Bitcoin bulls tend to celebrate when BTC’s funding rate is negative, but is it really a “generational buying opportunity?”

Cryptocurrency Financial News

Bitcoin bulls tend to celebrate when BTC’s funding rate is negative, but is it really a “generational buying opportunity?”

Six years after dropping support for bitcoin and, thus, crypto payments altogether, Stripe is bringing back the service later this summer, though initially only for Circle’s USDC stablecoin.

Stablecoin purchases in Turkey amount to 4.3% of GDP, the highest among global economies, according to Chainalysis.

Circle Internet Financial would have a distinct advantage over global stablecoin leader Tether under U.S. regulations along the lines being suggested by new legislation, according to one of the latest bill’s authors, Sen. Cynthia Lummis (R-Wyo.).

Stablecoin issuer Circle introduced a new smart contract function earlier Thursday to allow near-instant, around-the-clock redemptions from BlackRock’s BUIDL fund for USDC stablecoins.

While Bitcoin has dipped from its recent highs of around $74,000, some analysts are urging investors to stay calm and even see this as a buying opportunity. So far, Bitcoin prices have remained under pressure, trickling lower in the past trading week.

Though the downward momentum is slowing down, and there has been no confirmation of the April 2 dump, the failure of bulls to convincingly flow back and drive the coin above $71,000 remains a concern for some traders.

Even so, taking a bullish stand, one analyst on X compares the current formation with that of 2020. Pointing to the cyclic nature of prices and the inevitability of retracements from bottoms and peaks, the trader expects prices to bounce.

The trader said that in 2020, when Bitcoin prices fell, shaking out weak hands, the recovery sparked a bull run that forcefully saw the coin surge above previous all-time highs of $20,000. The analyst seems to allude to the retracement before the breakout as a catapult that eventually fed the “legendary” bull run, which saw Bitcoin float to as high as $70,000.

Based on this comparison, the trader is adamant that it may, reading from history, be the best time to “sell” at around spot levels. Still, for now, buyers can consider doubling down until there is a clear trend definition and shake-off of the current bear formation. Currently, BTC has strong rejections in the $71,700 to $72,000 liquidation zone, marking last week’s highs.

Besides technical candlestick formation, another trader thinks buyers better HODL even with sellers in control.

In a post on X, the analyst said Tether Holdings, the issuer of USDT, and Circle, the issuer of USDC, recently minted billions. On April 2, Tether issued 1 billion USDT on Tron, while Circle issued 250 million USDC on Solana.

This development, the analyst said, means there is “plenty of dry powder.” Stablecoins like USDT and USDC offer stability in the crypto markets, providing a refuge for crypto holders whenever prices tumble.

However, they can also act as conduits of liquidity from the traditional market, providing an avenue for interested users to get exposure to top coins or even engage in activities such as decentralized finance (DeFi).

In the past, prices often edged higher when there were huge stablecoin mints.

The unabated expansion of stablecoin supply shows capital continues to flow into the crypto market, one observer noted.

On-chain data shows Coinbase has just witnessed its largest USD Coin (USDC) inflow. Here’s why this may be relevant for Bitcoin.

As pointed out by analyst Maartunn in a post on X, a large amount of USDC has flowed into Coinbase during the past day. The on-chain indicator of interest here is the “exchange inflow,” which keeps track of the total amount of a given asset entering into the wallets associated with a centralized exchange or group of platforms.

A spike in the exchange inflow can indicate that investors are interested in trading away the cryptocurrency. In the case of an asset like Bitcoin, such a trend can naturally be a bearish signal for the price.

In the context of the current discussion, though, a stablecoin is of focus. While USDC exchange inflows would also imply that the holder wants to sell the asset, the transaction wouldn’t affect the price since, by nature, the coin always remains stable at around $1.

This doesn’t mean that the sale of USD Coin isn’t of interest to the cryptocurrency sector as a whole, however. If investors are swapping stable coins in favor of volatile coins like BTC, then the prices of these latter assets would observe a buying effect.

