The protocol’s’s pseudonymous founder Rooter previously has been critical of “predatory” points programs.

SUI Gets Spicy: Network Fires Back At Token Supply FUD

Sui, the year-old Layer-1 blockchain darling, is facing a harsh reality check. While celebrating its first anniversary on May 3rd, 2034, the network finds itself embroiled in a controversy surrounding its tokenomics, the design and distribution of its cryptocurrency, SUI.

SUI Supply: Cause for Concern?

The fire was ignited by Justin Bons, founder of Cyber Capital, who tweeted concerns about the SUI token supply being overly concentrated in the hands of the founders and early contributors.

Bons pointed to a potential 80% allocation – 160 million out of a total 10 billion – going to Mysten Labs, Sui’s creator, and another 600 million earmarked for “early contributors,” raising eyebrows about potential centralization.

1/16) SUI has a great design, except for its token economics:

SUI claims to have a capped supply of 10B, with 52% being “unallocated” till 2030

The problem is that over 8B SUI is being staked right now!

Over 84% of the staked supply is held by founders! SUI is centralized:

— Justin Bons (@Justin_Bons) May 2, 2024

This alleged lack of decentralization worries investors. If these significant token holders decide to sell their SUI holdings (dump), it could cause a dramatic price drop, harming regular investors.

Sui Fights Back: Transparency On The Agenda

The network wasted no time in refuting these claims. The network vehemently denied any accusations of a centralized token supply, calling them “misleading” and “inaccurate.”

In a bid to assure investors, Sui emphasized that Mysten Labs doesn’t have control over the Sui Foundation treasury, community reserves, or investor tokens.

The network further clarified that the foundation, as the largest holder of locked tokens, will release them according to a publicly available schedule. They reiterated their commitment to transparency, stating that “every token that will be released has been allocated.”

Additionally, Sui highlighted that all staking rewards earned by the foundation are reinvested back into the community, a detail also reflected in the public emission schedule.

Trust Issues: The Market Responds

While Sui attempts to quell concerns, some market participants remain skeptical. They question the network’s motives, labeling the token distribution strategy as potentially manipulative. This skepticism coincides with a recent slump in SUI’s price.

Despite impressive gains in the past, the token has shed over 25% in the last month and sits a staggering 90% below its all-time high. This price performance fuels doubts about the project’s long-term viability.

The Importance Of Transparency: A Lesson For Blockchain Projects

The SUI tokenomics controversy underscores a critical lesson for the entire blockchain industry: transparency is paramount for building investor trust.

Justin Bons’ concerns, though potentially exaggerated, highlight the need for clear communication and verifiable token distribution plans.

As the blockchain space matures, projects that prioritize transparency and fair distribution models will likely garner stronger investor confidence and ultimately, a more sustainable future.

Featured image from Penn Today – University of Pennsylvania, chart from TradingView

Vested crypto tokens worth over $3B to be unlocked in May

Sui, Pyth Network, Avalanche, Arbitrum and Aptos are set to release vested crypto tokens in May, according to data tracker Token Unlocks.

Upcoming Token Releases: These Altcoins Are Set To Inject Billions Into The Crypto Market By May

May 2023 is poised to become a landmark month for the crypto market, with major token releases slated to inject substantial liquidity and potentially catalyze shifts in market dynamics.

Key developments from AEVO and PYTH and significant contributions from other projects are set to channel over $3 billion into the sector.

Substantial Crypto Releases Set the Stage

Token Unlock, a platform dedicated to tracking the release schedules of digital assets, indicates that May will witness one of the most substantial influxes of tokens into the cryptocurrency market this year.

At least 20 crypto projects are preparing to unleash tokens worth more than $10 million each, cumulatively amounting to $3.661 billion. These releases underscore the activity and continuous growth within the crypto sector, even amid fluctuating market conditions.

Among the tokens set to be released, AEVO and PYTH stand out with their billion-dollar injections, underscoring their strong market presence and investor confidence.

AEVO, a decentralized exchange, is scheduled to release 827.6 million AEVO tokens on May 15, which surpasses $1.25 billion at current valuations. This release will dramatically increase AEVO’s circulating supply by 757.95%

PYTH Network, known for providing decentralized market data, plans to follow suit with its considerable token release. On May 20, PYTH will distribute 2.13 billion tokens, valued at around $1.21 billion, representing 141.67% of its existing circulating supply.

Such movements are pivotal for the projects and the broader market, influencing liquidity and potentially price stability.

In addition to AEVO and PYTH, Wu Blockchain reports that Token Unlock has identified several other cryptocurrencies set for significant releases in May.

These include DYDX, ENA, SUI, MEME, GAL, MAVIA, APT, STRK, ARB, APE, IMX, ROSE, PIXEL, and AVAX. ID, YGG, OP, and PRIME are poised to release tokens valued at over $10 million each, rounding out a comprehensive list for the month.

According to TokenUnlocks, the large-amount unlocks in May (unlocked amount greater than $10m) include DYDX ENA SUI MEME GAL MAVIA APT STRK AEVO ARB APE IMX ROSE PIXEL PYTH AVAX ID YGG OP PRIME, etc., with an unlock value of over 3.661 billion US dollars. Among them, the unlocked… pic.twitter.com/tZmihAom3c

— Wu Blockchain (@WuBlockchain) April 30, 2024

Anticipating An Altcoin Surge

Meanwhile, El Crypto Prof, a prominent crypto analyst on X, recently projected a significant rally for the altcoin market based on historical market cycles. He notes that post-Bitcoin halving periods, like those in 2016 and 2020, typically lead to a phase of accumulation in altcoins, followed by a market rally.

