In a detailed analysis shared on X, Miles Deutscher, a renowned crypto analyst, cast a spotlight on the burgeoning sector of Real World Assets (RWA) within the crypto market. Deutscher’s discourse comes in the wake of BlackRock’s groundbreaking venture into tokenized funds, signaling a seismic shift in the digital asset landscape.

With projections indicating that tokenized assets are poised to reach a valuation of $10 trillion by 2030, Deutscher’s enthusiasm is palpable. “If you’re still sleeping on this sector, now is the time to wake up,” he declares, laying the groundwork for a deep dive into RWAs and their associated investment opportunities.

The Genesis And Essence Of Real World Assets (RWA)

Real World Assets (RWA) serve to bridge the tangible with the digital, tokenizing physical commodities such as gold, real estate, and various other commodities, thereby enhancing their efficiency and accessibility. This digitization process eliminates the need for traditional brokers, reduces entry barriers, and significantly cuts down on associated costs.

“RWAs represent a revolutionary step forward in democratizing access to investment in major assets,” Deutscher asserts. He further explains that RWAs not only unlock vast markets for participation—such as global bonds and gold—but also integrate real-world, income-generating assets into the DeFi yield ecosystem.

At their core, RWAs embody ownership rights over physical assets through the digital tokenization on blockchain platforms. Through smart contracts, issuers can mint these tokens, defining their value and the mechanics of their trade. This innovative approach has seen the market capitalization of tokenized public securities surpass $700 million, with the tokenized gold market nearing a $1 billion valuation, according to a report by Bank of America.

This growing demand underscores the sector’s potential, significantly buoyed by BlackRock’s recent foray into RWA with its digital asset fund focused on bonds. Within a mere fortnight, this fund ballooned to a $274 million market cap, capturing a 37.53% market share.

BlackRock’s pivot towards RWAs is not an isolated trend but a bellwether for the industry’s trajectory. “Larry Fink’s bullish stance on tokenization heralds a new era for securities,” Deutscher notes, highlighting the BlackRock CEO’s long-maintained belief in the transformative power of tokenization.

This movement is gaining momentum, with heavyweight TradFi players such as Citi, Franklin Templeton, and JPMorgan exploring RWA avenues. “The convergence of traditional finance and blockchain through RWAs is a testament to the sector’s viability and growth potential,” Deutscher adds, underlining the legitimization of RWAs by these financial titans.

Deutscher’s Curated List Of Top RWA Altcoins

Delving deeper into the specifics, Deutscher categorizes his top picks within the RWA ecosystem:

Layer 1 and Layer 2 Blockchains: Highlighting the significance of foundational blockchain platforms, Deutscher points to L1 and L2 chains that are pivotal in hosting RWA protocols. He emphasizes the strategic advantage of these chains in attracting liquidity and users, albeit noting the nuanced investment approach needed to maximize RWA-specific gains.

“Hyped narratives often drive a lot of liquidity and users to the main chain that powers the underlying dApp. […] The issue with this style of investing, despite its ability to hedge against downside, is the lack of direct upside. If you want capture more RWA-specific upside, RWA-focused chains like Redbelly Network & MANTRA offer more direct exposure,” Deutscher argues.

