Tether has minted 4 billion USDT over the past month, which accounts for nearly 18% of all USDT issued so far in 2023.

Cryptocurrency Financial News

Tether has minted 4 billion USDT over the past month, which accounts for nearly 18% of all USDT issued so far in 2023.

The Campaign for Accountability wanted to let the anti-crypto senators know that the threat of terrorist financing with crypto was worse than they thought.

Crypto exchange platform Poloniex was attacked by a bad actor, losing over $60 million of its customer’s funds. The Justin Sun led the exchange and launched an investigation, which remains ongoing, to determine the identity of the attackers.

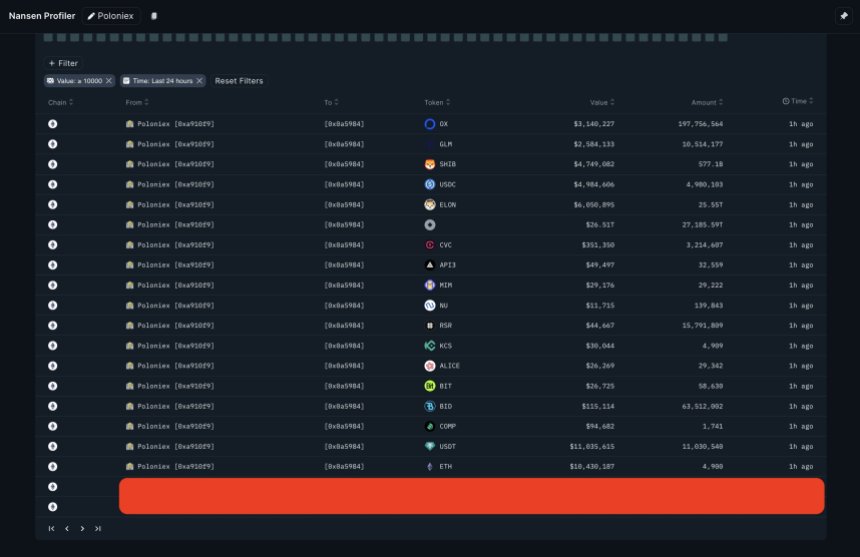

The crypto analytics platform Nansen data indicates that over $68 million in tokens left Poloniex over the past day. The image below shows that the attacker stole assets in ETH, BADGER, REN, OKB, NEXO, and 170 other tokens.

Nansen also confirmed that the biggest losses were suffered in top assets, Ethereum and USDT, with around $11 million each. Other tokens such as ELON, USDC, SHIB, and GLM saw inferior losses but still in the millions of dollars.

A few hours ago, as mentioned, the exchange launched an investigation and Justin assured its users that the platform keeps a “healthy financial position.” In that sense, Sun, also the founder of blockchain TRON, claimed that users will be reimbursed for their losses.

The platform is currently exploring a partnership with other crypto exchanges to recover the fund. Sun stated:

We are offering a 5% white hat bounty to the Poloniex hacker. Please return the funds to the following ETH/TRX/BTC wallets. We will give you 7 days to consider this offer before we engage law enforcement.

In the crypto community, some users praised these efforts to recover the fund and encouraged the attacker or attackers to take the bounty for “pointing out vulnerabilities” in the platform’s security. However, other users were critical of the measure. One community member stated:

(…) a white hat doesn’t steal funds and then ask for a bounty, whatever you’re promising, law enforcement will be involved. It’s like saying you can beat someone to death but if you take them to the hospital you’ll be safe (…).

It remains to be seen if the attacker will accept the offer. In the crypto space, many cyberattacks have been conducted by state-sponsored hacker groups, such as the infamous Lazarus Group, allegedly working for the North Korean Government.

According to a report from our sister website, Bitcoinist, this group stole billions of dollars from the nascent industry in the past two years. The terrorist group is allegedly a key component of the country’s nuclear program. Jason Bartlett, a researcher at the Center for a New American Security (CNAS), said:

Cryptocurrency offers Pyongyang a new kind of currency that is substantially less regulated and understood by national governments, financial institutions, and international organizations.