Anyone who is bearish here obviously hasn’t done their homework.

Altcoins about to enter the parabolic curve, if we repeat 2016 and 2020.

History doesn’t repeat itself, but It often rhymes.

-Accumulation1⃣

-Backtest2⃣

-Send it3⃣Months of glory ahead imo. pic.twitter.com/uUrKj8qau1

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖

(@el_crypto_prof) April 28, 2024

The analyst suggests the current market mirrors these past cycles, indicating a potential upcoming surge. He believes this could result in the altcoin market cap potentially doubling from its current estimate of around $1 trillion to $2 trillion.

Additionally, Daan Crypto Trades, another analyst, supports the view that the ETH/BTC ratio is a more accurate measure of altcoin market sentiment than the SOL/BTC ratio, signaling positive prospects for altcoins.

Featured image from Unsplash, Chart from TradingView.

Is SUI Sinking? TVL Tanks As Crypto Price Fails To Keep Afloat

For crypto investors, the last several weeks have been a rollercoaster, with many assets seeing price dips and failing to post meaningful gains. The short-term outlook is bleak, despite some analysts’ continued optimism on the market’s long-term prospects.

Halving Hype Fades

Even the granddaddy of cryptocurrencies, Bitcoin (BTC), hasn’t been immune to the market downturn. Currently trading around $63,400, BTC is down 5% in the past day and a staggering 13% from its all-time high of over $73,000.

This sluggish performance follows the recent Bitcoin halving event, which some enthusiasts believed would trigger a price surge. However, market experts had predicted otherwise, and it seems their forecasts were on point.

The halving, which cuts the number of new Bitcoins entering circulation in half every four years, is intended to control inflation and theoretically increase scarcity over time. However, its impact on short-term price movements appears minimal.

SUI Ecosystem Feels The Squeeze

One cryptocurrency experiencing a particularly harsh beating is Sui (SUI), the native token of the Sui blockchain ecosystem. SUI has been on a downward trajectory for the past week, plummeting a staggering 30% from its all-time high of $2.20.

This week alone, SUI has dipped as low as $1.15 before experiencing a brief uptick, only to fall again. The current price sits around $1.18, reflecting a 10% loss in the past 24 hours.

SUI’s TVL Tumbles

Adding to Sui’s woes is the significant decline in its total value locked. TVL refers to the total amount of cryptocurrency locked in DeFi (Decentralized Finance) protocols within a particular blockchain ecosystem.

A high TVL indicates strong user activity and locked funds, which are seen as positive indicators for the health of the ecosystem. Unfortunately for Sui, its TVL has tumbled 30% from its record high earlier this year, currently sitting at around $535 million according to DefiLlama data.

This drop in TVL suggests a decrease in user engagement and locked funds within the Sui ecosystem, mirroring the broader negative sentiment.

Broader Market Correction Or Underlying Issues?

The current market slump isn’t limited to Sui or even Bitcoin. Major altcoins like Ethereum, Solana, and Curve DAO have also seen losses ranging from 4% to 6% over the past week. This suggests a broader market correction rather than an issue specific to Sui.

Analysts point to several factors potentially contributing to the downturn, including rising inflation concerns, ongoing geopolitical tensions, and a general risk-off sentiment among investors.

What Lies Ahead For Crypto?

While the short-term outlook for the crypto market appears uncertain, many analysts remain optimistic about the long-term potential of the technology. The underlying innovation and potential for disruption across various sectors continue to attract interest.

However, navigating the current volatility will likely require a strong stomach and a long-term investment horizon for those looking to weather the storm.

Featured image from Charleston Dermatology, chart from TradingView

Hong Kong-Based First Digital’s $3B Stablecoin Arrives to Sui Network in DeFi Push

FDUSD has quickly become the fourth-largest stablecoin since its launch in July under Hong Kong’s digital asset regulations, benefitting from crypto exchange giant Binance’s trading promotion.

SUI Slips After Hitting All-Time High: TVL Tumbles 12% – Token Price In The Gutter?

The burgeoning world of Decentralized Finance (DeFi) has witnessed a rollercoaster ride for newcomer Sui, a Layer 1 blockchain designed to scale DeFi applications. After a stellar start to 2024, Sui’s Total Value Locked (TVL) – a metric reflecting the total value of crypto assets deposited in its DeFi protocols – surged to a record $724 million in late March. However, this celebratory moment proved fleeting, as the platform has since experienced a downward trend.

SUI TVL Takes A Tumble

Despite the recent decline, Sui’s TVL currently sits at a healthy $654 million, according to DeFiLlama. This translates to a 12% drop from its peak, showcasing a correction following its initial surge. However, it’s important to note that Sui remains in a positive light compared to some established players.

Silver Linings For Sui

While the recent dip might raise concerns, Sui boasts a more optimistic outlook when considering a broader timeframe. Compared to its New Year’s Day value, the current TVL represents a significant 25.5% increase.

This upward trajectory extends further back, with a staggering 68% growth since the beginning of the year. This impressive background performance fuels optimism for Sui’s potential to regain its momentum, potentially propelling it towards a coveted spot amongst the top 10 DeFi chains.

