The Securities and Exchange Commission has delayed making a decision on Invesco Galaxy’s application for an Ether ETF, with the next deadline on July 5.

Cryptocurrency Financial News

The Securities and Exchange Commission has delayed making a decision on Invesco Galaxy’s application for an Ether ETF, with the next deadline on July 5.

KPMG Canada partner Kunal Bhasin says rising debt and increasing inflation have likely attracted institutional investors into crypto.

The Hong Kong Securities and Futures Commission (SFC) has officially approved several spot Bitcoin and Ethereum exchange-traded funds (ETFs), a decision that marks a significant development in the region’s burgeoning crypto market. These approvals were granted to prominent asset managers including China Asset Management, Bosera Capital, and HashKey Capital Limited, alongside an in-principle approval for Harvest Global Investments.

China Asset Management’s Hong Kong unit, as detailed in their press release, has received SFC approval to launch spot Bitcoin and Ethereum ETFs. This initiative is part of a collaboration with OSL Digital Securities Limited and BOCI International, aiming to provide retail asset management services with direct cryptocurrency subscriptions.

Similarly, Bosera Asset Management and HashKey Capital have announced that they have received conditional approval from the SFC for their own spot crypto ETFs. These products, named the Bosera HashKey Bitcoin ETF and the Bosera HashKey Ether ETF, will allow investors to directly use Bitcoin and Ethereum to subscribe for ETF shares, as stated in their press release.

Harvest Global Investments has also been spotlighted with the SFC’s in-principle nod for two major digital asset spot ETFs. According to their press release, Mr. Tongli Han, CEO and CIO of Harvest Global Investments, remarked, “This in-principle approval for Harvest Global Investments’ products in two major digital asset spot ETFs not only underscores Hong Kong’s competitive edge in the digital asset space, but also demonstrates our unrelenting pursuit of promoting innovation in the industry and meeting diversified investor needs.”

These ETFs are set to be launched through a partnership with OSL Digital Securities, the first digital asset platform licensed and insured by the SFC, highlighting a significant stride in addressing common market challenges such as excessive margin requirements and price premiums.

The press release from Bosera and HashKey highlights that the introduction of these virtual asset spot ETFs will not only provide new asset allocation opportunities but also reinforce Hong Kong’s status as an international financial center and a hub for virtual assets. This move is aligned with the city’s strategic push to establish itself as a regional leader in financial innovation, particularly in the digital asset sector.

The approvals are indicative of Hong Kong’s progressive regulatory framework which aims to integrate digital assets within its financial ecosystem safely and securely. The establishment of these ETFs is expected to provide a regulated, innovative investment avenue for both retail and institutional investors in the region. While there is not as much hype as there is around US ETFs, some analysts believe the impact could be similar.

These approvals come on the heels of rumors last Friday about the potential approval of these ETFs. The market had been abuzz with speculations, and today’s confirmation has provided the Bitcoin and ETH prices with a much needed boost. BTC is up 2.2% since the announcement, surpassing the $66,000 mark. The approved ETFs are reportedly set to launch by the end of April.

At press time, BTC traded at $66,535.