However, cryptocurrencies also operate as an important tool for law enforcement agencies to track down and cut funding for rogue entities. Due to blockchain technology’s transparency, some criminals stay clear of digital assets and crypto exchanges.

As of this writing, Ethereum (ETH) trades at $2,077 with a 7% profit in the last 24 hours.

Cover image from Unsplash, chart from Tradingview

Cryptocurrency exchange Poloniex has had its hot wallets drained by hackers with an estimated loss of around $60 million.

Tron price is gaining pace above $0.0865 against the US Dollar. TRX is outperforming Bitcoin and could rise further toward $0.091.

After facing a rejection near $0.0910, Tron price started a downside correction. TRX declined below the $0.088 and $0.0865 support levels. Finally, it found support near the $0.0850 zone.

A low was formed near $0.0847 and the price is now rising. It broke a couple of hurdles near the $0.0850 level. There was a break above a key bearish trend line with resistance near $0.0850 on the 4-hour chart of the TRX/USD pair.

The pair is up over 2% and outperforming Bitcoin and Ethereum. It also cleared the 23.6% Fib retracement level of the downward move from the $0.0910 swing high to the $0.0847 low.

TRX price is now trading above $0.0870 and the 100 simple moving average (4 hours). On the upside, an initial resistance is near the $0.0875 level and the 100 simple moving average (4 hours). The first major resistance is near $0.0880 or the 50% Fib retracement level of the downward move from the $0.0910 swing high to the $0.0847 low, above which the price could accelerate higher.

Source: TRXUSD on TradingView.com

The next resistance is near $0.091. A close above the $0.091 resistance might send TRX further higher toward $0.095. The next major resistance is near the $0.098 level, above which the bulls are likely to aim for a larger increase toward $0.100.

If TRX price fails to clear the $0.0875 resistance, it could start a downside correction. Initial support on the downside is near the $0.0862 zone.

The first major support is near the $0.0850 level, below which it could test $0.0847. Any more losses might send Tron toward the $0.0830 support in the coming sessions.

Technical Indicators

4 hours MACD – The MACD for TRX/USD is gaining momentum in the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI for TRX/USD is currently above the 50 level.

Major Support Levels – $0.0862, $0.0850, and $0.0830.

Major Resistance Levels – $0.0875, $0.0880, and $0.0910.

Tron price is gaining pace above $0.0850 against the US Dollar. TRX is outperforming Bitcoin and could rise further toward $0.092.

In the last Tron price analysis, we discussed the chances of more gains in TRX against the US Dollar. TRX remained stable, outperformed Bitcoin, and traded above the $0.082 resistance level.

The bulls were able to pump the price above the $0.0825 and $0.0850 resistance levels. A high was formed near $0.0879 and the price is currently consolidating gains. The current price action suggests that the price could climb further higher above $0.088.

It is now trading well above the 23.6% Fib retracement level of the upward move from the $0.0820 swing low to the $0.0879 high. TRX is also trading above $0.0865 and the 100 simple moving average (4 hours). There is also a major bullish trend line forming with support near $0.0855 on the 4-hour chart of the TRX/USD pair.

On the upside, an initial resistance is near the $0.088 level. The first major resistance is near $0.0920, above which the price could accelerate higher. The next resistance is near $0.095.

Source: TRXUSD on TradingView.com

A close above the $0.095 resistance might send TRX further higher toward $0.10. The next major resistance is near the $0.105 level, above which the bulls are likely to aim for a larger increase toward $0.112.

If TRX price fails to clear the $0.088 resistance, it could start a downside correction. Initial support on the downside is near the $0.0867 zone. The first major support is near the $0.0855 level or the trend line.

The trend line is near the 50% Fib retracement level of the upward move from the $0.0820 swing low to the $0.0879 high, below which it could test the 100 simple moving average (4 hours). The next major support is $0.0830.

Technical Indicators

4 hours MACD – The MACD for TRX/USD is gaining momentum in the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI for TRX/USD is currently above the 50 level.

Major Support Levels – $0.0867, $0.0855, and $0.0830.

Major Resistance Levels – $0.0880, $0.0920, and $0.0950.

