The token will be “100% backed by U.S. dollar deposits, short-term U.S. government Treasuries and other cash equivalents.” according to the company.

The Benefits of Assets Tokenization

We need to start thinking of blockchains as infrastructure for financial innovation rather than concentrating on the prices of a few digital assets, like bitcoin and ether, says WisdomTree’s digital of digital assets, Benjamin Dean.

A16z-Backed Protocol Unveils U.S. Dollar Stablecoin Passing Yield from RWA and DeFi

Angle also aims to establish a forex hub offering seamless conversion between its dollar and euro-pegged stablecoins.

Key U.S. Lawmaker McHenry Says House Has ‘Workable’ Stablecoin Bill

U.S. Rep. Patrick McHenry (R-N.C.) said some of the recent chaos in Congress derailed crypto legislation for a while, but a stablecoin bill is largely worked out in the House of Representatives and just needs a schedule floor vote.

Stablecoin Project Gyroscope to Conduct Points Program, Launch High-Yield Liquidity Pools

Gyroscope seeks to boost its GYD stablecoin with new products servicing airdrop farmers and yield seekers.

Fireblocks, Zodia Markets Partner to Improve Cross-Border Payments

The two crypto firms are attempting to improve cross-border payments via stablecoins for large corporations and institutions.

EU Regulators Publish Batch of Draft Rules for Stablecoins Under MiCA

The draft Regulatory Technical Standards (RTS) lay out requirements for issuers when dealing with complaints about stablecoins referencing multiple currencies.

Hong Kong’s Central Bank Starts Regulatory Sandbox for Stablecoin Issuers

The regulator invited applicants with a “genuine interest in developing a stablecoin issuance business” to join the sandbox.

Tether’s USDT Stablecoin Touches $100B Market Cap, Benefiting From Crypto Trading Frenzy

USDT, a stablecoin issued by Tether, hit the $100 billion market value for the first time in its history, according to CoinGecko data, as the rally on crypto markets expanded.

Stablecoins Join The Crypto Bull Run With $140B Market Cap, Highest Since 2022

February has been an overall notable month for cryptocurrencies and the crypto industry. We’ve seen Bitcoin and Ether, the two largest cryptocurrencies by market capitalization, reach milestones not seen since the crypto winter started.

The bull run has seemingly started, as many analysts and investors have announced, and it appears to be following a ‘2-year trend’ where the industry is beginning to reclaim the heights lost in 2022. Consequentially, the rally has propelled the overall market cap of the crypto industry.

Stablecoins Remain Stable, But The Market Is Expanding

According to data from DefiLlama, stablecoins have joined the crypto market in the bullish rally, as its market capitalization hit $140 billion for the first time since December 2022.

Stablecoins are cryptocurrencies designed to have value pegged to another currency, like the US dollar, or a commodity, like gold. They account for a large portion of the daily trading volume of cryptocurrencies, as many consider them more useful for everyday transactions.

The slow and steady recovery of the crypto industry has been maturing the bullish sentiment in the community. Fueled by investors’ trust in crypto assets and important developments in the industry, the crypto market seems to be recovering to achieve a performance like that of the previous crypto bull run.

However, stablecoin’s recent market expansion is not only fueled by the positive sentiment. Tether (USDT) sits as the third largest cryptocurrency by market capitalization, with over $98 billion, and it has continued to extend its reach in the last few years.

Just this month, USDT’s market cap increased by $2 billion; in the last year, it has risen by over $28 billion. USDT is also ranked as the first cryptocurrency by trading volume in the previous 24 hours, according to data from CoinMarketCap.

Circle’s USDC, ranked fifth by daily trading volume and seventh by market cap, has also seen impressive growth, with its $2 billion market cap increase showing a recovery this month.

The stablecoin’s market capitalization saw a 1-year slump after dropping from $40 billion in March last year. However, the relisting of its trading pairs on Binance and the recent expansion to international markets has fueled USDC’s ‘resurgence,’ as Coinbase recently called it.

