Uniswap’s UNI gained 20% as a governance proposal to distribute protocol revenues among token holders gets overwhelming support in a temperature check before voting.

Uniswap Foundation Unveils Major Upgrade Plan, UNI Price Skyrockets 52%

Uniswap (UNI), one of the industry’s largest decentralized cryptocurrency exchanges (DEXs), has set the stage for a major shift in its ecosystem with a proposed upgrade that could have significant implications for UNI token holders.

The upgrade aims to bolster governance participation, enhance resilience, and reward token holders for active engagement within the Uniswap ecosystem.

Uniswap Takes Big Leap In Governance

Uniswap Foundation (UF) Lead Developer Erin Koen, while expressing his enthusiasm, has suggested that it has been the “biggest week in Uniswap Protocol Governance” and revealed a major upgrade proposal for the system.

At the heart of the proposed upgrade lies a fee mechanism designed to reward UNI token holders who stake and delegate their tokens. As announced, by actively participating in the governance process, token holders can earn additional rewards in the form of protocol fees.

In addition to the enhanced rewards, the proposed upgrade seeks to fortify Uniswap Governance, making it “more resilient and decentralized.”

According to Koen, by increasing the number of actively involved token holders, the governance structure becomes more robust, ensuring that decisions align with the collective interests of the UNI community.

The proposed upgrade maintains governance control over core parameters such as fee-charged pools and fee magnitude. Token holders will collectively decide on these critical aspects, allowing for flexibility and adaptability in response to market dynamics.

Beyond the immediate benefits, the proposed upgrade holds the potential for long-term value appreciation of the UNI token. By incentivizing participation and aligning token holders’ interests with the ecosystem’s success, Uniswap aims to foster organic growth and adoption.

Assuming a successful on-chain vote, the community will have the option to activate fees. Gauntlet, a trusted entity, is reportedly preparing a proposed roll-out process that will be shared on the forum.

Only after completing this separate governance process will fees be collected and distributed according to the adopted contracts. Koen further noted:

We’re excited to invigorate governance – incentivizing not only delegation but thoughtful and active delegation – by tying delegation to protocol fees. Specifically, we believe UNI token holders will be incentivized to choose delegates whose votes and engagement with the protocol will lead to the Protocol’s growth and success. If this proposal succeeds we believe we will see an influx of new delegations.

UNI Records 23-Month High

As these developments unfold, considerable excitement has emerged around the Uniswap protocol. Notably, a cryptocurrency investor named “Virtual Bacon” expressed enthusiasm, stating, “Uniswap finally proposes to share revenue with UNI token stakers. Chart exploding on this ‘proposal’ which hasn’t passed yet.”

Within 24 hours, the UNI token witnessed a surge of over 52%, signaling the market’s anticipation of the potential benefits this upgrade could offer token holders.

Currently, the UNI token is trading at $11.29. However, with the unveiling of the upgrade proposal, the token quickly surged to the $12.50 level, reaching its highest point in 23 months.

The gains over longer time frames have also experienced a dramatic surge. Over the past fourteen days, the UNI token has seen an impressive increase of 73%. Similarly, the token’s value has soared by 94% in the last thirty days.

Overall, should the proposed upgrade be approved and implemented, Uniswap will reinforce its position as a leading DEX and establish a framework that empowers token holders and fosters the continued growth and success of the Uniswap protocol.

Featured image from Shutterstock, chart from TradingView.com

Uniswap’s UNI Jumps 50% on Proposal to Upgrade Governance

The upgrade would reward UNI token holders who staked and delegated their tokens, according to the proposal.

Uniswap V4 Catalyst: UNI Token Primed For Growth As New Chain Launch Loom

Uniswap, one of the world’s largest decentralized exchanges (DEX), is poised for significant growth with the upcoming launch of its V4 upgrade. This anticipated update will introduce custom Automated Market Maker (AMM) functionality directly on top of Uniswap, eliminating the need for separate AMM designs.

In addition, Uniswap’s governance token, UNI, has seen notable growth, with a 6.8% increase in the last 24 hours and an 8% increase in the previous 30 days, bringing the UNI token to $7.318.

However, while these developments favor the exchange and investors, decentralized finance (DeFi) researcher DeFi Ignas has raised concerns regarding the launch and its potential impact on critical features.

The Ultimate DeFi Liquidity Solution With Uniswap V4?

According to DeFi Ignas’ latest analysis on X (formerly Twitter), Uniswap V4 represents a significant transformation from a protocol to a platform. Like the Apple Store’s impact on the iPhone, Uniswap V4 will consolidate all pools into a single framework, reducing creation costs by 99% and enabling more cost-effective multi-pool swaps.

The introduction of the “Hooks” system is particularly noteworthy. These hooks act as plugins or extensions, allowing for customized code execution during crucial events within a pool.

The 13 available hooks enable various functionalities, including on-chain limit orders, time-weighted average market making, liquidity depositing into lending protocols, auto compound liquidity provider (LP) fees, and know-your-customer (KYC) integration.

Introducing hooks leads DeFi Ignas to believe that the launch of Uniswap V4 will allow developers to experiment and launch their protocols while leveraging Uniswap’s liquidity.

According to the researcher, this has the potential to attract even more liquidity from other decentralized exchanges and establish Uniswap as the dominant liquidity layer for all DeFi activities, from trading to lending.

Yet, while unified liquidity may benefit users by increasing market efficiency, it raises concerns about potential market concentration and stifling of competition.