Tron price is holding gains above $0.0825 against the US Dollar. TRX is outperforming Bitcoin and could rise further toward $0.095.

In the last Tron price prediction, we discussed how TRX outperformed Bitcoin against the US Dollar. TRX remained stable and was able to settle above the $0.080 pivot level.

There was a decent increase above the $0.0825 and $0.0832 resistance levels. A high was formed near $0.0849 and the price recently corrected lower. There was a minor decline below the $0.0835 level. However, the bulls were active near the $0.0830 support.

The price found support near the 23.6% Fib retracement level of the upward move from the $0.0770 swing low to the $0.0849 high. TRX is now trading above $0.0825 and the 100 simple moving average (4 hours). There is also a short-term contracting triangle forming with resistance near $0.0844 on the 4-hour chart of the TRX/USD pair.

On the upside, an initial resistance is near the $0.0844 level. The first major resistance is near $0.0850, above which the price could accelerate higher. The next resistance is near $0.088.

Source: TRXUSD on TradingView.com

A close above the $0.088 resistance might send TRX further higher toward $0.0920. The next major resistance is near the $0.095 level, above which the bulls are likely to aim for a larger increase toward $0.095.

If TRX price fails to clear the $0.085 resistance, it could slowly move lower. Initial support on the downside is near the $0.083 zone. The first major support is near the $0.082 level or the 100 simple moving average (4 hours).

The next major support is near $0.080 or the 61.8% Fib retracement level of the upward move from the $0.0770 swing low to the $0.0849 high, below which the price could accelerate lower. The next major support is $0.0770.

Technical Indicators

4 hours MACD – The MACD for TRX/USD is gaining momentum in the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI for TRX/USD is currently above the 50 level.

Major Support Levels – $0.083, $0.082, and $0.080.

Major Resistance Levels – $0.085, $0.088, and $0.095.

Google’s BigQuery added 11 new public datasets for blockchain networks, allowing users to obtain a variety of data from these networks.

Google’s cloud-computing business has stored historical data on Bitcoin since 2018, claiming the service provides faster access than can be obtained directly from the blockchain.

Blockchain trackers flag $1-billion “authorised but not issued” USDT mint at Tether’s Treasury; CTO Paolo Ardoino clarifies holdings will be used for ongoing TRON issuance requests and chain swaps.

Tron (TRX), the blockchain platform founded by Justin Sun, has been showing a good performance for the most part of 2023. The project, which was launched just six years ago, recently registered an impressive surge in transaction activity, underscoring the increasing organic demand for the TRX cryptocurrency.

Recent data from a Nansen report reveals that Tron has been processing a remarkable average of over 4.8 million daily transactions, a testament to its rapid expansion within a relatively short period.

Tron’s growth can be attributed primarily to its steadfast pursuit of utility and, notably, the burgeoning demand for cost-effective and reliable stablecoin transactions. The stablecoin marketcap has exhibited aggressive growth in 2023, reaching a pinnacle of over $45 billion between May and June, with daily transactions peaking at an impressive 13 million transactions around the same period.

According to recent data from @nansen_ai, TRON is processing around 4.8M daily transactions!

We’re glad to see so many people using this network and we’re looking forward to increasing that number.

Take a look at more data here: https://t.co/weWHfWXz2k pic.twitter.com/z47TpyIRpQ

— TRON DAO (@trondao) September 12, 2023

What’s particularly noteworthy is that these daily transaction volumes have been achieved during a relatively subdued phase in the cryptocurrency market, suggesting the potential for even higher transaction counts during bullish market conditions. This robust adoption underscores Tron’s resilience and appeal within the blockchain ecosystem.

The cryptocurrency market has reacted positively to Tron’s outstanding performance. At the time of writing, TRX is priced at $0.081092, according to CoinGecko, showing a modest 0.8% gain over the past 24 hours and a 2.6% increase in the seven-day period.

However, it’s essential to exercise caution as Tron continues its upward trajectory. According to cryptocurrency data provider Messari, TRX is one of the digital assets that could face price fluctuations due to impending FTX liquidations.

