In the wake of the November 2022 crypto market crash, which saw the bankruptcy and collapse of FTX and other firms, Solana (SOL) has emerged as a standout performer, experiencing a year-to-date price increase of over 560%.

With a market capitalization of $67 billion, Solana has secured its place as the fifth largest cryptocurrency, trailing only Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), and Tether’s USDT stablecoin.

Despite its substantial growth, asset management giant and Bitcoin exchange-traded fund (ETF) issuer Franklin Templeton anticipates further expansion for Solana as the emerging bull market takes shape.

Solana Poised For Continued Growth

A recent report released by the firm highlights Solana’s strong position to capture the next wave of crypto adoption, solidifying itself as a major crypto asset alongside Bitcoin and Ethereum.

The report emphasizes that Solana’s growth will continue due to several key factors. Notably, the crypto industry witnessed accelerated activity during Q4 2023, with Solana as a focal point for major airdrops within its ecosystem, such as Jito and Pyth.

According to the report, these airdrops generated a wealth effect of over a billion dollars, driving up the value of SOL and other Solana ecosystem tokens, particularly meme coins. This surge occurred concurrently with Bitcoin’s upward trend, providing additional momentum to the Solana ecosystem.

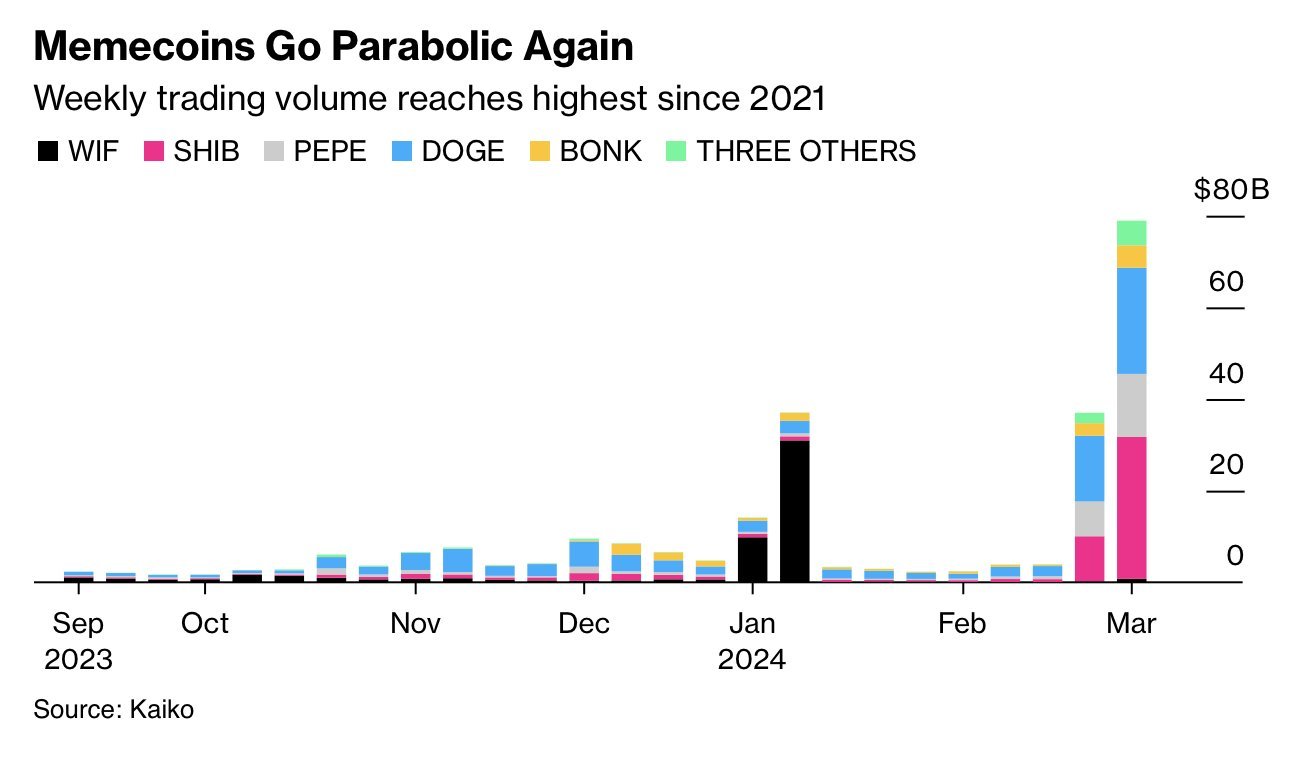

Since then, meme coins have gained significant attention, with a substantial portion of activity occurring on Solana. The network has witnessed the creation and trading of numerous meme coins, with some attaining multi-billion-dollar market caps, including Bonk (BONK) and Dogwifhat (WIF).

