The Nakamoto update will decouple block production from Bitcoin itself, solving the problem of network congestion Stacks has had since it launched its mainnet in 2021.

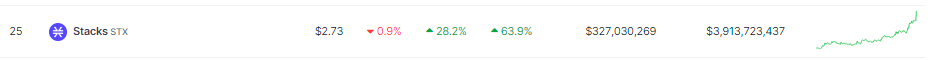

STX Brushes Off Sluggish Crypto Market As It Shoots Up By 30%

With a broader slowdown in the broader market, some altcoins continue to push forward with minimal resistance; STX is one of those, with the token up nearly 30% in the weekly timeframe.

The market, as of the moment, is up less than a percent. This movement is minute compared to the huge swings noted in the last few months. However, Stacks’s internal growth goes against the slowing trend in the market.

April Prospects Grow by The Day

Next month is expected to be the biggest month for STX as internal developments sweep across the ecosystem. The official Stacks X account recently posted about the ecosystem’s recent wins. Most notable of these is the feature done by digital asset investment firm Frank Templeton on Stacks’s upcoming Nakamoto Upgrade.

Another big week for the Stacks ecosystem

Congratulations to @VelarBTC @ArkadikoFinance & @StackingDao for their latest wins

Check out all the Stacks ecosystem wins in the new Stacks Snacks newsletter edition

pic.twitter.com/vr6hPdTWUM

— stacks.btc (@Stacks) March 23, 2024

On Velar’s Dharma Automated Market Maker (AMM), the stSTX/aeUSDC pair has been added, giving investors more staking options on Velar’s platform. This development might’ve had an effect on the growth of StackingDAO which recently breached the $100 million mark. This means investor confidence in Stacks is gradually growing, grabbing the attention of people who are hesitant about DeFi on the Bitcoin blockchain.

Another confidence booster for investors is the announced partnership of Xlink, Bifrost, and ALEX Labs to bridge Stacks with other blockchains outside the realm of Bitcoin DeFi.

“Our collaboration with XLink and ALEX represents a significant step towards achieving true interoperability across blockchain networks, including that of Stacks and Bifrost. We are proud to contribute our capabilities to this partnership, unlocking new possibilities for BTC enthusiasts,” Dohyun Park, founder of the Bifrost Foundation, said in a statement on Bifrost’s official blog post about the partnership.

These events singlehandedly helped STX gain ground against the bears in the short to medium term. But with April at the corner, can the token stand on solid ground?

Bears Might Gain Ground In The Coming Days

STX’s recent price movements have attracted investors with the fear of missing out on previous gains. In the short to medium term, we might see STX slow down to a halt, following the broader market trend.

At the moment, the fresh breach on $3.28 might be able to hold any bearishness once bulls solidify their current position above this price level. If they fail to do this, however, we might see a fall towards $2.91 before the start of April.

Featured image from Pexels, chart from TradingView

Stacks (STX) Stuns: Price Soars Over 60% In Epic Recovery As TVL Explodes

Stacks (STX), a cryptocurrency facilitating smart contracts on the Bitcoin blockchain, has defied broader market turbulence to emerge as a standout performer. Over the past week, STX price skyrocketed over 60%, reaching a nine-day high of $2.15 and flirting with its all-time peak of $2.45. This impressive rally has propelled Stacks into the top 25 cryptocurrencies by market cap, leaving many wondering: what’s driving the surge?

Stacks (STX) Climbs Over 60% On Back Of Bitcoin Ascent

Several factors appear to be fueling Stacks’ ascent. Firstly, its unique ability to bring smart contract functionality to Bitcoin resonates with investors seeking advanced applications on the world’s oldest blockchain. Unlike Ethereum, Bitcoin inherently lacks support for smart contracts, limiting its DeFi and NFT capabilities.

Stacks bridges this gap by anchoring itself to Bitcoin while offering smart contract features. This innovative approach has garnered significant attention, particularly as Bitcoin itself enjoys a recent price appreciation, reaching more than $52,000 at the time of writing.