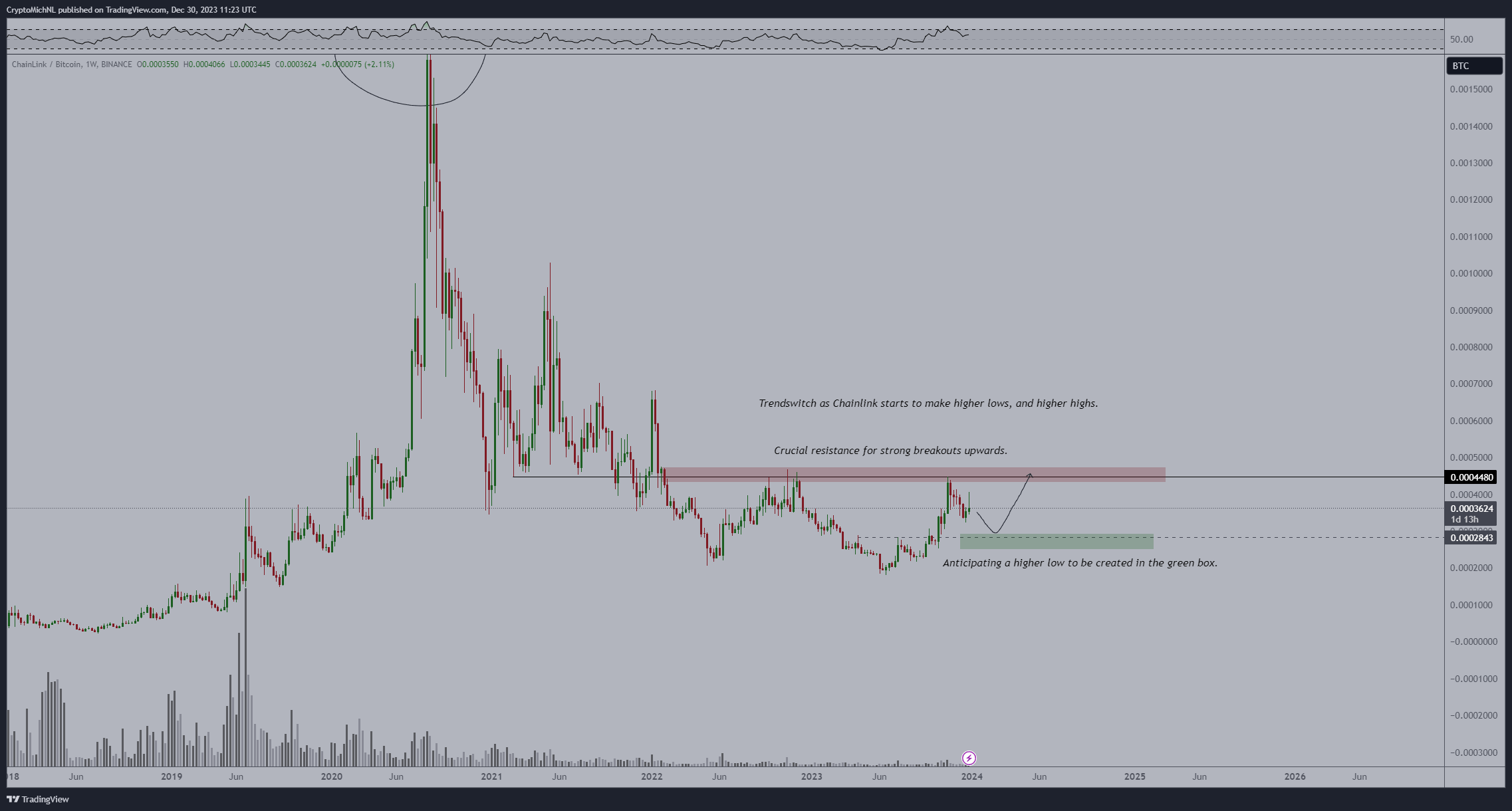

Oracles as the Backbone of RWA Tokenization: Oracles play a crucial role in ensuring the accurate reflection of real-world asset values on the blockchain. Deutscher is particularly bullish on Chainlink (LINK), citing its foundational role in secure, cross-chain information bridging. “Chainlink is indispensable for the RWA sector, offering real-time data verification that’s critical for the integrity of tokenized assets,” he explains.

Moreover, the crypto analyst points to Pyth Network (PYTH) if investor want to “move further down the risk curve.” He added, “whilst Chainlink serves more broader sectors, Pyth is interesting as a DeFi-centric bet, due to its wide L1 compatibility.”

RWA-Specific Protocols: Projects like Ondo Finance, Pendle Finance, and Frax Finance are lauded by Deutscher for their direct engagement with RWAs, each offering unique solutions to leverage real-world assets within the DeFi space. Deutscher applauds Ondo Finance for addressing liquidity challenges, Pendle Finance for its innovative yield-tokenization approach, and Frax Finance for its multifaceted DeFi offerings that include traditional investment avenues.

Emerging Stars in the RWA Space: Deutscher also sheds light on upcoming projects like Lingo and Truflation, earmarking them as ones to watch. With Lingo’s unique model of funding RWA pools for brand partner rewards and Truflation’s infrastructure play in decentralizing economic data, these platforms are at the forefront of RWA innovation, according to him.

At press time, ONDO had a market capitalization of $1.12 billion and was the 94th largest cryptocurrency by market cap. The price stood at $0.80.

: My ULTIMATE DePIN guide (+ top picks).

: My ULTIMATE DePIN guide (+ top picks).