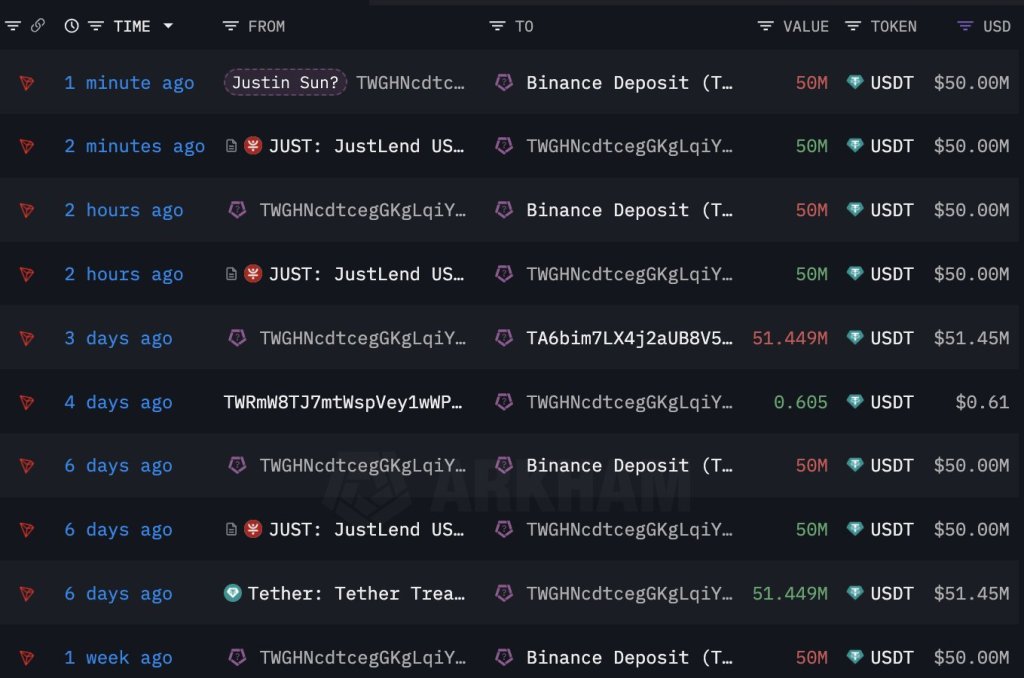

Justin Sun, the co-founder of Tron–a smart contracting platform for deploying decentralized applications (dapps), is once again moving and shuffling millions of dollars. According to Lookonchain data on February 29, Sun reportedly transferred 100 million USDT to Binance, days after moving huge sums earlier this week.

From February 12 to 24, a wallet associated with Sun acquired 168,369 ETH for an average price of $2,894. This purchase, valued at roughly $580.5 million, currently holds an unrealized profit of around $95 million. Profitability could increase considering the sharp demand for crypto, especially top coins like Bitcoin and Ethereum, in recent days.

The Ethereum price chart shows that ETH has been on a clear uptrend, rising from around $2,200 in early February to over $3,450 when writing. At this pace, and considering the institutional interest in potent crypto assets, including ETH, the odds of the second most valuable coin stretching gains will be highly likely.

As Bitcoin inches closer to $70,000, the probability of Ethereum also tracking higher toward its all-time high of around $5,000 will be elevated.

Since ETH already owns a big stash of coins, there is speculation that the co-founder will double down, buying even more coins. The crypto community will continue watching the address until this happens and there is solid on-chain data to support the purchase.

So far, optimism is high, especially among the broader altcoin community. As Bitcoin races to register new all-time highs pumped by institutional billions, eyes will be on the United States Securities and Exchange Commission (SEC). There are multiple applications for a spot Ethereum exchange-traded fund (ETF).

The agency has not provided a definitive timeline for approving or rejecting the derivative product. There is regulatory uncertainty around the status of ETH, a significant headwind that might delay or even prevent the timely authorization of this product.

Still, the community is looking forward to the next communication in May. If the spot Ethereum ETF is a go, the coin will likely rally to new all-time highs, following Bitcoin.

However, before then, eyes are on the expected implementation of Dencun. The upgrade addresses challenges facing Ethereum, including scalability. Through Dencun, Ethereum developers hope to lay the base for further throughput enhancements in the coming years.

With higher throughput, transaction fees drop, overly improving user experience. This upgrade might go a long way in cementing Ethereum’s role in crypto, wading off stiff competition from Solana and others, including the BNB Chain.

The Securities and Exchange Commission (SEC) is poised to follow a similar approach to approving spot Bitcoin (BTC) exchange-traded funds (ETFs) for spot Ethereum ETFs, with the expectation that approval will be granted on the initial final deadline of May 23, as per Standard Chartered Bank analysis.