The correlation between Stacks and Bitcoin is undeniable. Both assets saw pronounced recoveries in February’s second week, with STX mirroring Bitcoin’s climb from $38,500 to $50,000. This intertwined fate highlights the influence of Bitcoin’s broader sentiment on Stacks’ price action.

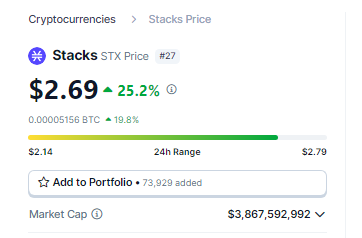

STX Gets Boost On Soaring TVL

Beyond price movements, another bullish indicator emerges from Stacks’ DeFi ecosystem. According to DefiLlama, the total value locked (TVL) within Stacks’ DeFi protocols has surged over 50% in the last three weeks, reaching $70.21 million. This growth signifies rising investor confidence and active capital commitment within the Stacks DeFi landscape.

Technical analysis further amplifies the optimistic outlook. Analysts predict a potential continuation of the rally, with price targets ranging from $2.475 to $2.82. This bullish forecast hinges on STX breaching the recent swing high resistance of $2.06, a decisive technical milestone achieved earlier this week.

.@Stacks has gone from around #60 ranked coin market cap to #34 in a year, passing many household names in the same

Expect it to enter top 20 around the halving as Bitcoin L2 narratives start dominating the discourse and L1 network fees reach new all-time-highs

As we go into…

— trevor.btc — b/acc (@TO) February 12, 2024

However, it’s crucial to acknowledge the inherent volatility of the cryptocurrency market. Recent US inflation data triggered a sell-off across the entire market, reminding investors of the unpredictable nature of this asset class. While Stacks managed to recover rapidly, the episode underscores the importance of responsible investment practices and thorough risk assessment.

Despite the risks, Stacks’ unique value proposition and recent momentum cannot be ignored. Its ability to connect the smart contract functionality of Ethereum with the security and immutability of Bitcoin positions it as a potentially disruptive force in the blockchain space.

Featured image from Pexels, chart from TradingView

Stacks (STX) Skyrockets Over 43% And Smashes $2 Threshold, Setting Sights On New All-Time Highs

Stacks (STX) has garnered significant attention in the cryptocurrency industry as it emerges as a leading altcoin contender. With an impressive performance surpassing all top 100 tokens, except for Dymension (DYM), Stacks has witnessed a remarkable surge in the past 24 hours, catapulting its value well above the $2 mark and inching closer to its all-time high (ATH) of $2.492.

This surge can be attributed to various factors, including its positioning as a Bitcoin layer for smart contracts, the recent surge in Bitcoin’s price, and the token’s adoption and growth rate.

Stacks Climbs The Market Cap Rankings

As outlined in the project’s white paper, Stacks serves as a Bitcoin layer for smart contracts, enabling trustless utilization of Bitcoin as an asset in smart contracts and facilitating transaction settlements on the Bitcoin blockchain.

The recent surge in Bitcoin’s price over the past few weeks has also acted as a catalyst for Stacks’ price surge. Currently trading at $2,156, Stacks has experienced a significant recovery from its low of $1,241 during a market downturn that bottomed on January 23.

Notably, this recovery coincided with Bitcoin’s price rebound from $38,500 to $43,000, highlighting the correlation between the two assets.

Market expert Trover.btc, known on X (formerly Twitter), has noted Stacks’ impressive ascent in the market cap rankings. From being ranked around 60, Stacks has climbed to the 34th position within a year, surpassing well-known projects.

With the Bitcoin Layer 2 narrative gaining prominence and Layer 1 network fees reaching all-time highs, expectations are high for Stacks to enter the top 20 rankings around the halving, according to Trevor.btc.

STX Sets All-Time High Total Value Locked

A key metric to consider is its market capitalization (fully diluted) to gauge Stacks’ adoption and growth rate. According to Token Terminal data, Stacks’ market cap has experienced a notable surge of 187% in the past 90 days and an impressive increase of over 527% year-to-date, aligning with the token’s price surge.