Now, here is a chart that shows the trend in the USDC exchange inflow over the past month:

The above graph shows that the USDC exchange inflow has just registered a huge spike. According to Maartunn, this inflow was headed towards the cryptocurrency exchange Coinbase.

In total, $1.4 billion worth of the stablecoin has entered the platform’s wallets with this inflow, the largest the exchange has ever observed. Given the extraordinary scale, this could prove to be quite bullish for Bitcoin and others if the entity behind the inflow is planning to go on a buying run with this dry powder.

There also exists the scenario, however, where the whale actually intends to trade away the USD Coin stack in favor of fiat rather than using it to buy other cryptocurrencies. In such a case, a net amount of capital would be exiting the sector, which would be a bearish sign.

It now remains to be seen whether the massive USDC deposit indeed ends up causing any noticeable fluctuations in the volatile side of the market, particularly in the price of Bitcoin.

Bitcoin had observed sharp bullish momentum earlier to cross above the $70,000 level, but since then, the asset has fallen back to sideways movement, with its price remaining unchanged.

Total market cap of the dollar-linked coin has increased faster than larger rival USDT’s in recent months.

Following the success of Tether and USDC, a generation of stablecoins are offering new features for investors and holders, says Scott Sunshine, Managing Partner of Blue Dot Advisors.

Celo, which is in the midst of transforming into an Ethereum layer 2 network, increasingly positions itself as a blockchain for real-world assets.

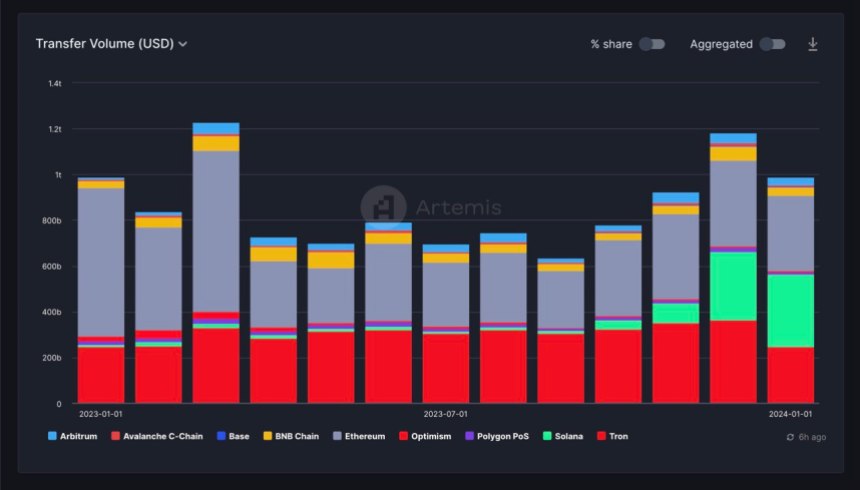

According to the latest on-chain data, the Layer-1 network Solana has hit a significant milestone in terms of the transfer volume of stablecoins this month.

Data from the blockchain analytics platform Artemis shows that the stablecoin transfer volume on Solana has already surpassed $300 billion in January. This is the largest transfer volume recorded by stablecoins on the Layer-1 blockchain in a single month.

To put this figure into context, the Solana network registered $297 billion in stablecoin volume in the entire December. Meanwhile, the blockchain’s stablecoin transfer volume was about $11.56 billion in January 2023, reflecting an over 2,500% growth in the past year.

From the chart above, it is clear that Solana’s stablecoin activity has been on a steady rise since October, increasing by more than 650% in the past few months. This growth has also impacted the network’s share in the stablecoin market, with Solana now boasting about 32% market share.

Unsurprisingly, Ethereum leads the market for stablecoins, with its transfer volume already reaching almost $317 billion in January. Meanwhile, the Tron network trails Solana in third place, with a stablecoin volume of roughly $240 billion.

On Thursday, January 18, Paxos revealed the launch of its regulated stablecoin, USDP, on the Solana network. According to DefiLlama data, USDC remains the dominant stablecoin on the Layer-1 network, with a market cap of over $1 billion.

