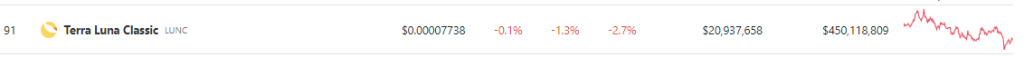

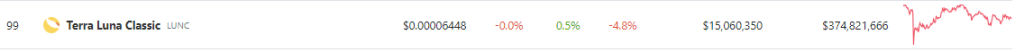

After an impressive 300% rally in the past week, Terra Luna Classic (LUNC) is now facing bearish pressure as it slumped nearly 10% this week.

Despite positive internal news for LUNC, the bears still hold the market at a chokehold. According to CoinGlass, a total of $222,000 worth of long positions were wiped out in the past 24 hours despite the open interest remaining positive.

Terra Luna Classic: Internal Developments Drive Growth

Terra Luna Classic is making some noise online with its community X account being fairly active this month. Enterprise Protocol, a project powered by Terra Luna Classic, recently announced that the protocol can now create cross-chain treasuries on the Juno Network.

1/10 It’s official: cross-chain treasuries are LIVE on Enterprise DAO!

With the addition of cross-chain treasuries, Enterprise DAO becomes an even more powerful no-code DAO platform. See the announcement for details, or read on

https://t.co/12HOpE6RJW

— Enterprise Protocol (@enterprise_dao) November 24, 2023

1/ Big announcement!

Enterprise DAOs can now create cross-chain treasuries on @JunoNetwork

What this means for DAOs and the $JUNO community

pic.twitter.com/ig4viyYvcK

— Enterprise Protocol (@enterprise_dao) December 14, 2023

“Enterprise is dedicated to simplifying DAO management. This includes no-code setup, voting & treasury management, and easy distribution of rewards to members. But limiting the fun to one chain would be sad. Which is why Enterprise DAO is expanding cross-chain!” the dev team said in a recent thread.

2/ Enterprise is dedicated to simplifying DAO management. This includes no-code setup, voting & treasury management, and easy distribution of rewards to members.

But limiting the fun to one chain would be sad

Which is why Enterprise DAO is expanding cross-chain!

— Enterprise Protocol (@enterprise_dao) December 14, 2023

This development would bring more throughput to the network, potentially increasing its exposure to other investors. Even though LUNC enjoys an active community, the market still holds a large sway on the token’s price. As of writing, the market is slowly cooling down after an enormous rally in the past week.

More Pain To Come At These Levels

LUNC’s current price is standing above $0.00017491. As it currently stands, the token is at a crucial price point as any movement here can make or break future price movements. Investors and traders should exercise caution in the next couple of days as the market slows down and assets return to a more stable price point.

LUNC’s main problem is its reliance on major market movements to instigate a hike in price. According to Coingecko, both Bitcoin and Ethereum are experiencing major pullbacks in price after a successful rally last week.

Although LUNC is included on the gainers list, investors should not hold this to heart as any pain in the broader market will hurt short to medium-term gains.

But there is hope on the horizon as the US economy enters a dovish phase with market leaders speculating about rate cuts in 2024.

“The soft landing that many doubted was possible is becoming more realistic every day,” Ryan Detrick, chief market strategist at Carson Group, said in an interview with Reuters.

“Inflation is no longer the problem it was and we still have a very healthy consumer, judging by today’s retail sales data,” he added.

Featured image from Shutterstock

(@ClassyCrypto_)

(@ClassyCrypto_)