Moreover, data from on-chain analytics aggregator DefiLlama reveals that Stacks’ total value locked (TVL) has reached an all-time high of $70.41 million.

This represents a significant increase of over 400% in just four months, highlighting the growing confidence and demand for Stacks within the decentralized finance (DeFi) ecosystem.

As the demand and interest in the protocol and its native token continue to grow, whether Stacks will surpass its previous all-time high or experience a correction remains to be seen.

The notable correlation between STX and BTC suggests that Bitcoin’s retracement from its current two-year high could also impact the price of STX.

However, the token has significant interest, as reflected in the highlighted metrics above. With the anticipated bull run gaining momentum leading up to the Bitcoin halving event, STX has the potential to reach even higher levels and climb the crypto rankings within the industry.

Observing how the STX price reacts in the coming days and weeks will be interesting. While uncertainties exist, the token’s current high level of interest suggests a positive outlook for its future performance.

Featured image from Shutterstock, chart from TradingView.com

Is Stacks The New Safe Haven? STX Soars 16% In Turbulent Market

In a stunning divergence from the recent altcoin carnage, Stacks (STX) has emerged as a beacon of green. The token has not only weathered the storm but thrived, soaring for seven consecutive weeks and etching its highest price point since March 2023.

At the time of writing, STX was trading at $1.80, down 10% in the last 24 hours, but managed to sustain a solid 16% rally in the last seven days, data from Coingecko shows.

This bullish defiance is no fluke. Stacks broke through a key resistance level, showcasing investor confidence. The lack of pullbacks underscores the sustained buying pressure, while the flash crash’s long wick transformed the once-intimidating barrier into a sturdy support floor.

STX Resilience Amid Market Volatility

Even amid the broader market correction, STX’s resilience speaks volumes about its relative strength. While this remarkable ascent undoubtedly excites, prudent skepticism remains.

The rapid climb without pullbacks might trigger a sudden correction, and concerns about potential overheating linger. Ultimately, STX’s fate remains intertwined with the overall cryptocurrency market sentiment.

Stacks has surged 694% in the past year, benefiting from the Bitcoin boom and standing out amid a recent decline in altcoins. This growth is driven by a mix of optimism around Bitcoin and Stacks serving as a prominent layer 2 solution for the cryptocurrency.

STX Price Movement Amid Anticipation Of BTC ETF Nod

Meanwhile, the potential approval of a Bitcoin ETF has generated excitement in the crypto community, benefiting projects like Stacks.

Stacks’s ability to incorporate smart contracts and decentralized applications onto the secure Bitcoin blockchain positions it well for potential developments in DeFi and NFTs within the Bitcoin ecosystem.

As a leader in the Bitcoin layer 2 space, Stacks is well-positioned to meet the rising demand for scaling solutions. This advantage allows it to attract developers and users interested in building on the security of Bitcoin.

However, the crypto market is volatile, and Stacks’s success depends on ongoing innovation and adoption, given intense competition in the layer 2 sector.

While acknowledging these challenges, Stacks’s impressive performance should be monitored by investors.

The cryptocurrency is navigating the evolving landscape of the Bitcoin resurgence, and its ability to sustain momentum and establish a lasting presence remains uncertain. Nonetheless, the current chapter of Stacks’s story is filled with exciting possibilities.

STX Technical Overview

Stacks (STX) is feeling the heat from the bulls, who are aiming to break through the $1.80 psychological barrier and potentially climb to $1.95, the upper channel limit.

This bullish sentiment finds fuel in a rising Relative Strength Index (RSI) at 66, suggesting buyer dominance, and upward-trending moving averages, hinting at favorable market conditions. If the bulls conquer $1.95, $2.0, a 14% climb from current levels, could be the next stop.

However, caution lurks beneath the optimism. Buyer exhaustion or profit-taking could trigger a correction, sending STX dipping towards $1.6 and even $1.48, the lower channel boundary. The moving averages currently act as strong support zones, potentially buffering this potential dip.

While the bulls lead the charge, keep an eye on the RSI and price action around $1.80 and $1.95. A clean break could propel STX higher, but consolidation or a dip is also a possibility.