Crypto Market Cap Hits $2T

Today, the total crypto market cap hit $2 trillion as Bitcoin’s price spiked to $57,000, increasing 32.2% monthly and 101.3% in the past year. This milestone has not been reached since April 2022, when the total crypto market cap was at $2.1 trillion.

However, Bitcoin’s parabolic surge is not the only reason behind this achievement, as the altcoin market cap, which includes all cryptocurrencies except for BTC, has grown 29.35% in 30 days.

Accordingly, the market capitalization for altcoins hit $255 billion, representing a 111.6% surge last year. Similarly, this level has not been seen since April of 2022.

The altcoin market has seen green throughout February as interest in cryptocurrencies soared massively, led by the ETFs frenzy that started building at the end of last year and exploded in January.

Collapsed Real Estate-Backed Stablecoin Charts Path to Recovery

Tangible is looking to move past its failed stablecoin after learning the liquidity lesson the hard way.

USDC Stablecoin’s Issuer Circle Dumps Tron Network; TRX Steady

Circle cited its “risk management” framework as part of the decision, among other factors.

Y Combinator, Startup Incubator Behind Airbnb, Coinbase, and Stripe, Looks to Invest in Stablecoin Finance

Y Combinator (YC), the Silicon Valley incubator, has listed stablecoin finance as a category in its new and updated list of areas it would like to deploy funds in.

Ether-Based Crypto Dollar Issuer Ethena Raises $14M, Opens Access to Public

Ethena’s USDe “synthetic dollar” is independent from the traditional financial system and aims to offer a dollar-denominated, yield-bearing savings vehicle for investors outside of the U.S.

Tether and Circle Stablecoin Purchases Dominate in Argentina

Stablecoin purchases are proving popular for Argentine citizens amid a severe economic crisis in the nation.

Cryptodollar Minting Protocol M^0 Will Allow Institutions to Issue Stablecoins Backed by U.S. Treasuries

US Treasury Secretary Janet Yellen Urges Congress To Pass Crypto Legislation

In a recent statement before the House of Representatives, US Treasury Department Secretary Janet Yellen emphasized the need for Congress to pass legislation that provides clarity and regulation in the crypto markets.

Secretary Yellen Calls For Action ‘Digital Asset Risks’

During the Financial Committee hearing, Yellen highlighted the “risks” associated with digital assets and called for measures to address potential vulnerabilities and non-compliance with applicable laws and regulations.

Yellen specifically mentioned concerns related to runs on crypto-asset platforms, stablecoins, and the “proliferation” of platforms acting outside regulatory boundaries.

The Treasury Secretary stressed the importance of enforcing existing rules and regulations while urging Congress to enact legislation specifically targeting stablecoins and “non-securities” crypto assets in the spot market.

Notably, Taylor Barr, head of policy at the blockchain trade association Chamber of Digital Commerce, pointed out that the bipartisan FIT for the 21st Century Act, led by Representative French Hill, aligns with Yellen’s call for market structure and regulation.

Hill, a proponent of the legislative environment for crypto, previously highlighted the progress made in the House of Representatives. He emphasized passing the first comprehensive regulatory framework for digital assets and the prudent approach to stablecoins.

Furthermore, Hill believes that these initiatives address significant “regulatory gaps” and contribute to the crypto industry’s growth.

Pro-Crypto Stance And Legislative Initiatives Align

Barr also commended the Clarity for Payment Stablecoins Act proposed by the Chairman of the US Financial Committee, Patrick McHenry.

This act aims to establish consistent oversight and consumer protection for payment stablecoins, incorporating successful state-level regulations and striking a balance between innovation and regulatory certainty.

McHenry, who has been vocal about the importance of the US leading the financial system of the future, has already emphasized the bipartisan progress on legislation to address the regulatory challenges posed by digital assets.

McHenry called for the “completion of the job,” highlighting the Clarity for Payment Stablecoin Act as a crucial step towards establishing a federal framework for stablecoins.

Overall, the convergence of Secretary Yellen’s call for regulation, Representative Hill’s legislative initiatives, and Chairman McHenry’s pro-crypto stance reflect a growing momentum toward establishing a comprehensive regulatory framework for the crypto industry.