SUI Token Mirrors Market Trends

The price of Sui’s native token (SUI) reflects a similar pattern to its TVL. Currently trading at $1.65, SUI has shed nearly 30% of its value compared to its all-time high of $2.20 reached in late March. Despite the recent slump, SUI has managed a modest 2% daily increase. However, zooming out reveals a 11% loss over the past week.

Can Sui Recover its DeFi Mojo?

Regaining the lost TVL will be a key test for Sui’s development team. Identifying the reasons behind the user exodus is essential. Were there any security concerns or technical glitches that caused users to pull their funds? Transparency and addressing these issues head-on will be critical for rebuilding user confidence.

Related Reading: Filecoin Bull Run On The Horizon? Analyst Sees 250% Surge

Building A Thriving DEX Ecosystem Is Vital

Meanwhile, a vibrant DEX ecosystem is another pillar for Sui’s future. Decentralized Exchanges allow users to trade cryptocurrencies directly with each other, without the need for a centralized intermediary.

Fostering a healthy DEX landscape will attract more users and liquidity to the Sui blockchain, ultimately boosting its TVL. Enticing established DEX protocols to migrate to Sui or supporting the development of native DEX solutions could be effective strategies.

Featured image from Pixabay, chart from TradingView

Sui Overtakes Aptos, Cardano in Value Locked; Sees $310M Inflow in 30 Days

Sui, the layer 1 blockchain built by a group of former Meta (META) employees, has experienced a cascade of inflows this month in a spike that has seen it overtake Cardano, Near and Aptos in terms of total value locked (TVL).

What Is Sui (SUI) Network?

[toc]

What Is SUI?

Sui (pronounced “Swee”) is a decentralized Layer 1 proof of stake blockchain, meaning it serves as the foundational infrastructure for verifying and processing transactions, similar to Bitcoin and Ethereum. Layer 1 blockchains are the backbone that supports a specific token or a network of different tokens.

Sui was developed by Mysten Labs, a group of former Meta employees. It is designed to limit how long it takes to execute smart contracts and support scalability for decentralized applications (dApps). The network believes it has cracked the code on smart contract execution in terms of speed, high security, and low gas fees. This is possible because of the programming language it was designed with called “Move”. Move is a Rust-based programming language that prioritizes fast and secure transaction executions.

According to the whitepaper, the network is named after the element water in Japanese philosophy, a reference to its fluidity and flexibility that developers can use to shape the development of Web3. The network is focused on low latency and super scalability. This has seen it termed by supporters as “the Solana Killer.”

The Sui project was announced by Mysten Labs in September 2021, and in December 2021, Mysten Labs invested $36 million into the project. This was followed by a $300 million series B announcement led by a $140 million commitment by FTX in 2022, valuing the startup at $2 billion.

Reasons Why Sui Network Was Created

In the words of Sui Co-Founder and CEO, Evan Cheng, the current Web3 infrastructure is slow, expensive, and notoriously unreliable. Given this, Cheng said the network was created to change the Web3 game with some 5G level upgrades that would allow developers to create blockchain-powered applications with scalability that you can only associate with centralized technology hubs that dominated Web 2.0.

In other words, the Sui network was created to solve Web3 problems by simplifying and improving the creation of various applications and functions in the Web3 ecosystem, solving the most common problems in the Web3 industry: speed, security, and stability.

How Does The Blockchain Work?

Sui operates as a Layer 1 blockchain focused on optimizing fast blockchain transfers. It places a high level of importance on immediate transaction finalization, making Sui an ideal platform for on-chain applications such as decentralized finance (DeFi), gaming, and other real-time use cases.

Unlike the existing Layer 1 blockchains where transactions are added one after the other, which makes it slow as more transactions are being added to the blockchain, Sui does not make every transaction go through all the computers in the network. Instead, it picks the relevant part of the data it needs to check, which eliminates the problem of congestion on the blockchain and drastically reduces gas fees to carry out transactions.

The Sui network uses a permissionless set of validators to reduce latency and a protocol called the Delegate Proof of Stake system. It has epochs (each consisting of 24 hours), during which Sui holders select a set of validators with whom they store their staked tokens. The validators are then in charge of transaction selection and approval.

Who Are The Brains Behind The Sui Network?

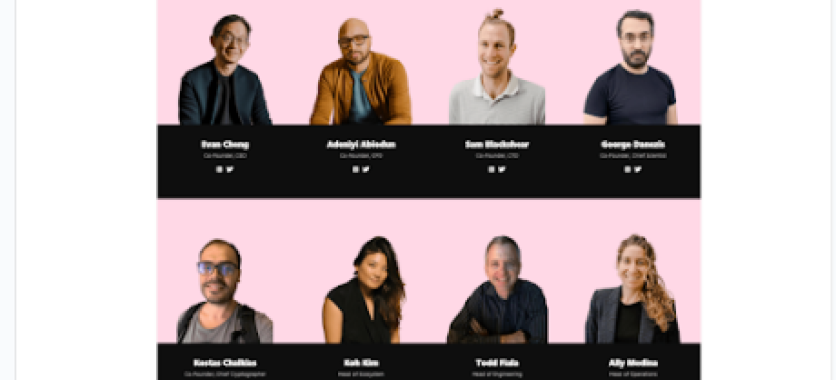

Co-Founder and CEO Evan Cheng: Cheng previously worked at Apple for 10 years, and he was also the former Head of Research and Development at Novi and Technical Director of Meta.