Paxos is thrilled to share our regulated stablecoin USDP is now live on the @solana blockchain! This integration makes it easier for anyone to access and use the safest, most reliable stablecoins in the market. Learn more here: https://t.co/0j4Kj0yyPk pic.twitter.com/1doexKvVmY

— Paxos (@Paxos) January 18, 2024

Despite Solana’s burgeoning network activity, the price performance of its native token SOL has somewhat dampened in the past few weeks. As of this writing, the Solana token is valued at $92, reflecting a 0.6% decline in the last 24 hours.

This sluggish performance in the past day underscores the altcoin’s challenges since the turn of the year. After reaching a multi-month high of $124 at the end of 2023, the SOL price has largely struggled to hold above the $100 mark.

According to data from CoinGecko, the Solana token is down by more than 5% in the past week. Meanwhile, the coin has declined by about double that figure since the beginning of 2024.

Nevertheless, SOL maintains its position as the fifth-largest cryptocurrency in the sector, with a market capitalization of more than $40 billion.

The integration allows developers to build cross-chain use cases via Chainlink’s CCIP that involve multichain transfers of Circle’s USDC stablecoin.

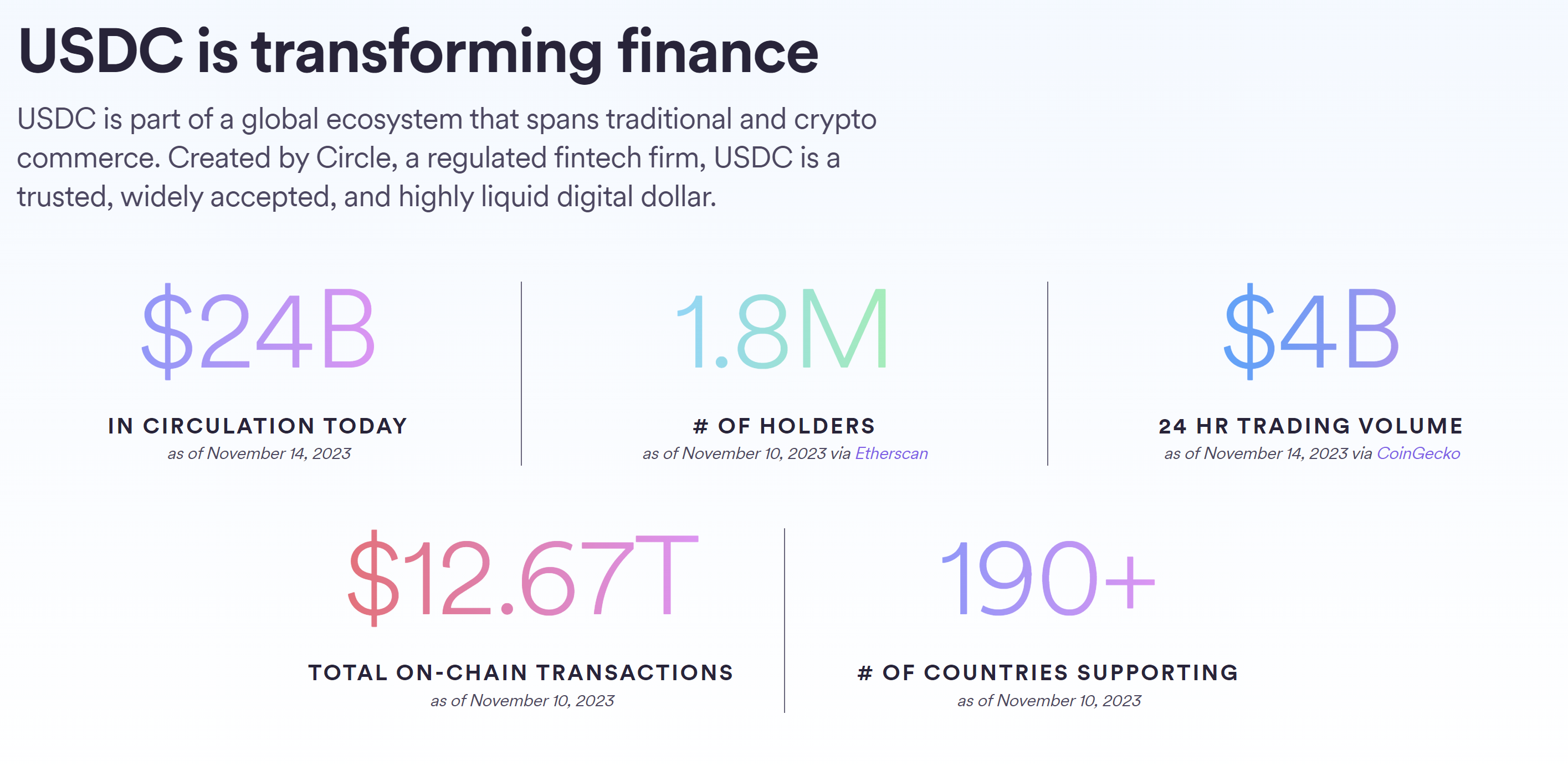

Since its introduction in 2018, USDC has been used to settle over $12 trillion in blockchain transactions.

On January 11, crypto exchange Coinbase unveiled its partnership with Yellow Card, the largest and first licensed Stablecoin on/off ramp on the African continent, to expand the access of their products to emerging economies across the African continent.

Coinbase will expand access to its products through this new partnership with Yellow Card, starting with 20 African countries. They will provide millions of African users access to USD Coin (USDC) on the Coinbase Wallet and the Yellow Card app.

Both partners expect to “increase economic freedom” in many of these countries, whose economies have suffered from high inflation and remittance dependency and the lack of a modern financial system vastly sought by the younger generations. As they state in their press release:

Young people are more likely to recognize the benefits of crypto: more than seven in 10 crypto owners globally (72%) are under age 34.

To achieve opening access to a more modern and global financial system, they will facilitate access to USDC on Base for cheaper fees and faster transactions than traditional transfers starting in February 2024.

