Amid the issues that continue to plague the network, the Solana open interest has seen a drop in the last week. This drop coincides with a decline in the cryptocurrency’s price, suggesting that investors may be getting wary of waiting for a fix to come through.

Solana Open Interest Drops By $370 Million

Solana saw its open interest rise steadily since the start of 2024, hitting an all-time high after an all-time high in the process. Between January and April, the Solana open interest went from around $1.22 billion to hit a new all-time high of $2.86 billion on April 1. This translates to an over 100% increase over this three-month period.

However, since hitting this new milestone, the cryptocurrency has encountered issues which have presented in the form of a network halt. Around a week ago, Solana users noticed that the blockchain had stopped processing transactions as usual, leading to a standstill in network activities.

Expectations at the time were that the network would be back up and running in a matter of hours like it usually does. However, this has proven not to be the case, as the network is going on a week of downtime, one of the longest in its history.

Since the network issues began, the SOL open interest has been falling as traders take a more cautionary approach. Coinglass data shows that the open interest is currently sitting at $2.39 billion on April 19, down $370 million from its all-time high, which is a 12.9% decline in around a week.

Open interest measures the total number of outstanding futures and options contracts, so it means that traders have been closing their positions during this time.

SOL Network Ready To Bounce Back?

Developers are still working on getting the Solana network back on track but it has not been an easy road. Even now, the network continues to battle the blackout, with developers giving a week as an estimated delivery time for the network to be back on track.

CEO of Helius Labs, Bert Mumtaz, revealed in an X (formerly Twitter) post that the current issues were being caused by an implementation bug. This bug has been the reason there have been more failed transactions on the network. Mumtaz also clarified that this bug does not equal a design flaw in the fact that it is relatively easier to fix.

The CEO explained that a patch for this implementation bug would still take a while and that developers are shooting for a fix by April 15, which was a week from the post. However, he added that this date was subject to change in the case where other bugs are discovered in testing.

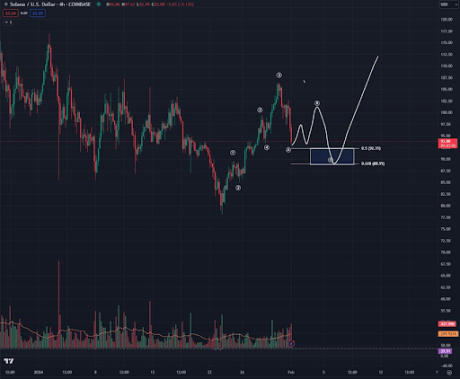

Following Mumtaz’s post, the Solana community is waiting with bated breaths for the network to return to fill operation. In the meantime, the price of Solana and other coins in the ecosystem has taken a hit. Bears have pushed down the SOL price as low as $175. However, the expectation is that SOL will come back with a vengeance once the network is operational again.

Crypto analyst Ash Crypto has said that they expect that the price of SOL will eventually rise above $400. If this is correct, then the present predicament will be a short-lived roadblock in Solana’s rise.