Solana (SOL) faced difficulties the past week after the network’s transaction failure rate reached over 75%. Since then, Solana’s core contributors have been working to find the congestion problems.

SOL’s price tumbled 7.8%, and users seemed worried about the network’s state. Despite this, some analysts predict a more optimistic performance for SOL soon.

Is Solana Poised For A Bounce?

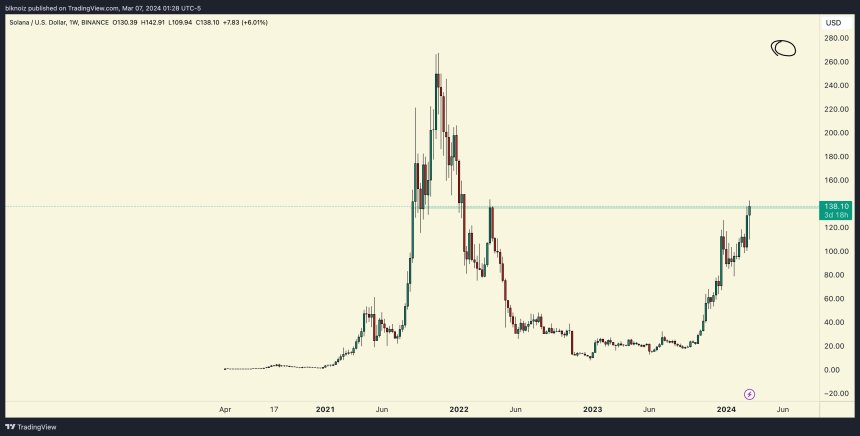

According to crypto analyst Bluntz, Solana’s drop has reached its bottom. When the news of network congestion broke, the analyst predicted that SOL’s price would likely fall to $160 before seeing a bounce.

According to his chart, the performance was starting to show an ABC zig-zag pattern. At the time, the token was trading around the $184 price range, which meant that the C wave of $160 had yet to be confirmed.

The analyst remained open to the “possibility of a sideways correction.” Nonetheless, he considered it “would make no sense for sol/usd to sweep down lower below 160.”

On Wednesday, SOL reached a low of $162, sweeping the “A wave low.” To the analyst, this seems to be the bottom for SOL’s price despite being $2 short of his prediction. As a result, Bluntz considers that the token’s price will go “higher from here.”

Another analyst, Immortal Crypto, pointed out that SOL has shown a “good range” between $210 and $160. According to the analyst, “a deviation from here is a fat long, 100%.”

Despite the possible bounce forecast, analyst Altcoin Sherpa expects SOL to drop to $140, a level it has not seen in almost a month.

Will The Network Upgrade Help SOL?

In the last 24 hours, Solana’s price has risen 6%, recovering from the drop to the $162 range. Despite a 7.8% drop in the past week, the price surged 13.5% in the last 30 days.

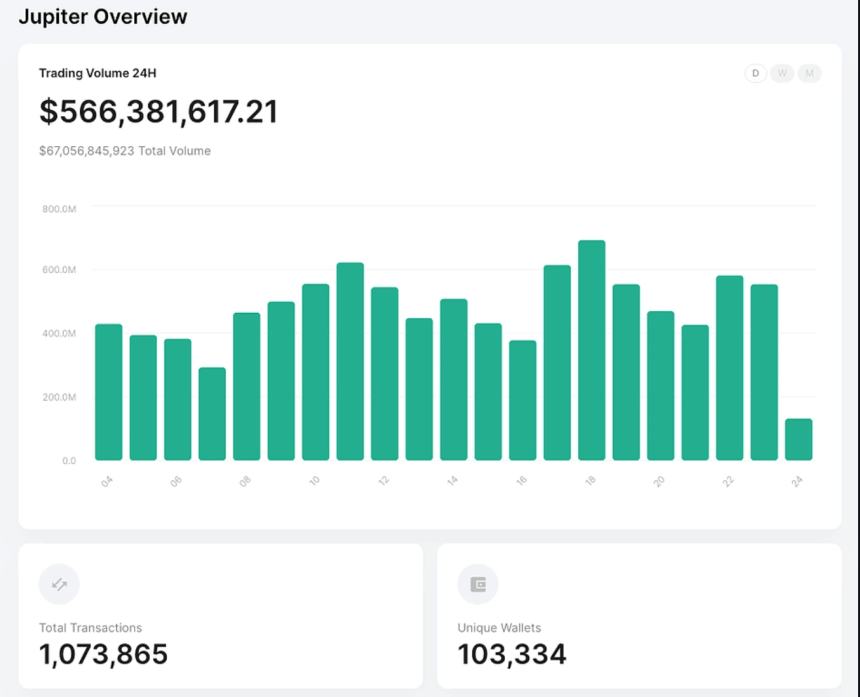

Similarly, the daily trading volume increased by 28% in the past 24 hours, suggesting a surge in the token’s market activity.

Nonetheless, investors remain concerned about the network as the problems continue, with some suggesting that the token’s price won’t start pumping until the “tech is sorted out.”

Solana is widely recognized for its fast transactions and low fees. However, the current on-chain failure rate presents problems for both users and developers.

Responding to the critics and concerns, Austin Federa, Head of Strategy at the Solana Foundation, gave insights into the problem.

Developers from Anza, Firedancer, Jito, and other core contributors are working diligently (and not sleeping much) to shore up Solana's networking stack to meet the unprecedented demand the network is seeing today.

There's been a lot of threads on what exactly is causing the…

— Austin Federa |

(@Austin_Federa) April 10, 2024

According to Federa, developers from the core contributors to the Solana chain are “working diligently to shore up Solana’s networking stack to meet the unprecedented demand the network is seeing today.”

The developer explained that “the implementation of a software system is today not robust enough to handle the amount of traffic being thrown at it.” As a result, the core protocol developers are working to test and implement improvements, leaving “increasing fees as a last resort.”

At the time of this writing, SOL is trading at $174.57.

BitcoinExpert.sol

BitcoinExpert.sol