The Chief Scientist George Danezis: Former researcher at Novi, Meta, and previously worked at Chainspace, Microsoft.

Adeniyi Abiodun, CPO: Former Head of Product Development at Novi, Meta. Previously worked at VMware, Oracle, PeerNova, HSBC, and JP Morgan.

Kostas Chalkias: Former leading cryptographer at Novi. He previously worked at R3, Erybo, Safemarket, and NewCrypt.

Sam Blackshear, CTO: Former Chief Engineer at Novi, specializing in the Move programming language.

Investors and Institutions Backing The Network

Sui was valued at $2 billion after FTX Ventures committed $140 million to the project. However, Sui also has other credible investors who also committed, like Binance Labs, the largest centralized crypto exchange by daily trading volume, and Coinbase Ventures, the largest crypto exchange in the United States.

Other investors included Franklin Templeton, a global leader in asset management with more than seven decades of experience, and Jump Crypto, an experienced team of builders, developers, and traders. Apollo, Lightspeed Venture, Circle Ventures, Partners, Sino Global, Dentsu Ventures, Greenoaks Capital, and O’Leary Ventures also invested in the blockchain.

Uses of Sui Coin

SUI coin plays a crucial role within the ecosystem and serves various functions:

- Governance: Sui coin holders can participate in governance decision-making, which includes parameter adjustments, protocol upgrades, and other key network changes. This means SUI holders have a say in the direction and development of the Sui Network.

- Transaction Fees: SUI coin is used to pay for transaction fees within the network. The coin acts as the medium of exchange to cover all associated fees, whether you are interacting with smart contracts, transferring assets, or participating in any Sui on-chain activity.

- Utility: The native coin will be used in various decentralized applications (dApps), gaming applications, and other projects built on the network. It will be used to purchase in-game accessories and NFTs.

- Staking: Staking SUI coin helps network security and consensus. SUI coin holders who stake their coins are being rewarded and given incentives for participation and engagement.

- Investment: Investors can buy and hold or trade SUI coins as an investment on centralized exchanges, just like Bitcoin, Ethereum, Solana, Cardano, BNB, and all other blockchains with good use cases.

Sui Network Plans To Improve The Web3 Ecosystem

Transaction Speeds

Sui Network aims to solve the slow transaction problems on Web3. The network was built on a Rust-based programming language called Move, which prioritizes fast and secure transaction executions. Transactions on the Sui network are validated in epochs of 24 hours, each epoch can be validated independently rather than in blocks like it’s done on traditional blockchains.

The parallel execution of transactions increases Sui network transaction speed to 297,000 transactions per second and 400 milliseconds time of finality compared to Ethereum’s 20 transactions per second and 6 minutes time of finality or Solana’s 10,000 transactions per second and 2.5 seconds time of finality.

Focus On Web3 And Asset Ownership

The Sui network is focused on improving Web3 and Web3 experience by catering to the needs of millions of users, which includes speed and security. Sui allows users to create, upgrade, and deploy decentralized applications and non-fungible tokens (NFTs)

Scalability

Sui Network aims to make Web3 more scalable through parallel processing or execution. This means that the Sui network identifies independent transactions and processes them simultaneously. The implication is that transaction times are reduced, and it accommodates larger transactions loaded per time. It is made possible because of the Sui implementation of the Move programming language and the Narwhal-Bullshark-Tusk Consensus algorithm, which focuses on the details of a transaction rather than the entire chain of transactions.

The Tokenomics Of SUI coin

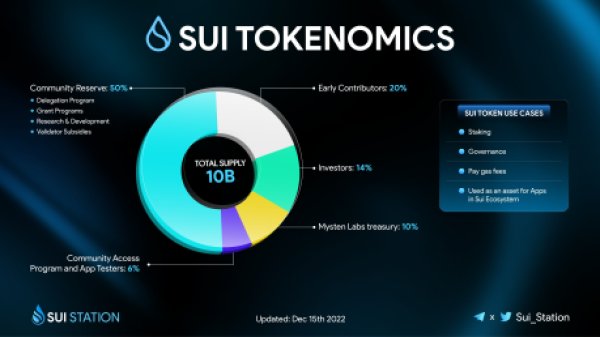

Sui’s native token is called SUI, which has several use cases. According to Coingecko, the max and total supply of SUI is capped at 10 billion coins with a current circulating supply of 1.2 billion, and it is ranked number 48 based on market cap value.

A share of the total supply of SUI was made liquid at the launch of its mainnet on May 3, 2023. Sui’s all-time high was on the day it was launched at $2.16. However, it is currently trading at $1.51, which is a 320% pump from its all-time low of $0.364 last year on October 19.

