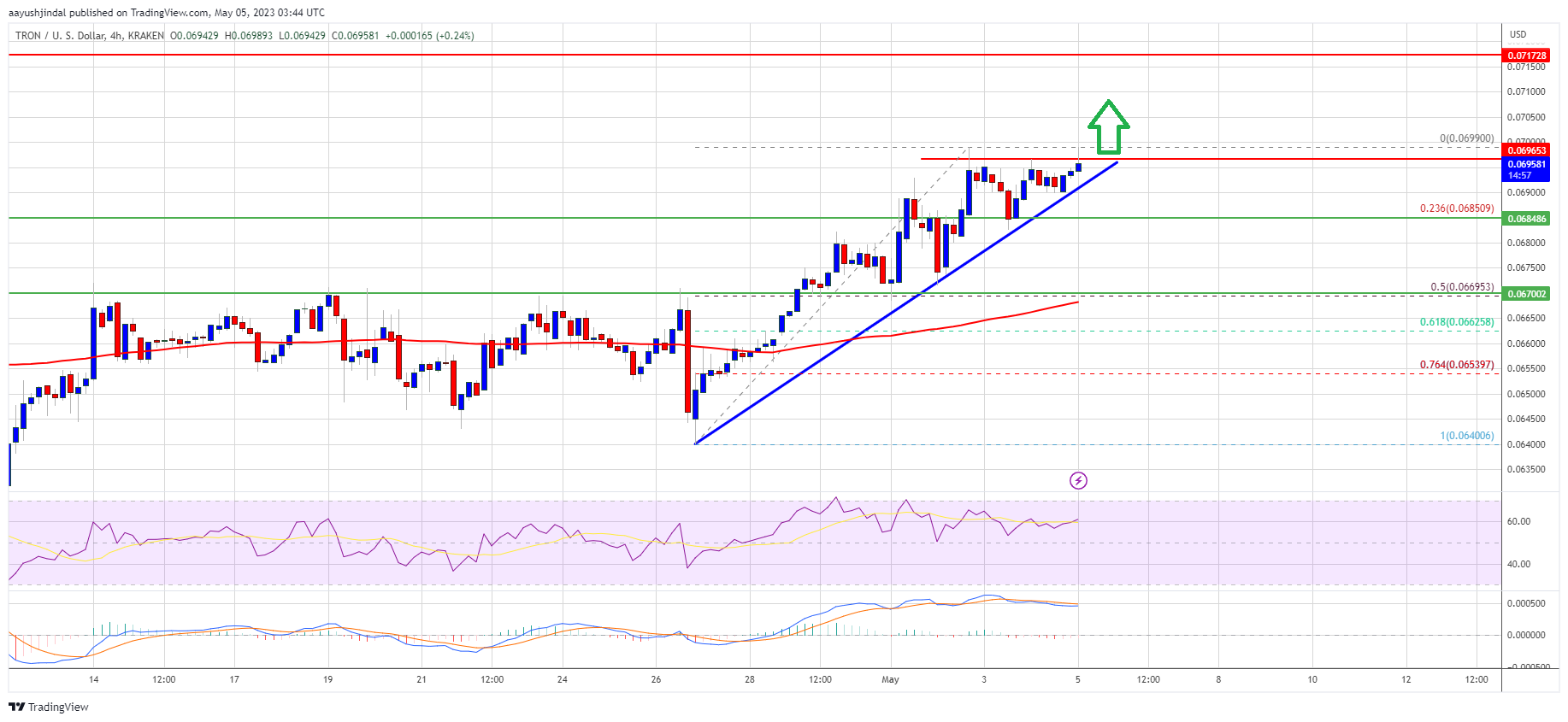

Tron price is rising and trading above $0.0760 against the US Dollar. TRX is outperforming Bitcoin and could rally further toward the $0.0820 resistance.

- Tron is moving higher from the $0.0720 support zone against the US dollar.

- The price is trading above $0.0760 and the 100 simple moving average (4 hours).

- There is a key bullish trend line forming with support near $0.0762 on the 4-hour chart of the TRX/USD pair (data source from Kraken).

- The pair could continue to climb higher toward $0.080 and $0.0820.

Tron Price Starts Fresh Increase

This past week, Tron’s price saw a sharp decline below the $0.0760 support against the US Dollar, similar to Bitcoin and Ethereum. TRX tested the $0.0715 zone where the bulls took a stand.

A low was formed near $0.0713 and the price started a fresh increase. There was a decent increase above the $0.0740 and $0.0750 resistance levels. It even outperformed Bitcoin in the past couple of sessions and broke the $0.0760 resistance.

There was a move above the 76.4% Fib retracement level of the downward move from the $0.0775 swing high to the $0.0713 low. TRX is now trading above $0.0760 and the 100 simple moving average (4 hours).

There is also a key bullish trend line forming with support near $0.0762 on the 4-hour chart of the TRX/USD pair. On the upside, an initial resistance is near the $0.0790 zone. The first major resistance is near $0.080, above which the price could rise toward the $0.0820 resistance or the 1.618 Fib extension level of the downward move from the $0.0775 swing high to the $0.0713 low.

Source: TRXUSD on TradingView.com

A close above the $0.0820 resistance might send TRX further higher. The next major resistance is near the $0.0850 level, above which the bulls are likely to aim a larger increase toward the key $0.0900 zone in the coming days.

Are Dips Limited in TRX?

If TRX price fails to clear the $0.080 resistance, it could start a downside correction. Initial support on the downside is near the $0.0760 zone and the trend line.

The first major support is near the $0.0745 level, below which the price could accelerate lower. The next major support is $0.0715.

Technical Indicators

4 hours MACD – The MACD for TRX/USD is gaining momentum in the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI for TRX/USD is currently above the 50 level.

Major Support Levels – $0.0760, $0.0745, and $0.0715.

Major Resistance Levels – $0.0790, $0.0800, and $0.0820.

Binance (@cz_binance)

Binance (@cz_binance)

₮ (@justinsuntron)

₮ (@justinsuntron)