The Crypto Industry’s Next Big Breakthrough?

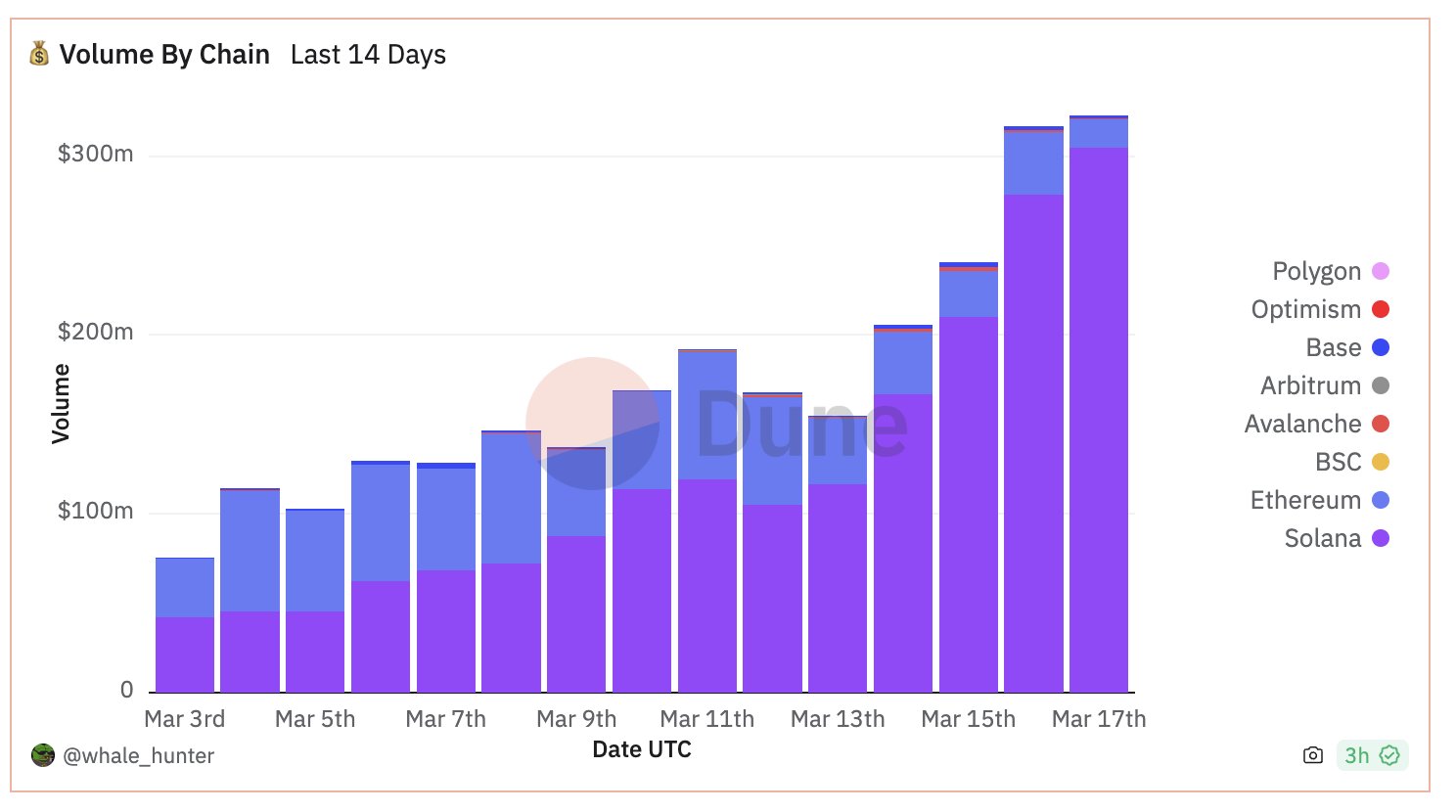

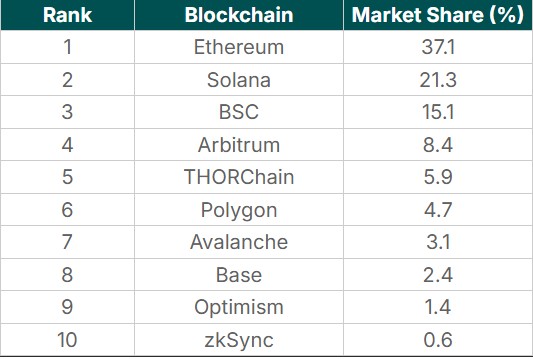

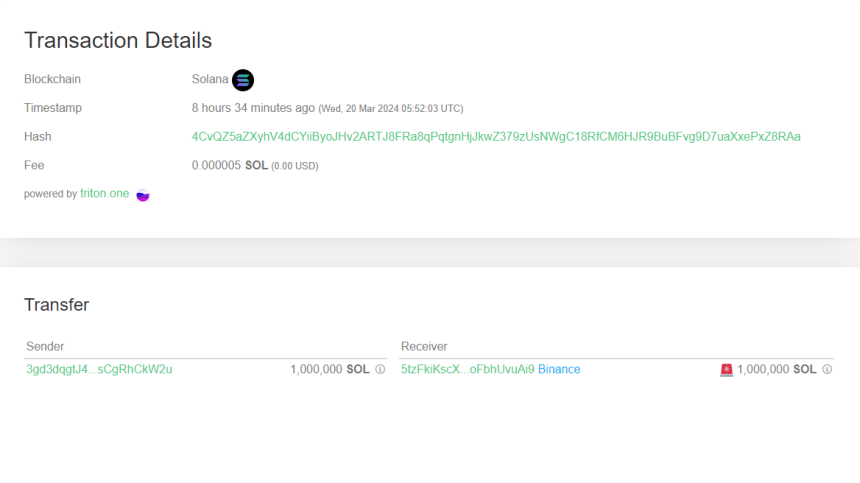

According to the asset manager, Solana has demonstrated significant growth over the past year, which is evident in the network’s increased total fees and decentralized exchange (DEX) volumes. The network’s low fees, transaction latency, and high data throughput relative to other networks have contributed to its success.

Solana’s network effects are expected to strengthen further as its performance improves, positioning it to capture upcoming trends in the crypto space.

The future remains uncertain as crypto enthusiasts ponder the next big thing in the industry. However, Franklin Templeton suggests that there is a strong possibility that Solana could play a pivotal role.

According to the report, the Solana ecosystem anticipates additional airdrops in the coming months, which will continue to enhance the ecosystem’s wealth effect.

Moreover, meme coin activity shows no signs of slowing down on the Solana network, further adding to the bullish sentiment surrounding the cryptocurrency and its ecosystem.