In the Coinbase Wallet, users will be able to purchase USDC directly from their Wallet app, as well as sending USDC without any fee to messaging and social media apps, as they noted:

Coinbase Wallet users will be able to easily send USDC without fees on any platform where they can share a link — including messaging apps like WhatsApp, iMessage and Telegram, and through popular social media apps and email.

Users of the Yellow Card’s platform can purchase USDC on Base and transfer through the L2 blockchain, benefiting from cheaper fees and easy access to the stablecoin, too.

Chris Maurice, Co-Founder and CEO of Yellow Card, expressed his excitement in an X (formerly known as Twitter) post. Maurice is optimistic about the future of the partnership and the solutions it might bring to African people and businesses.

Beyond excited to bring @coinbase to Africa!

Stablecoins like USDC solve real problems for real people & businesses on the continent.

With @yellowcard_app's regional expertise and Coinbase’s global brand and infrastructure, we will empower the next one billion people. https://t.co/9DOgZ4TKMr

— Chris Maurice

(@chrismaurice) January 11, 2024

The partnership aims to protect users’ savings across the African continent from “unstable currencies” and economic volatility due to the high inflation rates of up to 18.5%.

They will offer lower remittance fees, with the maximum fee being 2%. As well as offering access to the global financial system to small and medium enterprises (SMEs) by allowing merchants to set up a Wallet in less than a minute and broadening their growth.

In summary, the Coinbase and Yellow Card partnership will expand solutions for people and businesses in 20 African countries by making the global financial system more accessible.

Circle’s USDC stablecoin spiked down to as low as $0.74 on three occasions today following a marketwide sell-off spurred by a report casting doubt over whether a spot bitcoin ETF will be approved this month.

Bitwise isn’t alone in its bullishness on stablecoins with Circle CEO Jeremy Allaire predicting the explosive growth of the sector due to a “huge appetite” for digital dollars.

Data Nerd Data on December 13 shows that over the past 24 hours, the wallet “0xea8” moved 200 million BUSD from Binance, the world’s leading cryptocurrency exchange by client count.

The whale transfer caught the attention of keen crypto users, who also noted that the transfer was soon followed by a deposit of 99.95 million FDUSD, a stablecoin supported by the exchange.