Featured image from Shutterstock

Social Frenzy: Stacks (STX) Hits 8-Month High, But It Unveiled An Intriguing Twist

In contrast to the majority of cryptocurrencies, which began the week on a downward trajectory, Stacks (STX) deviated from the prevailing trend and registered gains.

Stacks Network’s native token, STX, had a strong 600% increase in 2023. Stacks is a noteworthy 2019 SEC-qualified token that functions as a layer-2 Bitcoin protocol for smart contracts.

Stacks Surges: Social Buzz And Growth

Stacks has been the talk of the cryptocurrency community lately, receiving a lot of attention on social media. The altcoin’s market value has experienced a notable upswing, having reached a new eight-month high, concomitant with this rise in social volume.

STX’s price has increased by more than 30% in the last week, which has been an impressive rise. This increase in social media mentions and the price gain that followed highlight the rising attention and involvement that Stacks is getting, pointing to increased excitement and hope among investors and the cryptocurrency community as a whole.

Furthermore, in the last few hours, the Bitcoin scaling solution minted its first STX-20. The inscription caused a spike in network activity that led to a sharp rise in transactions and brief network congestion.

The upsurge coincided with the excitement surrounding Bitcoin Ordinals and BRC-20. The average transaction amount experienced a record increase earlier this month, rising from $5 to $7.

Because more users were etching non-financial data onto the Bitcoin blockchain, there was an increase in demand for block space, which contributed to the growing transaction costs.

The token’s price has been steadily rising for the past month, which has encouraged more social contact among members of the cryptocurrency community.

Meanwhile, on-chain data provider Santiment cautioned in a recent post on X (formerly Twitter) that excessive social media activity frequently leads to “fear of missing out” (FOMO) buying.

#Solana (+13%), #Stacks (+23%), and #NEARprotocol (+17%) are the top trending assets, according to rising social volumes. In each case, when there is mainstream talk at this level, #FOMO will create price tops. If holding any, take a cautious approach. https://t.co/bb3O2lFJd1 pic.twitter.com/oMnVvAI0ea

— Santiment (@santimentfeed) December 21, 2023

STX Price Surge Raises Red Flags

The emergence of local price peaks is usually the result of this trend, and as the initial euphoria wears off, prices frequently correct quickly. Following a spike in enthusiasm and speculative interest that drives price increases, there follows a correction phase in the market.

The Bollinger Bands (BB) indicator for STX shows a growing gap between its upper and lower bands, indicating more volatility following the recent price ascent. Since December 3rd, the Average True Range (ATR) has increased by 140% to reach 0.12, suggesting that there may be notable price swings.

Due to the spike in demand, STX’s major momentum indicators—the Money Flow Index (MFI) at 80.22 and the Relative Strength Index (RSI) at 71.56—have reached overbought levels, indicating a potential for a short-term price decrease and the probability of buyer exhaustion.

Despite an endorsement from billionaire investor Tim Draper, it seems that STX couldn’t leverage this significant support to its fullest potential.

In a recent interview with Coin Bureau, Draper designated Stacks as the foremost “showstopper” among crypto projects, highlighting it as the most impactful project he discovered this year.

As STX captures attention and climbs to new heights, the unfolding twists in its journey continue to captivate the cryptocurrency space, leaving enthusiasts eager to see what the next chapters hold for this compelling digital asset.

Featured image from Shutterstock

Investors Flock To Stacks (STX) As It Gains 10% Against The Bears – Here’s Why

Although the market is experiencing an enormous pullback from its month-long rally, a few outliers continue on their upward march. Stacks (STX) is one of the few altcoins that stemmed the bearish tide and even went against the grain of the market. According to Coingecko, the token is up nearly 21% in the weekly timeframe.

However, STX is starting to feel the pressure. As of writing, the token is already down 3% in the past hour. This brings the question of whether STX bulls can continue the rally or will falter along with the others.

A New Project Enters The Fray

In an exciting turn of events, the Stacks Status X account posted an update about network congestion that happened yesterday.

