Stablecoin issuer Tether, a prominent player in the cryptocurrency market behind the widely used USDT stablecoin, has released its audit statement for the first quarter of 2024, accompanied by a report conducted by independent accounting firm BDO.

The report, which provides additional financial information beyond the reserves backing Tether’s fiat-denominated stablecoins, shows the company’s profit for the first quarter of the year, which saw an increased influx of capital into the market.

Tether Q1 2024 Financials Soar

Digging into the numbers, the first quarter of 2024 proved highly profitable for Tether, with a net profit of $4.52 billion.

The main contributors, the entities responsible for issuing stablecoins and managing reserves, reportedly generated approximately $1 billion of this profit from net operating gains, primarily from US Treasury holdings. The remaining profits were attributable to mark-to-market gains on Bitcoin (BTC) and gold positions.

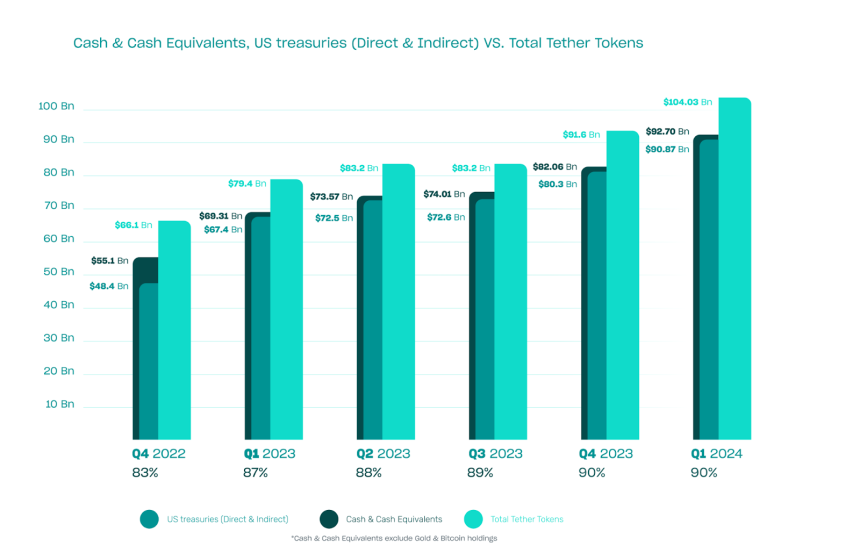

The report also highlighted Tether’s success in increasing its direct and indirect holdings of US Treasuries to over $90 billion. This includes indirect exposure through overnight reverse repurchase agreements collateralized by US Treasuries and investments in US Treasuries through money market funds.

In a sign of significant growth, Tether also disclosed its net equity for the first time, revealing a figure of $11.37 billion as of March 31, 2024. This is an increase from the $7.01 billion equity reported as of December 31, 2023.

The report also highlighted a $1 billion increase in excess reserves, which support the company’s stablecoin offerings, bringing the total to nearly $6.3 billion.

CEO Emphasizes Transparency And Stability

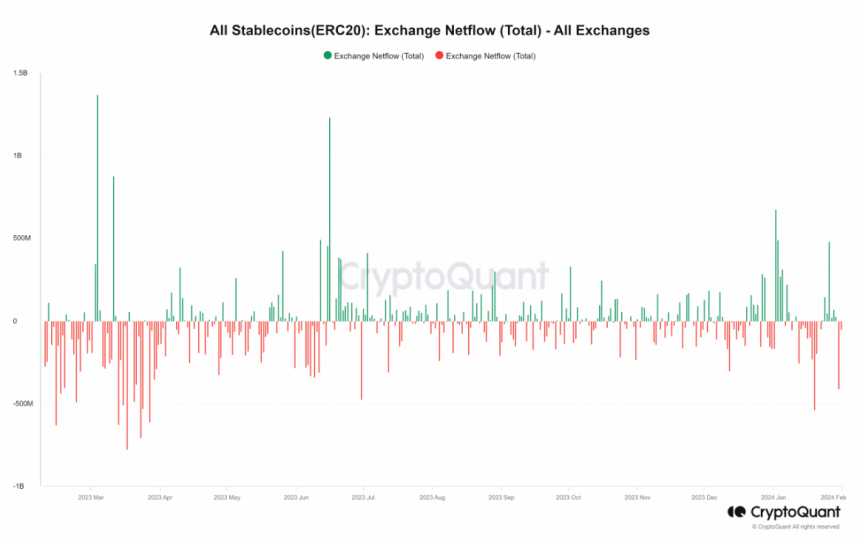

The BDO confirmation reiterated that Tether-issued tokens are 90% backed by cash and cash equivalents, underscoring the company’s stance on maintaining liquidity within the stablecoin ecosystem. Furthermore, the report revealed that over $12.5 billion worth of USDT was issued in the first quarter alone.

Tether Group’s strategic investments, which exceed $5 billion as of the report date, span various sectors, including artificial intelligence (AI) and data, renewable energy, person-to-person (P2P) communication, and Bitcoin Mining.

In response to the latest report, Paolo Ardoino, CEO of Tether, expressed the company’s commitment to transparency, stability, liquidity, and responsible risk management.

Ardoino highlighted Tether’s record-breaking profit benchmark of $4.52 billion and the company’s efforts to increase transparency and trust within the cryptocurrency industry. Ardoino further claimed:

In reporting not just the composition of our reserves, but now the Group’s net equity of $11.37 billion, Tether is again raising the bar in the cryptocurrency industry in the realms of transparency and trust.

Featured image from Shutterstock, chart from TradingView.com