That the address is shuffling and accumulating large amounts of stablecoins is noteworthy. Data Nerd Data shows that the address has transferred over 781 million FDUSD to Binance in the last four months.

During this period, from around September, the crypto market has been recovering, edging higher on the back of improving fundamental factors.

The accumulation of over $781 million of stablecoin by the wallet controlled by an unknown individual or entity is overly bullish for crypto and Bitcoin prices.

It could suggest that a large institutional investor or group of investors is amassing stablecoins, potentially preparing for a significant market move.

Historically, large movements of stablecoins into centralized exchanges have often preceded major bull runs.

Stablecoins are vital for crypto, ensuring there is enough liquidity. Since most are pegged to the USD and can be backed by fiat, these tokens, mostly minted on Ethereum or Tron, are often used as a gateway to crypto. Therefore, their accumulation can signal increased institutional interest and potential buying pressure.

That the wallet address is fortifying its FDUSD base reinforces the notion that institutional investors, ahead of the possible approval of the first batch of Bitcoin ETFs in the United States, could be increasingly warming up and preparing for leading coins like Bitcoin and Ethereum to extend gains in 2024.

When writing on December 13, Bitcoin and top altcoin prices are relatively stable. To illustrate, Bitcoin is trending higher, stable above the $41,000 level after pulling back from 2023 highs of around $44,000. Crypto participants are bullish and expect Bitcoin prices to float even higher in 2024 before halving.

Binance will stop supporting BUSD in 2024. The exchange has also delisted USDC. Accordingly, USDT and FUSD are popular on Binance. However, the exchange continues to be on the Securities and Exchange Commission’s (SEC) crosshairs.

In late November, the Department of Justice (DOJ) issued a $4.3 billion penalty on Binance as settlement with the SEC, Commodity Futures Trading Commission (CFTC), and other aggrieved agencies in the United States. The deal also saw Changpeng Zhao, the founder of Binance, step down from the CEO role.

Stablecoins like USDC have become a cornerstone in the cryptocurrency ecosystem, offering unique stability and reliability. This article provides an in-depth exploration of the USDC Coin, offering you a detailed understanding of its functions, market dynamics, and the organization behind it, particularly Circle USDC. As you navigate through this guide, you’ll gain insights into the USDC price and its stability, explore whether USDC is fully reserved, and understand its role and impact within the broader crypto ecosystem.

USDC, or USD Coin, stands as a paradigm of stability in the volatile world of cryptocurrencies. It is a type of stablecoin, which means its value is pegged to a stable asset, in this case, the US dollar. This pegging mechanism is designed to combine the flexibility and speed of cryptocurrency transactions with the stability of a fiat currency.

USDC operates on several blockchain platforms, including Ethereum and Solana, making it a multi-chain asset. This flexibility allows for broader adoption and integration into various decentralized finance (DeFi) applications and ecosystems.

One of the critical features of USDC is its backing by fiat currencies, typically held in reserve by regulated financial institutions. This backing not only provides a level of security but also enhances trust among users, as each USDC token is purportedly equivalent to one US Dollar held in reserve.

Moreover, USDC’s adherence to regulatory compliance and transparency standards, particularly in terms of reserve audits, further cements its position as a reliable and trustworthy digital currency in the crypto market.

The Basics of USDC In The Crypto World

In the dynamic landscape of cryptocurrencies, USDC has carved out a niche as a stablecoin that bridges the traditional financial world with the burgeoning digital economy. Its creation and ongoing management by Circle, in collaboration with Coinbase, reflect a commitment to ensuring that the coin maintains its 1:1 peg to the USD through regular audits and compliance with financial regulations.

The utility of USDC extends beyond mere value storage. It is a crucial instrument in various crypto-related activities, including trading, lending, and yield farming, as it provides a stable medium of exchange and value reference. Additionally, USDC’s integration into various blockchain ecosystems has made it a linchpin in the DeFi space, facilitating seamless transactions across different platforms without the typical volatility associated with other cryptocurrencies.

