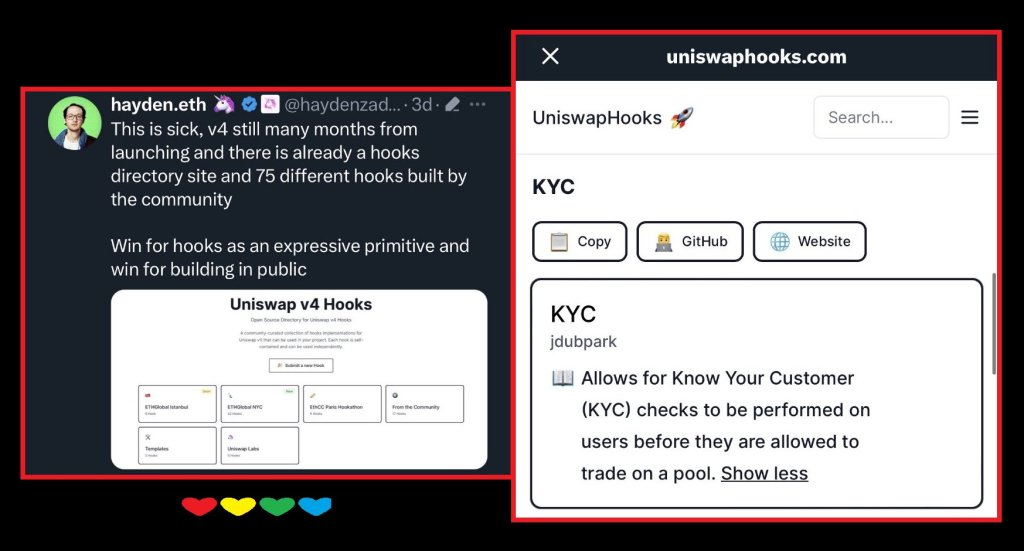

Hayden Adams, founder of the Uniswap protocol, has shared his opinion on what characterizes a good distribution or rollout of a token. In a recent post on the X platform, the prominent crypto figure listed 10 qualities of good token distributions, highlighting the complexities surrounding the launch of a cryptocurrency.

Uniswap Founder Gives Opinion On Good Token Distributions

Adams began his take on good token distributions by stating that projects should allocate “tokens, not points” to the community. This phrase implies that participants should receive actual tokens that hold value within a particular ecosystem or on a network, instead of receiving points that may have limited utility.

Not aimed at any specific project, but have seen a ton of discourse recently on the topic so figured I’d share my take on good token distributions:

1) tokens, not points

2) don’t farm the farmers – teasing and creating ambiguity around a token distribution to grow your numbers…

— hayden.eth

(@haydenzadams) May 4, 2024

Secondly, Adams warned against creating ambiguity or being vague about a token distribution to increase the number of participants or to “farm the farmers.” A good token distribution practice includes sharing real details when ready, according to the Uniswap founder.

Additionally, Adams criticized “low float tokens,” while calling them malicious. The prominent DeFi figure urged project teams to ensure sufficient tokens are available in circulation to prevent manipulation and allow genuine price discovery.

Adams also discouraged hyping a token’s price and how it will skyrocket before it launches. The founder believes hiring an influencer or a marketing company to promote a token’s value only depicts a get-rich-quick scheme rather than a genuine attempt at building real value.

What’s more, the Uniswap founder stressed the importance of free token airdrops during token distributions. “Don’t be stingy – give a significant amount away. If you don’t think the community deserves a significant amount, don’t release a token,” Adams said in his post.

Ultimately, Adams advised new crypto projects to be careful and thoughtful in their decision-making to avoid making mistakes that might put them at odds with the crypto community. “Create something you’re proud of and stand behind it,” the Uniswap founder added.

A Jab At Friend.tech and its FRIEND?

At the beginning of his post, the Uniswap founder clearly stated that the opinion is not aimed at any specific project. However, the timing is interesting, especially after social media platform Friend.tech’s “unsuccessful” token airdrop.

On Friday, May 3rd, Friend.tech airdropped its new FRIEND tokens to users in conjunction with the launch of the protocol’s version 2. While the token’s value quickly rose to $167 after launch, FRIEND’s price nosedived to below $2 within a few hours.

Analysts pinpointed liquidity issues and a mass sell-off as the primary reasons behind the downturn of FRIEND and, ultimately, the ineffectual token launch. Moreover, many users complained about how challenging it was to claim the token airdrop, as technical drawbacks reportedly frustrated the process.

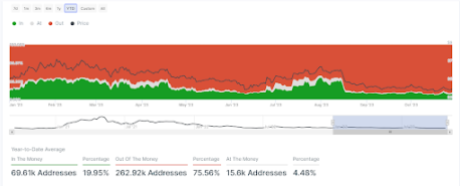

More addresses are out of the money | Source: IntoTheBlock

More addresses are out of the money | Source: IntoTheBlock