FTX LIQUIDATIONS UPDATE

FTX liquidators hold approximately $1.3 billion of liquid crypto assets (excluding stablecoins) which have been dragged down by fear of FTX liquidations potentially beginning Wednesday.

Largest holdings: $SOL, $BTC, $ETH, $APT, $DOGE, $TRX, $MATIC… pic.twitter.com/ki3l6xKgPf

— Messari (@MessariCrypto) September 11, 2023

FTX and Alameda Research hold significant amounts of TRX, totaling $33 million, along with $37 million worth of Dogecoin (DOGE) and $22 million worth of Polygon (MATIC). These holdings raise concerns about potential market volatility, as large liquidations can impact the price of these assets.

Implications For The Future

As the cryptocurrency market continues to evolve, Tron’s pursuit of utility and its growing adoption rates indicate a promising future.

However, investors should remain vigilant amid potential price fluctuations linked to FTX liquidations, underscoring the need for careful risk management in the cryptocurrency space.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Goodreturns

Huobi’s new name HTX stands for exchange, the blockchain project Tron and the company’s 10th anniversary.

Tron price is showing positive signs above $0.080 against the US Dollar. TRX is outperforming Bitcoin and could start another increase toward $0.10.

In the last Tron price analysis, we discussed the chances of more gains in TRX against the US Dollar. TRX formed a base above the $0.0770 level and started another increase.

There was a clear move above the $0.080 resistance zone, outperforming Bitcoin. The price even cleared the $0.082 level. A high is formed near $0.0828 and the price is now correcting gains below the 23.6% Fib retracement level of the upward move from the $0.0770 swing low to the $0.0828 high.

TRX is now trading above $0.080 and the 100 simple moving average (4 hours). There is also a connecting bullish trend line forming with support near $0.0780 on the 4-hour chart of the TRX/USD pair.

Source: TRXUSD on TradingView.com

On the upside, an initial resistance is near the $0.0815 level. The first major resistance is near $0.0828, above which the price could accelerate higher. The next resistance is near $0.085. A close above the $0.085 resistance might send TRX further higher. The next major resistance is near the $0.092 level, above which the bulls are likely to aim a larger increase toward the key $0.10 zone in the coming days.

If TRX price fails to clear the $0.0815 resistance, it could slowly move lower. Initial support on the downside is near the $0.080 zone. The first major support is near the $0.0792 level or the 61.8% Fib retracement level of the upward move from the $0.0770 swing low to the $0.0828 high.

The next support is near $0.0780 or the trend line, below which the price could accelerate lower. The next major support is $0.0755.

Technical Indicators

4 hours MACD – The MACD for TRX/USD is losing momentum in the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI for TRX/USD is currently above the 50 level.

Major Support Levels – $0.080, $0.0792, and $0.0780.

Major Resistance Levels – $0.0815, $0.0828, and $0.092.

In a completely unexpected move, Justin Sun, Founder of Tron and Advisor to Huobi Global has expressed his interest in acquiring FTX’s considerable crypto assets worth billions of dollars.

Justin Sun, Creator of Tron, one of the world’s largest blockchain ecosystems, has hinted at the possibility of acquiring the assets of insolvent crypto exchange FTX. This statement comes a year after the crypto billionaire was contemplating a majority takeover of Huobi Global.

According to data from Messari, a provider of market intelligence products, FTX liquidations hold a total of $1.3 billion in liquid crypto assets excluding stablecoins. The report revealed some of the largest holdings for FTX liquidators which include cryptocurrencies like Solana (SOL), Ethereum (ETH), Aptos (APT), Dogecoin (DOGE), Tron (TRX), and Polygon (MATIC).

Given the considerable holdings, there have been fears that the market could witness a crash if the exchange were to start dumping its crypto assets. In response to this, Sun revealed in a post on X (formerly known as Twitter) that he was considering the possibility of purchasing FTX holdings.

The Tron Founder explained that the reason behind it was to reduce their selling influence on the crypto market.

“Contemplating an offer for FTX’s holding tokens and assets to reduce their selling impact on the crypto community. Let’s unite to bolster our crypto ecosystem,” Sun stated.