As such, USDC is not just a digital version of the dollar; it is a vital tool for financial innovation and digital economy expansion, reflecting the evolving nature of money and finance in the 21st century.

Understanding the mechanics of USDC is crucial for comprehending its stability and efficiency as a digital currency. In this section, we delve into the technical aspects that govern USDC’s functionality and its practical usage through the USDC contract address.

How Does The Stablecoin Function?

At first, USDC was an ERC-20 token on the Ethereum blockchain, but it has expanded to other blockchains like Solana and Algorand. This interoperability allows for broader utilization across various decentralized platforms. The fundamental principle behind USDC’s functioning is its 1:1 peg to the US Dollar, maintained through a reserve of equivalent fiat currency. This reserve is audited to ensure transparency and trust.

The minting and redemption process of USDC is a critical aspect of its mechanics. Users can create USDC by depositing USD into a bank account managed by Circle, the consortium behind USDC. In return, an equivalent amount of USDC is minted and sent to the user’s blockchain address. Conversely, USDC can be ‘burned’ or destroyed to withdraw the equivalent USD, maintaining the stablecoin’s value in parity with the fiat currency.

USDC Contract Address

The USDC contract address or “USDC Token Address” is a fundamental component of its operation on various blockchains. These addresses represent a unique identifier for the smart contract that governs the USDC token on a specific blockchain. It is through these contract addresses that USDC interacts with the blockchain ecosystem, enabling transactions, minting, and redemption processes.

Here are the USDC contract addresses on different blockchains:

Each blockchain has its unique contract address for USDC, allowing for seamless integration and interoperability across different platforms. These addresses enable the tracking and verification of USDC transactions, ensuring the integrity and transparency of the token across multiple networks.

At the helm of USDC’s development and ongoing operations is Circle, a prominent financial services company specializing in digital currency solutions. In partnership with Coinbase, one of the largest cryptocurrency exchanges globally, Circle co-founded the Centre Consortium, which oversees the USDC project.

Circle’s role in the USDC ecosystem is multifaceted. It involves overseeing the issuance of USDC, maintaining regulatory compliance, managing reserve assets, and ensuring the stablecoin’s overall integrity and transparency. Circle’s commitment to adhering to stringent regulatory standards, conducting regular audits, and publishing transparency reports has been instrumental in establishing and maintaining trust in USDC among users and regulators alike.

Moreover, the collaboration between Circle and Coinbase under the Centre Consortium umbrella is a testament to the synergy between traditional finance and modern fintech innovation. This partnership leverages Circle’s expertise in financial compliance and Coinbase’s robust platform and user base, creating a stablecoin that is widely accessible, highly secure, and seamlessly integrated into the broader cryptocurrency market.

Who Owns And Manages USDC?

Ownership and management of USDC are structured around the CENTRE Consortium, jointly created by Circle and Coinbase. This structure ensures a balance of power and shared responsibility in managing the stablecoin. While Circle plays a pivotal role in the operational aspects of USDC, including minting, redemption, and ensuring regulatory compliance, Coinbase contributes to its widespread distribution and integration into the cryptocurrency ecosystem.

The governance of USDC is designed to be transparent and compliant with existing financial regulations. Regular audits and public reports of the reserve holdings back the stablecoin, providing assurance of its backing and stability. This governance model is part of a broader strategy to maintain user trust and to ensure that USDC remains a stable and reliable digital asset within the volatile cryptocurrency market.

The USDC price is designed for stability, maintaining a 1:1 peg with the US dollar. This stability comes from a corresponding reserve of dollars, contributing to its minimal volatility compared to non-stable cryptocurrencies.

However, market dynamics can still influence USDC’s price, albeit in a more constrained manner. Factors such as transaction volume, liquidity in various exchanges, and overall demand for stablecoins can cause slight fluctuations in its value, often reflected in the premium or discount of USDC during high volatility periods in the broader crypto market. These deviations, although typically small, can create opportunities for arbitrage.

Arbitrage, in the context of a depegged USDC, involves capitalizing on the price difference between USDC and the actual USD. Traders can buy USDC at a discount (when its value falls slightly below one dollar) and redeem it for a full dollar, or conversely, sell it at a premium (when its value rises above a dollar). This practice, while potentially profitable, requires swift action and a keen understanding of market conditions, as the window for arbitrage is often narrow.

