short-sell orders in the futures market are liquidated in a short period of time. When the shorts are liquidated, short-sellers will have to buy back their positions. This automatically causes buyer demand to increase in the market.

Hence, the number of shorts rapidly declines, and long contracts or buy orders begin to dominate the market.

In the case of Ethereum, the last 24 hours has seen all-time high short liquidations across all derivative exchanges. According to cryptoanalysis firm, CryptoQuant, the cryptocurrency liquidations reached about $55 million in exit leveraged long positions causing the price to surge to a new record high.

As a result of the increased volatility, Ethereum (ETH) saw its market capitalization spike to almost $400 billion. Notably, its daily average traded volume stood at approximately $72.7 billion according to metrics provided by CoinGecko.

According to the chart, higher support is required to keep the bears at bay and allow bulls to focus on price levels above $3,500 and $4,000, respectively. The Moving Average Convergence Divergence (MACD) suggests that Ethereum is firmly in the bulls’ hands.

Related article | $150 Million In Short Squeeze Liquidated As Bitcoin Scales Above $53,000

Ethereum Continues To Enjoy Acceptance

Ethereum, the second-largest digital asset by market capitalization, has earned a warm welcome from institutional investors, owing to its massive DeFi supremacy. Coincidentally, Ethereum began to eat away at Bitcoin’s market share, with the latter having about 44.6 percent against 16.7% for ETH. The average amount of ETH gas is 39 gwei.

After a two-week period of consolidation, the cryptocurrency bulls were re-energized by a surge in the price of Ethereum. The cryptocurrency market, however, is in a super-cycle. According to Dan Held, a prominent cryptocurrency analyst, and will continue to rise in the coming months.

“Money printers go Brrrr…Bitcoin was planted during the 2008 financial crisis as an antidote to bad central banking policy, but it has grown during a macro bull run (largely no recessions or depressions from 2008 – 2020),” Held noted.

He further added that:

“With Bitcoin’s current 4-year microcycles coinciding with the longer macro ~10-year cycles, that puts Bitcoin in a potential Supercycle. This is similar to Ray Dalio’s observation of short and long-term debt cycles but on an accelerated timeline.”

For most decentralized financial networks, the Ethereum ecosystem is considered a pioneer in the smart contract market. DeFi networks, such as Uniswap DEX, is based on the Ethereum ecosystem and manages the majority of daily cryptocurrency transactions.

“Thousands of developers are building applications that recreate traditional financial products in decentralized ways on top of Ethereum, and as more and more users pour in to interact with these apps, they require ETH (ether) to conduct any transaction,” said Sergey Nazarov, co-founder of smart contract company Chainlink.

“Second, there seems to be growing institutional interest in the public Ethereum blockchain, as stakeholders play around with ways to leverage the public network,” he added.

It’s also interesting to note that Ethereum’s co-founder, Vitalik Buterin, has made it the list of the world’s youngest cryptocurrency billionaires. The 27-year-old programmer’s crypto holding soared to higher levels as Ethereum price hit new record highs.

With a balance of over 333,520.81+ in his public Ether wallet, Buterin valued crossed the billion dollars when this cryptocurrency reached $3,000. Store at address 0xAb5801a7D398351b8bE11C439e05C5B3259aeC9B since September 8, 2015, Buterin’s lowest value in USD terms stood at $0,12 on November 19 of that year and stands at $1,044,090,315.14 today, according to Etherscan data.

Related article | Ethereum Rally Extends Above $3,400, Why Dips Remain Attractive

Featured image from Pixabay, Charts from Tradingview.com and CryptoQuant.

$150 Million In Short Squeeze Liquidated As Bitcoin Scales Above $53,000

On Monday, Bitcoin surged above $53,000. At 13:15 GMT, the coin was exchanging hands at $53,324, a 7.07% increase over the last 24 hours.

However, about $150 million worth of shorts were liquidated within a few hours as bulls returned to take a firm grip over the market. The cryptocurrency rose from $47,000 to over $53,000 as the short squeeze occurred following a fall to the bear market late last week.

Other cryptocurrencies like ETH, BNB, also experienced short squeeze as they rose by around 15%. As Bitcoin recovered by 12% within a single day, it appears the futures market is completely reset.

Bitcoin Short Squeeze Is Bullish

A short squeeze refers to when short-sell orders in the futures market are liquidated in a short period of time. When the shorts are liquidated, short sellers will have to buy back their positions. This automatically causes buyer demand to increase in the market.

Hence, the number of shorts rapidly declines, and long contracts or buy orders begin to dominate the market.

Related article | Cuban Expects Number of Bitcoin Hodlers to Double, But Ban Fears Still Linger

In the case of Bitcoin in the last 24 hours, despite BTC’s strong rally back up, the funding rate has remained relatively low. According to Bybt.com, the funding rate across major exchanges for Bitcoin is below 0.01%, which is below the neutral rate.

At the current rate, there are still more longs in the futures market, which could push the price to go higher.

Lex Moskovski, the CIO at Moskovski Capital, said:

“~$150M of #Bitcoin shorts liquidated on this brief move up. Nothing smells better than roasted bears in the morning.”

Sentiment From Traders Show Bullish Expectations

In the near term, many traders are optimistic that the $55,000 price level is an important one to reclaim for the chance of Bitcoin reaching its previous ATH.

Johnny, a cryptocurrency derivatives trader, said:

“Swept the lows and now we have a very strong bounce. We are not out of the woods yet. Reclaim $55,500 and than we can talk about new ATH. For now, play it level by level. Strong reaction so far.”

Another trader, Adnan Van Dal, noted that if the price of BTC doesn’t drop until the US market opens, the chance of the price going higher is highly probable. He wrote on Twitter:

“If $BTC can make it to the US open (EUR am Man shrugging) think cud be ok for a bit. Durable goods orders at open, actual data’s been good, SPX near ATH post useful Friday profit taking & started firm. Think helps – coincident SPX / $BTC weakness a thing this year. TSLA wildcard later tho.”

As it stands, it appears that the bulls are back. The bears’ grip on the market has been short-lived. Currently, the price is aiming for a recovery above $55,000 and the likelihood that the benchmark cryptocurrency will hit a new all-time high soon cannot be ignored.

Related article | Bitcoin Makes Comeback, Here’s Why $53.5K Holds The Key

Featured image from Pixabay, Charts from Tradingview.com