However, it remains to be seen how Secretary Yellen’s proposed regulatory enforcement ideas and proposals will strike a balance between fostering innovation, as emphasized by McHenry and Hill while ensuring the growth of nascent technology.

As discussions on crypto legislation continue, the industry eagerly anticipates the outcome, seeking a regulatory environment that provides clarity and consumer protection and positions the United States at the forefront of digital asset innovation.

Featured image from Shutterstock, chart from TradingView.com

Stablecoins Surge: USDT Leads $400 Million Inflows, Signaling Investor Confidence

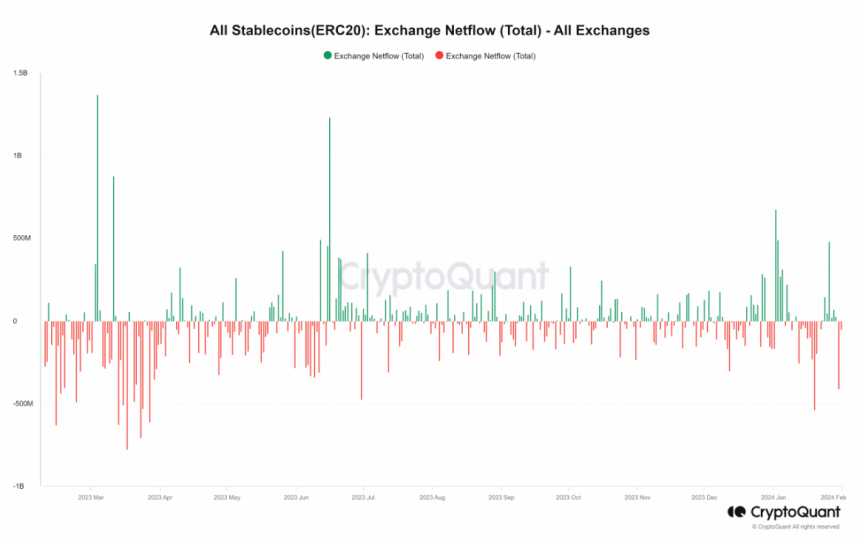

The cryptocurrency industry has witnessed a significant change in the movement of stablecoins, offering valuable observations into the evolving dynamics of the market. Recent data from IntoTheBlock and CryptoQuant has shown a surge in stablecoin inflows into exchanges, reaching record highs in January.

Notable inflows were observed on January 2nd ($478 million), January 3rd ($489 million), and January 26th ($673 million). However, this trend has since reversed, with outflows dominating the market.

On January 30th, there was a substantial outflow of $412 million, marking the second-highest daily outflow recorded in the month, following the $541 million outflow on January 19th.

USDT Leads Stablecoin Rally, But Caution Persists In Crypto Market

An analysis of the 24-hour trading volume of the top stablecoins on CoinMarketCap reveals that Tether (USDT) and USD Coin (USDC) collectively accounted for approximately 90% of the total volume. Tether, in particular, has been dominant in terms of flows, with a 24-hour trading volume exceeding $42 billion, while USDC’s volume stood at around $6 billion.

Taking a closer look at the flow of USDT through CryptoQuant, it was found that there was a substantial inflow of $373 million on January 26th, followed by a prevailing trend of outflows, with over $83.4 million observed at the time of writing.

Experts suggest that the rise in stablecoin inflows onto exchanges, particularly the $478 million on January 2nd, could indicate traders’ and investors’ readiness to participate in the market or their desire to safeguard their funds during uncertain times.

Conversely, the shift towards outflows may signal caution or preparation for potential market volatility. Additionally, the substantial inflow of stablecoins, especially USDT, could indicate increased buying power and intentions to establish positions in the cryptocurrency space.

Stablecoins Surge, Signal Investor Preparation

The increase in stablecoin inflows onto exchanges can be interpreted in two ways. Firstly, it may indicate that investors and traders are preparing to enter the market. By moving their funds into stablecoins, they can quickly transition into other cryptocurrencies when they perceive favorable opportunities. This suggests a readiness to participate and take advantage of potential market movements.