Conversion Mechanics

The conversion process between USDC and USD is a foundational aspect of its functionality. Users can convert US dollars into USDC by sending USD to the issuer’s bank account, triggering the minting of an equivalent amount of USDC. The reverse process involves ‘burning’ USDC, removing it from circulation, and withdrawing the equivalent amount in USD. This one-to-one exchange mechanism is facilitated by smart contracts on the blockchain, ensuring the transparency and audibility of the stablecoin’s supply.

The ease of conversion between USDC and USD underpins the token’s utility as a digital stand-in for the dollar, providing a stable medium for transactions and value storage in the cryptocurrency ecosystem.

Price Chart And Predictions

Despite its stable nature, analyzing USDC’s price charts can offer valuable insights, particularly during depegging events. Such analyses involve observing deviations from its pegged value, which can indicate market stress or changing perceptions about the stability of the stablecoin. While USDC is generally restored to its peg quickly, these fluctuations are closely watched by traders for arbitrage opportunities.

Long-term predictions about USDC often focus on its adoption rates, regulatory developments, and the overall growth of the stablecoin market. Observing transaction volumes and patterns also provides indicators of the broader crypto market’s liquidity and stability, informing investment strategies and risk management within the cryptocurrency space.

The safety and stability of USDC, a major concern for users and investors alike, hinge significantly on whether the stablecoin is fully reserved. To address this, Circle, the issuer of USDC, has implemented robust practices for transparency and accountability.

Notably, Circle provides monthly transparency reports. These are crucial in disclosing USDC’s reserve holdings and the associated minting and burning activities of the coin. These reports offer a clear view of the assets backing USDC, ensuring that each token is fully collateralized.

The backbone of this transparency lies in the audited consolidated financial statements, confirming that a mix of cash, cash equivalents, restricted cash, and USDC deposits back USDC. This approach aims to maintain a dollar-for-dollar parity, a critical factor for the trust and stability of the stablecoin.

In a significant move towards enhanced transparency and trust, Circle announced in January 2023 that it switched its auditing partner from Grant Thornton to Deloitte, one of the ‘Big Four’ accounting firms. This change aligns Circle with Coinbase, which also uses Deloitte for its accounting and audits. Remarkably, the decision to partner with Deloitte for proof of reserves audits represents a step forward in ensuring the highest standards of financial scrutiny and transparency for USDC.

Regulatory Insights: SEC Vs. Circle

Circle, the issuer of USDC, has actively engaged with the SEC to navigate the evolving regulatory landscape of cryptocurrencies. In July 2021, Circle received an investigative subpoena from the SEC, requesting information about its holdings, customer programs, and operations. Circle has cooperated fully with this investigation, demonstrating its commitment to regulatory compliance.

Furthermore, Circle has taken a firm stance that stablecoins like USDC should not be classified as securities. In September 2023, during its intervention in the SEC’s case against Binance, Circle argued that payment stablecoins like USDC, tied to assets like the dollar, lack features of an investment contract because their users do not expect profits from standalone purchases. This position suggests that such assets, according to Circle, fall outside the SEC’s jurisdiction, supported by decades of case law that distinguishes asset sales from investment contracts.

Conclusion: Is USDC Safe?

Assessing the safety of USDC involves considering several factors, including its reserve backing, regulatory compliance, and Circle’s proactive engagement with regulatory bodies. The fact that each USDC is backed by a dollar in reserves, verified by regular independent audits, provides a strong foundation for its stability.

Circle’s cooperative stance with the SEC and its argument that USDC does not constitute a security further highlight its commitment to compliance and transparency. While no digital asset is entirely risk-free (see below section about historical depegs), these measures position USDC as one of the more reliable and secure stablecoins in the cryptocurrency market.

As a key player in the cryptocurrency market, USDC’s role and performance can be best understood in the context of its interaction with other stablecoins and its historical stability, particularly during depeg events.

