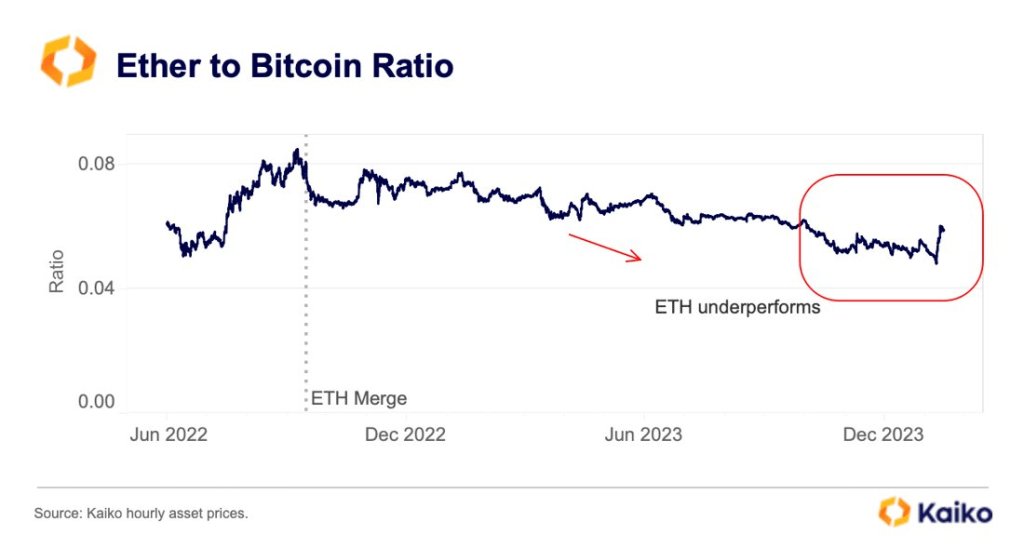

Over the past 24 hours, Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has experienced a significant 5% price drop. This drop comes amid growing speculation that the highly anticipated Ethereum ETFs will likely be rejected by the US Securities and Exchange Commission (SEC) in the upcoming May deadline.

US Bitcoin ETF Issuers Brace For SEC’s Expected Denial

According to a recent Reuters report, various US Bitcoin ETF issuers and firms anticipate the SEC’s denial of their applications to launch ETFs tied to the price of ETH.

These expectations have been fueled by “discouraging meetings” between the applicants and the regulatory agency in recent weeks, as disclosed by four individuals familiar with the matter.

Prominent investment firms such as VanEck, ARK Investment Management, and seven other issuers have submitted filings with the SEC to list ETFs that would track the spot price of Ethereum.

As the first in line, VanEck’s and ARK’s applications are subject to the SEC’s decisions by May 23 and May 24, respectively.

The sources involved in the meetings between Bitcoin ETF issuers and the SEC have reported that the discussions have been primarily “one-sided,” with agency staff not engaging in substantive details about the proposed products.

This starkly contrasts the intensive and detailed discussions between issuers and the agency before the SEC’s landmark approval of spot Bitcoin ETFs in January.

The issuers argued during the meetings that the approval of spot Bitcoin ETFs and Ethereum futures-based ETFs by the SEC in October set a precedent for the spot ETH products. They also made efforts to address potential regulatory concerns.

Despite their arguments, the report notes that the SEC staff did not clarify specific concerns or engage in meaningful dialogue, further indicating a possible denial of the requests.

Setback For Crypto Industry

If these expectations materialize, it would be a setback for the cryptocurrency industry, which had hoped that the approval of spot Bitcoin ETFs would pave the way for similar products and contribute to the mainstream adoption of cryptocurrencies.

According to Todd Rosenbluth, head of ETF analysis at data firm VettaFi, the likely delay in approval or rejection until later in 2024 or beyond has left the regulatory landscape uncertain.

While some issuers have expressed their intention to submit additional disclosure paperwork to continue the conversation with the SEC, the overall sentiment indicates a growing belief that the applications will be rejected.

VanEck CEO Jan van Eck has already stated that the company’s application will likely be rejected, while ARK Investment Management has yet to comment.

Rejected Ethereum ETFs Could Spark Potential Court Battles

Several applicants expect the SEC to cite broader issues, such as the nature and depth of statistical data on the underlying ETH market, as reasons for their decision in the event of ETF rejections.

Matt Hougan, chief investment officer at Bitwise Asset Management, which has filed for a spot in Ethereum ETF, believes that the SEC may require more time to observe Ethereum futures and gather additional data.

Industry insiders further speculate that rejecting Ethereum ETFs could potentially lead to legal action, with one source suggesting that the courts may get involved before Ethereum ETFs eventually become a reality.

The anticipated rejection has already influenced the price of Ethereum, with Hong Fang, president of the crypto exchange OKX, stating that the cryptocurrency is experiencing downward pressure as market participants factor in the likelihood of a negative outcome.

Currently, ETH is trading at $3,100, further highlighting the cryptocurrency’s persistent downtrend over broader time frames. Over the past fourteen and thirty days, the token has experienced significant declines of 12% and 14%, respectively.

Featured image from Shutterstock, chart from TradingView.com