Secondly, the rise in stablecoin inflows may also reflect a desire to keep funds in a secure manner, particularly during uncertain times. Stablecoins offer stability by being pegged to a specific asset, such as the US dollar, which can be appealing to investors seeking to protect their capital in times of market volatility. This cautious approach can be seen as a way to safeguard funds and mitigate risks in an unpredictable market.

Tether Records Nearly $3 Billion Profit

Meanwhile, Tether announced a “record-breaking” $2.85 billion in quarterly profits as the market capitalization of its main token, USDT, approached $100 billion.

According to a blog post by Tether, the interest gained on the company’s enormous holdings in US Treasury, reverse repo, and money market funds—which support the USDT stablecoin—account for around $1 billion of the earnings in the most recent quarterly attestation report that was released on Wednesday. Everything else was “mainly” due to the growth of Tether’s other assets, like gold and bitcoin (BTC), the stablecoin issuer said.

Featured image from Wccftech, chart from TradingView

MIM Stablecoin Suffers Flash Crash Amid $6.5M Exploit

The stablecoin issued by decentralized platform Abracadabra.money {MIM}, suffered a flash crash to $0.76 after reports emerged of a $6.5 million exploit.

Solana Unveils Token Extensions As SOL Bounces Back, Surging 5%

The Solana Foundation, a non-profit organization dedicated to decentralization, adoption, and security on the Solana network, has launched token extensions.

Solana Token Extensions Gains Traction

According to a January 24 announcement, token extensions provide developers, enterprises, financial institutions, and Solana-native development teams with a comprehensive suite of turnkey solutions for advanced token functionality. Anatoly Yakovenko, co-founder of Solana and CEO of Solana Labs, commented on the launch, stating:

Token extensions build on the characteristics that make Solana the ideal destination for developers. Solana is the first network to offer this level of integrated developer and user experience in a single token program. We’re already seeing the potential to build using token extensions via deployments from some of the most recognizable names in crypto.

Industry giants Paxos and GMO-Z.com Trust Company Inc. (GMO Trust) are leading the way in adopting token extensions. As announced by the Solana Foundation, these companies are “leveraging the benefits” of token extensions to issue stablecoins on the Solana blockchain.

As previously reported, Paxos, a regulated blockchain and tokenization infrastructure platform, expanded its stablecoin issuance to the network in December. Similarly, GMO Trust announced the launch of the first regulated Japanese yen stablecoin and their own US dollar stablecoin on the Solana network.

New Standards For Blockchain Compliance?

Sheraz Shere, Head of Payments at the Solana Foundation, emphasized the appeal of the Solana network for enterprise-grade companies entering the web3 space. Shere stated:

Companies like Visa, Worldpay, Stripe, Google, and Shopify have already seen the performance advantages inherent to the Solana network and have launched solutions and applications that are only possible on Solana. With token extensions, we are expanding what is possible for enterprise adoption of blockchain by natively enabling features that matter to large regulated enterprises.

Token extensions, designed to cater to builders across diverse industries such as stablecoins, real-world assets (RWA), and payments, offer a range of interesting features:

- Transfer Hooks: Enables token issuers to exert control over token interactions, empowering developers to create intricate and flexible token mechanisms.

- Transfer Fees: Provides the ability to charge fees for each token transfer, offering sustainable revenue models for different types of tokens built using token extensions.

- Confidential Transfers: Utilizes zero-knowledge proofs to encrypt the transfer amount while publicly sharing the source, destination, and token type. This ensures compliance while preserving privacy.

- Permanent Delegate Authority: Grants token issuers absolute authority over their tokens, particularly for those requiring revocation ability, such as licenses or credentials.

- Non-transferability: Restricts token transfers to the issuer only, making it ideal for unique user identification and credentialing purposes.

Ultimately, with the launch of token extensions, Solana aims to position itself as a force in blockchain development, offering builders the tools to create new applications across various industries.

The SOL token experienced a sharp drop of over 28% in the past 30 days, leading to a decline to the $79 level. However, the token has recovered in the past 24 hours with a 5% bounce, leading to a current trading price of $87.

Featured image from Shutterstock, chart from TradingView.com