According to a report by The Block, Geoffrey Kendrick, head of forex and digital asset research at Standard Chartered Bank, stated that they expect pending applications for spot Ethereum ETFs to be approved on May 23, which is considered the equivalent date to January 10 for Bitcoin ETFs.

Furthermore, Kendrick predicts that if Ethereum prices follow a similar trajectory to Bitcoin leading up to ETF approval, Ethereum could trade as high as $4,000 by the specified date.

Kendrick further supports the approval of spot Ethereum ETFs based on the SEC’s classification of ether as a non-security in its legal actions against crypto companies.

Additionally, the fact that Ethereum is listed as a regulated futures contract on the Chicago Mercantile Exchange (CME) adds weight to the expectation of approval.

Following the same line, Scott Johnsson, a financial lawyer, offered insights into the potential roadmap for Ethereum ETFs. Johnsson emphasized that while long-term approval for spot Ethereum ETFs is highly likely, there may be short-term delays due to ongoing regulatory actions involving Coinbase/Binance securities exchanges.

Johnsson highlighted the regulatory path from a plain spot digital asset to a spot ETF offering, using Bitcoin as an example. Johnsson noted that the process for Bitcoin took seven years, involving multiple steps and disapprovals along the way.

However, Johnsson noted that the timeline for Ethereum is compressing, with applications open for both futures ETFs and spot ETFs. He suggested certain prerequisites that Johnsson believes may no longer be necessary for spot approval, such as Step 3, which requires the SEC to issue a formal 19b-4 approval for the futures ETF.

Johnsson highlighted two key factors to understand the SEC’s current approach to future approvals, including Ethereum. Firstly, he discussed the threshold question in the context of the Grayscale ruling, which focused on correlation analysis.

Secondly, Johnsson emphasized the SEC’s view, as bounded by the recent BTC approval order, which considers correlation with the CME, a lengthy sample period, intra-day trading data, and consistency throughout the sample period.

While the specific threshold for sufficiency remains unknown, the correlation analysis for Bitcoin is within an acceptable range. Therefore, it is expected that Ethereum will likely meet this threshold in the foreseeable future, Johnsson suggests.

Once the required level of correlation is achieved, Johnsson believes that approval for spot Ethereum ETFs is likely to follow shortly after that, with May being the expected month of approval.

Overall, industry analysts and experts suggest that the SEC’s approval of spot Ethereum ETFs is a matter of time, barring any major legal shifts.

ETH is currently trading at $2,370, up more than 2% in the past 24 hours and more than 7% in the past seven days, following Bitcoin’s lead.

Featured image from Shutterstock, chart from TradingView.com

An Ethereum (ETH) whale has recently executed a series of transactions, carrying out a considerable movement of funds across various platforms. The blockchain analytics platform Spot On Chain initially brought to light this activity, involving roughly $46.02 million in ETH tokens.

The whale, operating through a network of eight wallets, initiated the withdrawal of these funds from major exchanges, Binance and Bitfinex.

The complexity of these transactions did not end there. Following the withdrawals at an average price of around $2,419 per ETH, the whale engaged with Lido, a prominent liquid staking solution.

This move involved withdrawing 50.15 million USDT from Aave, a well-known decentralized finance (DeFi) protocol, and exchanging the stablecoin for 19,021 ETH, amounting to $46.02 million. Spot On Chain also revealed that three wallets still hold about 30 million USDT in Aave.

Over the past 2 days, an entity with 8 wallets withdrew $46.02M in $ETH from #Binance and #Bitfinex at ~$2,419, then staked with #Lido:

– 5 wallets withdrew 50.15M $USDT from #Aave to CEX for 19,021 $ETH ($46.02M).