However, data from Messari revealed that FTX and Alameda’s BTC holdings, which are approximately $353 million, account for only 1% of BTC’s weekly trading volume, meaning the crypto market can easily handle selling impacts.

Whereas, FTX’s crypto holdings such as DOGE, TRX, and MATIC which range from $20 million to $30 million account for 6-12% of weekly trading volumes, and liquidations could significantly impact the crypto market.

Most of FTX’s SOL are also locked up in Alameda and FTX ventures, and they have a unique liquidation pattern, which allows only $9.2 million SOL to be unlocked every month. This monthly liquidation system allows selling impacts of FTX’s Solana holdings to be easily managed.

On November 11, 2022, FTX and a number of its affiliates filed for bankruptcy in Delaware, United States. At the time, the exchange owed a staggering $8 billion after it collapsed due to a liquidity crisis.

The crypto exchange is currently under investigation by the United States Securities and Exchange Commission (SEC) while its Founder and CEO, Sam Bankman Fried was charged on 13 accounts for alleged illegal proceedings he performed in FTX, five of which were later withdrawn in June.

FTX liquidators are currently scheduled for a hearing on Wednesday, September 13. The result of the hearing may see the liquidators given clearance to begin liquidations immediately.

A recent court filing has also revealed that the bankrupt crypto exchange still holds assets worth $7 billion. Some of these assets include digital assets, venture investments, and reclaimed properties.

Tron price is gaining pace above $0.0780 against the US Dollar. TRX is outperforming Bitcoin and could rally further above the $0.0800 resistance.

In the last Tron price prediction, we discussed the chances of an upside break against the US Dollar. TRX remained well-bid and stable above the $0.0750 level.

It started a decent increase and broke a few key hurdles near $0.0775, outperforming Bitcoin. There was a break above a major contracting triangle with resistance near $0.0770 on the 4-hour chart of the TRX/USD pair. The pair even cleared the $0.0785 level.

A high is formed near $0.0793 and the price is now consolidating gains above the 23.6% Fib retracement level of the upward move from the $0.0751 swing low to the $0.0793 high.

TRX is trading above $0.078 and the 100 simple moving average (4 hours). On the upside, an initial resistance is near the $0.0795 level. The first major resistance is near $0.080, above which the price could accelerate higher. The next resistance is near $0.088.

Source: TRXUSD on TradingView.com

A close above the $0.0880 resistance might send TRX further higher. The next major resistance is near the $0.095 level, above which the bulls are likely to aim a larger increase toward the key $0.10 zone in the coming days.

If TRX price fails to clear the $0.080 resistance, it could start a downside correction. Initial support on the downside is near the $0.0780 zone.

The first major support is near the $0.0770 level or the 50% Fib retracement level of the upward move from the $0.0751 swing low to the $0.0793 high, below which the price could accelerate lower. The next major support is $0.0750.

Technical Indicators

4 hours MACD – The MACD for TRX/USD is gaining momentum in the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI for TRX/USD is currently above the 50 level.

Major Support Levels – $0.0780, $0.0770, and $0.0750.

Major Resistance Levels – $0.080, $0.0880, and $0.100.

Tron price is rising and trading above $0.0750 against the US Dollar. TRX is outperforming Bitcoin and could rally further above the $0.0780 resistance.

This past week, Tron’s price saw a rejection pattern near the $0.0780 resistance against the US Dollar. TRX made a couple of attempts to clear $0.0775 and $0.0780 but failed.

There was a downside correction below the $0.0765 level. The price declined below the 23.6% Fib retracement level of the upward move from the $0.0713 swing low to the $0.0778 high. However, the bulls were active near the $0.0750 support.

TRX stayed above the 50% Fib retracement level of the upward move from the $0.0713 swing low to the $0.0778 high. The price is now trading above $0.0750 and the 100 simple moving average (4 hours).

It is showing positive signs and outperforming both Bitcoin and Ethereum. On the upside, an initial resistance is near the $0.0775 level. Besides, there is a crucial contracting triangle forming with resistance near $0.0775 on the 4-hour chart of the TRX/USD pair.