The tokenomics included 6% going to its Community Access Program and App Testers, 10% of the supply went to the Mysten Labs Treasury, 14% went to its Investors, and 20% went to Early Contributors. The vast majority of the supply, 50%, is kept in its Community Reserve. The purpose and distribution of the Community Reserve include a Delegation Program, Grant Programs, Research & Development, and Validator Subsidies, as shown in the illustration below:

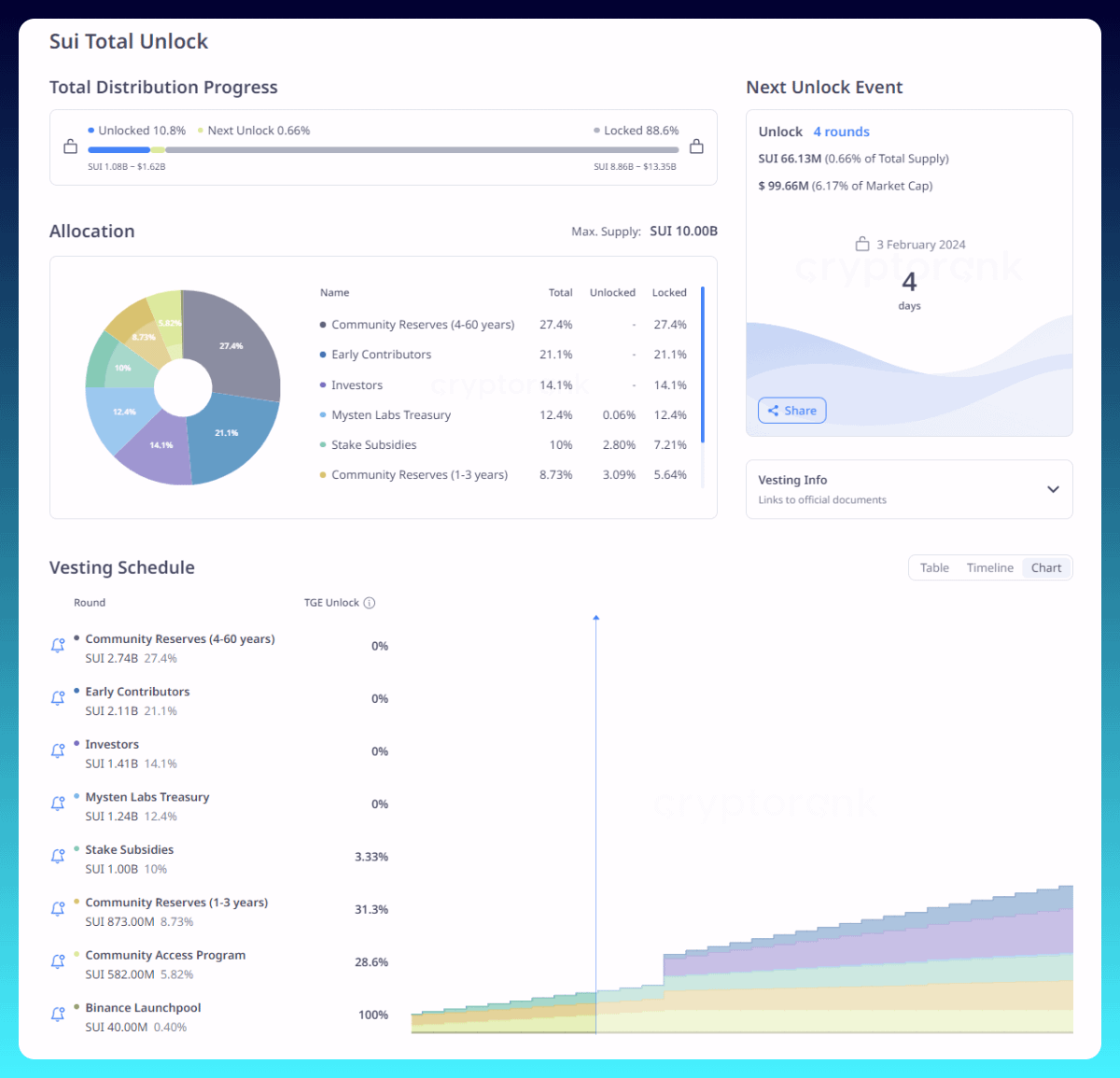

Only about 5% of SUI coins were already in use when the Sui Mainnet launched, while the rest will be gradually released according to their planned schedule, as shown below:

Conclusion

Sui Network aims to improve Web3 by giving every Web3 user a much better Web3 experience without the struggles of slow transaction speeds. The network uses parallel execution for transactions to ensure lightning-fast speed, high security, and low gas fees.

Almost $1B In Altcoins Set To Flood The Market This February: Here Are The Key Ones

February 2024 is a pivotal month, with nearly $1 billion in altcoins set to unlock. This phenomenon, crucial for investors and newcomers alike, signifies the release of previously restricted altcoins into the market, influencing supply and demand dynamics.

Alex Wacy, a renowned decentralized finance (DeFi) research specialist, has highlighted this significant event, emphasizing its impact on some of the notable altcoins among this February unlock.

Altcoins Unleash: The February Token Unlocks

February’s token unlocks encompass a diverse range of projects. Key players such as Aptos (APT), Immutable (IMX), Sui (SUI), Sei Network (SEI), and Oasis Network (ROSE) are at the forefront of this movement.

Aptos is set for a substantial release on February 12, with roughly $230 million worth of tokens poised for circulation. Despite previous unlocks, APT’s price has remained relatively stable.

Similarly, IMX and SUI are preparing for significant unlocks on February 23 and February 3, respectively. IMX’s unlock is valued at around $70 million, while SUI’s, worth $100 million, is particularly noteworthy as it marks its inaugural annual unlock.

SEI and ROSE are also partaking in February’s unlock, with SEI releasing $85 million worth of tokens on February 15 and ROSE’s $19 million unlock scheduled for February 18. These events come when both projects have shown modest gains in the market.