– 3 wallets still hold ~30M $USDT in #Aave and may deposit it… pic.twitter.com/vqPYTTaWjT

— Spot On Chain (@spotonchain) January 23, 2024

This lingering balance has sparked curiosity as it might indicate that these funds might soon be deployed into a centralized exchange (CEX) for further acquisition of Ethereum.

The context of these whale movements is particularly crucial, considering the current market conditions Ethereum is experiencing. Over the last 24 hours, Ethereum’s price has dropped by 7.7% to trade at $2,211.

This bearish trend is not isolated, as the entire crypto market, led by Bitcoin, appears to be in a downturn. Based on the key support zone between $2,380 and $2,461 highlighted by crypto analyst Ali, Ethereum appears to have breached a critical demand zone. This break could lead to a further plunge towards the $2,000 mark, escalating concerns about a bigger correction.

The Ethereum market has seen a dip in value and a noticeable impact on traders. Data from Coinglass highlights that the recent market conditions have led to significant liquidations. In just 24 hours, over 137,000 traders were liquidated, amounting to $357 million.

Ethereum traders bear a significant portion of these total liquidations, with long and short traders suffering $72.82 million and 6.30 million in liquidations, respectively, in the past 24 hours.

Interestingly, these market conditions have coincided with notable actions by Celsius, a crypto lending firm currently navigating financial challenges. Recent on-chain analysis indicated that Celsius has been actively moving large sums of Ethereum, including a 13,000 ETH deposit on Coinbase.

The #Celsius wallet deposited 13K $ETH($30.34M) to #Coinbase and 2,200 $ETH($5.13M) to #FalconX again in the past 10 hours.

Currently, 2 staking wallets of #Celsius still hold 557,081 $ETH($1.3B).

Address:https://t.co/3gGOucC9gYhttps://t.co/zodN4gzVHKhttps://t.co/Jjt9fCN2Ej pic.twitter.com/E9DIZ9KDAH

— Lookonchain (@lookonchain) January 23, 2024

This aligns with reports from Arkham Intelligence, which noted that Celsius liquidated over $125 million in Ethereum to address its financial obligations. This auction was primarily geared towards paying off creditors, aligning with the firm’s bankruptcy proceedings.

Featured image from Unsplash, Chart from TradingView

While Bitcoin exchange-traded fund (ETF) applications are still awaiting approval from the US Securities and Exchange Commission (SEC), executives from asset management firms are already speculating about the potential launch of spot ETFs for other major cryptocurrencies, including XRP and Ethereum (ETH).

Valkyrie Invest’s Chief Investment Officer, Steven McClurg, expressed his belief that the SEC’s potential approval of a Bitcoin ETF could pave the way for similar offerings in the XRP and Ethereum markets.

However, regulatory challenges and classifying XRP and Ethereum as securities may present hurdles toward these index funds.

Unlike Bitcoin, which has been classified as a commodity by regulators, XRP and Ethereum have been deemed securities. This divergence in classification poses potential difficulties and may necessitate a more complex approval process for spot ETFs tracking these cryptocurrencies.

The anticipated impact of spot ETF approval on the XRP and Ethereum price would mirror the pattern seen with Bitcoin. Still, the SEC’s skepticism towards the broader cryptocurrency market could pose additional hurdles for XRP and Ethereum ETFs.

Nevertheless, the outcome of the ongoing Ripple vs. SEC case holds significant implications and could hold the key for the cryptocurrency industry to pursue these index funds for other cryptocurrencies.

If Ripple, the blockchain payment company associated with XRP, emerges victorious and is not classified as a security by Judge Analisa Torres, it could establish a precedent for asset managers seeking to apply for an XRP ETF.

This legal precedent could also prompt potential litigation against the SEC to support an Ethereum ETF application.

While discussions revolve around the possibility of spot ETFs for XRP and Ethereum, there is still uncertainty surrounding the approval of Bitcoin ETFs.

The SEC may reject or delay the pending applications, making it uncertain whether these other index funds will materialize. Furthermore, US regulators’ current classification of XRP and Ethereum as securities adds an additional layer of complexity to their respective ETF prospects.

