The cryptocurrency market witnessed a significant shift in momentum on February 23rd, as Uniswap native token, UNI, skyrocketed by an impressive 71%. This surge marks the token’s highest price point since March 2022, sending shockwaves through the crypto landscape and reigniting interest in the decentralized finance (DeFi) sector.

Uniswap Proposes Fee-Sharing Feast For Stakers

The primary catalyst behind this astronomical rise appears to be a pivotal proposal unveiled by the Uniswap Foundation. This proposition advocates for the implementation of a novel fee-sharing mechanism, fundamentally altering the token’s utility and incentivizing long-term participation within the Uniswap ecosystem.

Under the proposed system, UNI holders who stake their tokens will be rewarded with a portion of the fees generated by the Uniswap protocol. This not only grants them a direct financial incentive but also empowers them to choose delegates who vote on governance proposals, shaping the future direction of Uniswap.

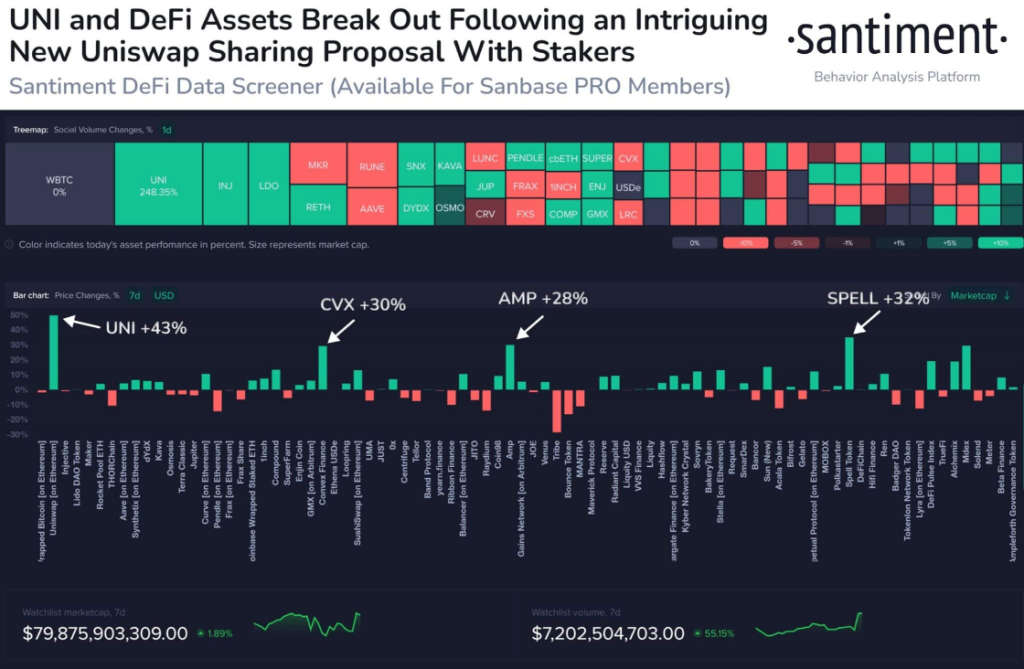

This revolutionary approach resonates with a broader trend of resurgent interest in DeFi. According to on-chain data provider Santiment, assets associated with decentralized lending, borrowing, and cryptocurrency exchange, like $COMP, $SUSHI, and $AAVE, have all experienced notable value increases, mirroring UNI’s upward trajectory.

Trade Volumes On A Roll

Further bolstering this trend, trading volumes across these protocols have also seen explosive growth. For instance, the COMP price jumped alongside a staggering 400% increase in trading volume, reaching over $175 million.

Similarly, SushiSwap (SUSHI) witnessed a 27% price surge coupled with a 153% increase in trading volume. This shift in investor focus is further underscored by a corresponding decline in the value of AI-related coins, indicating a potential capital rotation within the market.

Uniswap v4 Upgrade On The Horizon: Efficiency And Customization Beckon

Adding fuel to the fire is the impending arrival of the highly anticipated Uniswap v4 upgrade, slated for release in Q3 2024. This transformative update promises to enhance the protocol’s efficiency and customizability, catering to the evolving needs of the DeFi space.

While the direct impact of v4 on the current price surge remains debatable, its potential to revolutionize the Uniswap experience undoubtedly contributes to the overall bullish sentiment surrounding UNI.

Beyond Uniswap: DeFi Dominance On The Rise?

The Uniswap fee-sharing proposal and upcoming v4 upgrade have not only revitalized the UNI token but also cast a spotlight on the broader DeFi landscape. Analysts predict that other DeFi protocols like Blur and Lido Finance could witness similar surges in the wake of Uniswap’s bold move.

This potential domino effect underscores the growing importance of DeFi within the cryptocurrency ecosystem, attracting investors seeking innovative financial solutions beyond traditional centralized systems.

Featured image from Adobe Stock, chart from TradingView