“An exciting new project bringing Ordinals and Stacks closer together launched this weekend. We’re thrilled to see it, but flagging that as a result, the network is seeing increased fees and likely congestion,” said the X account on their recent thread.

This event is taken as a sign that Stacks is entering a painful growing phase that may or may not signal a brighter future for the network. However, running alongside this congestion is the most recent blog post of the dev team.

An exciting new project bringing Ordinals and Stacks closer together launched this weekend. We’re thrilled to see it, but flagging that as a result, the network is seeing increased fees and likely congestion. More

— Stacks Status (@stacksstatus) December 17, 2023

According to muneeb.btc, the code for the Nakamoto Testnet (now branded as Neon) is not complete and will be launched by the end of the month.

Nakamoto will be the update that will define the network.

The Stacks’s Notion site announced:

“The Nakamoto release brings many new capabilities and improvements to the Stacks blockchain by focusing on a set of core advancements: improving transaction speed, enhancing finality guarantees for transactions, mitigating Bitcoin miner MEV (miner extractable value) opportunities that affect PoX, and boosting robustness against chain reorganizations.”

If this testnet launch betters the usability of the network and the experience of its users, it will bring a certain bullish yearend for STX.

Related Reading: Internet Computer Loses Grip On $10, But Still Inks 82% Rally – Details

Stacks Stuck In Between Two Rocks

At the time of writing, STX bulls are trying to break out of the $1.1185 price ceiling which has been held by the bears since the start of the month. If the bulls manage to take this price level, STX will continue to reach higher highs.

However, the current market conditions might prohibit such price movements. Even with a bullish case for the yearend, the token might stabilize between $0.9594 and $1.1185 in the coming days.

Featured image from Pixabay

Hedge Fund Predicts Stacks (STX) As Best Altcoin In Upcoming Months

North Rock Digital, a player in the digital assets hedge fund arena, recently made a bold prediction regarding the altcoin Stacks (STX). In a statement released on X, the fund highlighted its investment strategy and reasoning for STX being the best altcoin to long at the moment.

“When looking for long ideas, we target those with strong fundamentals, supportive tokenomics, and significant upcoming catalysts. STX stands out with the most compelling catalyst path over the next few months and the greatest chance to rerate,” the fund stated.

In-Depth Analysis Of Stacks’ Prospects

North Rock Digital’s full thesis, published on Medium, delves into the details underpinning their positive outlook on STX. The thesis asserts, “Key developments have brought our initial STX thesis into further focus […] demand for Bitcoin block-space has solidified, increasing the demand for the product STX is building.”

Significant is the Nakamoto upgrade, scheduled before the Bitcoin halving in April. This upgrade is seen as a pivotal moment for STX, promising dramatic improvements in speed and efficiency, including 5-second block times and support for sBTC, a secure version of wrapped Bitcoin. This development, according to North Rock Digital, positions STX closer to being a true Bitcoin L2.

The hedge fund also points out the broader context within the Bitcoin ecosystem that favors STX. The rising demand for Bitcoin’s block space, notably with a 50x spike in network average gas fees this year, alongside the development of Ordinals, indicates a growing interest in utilizing Bitcoin beyond just a store of value. These developments, coupled with the anticipated US spot Bitcoin ETF approval, are expected to boost the demand for STX’s offerings.

Furthermore, STX has been somewhat overlooked recently, providing what North Rock Digital sees as a unique investment opportunity. “Despite these positive developments, attention on STX has declined […] leaving us with a unique opportunity,” the thesis elaborates. Notably, the Stacks developer team’s progress towards the Nakamoto upgrade is on track, with the Mockamoto milestone already completed.

The fund also emphasizes Stacks’ international partnerships and upcoming initiatives. These include the launch of a marketing campaign in Asia and the roll-out of the second Nakamoto testnet by January. “Stacks is expanding their footprint globally… They will run a marketing campaign to raise awareness for Bitcoin L2s in the first quarter of ’24 with a focus in South Korea, Singapore, Hong Kong and Dubai,” the fund explains.