As reported on Monday by NewsBTC, Sources close to the process have indicated that the ultimate approval for Bitcoin ETFs may come on Wednesday.

CNBC’s sources suggest that this coincides with the application deadline for Ark Invest and 21 Shares, raising the possibility of a potential trading launch between Thursday and Friday. Several applications are expected to receive the green light, pending updates from the SEC on the filings.

Overall, as anticipation builds around the potential approval of Bitcoin ETFs, asset managers are already contemplating the prospect of spot ETFs for other major cryptocurrencies like XRP and Ethereum.

However, the regulatory challenges and the classification of XRP and Ethereum as securities present significant hurdles for these index funds. The Ripple vs. SEC case outcome could have far-reaching implications, potentially setting a legal precedent for asset managers to pursue XRP and Ethereum ETFs.

XRP is trading at $0.5673, showing a lack of bullish momentum with a 1% decline in the past 24 hours. Furthermore, it has experienced a continuous downtrend of 13% over the past 30 days.

Featured image from Shutterstock, chart from TradingView.com

The journey towards the approval of an Ethereum ETF in the United States has seen a new development yesterday as the US Securities and Exchange Commission (SEC) has announced a delay in the decision for Grayscale’s Ethereum trust conversion into a spot Exchange Traded Fund (ETF). The SEC has stated the need for an extended period to evaluate the proposed rule change, pushing the new deadline Grayscale to January 25, 2024.

In its reasoning, the SEC has reiterated, “The commission finds it appropriate to designate a longer period within which to take action on the proposed rule change so that it has sufficient time to consider the proposed rule change and the issues raised therein.” Notably, the delay comes at a time where the US agency is working with now 13 spot Bitcoin ETF applicants on presumably the final amendments before a January 10 approval.

Despite the latest delay, the crypto community remains optimistic about the future of spot Ethereum ETFs. Bloomberg ETF analyst James Seyffart has suggested that delays are par for the course, tweeting, “Update: As expected Grayscale’s Ethereum trust filing just got delayed. It was due by 12/6/23 so this is completely normal.”

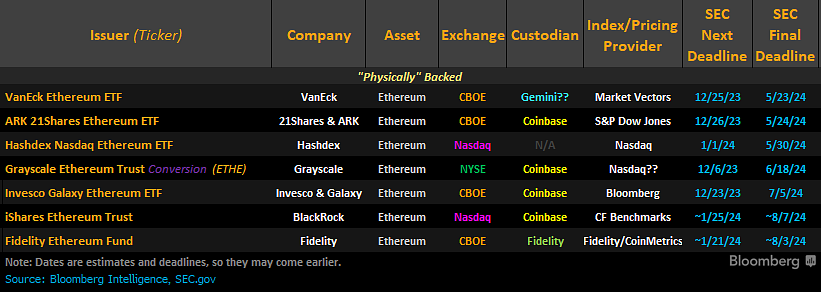

Seyffart also shared a table of all seven spot Ethereum ETF applicants: VanEck, 21Shares & ARK, Hashdex, Grayscale, Invesco & Galaxy, BlackRock, Fidelity and their deadlines. He further hinted at potential approvals by mid-2024, responding to criticisms from Adam Back, CEO of Blockstream, with “Unfortunately I think you’re gonna be really upset by June of next year.”

In response to queries about the probability of an Ethereum ETF approval following a Bitcoin ETF, Eric Balchunas of Bloomberg has indicated that the first filers, Ark and VanEck, have strong odds of approval by their final deadline on May 23, 2024, as they are expected to use the same mechanics as spot Bitcoin ETFs, and due to the fact that Ether futures have already received the green light from the US SEC.

Queried about for the odd of a spot Ethereum ETF approval, he remarked, “Not formally yet, but final deadline for the first filers Ark and VanEck is May 23rd so strong odds they approved by then given they’d be using same design as btc etfs and ether futures were Ok’d.”