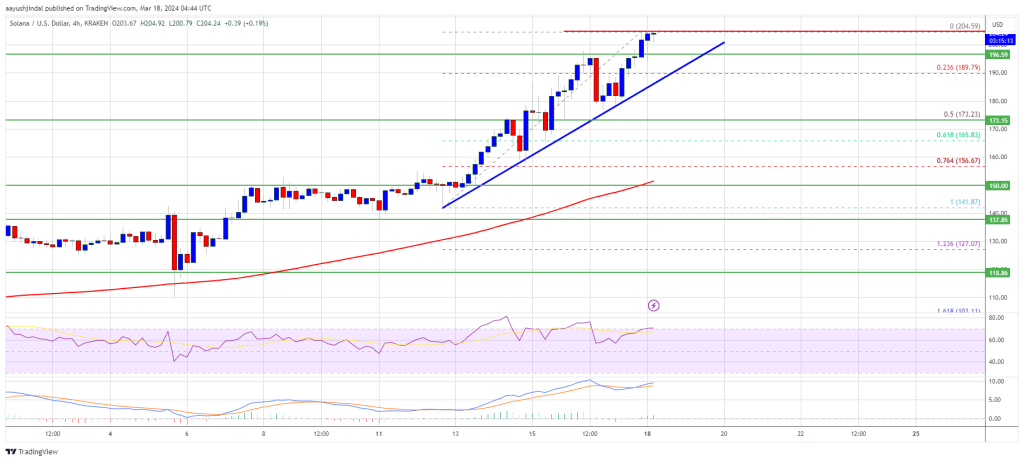

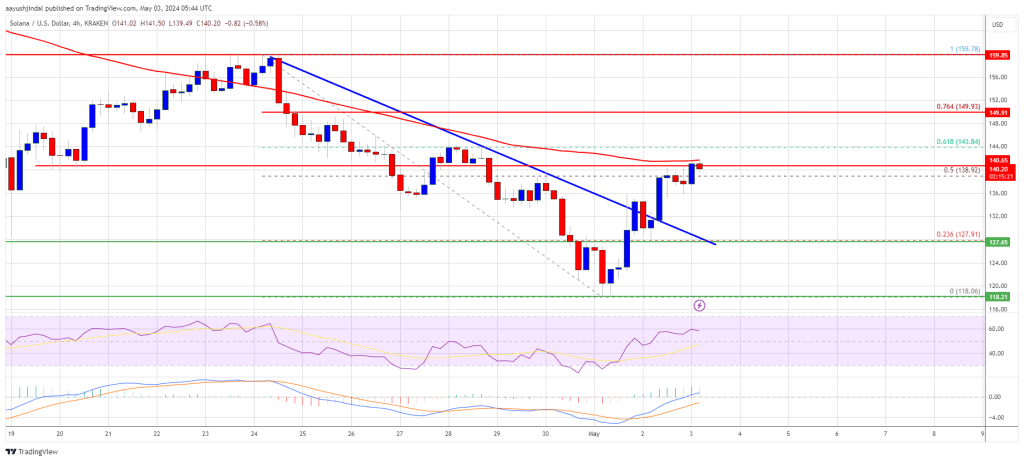

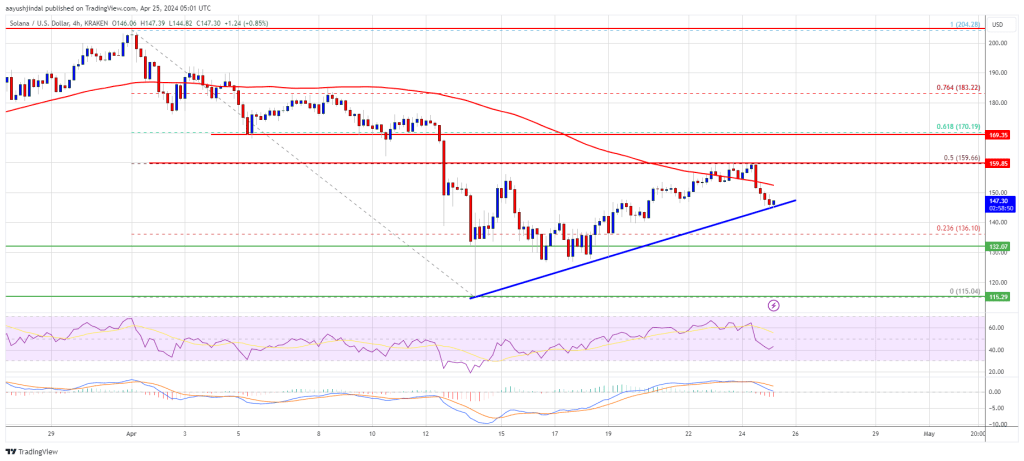

SOL is now attempting to consolidate above the $150 level and has seen a significant 21% increase in the last seven days alone.

Featured image from Shutterstock, chart from TradingView.com

ever surfaced. Until now.” This shift is largely credited to Solana’s embrace by the memecoin community and the speculative trading that follows, marking a clear PMF with retail users.

ever surfaced. Until now.” This shift is largely credited to Solana’s embrace by the memecoin community and the speculative trading that follows, marking a clear PMF with retail users.