Large token unlocks in February

:

• $DYDX – $91M February 1

• $SUI – $100M February 3

• $NYM – $14M February 3

• $GMT – $28M February 9

• $CGPT – $9M February 10

• $APT – $230M February 12

• $SEI – $85M February 15

• $MANTA – $51M February 18

• $ROSE – $19M February… pic.twitter.com/aK2dT2Phkk— AlΞx Wacy

(@wacy_time1) January 31, 2024

Market Performance Analysis Of Unlocked Tokens

Amid the anticipation of these altcoins unlock, SUI, IMX, and Aptos have experienced notable surges in their values, increasing by 27.3%, 10.6%, and 9.7%, respectively, over the past week. However, the last 24 hours have seen varied movements, with SUI facing a 6.4% decline, Aptos slightly up by 0.7%, and IMX reducing by a mere 0.1%.

SEI and ROSE, on the other hand, have witnessed less dramatic shifts. SEI saw a 6.4% increase over the week, while ROSE gained 5.4%. However, their 24-hour performance has diverged, with SEI dropping nearly 10% and ROSE decreasing by a marginal 0.2%.

These market performances reflect the broader crypto market trajectory, which has recently seen a 1.7% decline in the overall market cap, now at $1.72 trillion.

This decline is led by crypto giants Bitcoin and Ethereum, which have experienced a 1.7% and 1.8% decline in their market caps over the past 24 hours. To put this into perspective, Bitcoin’s overall market cap has dropped approximately $15 billion in the past day, falling from $856 billion yesterday to $841 billion today.

Similarly, Ethereum’s market cap has decreased by nearly $6 billion over the same period, moving from $282 billion yesterday to $276 billion today.

Featured image from Unsplash, Chart from TradingView

Sui Becomes a Top 10 DeFi Blockchain in Less Than a Year

Developers on Sui are building products that people are using to address real-world challenges, according to Greg Siourounis, Sui’s managing director.

SUI Token Blasts Off: Blockchain Newcomer Hits $443 Million TVL, Enters Top 10

In a stunning comeback, the price of Sui token has soared to new heights, painting an impressive picture in the cryptocurrency market. Reaching an impressive $1.61 on the back of a solid 50% weekly rally on Tuesday – its highest point since May 3rd of the previous year – Sui has proven to be one of the standout performers of 2024. With an astronomical surge of over 328% from its lowest level in 2023, Sui has solidified its position as one of the most successful cryptocurrencies of the year.

SUI Breaks Through Resistance

Analyzing the token’s price action, the daily chart paints a compelling picture of an upward trend over recent months. Sui has experienced a remarkable surge from its 2023 low of $0.3500 to its current high of $1.60. Significantly, the token successfully broke through the crucial resistance level at $1.44, effectively nullifying a potential double-top pattern in the making.

Technical indicators, including the 50-day moving average and the Ichimoku cloud, lend further support to the bullish outlook for the Sui token. Market analysts are now setting their sights on the psychological price point of $2, representing a 25% increase from the current level, as the next significant milestone.

Sui owes much of its growth to its innovative architecture and ecosystem fund. Its architecture ensures swift transactions and lower costs compared to similar networks like Ethereum, making it an attractive choice for users. The recent announcement of Banxa’s expansion to the Sui network has further propelled Sui’s price surge. This expansion paves the way for users to easily acquire Sui tokens through Banxa’s on-ramp platform.

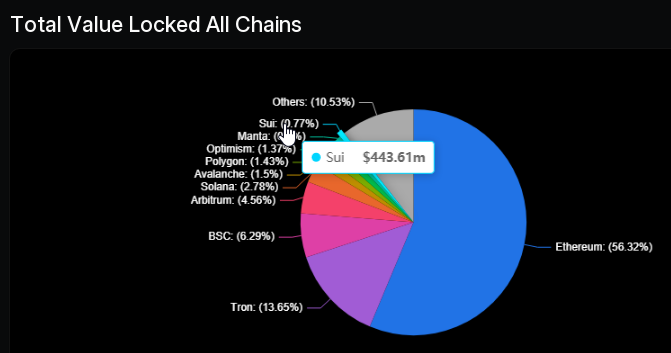

At the core of Sui’s phenomenal rise lies its blossoming Decentralized Finance (DeFi) ecosystem. Boasting a Total Value Locked (TVL) of over $443 million, Sui has secured a spot among the top 10 largest DeFi networks globally.

This achievement is particularly noteworthy as Sui has surpassed well-established cryptocurrencies such as PulseChain, Base, Cardano, Cronos, and Aptos, each valued in the billions. Notably, Cardano alone boasts a market cap exceeding $17 billion.

Sui’s Thriving Ecosystem And Growth Potential

Examining Sui’s thriving ecosystem, Defillama’s tracking reveals a remarkable 22 DeFi applications. Leading the pack is NAVI Protocol, a liquidity provider with over $98 million in assets. NAVI serves as a gateway for users to seamlessly lend and borrow assets across the Sui network, playing a crucial role in driving Sui’s growth.

Sui’s remarkable rise serves as a testament to the ever-evolving landscape of cryptocurrencies and the vast opportunities they present. As the cryptocurrency market continues to evolve, Sui stands out as a shining star, captivating the attention of investors worldwide.