The table by Seyffart shows that the next Ethereum ETF deadlines are from December 23 to 26 for VanEck, Ark Invest and Invesco & Galaxy, followed by Hashdex on January 1. Since a spot Bitcoin ETF is very unlikely to be approved by then, delays by the SEC are more than likely for this batch of filings.

Both iShares by BlackRock and the Fidelity Ethereum Fund have their next deadlines on January 25 and January 21, 2024 respectively. These dates are crucial as they could involve either an extension, a request for more information, or a final decision.

But things only get really tense towards the final deadlines for all Ethereum ETF filers, as outlined by both Bloomberg ETF experts. With VanEck poised for May 23, 2024, and ARK Invest for May 24, 2024 and other notable filers like Hashdex Nasdaq Ethereum ETF and Grayscale’s Ethereum Trust Conversion (ETHE) scheduled for decisions by May 30, 2024, and June 18, 2024, respectively, the timeline for potential approvals is taking shape.

At press time, ETH traded at $2,271.

BlackRock and NASDAQ have outlined why the SEC needs to approve the investment company’s new spot Ethereum exchange-traded fund (ETF) filing. According to the filing with the SEC, approval of a Spot ETH ETP would represent a major win for the protection of U.S. investors in the crypto asset space.

If approved, the iShares Ethereum Trust would allow regular investors to trade Ether, the world’s second-largest cryptocurrency by market cap, as easily as stocks can be traded.

BlackRock, the world’s largest asset manager, recently applied to the SEC to launch an Ethereum exchange-traded fund (ETF) linked to the spot price of Ethereum. BlackRock wasn’t the first investment company to make this type of application, as hedge fund Ark Invest already filed for a Spot Ethereum ETF in September. However, the news of BlackRock’s filing sent Ethereum surging more than 11% in less than 24 hours. As a result, ETH broke over the strong $2,000 resistance level for the first time in seven months.

BlackRock’s Spot ETF is called the “iShares Ethereum Trust” and is sponsored by Ishares Delaware Trust Sponsor LLC, a subsidiary of Blackrock Inc. Coinbase, the largest crypto exchange in the US, acts as the custodian for the Trust’s ether holdings, which are to be traded on the NASDAQ exchange.

In its SEC filing, NASDAQ asked for a proposed rule change in order for it to list and trade shares of the ETF. According to the filing, US investors, for the most part, have lacked a US-regulated way to gain exposure to Ethereum investments. It also argues that most of the current methods are risky and subject to high trading fees and volatile discounts.

For example, an investor who purchased the largest OTC ETH Fund in January 2021 and held the position at the end of 2022 would have had a 30% loss due to the change in the premium/discount, even if the price of ETH did not change. However, a spot ETH ETP like the proposed iShares Ethereum Trust ETF would better protect investors against the risk of losses through fraud and high premiums.

“To this point, approval of a Spot ETH ETP would represent a major win for the protection of U.S. investors in the cryptoasset space,” the filing said.

Despite spot crypto ETFs being available in other countries, including Germany, France, and Canada, the SEC has been hesitant to greenlight a crypto ETF in the US, and 12 Bitcoin spot ETFs are currently waiting for approval.

A US Spot Ethereum ETF would significantly boost interest and confidence in Ethereum and ultimately drive the asset to new highs. The hype leading up to the approval may also push the asset to a new yearly high.

ETH is up by more than 60% this year and has outperformed BTC in the past few days. It is currently trading at $2,060 and analysts believe a bullish cross over $2,150 would signal the end of the bear market for ETH.

Earlier in the day, BlackRock registered corporate entity “iShares Ethereum Trust” in Delaware, the first hint that a filing for a spot Ethereum ETF filing was imminent.

Bloomberg ETF analyst James Seyffart expects more spot Ethereum ETFs to be filed in the coming days.