UNI Token Gains Momentum

Uniswap’s V4 liquidity sourcing could concentrate liquidity within the platform, potentially making it the go-to liquidity layer for DeFi. According to DeFi Ignas, this dominance, coupled with Uniswap’s operating license that prohibits forking until 2027, raises questions about market competition and the potential impact on decentralized finance.

In addition, reports suggest that Uniswap Labs has sent takedown notices to gateways of the InterPlanetary File System (IPFS) – a decentralized and distributed protocol designed to facilitate the storage and sharing of files on a peer-to-peer network – adding another layer of concern about decentralized access and censorship resistance.

Regarding the potential upside of Uniswap V4 acting as a catalyst for the exchange’s token, the research went on to suggest that while UNI’s value “accrual” for retail investors has been relatively modest, the introduction of Uniswap V4 and its hooks opens up new possibilities.

In this sense, DeFi Ignas believes the UNI token could function as a platform/ecosystem token, benefiting from third-party decentralized applications (dApps) developed using Uniswap’s hooks, expanding the token’s use cases and potentially attracting more investors.

Additionally, there is speculation that Uniswap may solidify its dominance and liquidity by launching its chain, potentially as a layer-two (L2) solution, which could further boost the valuation of the UNI token.

As the upgrade deadline for Uniswap approaches, the impact of the exchange’s upgrade on the UNI token remains uncertain. However, there has been a noticeable growth in the token’s value over the past few weeks.

After reaching a 17-month high of $8.260 in January, the token experienced a correction but has since broken out of that pattern. As the upgrade deadline draws near, it is yet to be determined whether the token can consolidate its gains and regain previous levels.

Featured image from Shutterstock, chart from TradingView.com

Uniswap Is Decentralizing: Why Are DeFi Users Worried About This Feature?

Devin Walsh, Executive Director of the Uniswap Foundation, a non-profit organization supporting the growth and decentralization of the Uniswap decentralized exchange (DEX), believes that Uniswap is decentralizing. Walsh even compares the current state of the DEX to that of Ethereum. The executive also acknowledged that the DEX’s current level of success is due to the active participation and contribution of the developer community.

Uniswap Becoming More Decentralized?

The Executive Director responded to a thread on X where Antonio Juliano, the founder of dYxX, a layer-2 DEX on Ethereum, insinuated that Uniswap is now centralized. However, it started on a decentralized path.

With centralization, Juliano added, the protocol can iterate quickly, mainly to boost revenue. On the other hand, by being more decentralized, dapps allow users to enjoy the full advantages of decentralized finance (DeFi).

Decentralization of protocols launching on public ledgers, like Ethereum or Cardano, is crucial. Usually, the community will gauge how well a dapp is decentralized by looking at, among other factors, how decisions are made and which party spearheads development.

In the case of Ethereum, Walsh pointed out that the community has taken over from where Vitalik Buterin, the co-founder; and Consensys, a technology company developing solutions for Ethereum, left. Since then, multiple developers have been refining the network and ensuring it is secure and robust to anchor dapps.

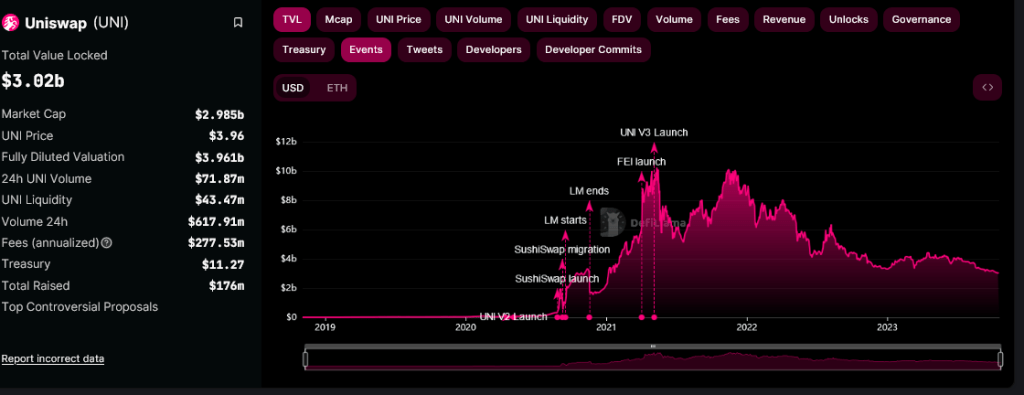

Uniswap is one of the most popular DEXes on Ethereum, looking at total value locked (TVL). DeFiLlama data shows that the exchange manages over $3 billion of assets and is primarily active on Ethereum. However, the exchange enables trustless swapping on layer-2 platforms like OP Mainnet, and public ledgers like the BNB Chain.

Preparing For Hooks And KYC?

Presently, Uniswap Labs leads the development of Uniswap. Nonetheless, Walsh said more developers are now building and contributing solutions. This, the Uniswap Foundation executive further observed, is especially considering the scheduled launch of Hooks in v4.

There is no specific timeline for when Uniswap will deploy the latest iteration, but the release of the Cancun upgrade on Ethereum will play a role. The protocol will be more customizable with Hooks since the feature acts more like a plugin.

Even so, there have been concerns that Hooks, though being developed by community developers, will be the basis for Uniswap to censor liquidity providers (LP) or traders who don’t verify by adhering to know-your-customer rules (KYC). UNI prices remain under pressure at spot rates and may break lower, registering new 2023 lows.

Uniswap Foundation proposal gets mixed reaction over $74M price tag

The largest DEX in the world could be supported by a new $74 million foundation if a new proposal from two community members passes a vote later this month.