Solana has recently become one of the trendiest cryptocurrencies in the space, capturing the interest of both crypto investors and enthusiasts in the space. The popular cryptocurrency has witnessed a significant surge in network activity, surpassing even that of Ethereum, the world’s second-largest cryptocurrency.

Solana Outpaces Ethereum Network Activity

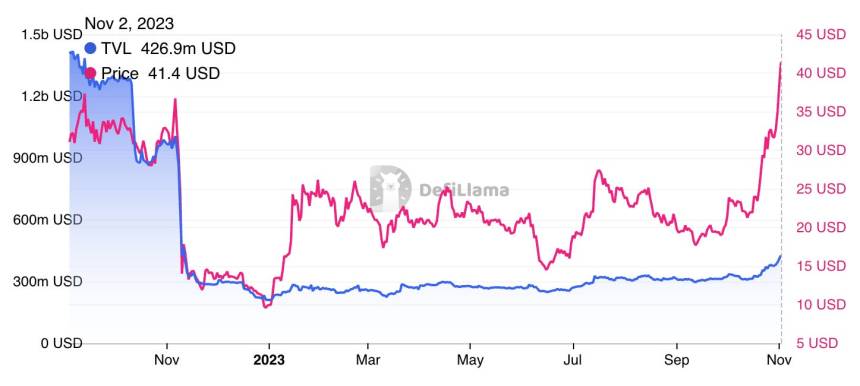

On March 16, Solana experienced a major increase in its overall network activity, pushing its capacity to its limits amidst the growing demands. The network had surged past Ethereum’s total trading volume and exceeded its daily trading volume by more than $1.1 billion, according to data by DefilLama.

Specifically, Solana’s 24-hour trading volume had recorded almost $3 billion, surging past Ethereum’s daily volume of $2.04 billion. During the surge, the network witnessed an unprecedented amount of trading activities, which resulted in failed transactions and a surge in ping times.

As highlighted by Solana Validator, the cryptocurrency network’s ping time on March 18, had jumped to a staggering 46 seconds, causing about a 30% to 40% failed transactions. The validator’s report also revealed a steady and rapid increase in Solanan’s transaction count, recording over 276 million transactions at the time of writing, with about 2,107 transactions per second.

This rise in Solana’s network activity has been attributed to the surge in interest in Solana-based meme coins. On Thursday, March 14, degens eagerly sought after a new meme coin called Book of Meme (BOME), which had experienced an unprecedented bullish spike that triggered its market capitalization to rise from almost zero to a staggering $1.45 billion.

During these periods, the price of Solana also rallied alongside, witnessing an unexpected price surge that propelled it by more than 30% in the past week. The cryptocurrency has been on a steady momentum since the beginning of the year, displaying slight price corrections before continuing on its upward trajectory.

SOL Price Rides The Bullish Wave

Amidst Solana’s burgeoning popularity and rising transaction volumes, the cryptocurrency saw a price increase to more than $200, reflecting a daily surge of approximately 8.9%, at the time of writing. The cryptocurrency’s market capitalization is also up by 11.10%, recording over $89 billion and steadily closing towards the $100 billion mark.

Due to its overwhelming network activities and growing popularity, Solana has successfully gained the position of the 4th largest cryptocurrency by market capitalization, overtaking BNB Chain (BNB) by more than four billion, according to CoinMarketCap.

Moreover, the cryptocurrency has reached peak levels globally in terms of Google search interest, hitting a new all-time high. This surge has been attributed to the increasing interest and demand for the popular digital asset.