“Stacks is expanding their footprint globally… They will run a marketing campaign to raise awareness for Bitcoin L2s in the first quarter of ’24 with a focus in South Korea, Singapore, Hong Kong and Dubai,” the hedge fund explained. Moreover, the introduction of new Bitcoin L1 tools like BitVM is also seen as a significant step towards realizing a true Bitcoin L2 vision without needing changes to Bitcoin L1.

STX Valuation

In terms of valuation, STX is currently seen as undervalued, especially when compared to other L1/L2 ecosystems. With the Nakamoto upgrade and the proximity to the next BTC halving, STX is expected to narrow its valuation discount relative to other assets, North Rock Digital claims.

Post-Nakamoto, STX is anticipated to enable a range of applications, including a performant BTC-denominated NFT marketplace and traditional DeFi applications. The potential for these applications, combined with the strong BTC-centric community of STX, presents a compelling case for its future growth.

At press time, STX stood near its yearly high and was trading at $1.15.

Stacks (STX) Rockets 26% Higher In A Single Week: The Factors At Play

The price of Stacks (STX) experienced a sustained rebound, driven by a prevailing sentiment of positivity within the cryptocurrency sector. STX had a significant increase, reaching a peak of $0.680, which represents the highest value observed since July 14th.

Stacks is a layer-1 blockchain solution aiming to enable smart contracts and decentralized applications on the Bitcoin network without altering its core features, like security and stability.

It operates through the Stacks token (STX), which powers smart contract execution, transaction processing, and asset registration on the Stacks 2.0 blockchain. This enhances Bitcoin’s capabilities without requiring a fork or changes to its original blockchain.

Stacks (STX) Rack Up 26% Gain

At the time of writing, STX was trading at $0.640, up 1.5% in the last 24 hours, and registering a solid 26% increase in the last seven days, data from crypto market tracker Coingecko shows.

The surge in STX is attributed to the prevailing optimism among investors on the potential acceptance of a spot Bitcoin ETF by the US Securities and Exchange Commission.

In a recent statement, Gary Gensler affirmed that the agency is currently engaged in an ongoing examination of the various proposals for exchange-traded funds (ETFs).

It is widely anticipated by analysts that the commission is likely to provide approval to proposals put up by established ETF companies such as Blackrock, Invesco, Infidelity and Franklin Templeton.

This expectation is influenced by their considerable knowledge and experience in the exchange-traded fund (ETF) sector. Given its previous setbacks in lawsuits against Grayscale and Ripple Labs, the SEC also hopes to head off any prospective legal challenges.

Meanwhile, Peter Schiff tweeted this week that the price of bitcoin might rise ahead of the ETF approval, only to fall afterward. Buying rumors and then selling them as news is a common practice.

How many times can #Bitcoin rally on the same ETF rumor? Once a U.S. Bitcoin EFT is approved, or $GBTC is able to convert into an ETF, there will be no more “good” news for Bitcoin to rally on. After years of buying the rumor, everyone will finally be able to sell the news.

— Peter Schiff (@PeterSchiff) October 16, 2023

Analysts’ Outlook For STX

A significant number of cryptocurrency traders utilizing platform X exhibit a favorable perspective towards STX.

DaanCrypto expresses a positive outlook regarding the possibility of a substantial increase in the STX price, contingent upon its ability to surpass the resistance level of $0.52.

$STX Not looking bad on the higher timeframe. Had this huge run up early in the year and has since come down to test the high timeframe support area.

Needs to break above $0.52 to break out of this consolidation.

Below $0.44 is the danger zone. pic.twitter.com/tGI6AeZZWN

— Daan Crypto Trades (@DaanCrypto) October 14, 2023

Nevertheless, the author cautions that a negative trajectory might potentially emerge in the event that the price descends below the threshold of $0.42.

Crypto Tony holds a positive outlook for the cryptocurrency, but his approach differs from the previous trader. He emphasizes a bullish ascending triangle pattern for the altcoin instead of placing the same emphasis on horizontal long-term levels.

