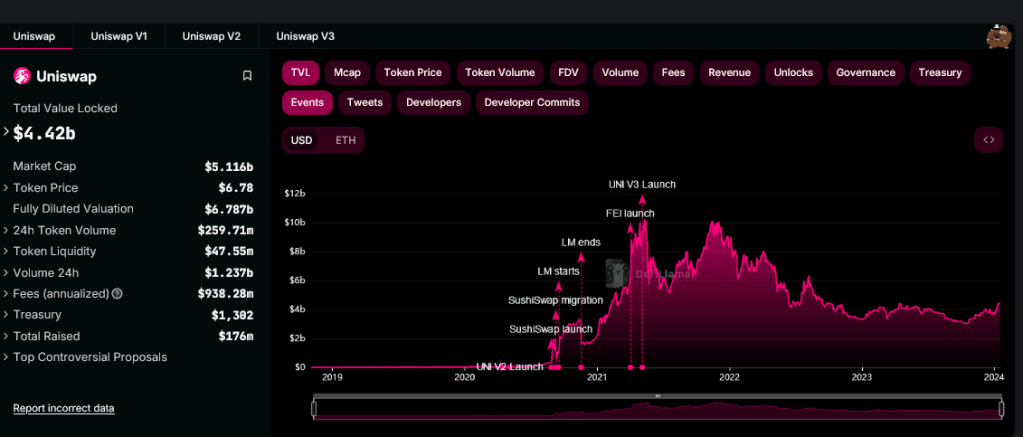

Uniswap (UNI), one of the industry’s largest decentralized cryptocurrency exchanges (DEXs), has set the stage for a major shift in its ecosystem with a proposed upgrade that could have significant implications for UNI token holders.

The upgrade aims to bolster governance participation, enhance resilience, and reward token holders for active engagement within the Uniswap ecosystem.

Uniswap Takes Big Leap In Governance

Uniswap Foundation (UF) Lead Developer Erin Koen, while expressing his enthusiasm, has suggested that it has been the “biggest week in Uniswap Protocol Governance” and revealed a major upgrade proposal for the system.

At the heart of the proposed upgrade lies a fee mechanism designed to reward UNI token holders who stake and delegate their tokens. As announced, by actively participating in the governance process, token holders can earn additional rewards in the form of protocol fees.

In addition to the enhanced rewards, the proposed upgrade seeks to fortify Uniswap Governance, making it “more resilient and decentralized.”

According to Koen, by increasing the number of actively involved token holders, the governance structure becomes more robust, ensuring that decisions align with the collective interests of the UNI community.

The proposed upgrade maintains governance control over core parameters such as fee-charged pools and fee magnitude. Token holders will collectively decide on these critical aspects, allowing for flexibility and adaptability in response to market dynamics.

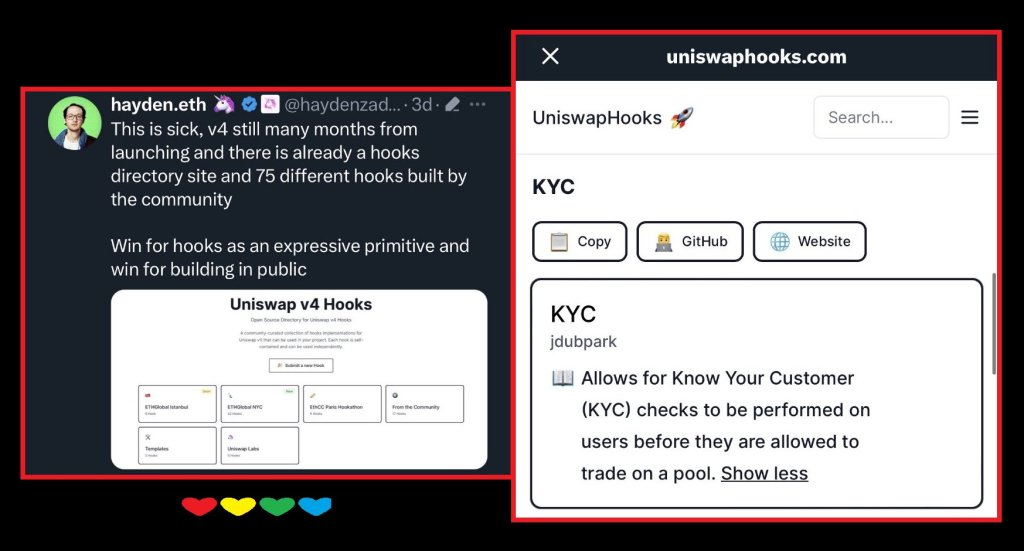

Beyond the immediate benefits, the proposed upgrade holds the potential for long-term value appreciation of the UNI token. By incentivizing participation and aligning token holders’ interests with the ecosystem’s success, Uniswap aims to foster organic growth and adoption.

Assuming a successful on-chain vote, the community will have the option to activate fees. Gauntlet, a trusted entity, is reportedly preparing a proposed roll-out process that will be shared on the forum.

Only after completing this separate governance process will fees be collected and distributed according to the adopted contracts. Koen further noted:

We’re excited to invigorate governance – incentivizing not only delegation but thoughtful and active delegation – by tying delegation to protocol fees. Specifically, we believe UNI token holders will be incentivized to choose delegates whose votes and engagement with the protocol will lead to the Protocol’s growth and success. If this proposal succeeds we believe we will see an influx of new delegations.

UNI Records 23-Month High

As these developments unfold, considerable excitement has emerged around the Uniswap protocol. Notably, a cryptocurrency investor named “Virtual Bacon” expressed enthusiasm, stating, “Uniswap finally proposes to share revenue with UNI token stakers. Chart exploding on this ‘proposal’ which hasn’t passed yet.”

Within 24 hours, the UNI token witnessed a surge of over 52%, signaling the market’s anticipation of the potential benefits this upgrade could offer token holders.

Currently, the UNI token is trading at $11.29. However, with the unveiling of the upgrade proposal, the token quickly surged to the $12.50 level, reaching its highest point in 23 months.

The gains over longer time frames have also experienced a dramatic surge. Over the past fourteen days, the UNI token has seen an impressive increase of 73%. Similarly, the token’s value has soared by 94% in the last thirty days.

Overall, should the proposed upgrade be approved and implemented, Uniswap will reinforce its position as a leading DEX and establish a framework that empowers token holders and fosters the continued growth and success of the Uniswap protocol.

Featured image from Shutterstock, chart from TradingView.com

(@Uniswap)

(@Uniswap)