Featured image from Shutterstock, chart from TradingView

Sui Teams Up With Oracle Stork to Provide Builders With Fast Pricing Data

Stork is an oracle purpose-built for the rigors of ultra-low latency trading.

SUI Overtakes Bitcoin, Aptos To Become 13th-Largest DeFi Network

The SUI blockchain has been ramping up since the year 2024 began, and a natural consequence of this rapid growth is that it has now surpassed some major players in the decentralized finance (DeFi) space. This has put it ahead of heavy hitters such as Bitcoin and Aptos as SUI begins to leave its mark on the market.

SUI Network TVL Crosses $360 Million

The total value locked (TVL) on the SUI network has completely exploded in the last year. The total value locked on the blockchain was sitting at less than $12 million in the middle of 2024. But now, less than a month into the year 2024, the TVL has already crossed the $360 million mark.

While this figure is still far off from the likes of Ethereum and BSC which continue to dominate the DeFi TVL, it puts it ahead of some heavy hitters in the game. For example, the Bitcoin TVL is currently sitting at $298.8 million, which means SUI TVL is much higher than that of Bitcoin.

Then again, another network which is currently lagging behind SUI is the Aptos TVL. The Aptos blockchain, which was launched to much fanfare back in 2022, is sitting at a TVL of $133 million. This means that SUI’s TVL is more than 2x higher than that of Aptos.

Other DeFi networks which SUI has surged ahead of include the likes of Kava at a TVL of $251 million, Near at a TVL of $94 million, and Metis at a TVL of $124 million. With its TVL figures, SUI is now the 13th-largest DeFi network.

DeFi Making A Comeback

After a long stretch of poor performance, the DeFi market looks to be making its comeback in 2024. As DeFiLlama data shows, after the market peaked at a TVL of almost $245 billion in 2022, it dropped more than 50%, spending the majority of 2023 trailing below $70 billion.

However, as crypto market sentiment has improved, so has the DeFi TVL. The TVL has grown from its October 2023 lows of $47 billion to more than $72 billion so far in 2024. This is as a result of the likes of SUI gaining more adoption and their token prices also increasing.

As expected, Ethereum dominates the majority of this TVL, currently sitting at $43.743 billion. The Tron and BSC networks are the second and third-largest, with TVLs of $8.14 billion and $5.41 billion, respectively.

Solid TVL Slingshots SUI Price To Break $1 For New All-Time High – Details

Sui (SUI), a newcomer in the crypto sphere, is making waves as it tallied an impressive 87% rally in the last seven days, pushing its price to reach $1.43 at the time of writing for a new record high. Its native token has outperformed Bitcoin, sparking renewed interest in the dormant DeFi scene.

Sui’s remarkable success can be attributed to the remarkable surge in its Total Value Locked (TVL), a key metric reflecting the amount of cryptocurrency locked into its decentralized finance (DeFi) protocols.

Over the course of the past week, the Sui network has witnessed an exponential increase in its TVL, reaching an astonishing figure of nearly $350 million. This achievement holds particular significance considering the relative youth of the platform in the competitive crypto landscape.

Strong TVL Lifts SUI Price To New ATH

The upswing in TVL is indicative of a robust and growing user base that is actively participating in Sui’s DeFi ecosystem. This surge in user engagement is a testament to the platform’s ability to attract and retain a diverse community of crypto enthusiasts.

As users flock to leverage Sui’s offerings, the platform has become a focal point for investors seeking exposure to the burgeoning DeFi space.

Meanwhile, Bitcoin, the former heavyweight champion, is facing challenges. Despite the historic approval of spot ETFs, Bitcoin’s TVL is decreasing, reflecting a decline in its token price.

SUI Ranks 3rd In Singapore Exchange

However, Sui’s achievement goes beyond Bitcoin’s setback. The platform is gaining recognition, with industry leaders like the Singaporean exchange Jubi ranking Sui as the third most-searched token. This signals a surge in curiosity and potential demand. Additionally, an upcoming integration with DeFi powerhouse Solend is expected to further boost Sui’s momentum.

Most searched coins last week on #Jubi (January 8 – January 14)

$BTC @Bitcoin

$ETH @ethereum

$SUI @SuiNetwork

$METIS @MetisDAO

$ENS @ensdomains

$SOL @solana

Which are your favorites?

Trade on Jubi: https://t.co/wSzA3eNtht#Crypto #Bitcoin #Ethererum… pic.twitter.com/fqdb7xY3RN

— JUBI (@JBEXCOM) January 15, 2024

On-chain data shows Sui edging Bitcoin in TVL last week, securing a spot in the top 13 global blockchains. This unexpected success has sent shockwaves through the crypto community, propelling Sui up the price charts.

Social Media Hype

While Bitcoin’s TVL and price struggle, Sui is on a rapid ascent. Just 48 hours after surpassing $250 million, Sui broke through the $300 million barrier, showcasing rapid growth.

Social media activity adds to the hype, especially with discussions around the impending Solend integration. With a current TVL of $335 million, Sui’s momentum is capturing global attention.

Despite the excitement, a word of caution is warranted. The crypto market is volatile, and Sui’s meteoric rise may be followed by a steep descent. Long-term sustainability is the true challenge, and only time will reveal if Sui can maintain its position.