Source: TRXUSD on TradingView.com

The first major resistance is near $0.0780, above which the price could start a fresh increase. The next resistance is near $0.080. A close above the $0.0800 resistance might send TRX further higher. The next major resistance is near the $0.0832 level, above which the bulls are likely to aim a larger increase toward the key $0.0880 zone in the coming days.

If TRX price fails to clear the $0.0780 resistance, it could start a downside correction. Initial support on the downside is near the $0.0760 zone and the 100 SMA.

The first major support is near the $0.0750 level, below which the price could accelerate lower. The next major support is $0.0715.

Technical Indicators

4 hours MACD – The MACD for TRX/USD is gaining momentum in the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI for TRX/USD is currently above the 50 level.

Major Support Levels – $0.0760, $0.0750, and $0.0715.

Major Resistance Levels – $0.0780, $0.0800, and $0.0832.

Tron (TRX) has orchestrated an impressive recovery, bouncing back from last week’s dip of $0.07000 and regaining losses it incurred this month.

As of the latest data from CoinGecko, the TRX price currently stands at $0.076, despite a minor 1.2% decline over the past 24 hours. This resurgence follows a decent seven-day rally that has seen TRX gain 5.4%.

Delving into the technical analysis on a weekly timeframe, it becomes evident that TRON has been tracing an ascending support line since November 2022. This trajectory has been consistently validated through multiple instances, underscoring its significance.

Market analysts and enthusiasts are now setting their sights on potential price trajectories for TRX. Based on a comprehensive price analysis, bullish sentiment is prevailing as TRX bulls seem poised to take on the next resistance level at $0.080.

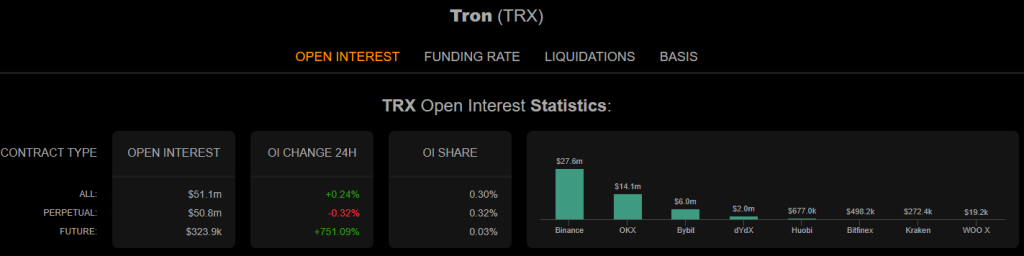

Meanwhile, a noteworthy development has emerged within the derivatives market, adding a new dimension to TRX’s ongoing journey. This development revolves around the concept of Open Interest rates, a critical metric that measures the cumulative value of outstanding derivative contracts.

Over a recent period, from August 18 to the present moment, Open Interest rates have experienced a remarkable surge, escalating from approximately $45 million to a robust figure exceeding $51 million.

This surge in Open Interest rates carries profound implications, casting a spotlight on the prevailing sentiment among traders. The notable increase is indicative of a prevailing bullish outlook held by a substantial portion of traders and market participants. This surge essentially signifies that there is a widespread belief in the potential for further upward movement in TRX’s price.

The significance of this rise in Open Interest rates transcends mere optimism. It’s also a concrete indicator of the broader market’s growing interest in TRX derivatives. This trend underscores a heightened willingness among traders to engage in derivative contracts linked to TRX, thereby enriching the trading landscape around the token.

Balancing Act: Consideration Of Fluctuating Funding Rates

Despite these encouraging signs, market participants are cognizant of potential headwinds. Fluctuating funding rates, which denote the cost of holding positions in futures contracts, could introduce volatility and potentially impede a solid and sustained upward momentum in the short term.

As TRX ventures toward key resistance levels, it faces the challenge of maintaining its upward trajectory while navigating potential dips. The derivatives market provides a favorable backdrop, but market players remain watchful of funding rate fluctuations. The coming days will shed light on whether TRX can maintain its ascent and solidify its position.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Zipmex

Tron price is rising and trading above $0.0760 against the US Dollar. TRX is outperforming Bitcoin and could rally further toward the $0.0820 resistance.

