Uniswap, one of the world’s largest decentralized exchanges (DEX) by total value locked (TVL), is approaching a major milestone on Arbitrum, the largest layer-2 by TVL on Ethereum.

According to data from Dune Analytics shared by Uniswap Labs, Uniswap on Arbitrum is on the cusp of surpassing a staggering $150 billion in total swap volume.

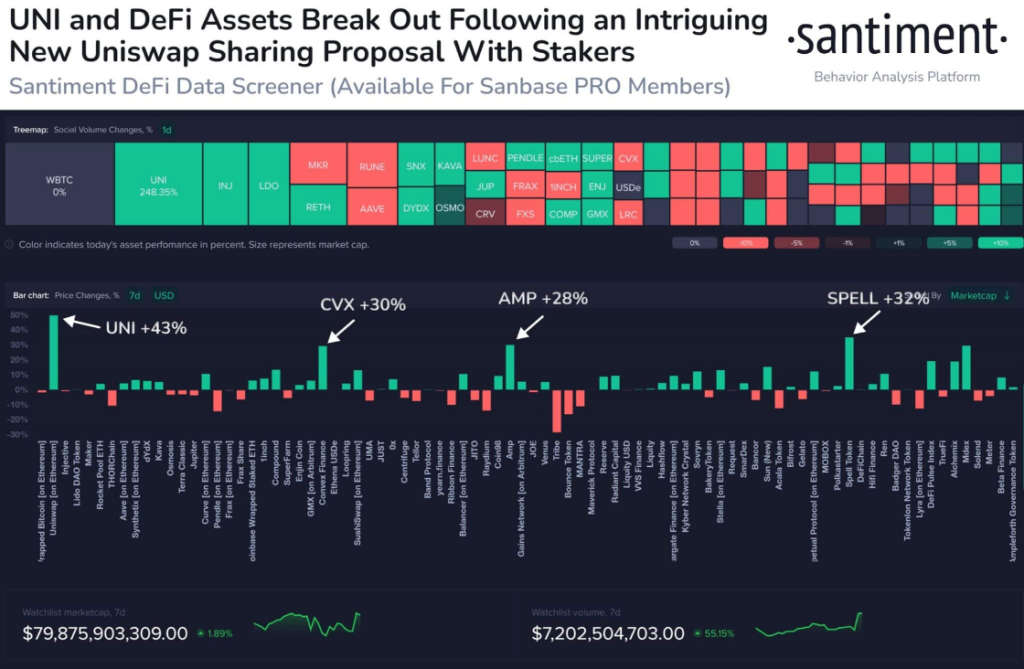

Riding The DeFi Boom

As of April 25, Uniswap had facilitated over $146 billion in cumulative swap volume on Arbitrum alone. The number has gradually increased over the past three years since June 2021, when it was deployed on Arbitrum, looking at on-chain data.

By August 2021, Uniswap was processing less than $5,000 in swap volume. After that, they steadily picked up momentum throughout the crypto bear run of 2022. Notably, a sharp uptick from October 2023 coincided with the start of the crypto boom that eventually propelled Ethereum to over $4,000 in Q1 2024.

The rising swap volume on Arbitrum reflects the increasing preference for Decentralized Finance (DeFi) solutions. As Uniswap on Arbitrum nears $150 billion, more users are increasingly turning to the popular DEX to trade, all without giving up control of their assets.

The surging popularity of Uniswap on Arbitrum can be partly attributed to significantly lower transaction fees compared to the Ethereum mainnet.

Through Arbitrum, the optimistic roll-up solution, swappers enjoy low transaction fees. They can also trade from a scalable environment secured by the Ethereum mainnet.

Ethereum developers recently implemented Dencun, introducing a new transaction format called “blobs.” Because of this, layer-2 solutions can store large chunks of data off-chain, reducing the mainnet bloat. Subsequently, fees have been lowered, drastically enhancing the user experience for Arbitrum and other layer-2 users like Base and Optimism.

Uniswap V4 And United States Wells Notice

Following Dencun’s activation, Uniswap Labs plans to deploy v4. This iteration introduces features like Hooks that developers say will make the DEX even more efficient and flexible. The launch is set for this year.

Though Uniswap V4 is huge for the DEX and DeFi as a whole, the United States Securities and Exchange Commission (SEC) ‘s decision to issue a Wells notice is a setback.

The regulator intends to sue. However, the founder, Hayden Adams, responded in a post on X that they are ready to fight.

(@Uniswap)

(@Uniswap)