Break above 0.53c would be a trigger for a long position legends. Love the structure we are forming so far pic.twitter.com/Gd4xBYptGi

— Crypto Tony (@CryptoTony__) October 8, 2023

This indicates his expectation for potential upward price movement, as ascending triangles are typically seen as bullish patterns with the potential for a breakout to higher price levels. This analysis showcases the diversity of trading strategies and technical indicators in the cryptocurrency market.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Cute Wallpapers

Top 5 Altcoins For October 2023 That Could 20X Your Crypto Portfolio

By now, Bitcoin has grown to the point where crypto investors do not expect very large returns from it and are now looking toward altcoins that could provide the kind of returns they seek. However, with thousands of altcoins circulating in the crypto market, it can become quite hard to pick the coins that could end up doing well.

So here are five altcoins that are well-positioned to do well in the next bull market that could potentially 20x your crypto portfolio.

Lido DAO (LDO) Is A Top Crypto Contender

Lido DAO (LDO) has grown rapidly to dominate the Ethereum liquid staking game, accounting for over 30% of all staked ETH in LSD protocols. This has brought immense attention to its native token, LDO, which on its own has also seen a good run over the years.

However, at just a $1.4 billion market cap, LDO is still what can be referred to as undervalued given its standing in the decentralized finance (DeFi) sector. A bull market could easily see the market cap of LDO cross $30 billion, which would be a more than 20x return on investment from its current $1.61 price level.

Arbitrum (ARB) Dominates Ethereum Layer 2 Altcoins

Arbitrum (ARB) features on this list because of the network’s performance over the years. Of all the Ethereum Layer 2 networks currently in the game, Arbitrum leads the pack both in terms of Total Value Locked (TVL) and daily trade volume.

This puts it ahead of the likes of Optimism (OP), Avalanche (AVAX), and Polygon (MATIC), all of which have been in the game just as long. However, of the 4 leading Ethereum L2s, Arbitrum has the lowest market cap. At $1.08 billion, it is yet to see the same kind of surge its competitors saw in 2021 due to the token launching in the bear market. Arbitrum’s performance even in a bear market shows that it could easily be a top 10 cryptocurrency in the bull market.

Stacks (STX): The Crypto Child Of Bitcoin

Currently, when crypto investors think of NFTs and DeFi on the Bitcoin network, they think of Stacks (STX). This is because Stacks is a Layer 2 network that allows the usage of smart contracts on Bitcoin. This means developers are able to build protocols as well as launch NFT collections on the Bitcoin network using Stacks (STX).

STX’s market cap is still very low at just $715 million especially given what it enables developers to do on the Bitcoin network. This offering makes sure that Stacks is always on the radar of investors, making it a billion-dollar token that could easily bring 20x returns.

Kava (KAVA) Joins The Fun With Layer 1 Technology

Kava (KAVA) has been building up into mainstream adoption despite competition with the biggest networks in the space. This Layer 1 blockchain is taking another route to interoperability by combining the best parts of the Ethereum and the Cosmos networks.

Ethereum is known for its developer power, enabling developers to build pretty much anything, but still held down by slow transactions and high fees. On the other hand, Cosmos has some of the highest speeds and interoperability and when both of these are combined, it presents basically a supercharged Layer 1 blockchain equipped to handle almost anything.

Its native token KAVA is already one of the most watched Layer 1 native tokens, and at a $500 million market cap, it’s fair to say that this altcoin is far from done.

Altcoins Are Not Complete Without The Trust Wallet Token (TWT)

With so many centralized exchanges running into issues such as hacks and bankruptcy, more crypto investors are choosing to self-custody their coins. The top 2 self-custody wallets that also allow users to take advantage of DeFi and NFTs are MetaMask and Trust Wallet. Since only the latter currently has a token, it has been able to corner that market share for itself.

Trust Wallet’s native TWT token rose in popularity when the FTX crypto exchange crashed in 2022 and has not stopped. Going into the bull market, self-custody is expected to be the main avenue to store coins and TWT’s current $411 million market cap could quickly turn into an $8 billion market cap in the bull market.