This past week, Tron’s price saw a sharp decline below the $0.0760 support against the US Dollar, similar to Bitcoin and Ethereum. TRX tested the $0.0715 zone where the bulls took a stand.

A low was formed near $0.0713 and the price started a fresh increase. There was a decent increase above the $0.0740 and $0.0750 resistance levels. It even outperformed Bitcoin in the past couple of sessions and broke the $0.0760 resistance.

There was a move above the 76.4% Fib retracement level of the downward move from the $0.0775 swing high to the $0.0713 low. TRX is now trading above $0.0760 and the 100 simple moving average (4 hours).

There is also a key bullish trend line forming with support near $0.0762 on the 4-hour chart of the TRX/USD pair. On the upside, an initial resistance is near the $0.0790 zone. The first major resistance is near $0.080, above which the price could rise toward the $0.0820 resistance or the 1.618 Fib extension level of the downward move from the $0.0775 swing high to the $0.0713 low.

Source: TRXUSD on TradingView.com

A close above the $0.0820 resistance might send TRX further higher. The next major resistance is near the $0.0850 level, above which the bulls are likely to aim a larger increase toward the key $0.0900 zone in the coming days.

If TRX price fails to clear the $0.080 resistance, it could start a downside correction. Initial support on the downside is near the $0.0760 zone and the trend line.

The first major support is near the $0.0745 level, below which the price could accelerate lower. The next major support is $0.0715.

Technical Indicators

4 hours MACD – The MACD for TRX/USD is gaining momentum in the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI for TRX/USD is currently above the 50 level.

Major Support Levels – $0.0760, $0.0745, and $0.0715.

Major Resistance Levels – $0.0790, $0.0800, and $0.0820.

Curve Finance, a decentralized liquidity pool for stableswap and stablecoin trading, has disclosed a strategic partnership that will see the decentralized exchange (DEX) launch on the TRON network.

Decentralized Exchange, Curve Finance has solidified its position as the second largest DEX, following the announcement of its integration into the TRON network.

Curve Finance’s recent alliance with the TRON network has prompted a substantial investment from TRON DAO Ventures, a venture capital firm established by the TRON network. On Thursday, August 17, TRON Founder, Justin Sun purchased $2 million worth of CRV, the native token of the DeFi protocol.

Similarly, Curve Finance has stated that it will be launching on the BitTorrent Chain (BTTC) network, a peer-to-peer network blockchain scaling solution for file and data sharing. The Integration of the protocol into TRON DAO and BTTC networks aims to fuel the development of innovative DeFi projects and the growth of DeFi ecosystems.

Curve Finance is widely known for its role in stable coin trading by providing low slippage exchanges through automated market maker (AMM) algorithms. By aligning with the protocol, TRON and BTTC will benefit from lower financial costs and indirect backing from prominent blockchains Curve DAO supports including Avalanche, Ethereum, and Arbitrum.

Justin Sun welcomed the newly formed alliance with enthusiasm. He commented that Curve Finance plays a pivotal role in the DeFi ecosystem and blockchain industry and looked forward to new innovative solutions promoted by the partnership.

“Curve is an essential DeFi infrastructure for the blockchain industry. Our thoughts are with the team and the users affected. As a community, let’s support and strengthen the security measures to protect our decentralized ecosystem,” Sun stated.

The decentralized finance (DeFi) landscape was previously shaken up following news of a hack on the DEX. On July 30, Curve Finance fell victim to a reentrancy attack that exploited vulnerabilities in its smart contract codes, resulting in a loss of $62 million.

Following the news of the hack attack, the CRV token declined and the majority of the DeFi ecosystem was in panic. However, Curve Finance has reportedly recovered 70% of the funds and to recover the rest of the stolen funds, the protocol has placed a bounty on the attacker, promising $1.85 million to anyone able to reveal the hacker’s identity.

Curve Finance has also promised to compensate victims of the security breach. The DEX has stated that it will distribute reimbursements fairly as they determine the extent of damages and work toward recovering the stolen funds.