Featured image from

Altcoin Rally Cools as Massive $650M Worth of Token Unlocks Loom Over Crypto Market

Several major alternative cryptocurrencies including DYDX, Optimism (OP) and SUI dropped sharply as massive token unlocks weighed on prices.

November To Witness Over $450M In Token Unlocks: Aptos And Avalanche Take The Lead

The crypto market is set to experience significant token unlocks in November, with projects such as Aptos (APT), Avalanche (AVAX), and Hashflow (HFT) leading the way.

These unlocks are anticipated to release more than $320 million worth of tokens, contributing to the overall $450 million set to enter circulating supplies in the crypto market this month.

It is worth noting that such substantial releases could have immediate and long-term effects on both the price and availability of these digital assets.

Aptos And Top Players In November’s Token Release

Token unlocks are events where previously locked tokens become available for trading, often increasing a project’s circulating supply. These events are critical moments for projects, as they can signal maturation and a new phase of market dynamics.

Aptos, a Layer 1 blockchain created by former Meta executives, is expected to have the most significant token unlock by value, releasing 24.8 million APT tokens, currently representing about $165.6 million at today’s price.

Aptos’s upcoming unlock on November 12 is not just substantial in value but also notable for its distribution, with core contributors, investors, the community, and the Aptos Foundation all set to receive portions of the release.

Meanwhile, Avalanche, another Layer 1 blockchain, is preparing for its considerable token unlock later in the month on November 24, which will see 9.54 million AVAX tokens (valued at approximately $99.3 million at today’s price) released, marking 2.7% of its circulating supply.

Hashflow, a multi-chain decentralized exchange, is slated to have the largest token release by circulating supply percentage. It is poised to unlock 160.38 million HFT tokens, approximately 73.9% of its circulating supply, on November 7, injecting roughly $42 million into the market.

The distribution of these tokens will span early investors, ecosystem development, the core team, and community rewards, adding another layer to the economic activities of the project.

Other Notable November Token Unlocks

Other projects like Optimism (OP), ApeCoin (APE), and Sui (SUI) are also scheduled for significant token unlocks this November. However, they pale in comparison to the top three in terms of value. Optimism is set to unlock 24.16 million OP tokens worth $32.4 million.

Apecoin (APE) is poised for an unlock of 15.60 million APE tokens worth $19.5 million, and SUI is to unlock 34.62 million tokens valued at $14.6 million at today’s market prices.

Each unlock carries potential implications for the broader crypto market, as they may affect liquidity, trading volume, and investor sentiment. Furthermore, out of these six tokens above set to unlock this month, Aptos and Avalanche are the top gainers.

Currently, both assets are up 38% and 22%, respectively, in the past 14 days. APT trades at $6.82, down by 2% over the past 24 hours, while AVAX trades at $11.02, down by 2.7% over the same period, at the time of writing.

Featured image from Unspkash, Chart from TradingView

Sui token struggles to regain despite denial of ‘unfounded’ allegations

The price of the SUI token plummeted after allegations of supply manipulation from regulatory officials in South Korea.

Sui Foundation Calls Report of Supply Manipulation ‘Materially False’

SUI, the native token of the blockchain that was built by former Meta (META) employees, has tumbled by 5% on Tuesday after the community raised concerns over whether the team had been selling staking rewards on Binance.

Brace For Impact As $200 Million In Crypto Is Being Unlocked In October

In a sudden turn of events for what is usually expected to be a bullish month for the crypto industry, a series of token unlocks set to take place this month is now threatening this bullish momentum. With around $200 million in various altcoins expected to flood the open market, the current market rally may end up being short-lived.

$200 Million In Crypto Being Unlocked

Token tracking website Token Unlocks has revealed that around $200 million in various cryptocurrencies are being unlocked at various intervals through the course of this year. The tokens being unlocked range from SUI to Optimism to Aptos’s APT, among others.

A screenshot shared by Wu Blockchain on X (formerly Twitter) showed a list of tokens expecting large crypto unlocks in October, as well as the percentage of supply they represent and their equivalent dollar value. The first on the list is SUI.

SUI’s upcoming token unlock is by no means the largest on the list. But it is significant and will be the first to take place this month. Set to happen on October 3, 34.62 million SUI tokens (4.37% of supply) worth $17.11 million will flow into the open market.

Following this just a couple of days later on October 7 is the Immutable X (IMX) token unlock. This unlock will see another 1.55% of the total supply (18.08 million tokens) worth $10.91 million unlocked. Aptos follows five days later on October 12 with 4.54 million APT tokens accounting for 1.91% of supply and worth $25.81 million.

ApeCoin’s unlock of 15.6 million tokens will then take place on October 17. This represents 4.23% of supply and is worth $19.50 million; the third-lowest of the bunch.

The highest on the list in terms of dollar figures is the Axie Infinity token unlock. This crypto unlock will happen toward the end of the month on October 20, with 15.13 million tokens representing 11.50% of the total AXS supply. The dollar value of these tokens is $71.24 million going by current prices.

Last but not least, is another Optimism OP token unlock. It is slated for October 30 and 24.16 million tokens, similar to previous unlocks, will be brought into circulation. This translates to 3.03% of supply with a dollar value of $35.03 million.

In total, 31 crypto projects have scheduled token unlocks for the month of October. Other notable but smaller unlocks include DYDX’s $4.51 million unlock, CYBER’s $6.87 million unlock, FLOW’s $3.44 million unlock, and Space ID’s $3.98 million token unlock.