Stacks (STX) Surges 10% Due To Bitcoin Network Congestion

While the Bitcoin and crypto markets are deep in the red, one altcoin stands out today, posting a double-digit price increase: Stacks (STX). Along with the Lightning Network, the project is considered the most promising layer-2 technology for Bitcoin at the moment and is currently benefiting from the network congestion dilemma.

There are currently over 425,000 unconfirmed transactions in the meme pool. Before being added to the Bitcoin blockchain, transactions are sent to the network’s meme pool, where they wait to be selected by a Bitcoin miner and inserted into the next Bitcoin block. At medium priority, a transaction currently costs an average of $19.04.

The Case For Stacks

The congestion is causing a heated debate: While one side calls it a DDoS attack on Bitcoin, the opposing side is calling the reason for the high fees, Bitcoin ordinals and BRC 20 tokens, a revolution. But no matter which side one takes, one thing becomes obvious. Layer-2 technologies are absolutely necessary and could emerge as a big winner.

Revolution or DDoS?

Market cap of BRC20 based #Bitcoin tokens reaches $1 billion.

Sh*tcoins are extremely congesting the network. There are still 425,000 unprocessed transactions piled up in the meme pool.

— Jake Simmons (@realJakeSimmons) May 8, 2023

However, if the BTC price alone is to be the leading indicator, the current dilemma surrounding BRC20 tokens on the Bitcoin blockchain is not really doing the network any good. Binance hasn’t really done the market any favors either with the multiple withdrawal halts.

But in the long run, higher fees are needed for the BTC network to replace the falling block reward. Co-inventor of Stacks, Muneeb Ali, therefore wrote today on Twitter that high fees are not an attack on Bitcoin, as they will be the norm when Bitcoin grows to a billion people. Rather, Ali says they are a wake-up call to developers to improve and grow Bitcoin L2s.

Bitcoin fees just hit a new record. Up 500x from just a few months ago. Officially marks the start of the arms race to build the best Bitcoin L2s. Lightning, Stacks, and Rootstock have a head start. Time to build.

Bitcoin expert Will Clemente also made the case for L2 today:

If we are in a new regime of higher Bitcoin tx fees due to ordinals/brc-20s, think there’s a very compelling setup for the lightning network over the next few years.

STX Rises 10%

During the first days of May, the Stacks price has broken a downtrend that has lasted since March 20 (black line). Thanks to today’s 10% rise, the STX price now faces the 23.6% Fibonacci level at $0.82. At the price level, stronger resistance from the bears can be expected. Since April 19, STX has not managed to regain the mark.

If this succeeds, a rally to the region of $0.92, where the 38.2% Fibonacci is located, seems possible. Afterwards, the way to the psychologically important mark of $1 would be clear (50% Fibonacci). If the bulls also break through this level, $1.07 (61.8% Fibonacci) and $1.18 (78.6% Fibonacci) would be the next targets.

Bitcoin Layer 2 Stacks’ Token a Top Performer in March

STX has gained 23% in March and is up 350% over the past year.

Open-Source Protocol Ren Token Surges 18% Amid Rising Interest in Multichain Projects

In November, following the protocol’s loss of funding from Alameda, Ren accelerated its shift from Ren 1.0 to a more efficient, secure version.

STX Perpetual Futures Open Interest Doubles to $80M as Traders Take Shorts

I suspect traders are betting that there isn’t a follow-up to Bitcoin NFTs and this is more of a flash in the pan, one analyst said.

Bitcoin Layer 2 Stacks Network’s STX Token Spikes 50% as ‘Ordinals’ Boom

Stack Network is a Bitcoin layer 2 for smart contracts aimed at unleashing the world’s oldest blockchain’s potential as a programmable platform.

Stacks price plunges hard after rallying 70% in a day — more STX losses ahead?

The massive move upside appeared as a $165 million fund is launched by OKcoin to build apps on the Bitcoin blockchain using Stacks.

Blockstack Nodes Will Be Paid in BTC – Not STX – to Secure the Network

Blockstack is rolling out a new consensus mechanism that presents a fresh use case for the world’s most popular cryptocurrency.