Comparison With Other Stablecoins

USDC is often compared with other major stablecoins like Tether (USDT) and Binance USD (BUSD) due to its similar goal of providing stability in the volatile crypto market. While all these stablecoins aim to maintain a 1:1 peg with the US dollar, they differ in their operational approaches, transparency levels, and regulatory compliance.

USDC stands out for its strong commitment to regulatory standards and transparent auditing practices, setting it apart from competitors like USDT, which has faced scrutiny over reserve backing. Unlike the “offshore” labeled USDT (Tether), a top-tier firm audits USDC’s operations and reserves, enhancing its credibility and trust. Tether, on the other hand, has drawn criticism for its less transparent reserve audits, not conducted by a ‘Big Four’ audit firm.

On the other hand, BUSD, which is a stablecoin issued by Binance in partnership with Paxos, has faced regulatory issues. Binance announced in August 2023 that it will gradually end support for BUSD, following a directive from the New York Department of Financial Services (NYDFS) to Paxos to halt the minting of new BUSD tokens.

USDC Depeg: A Brief History

USDC has a strong track record of maintaining its peg to the USD, but it has faced moments of depegging. A notable instance occurred during the banking turmoil involving Silicon Valley Bank (SVB) in March 2023.

Circle disclosed that it had $3.3 billion of its reserves in SVB. Amid fears of a banking crisis, USDC’s price on exchanges like Kraken plunged to 87 cents, a significant deviation from its $1 peg. This event led to a surge in trading volumes as market participants rushed to arbitrage opportunities, and decentralized exchanges saw record-high volumes.

Circle swiftly addressed the situation by removing about 3.9 billion USDC from circulation, exceeding the amount minted, and confirmed the transfer of its reserves to BNY Mellon. Subsequently, USDC regained its peg, highlighting its resilience despite the temporary depeg caused by external banking pressures.

USDC’s versatile nature enables its use in a variety of financial activities, ranging from straightforward buying and selling to more complex applications like staking, earning interest, and participating in lending and borrowing schemes.

Buying, Staking And Earning Interest

Users can stake USDC by locking up their tokens to support a blockchain network’s operation, earning interest in return. Additionally, many platforms offer interest-earning accounts where depositing USDC can yield returns, similar to a traditional savings account but often at higher rates.

Notably, the interest rates vary greatly depending on the platform. The rate can be an indication of how risky the provider’s practices are in order to earn the interest. You should always read the terms and conditions in detail to understand what is happening with your money.

Borrowing, Lending And Practical Uses

In decentralized finance (DeFi), many use USDC for borrowing and lending. Users can lend their USDC to earn interest or use it as collateral to borrow other assets. This flexibility makes USDC a valuable tool for liquidity and risk management in the crypto ecosystem. Here, too, you should understand the risks of the respective products before you invest.

How To Buy USDC?

Buying USDC typically involves registering on a crypto exchange or platform that supports USDC trading. Users can purchase USDC using fiat currencies like USD or exchange it for other cryptocurrencies. The process involves creating an account, completing any required KYC procedures, and then executing the purchase through the platform’s trading interface.

USDC’s future is taking shape with its growing role beyond traditional cryptocurrency trading and speculation, as it ventures into global payments, decentralized finance (DeFi), and the emerging metaverse.

Growth and Future Projections for USDC

Several emerging use cases could drive USDC’s growth:

Innovations And Developments In The Ecosystem

USDC stands ready for continuous innovation, potentially expanding its blockchain integration and developing new features to meet user needs. Its role in facilitating more equitable financial services and its integration into evolving digital economies positions USDC as a significant player in the future of digital currency and global finance.

What Is USDC Coin?

USDC, or USD Coin, is a digital stablecoin pegged to the US dollar. It offers stability in cryptocurrency transactions compared to more volatile digital currencies.

Is USDC ERC-20 Based?

Yes, USDC is primarily based on the Ethereum blockchain, following the ERC-20 standard. It’s also available on other blockchains like Solana and Algorand.

What’s Circle USDC?

Circle USDC refers to the USDC stablecoin issued by Circle, a financial technology firm. Circle co-founded the CENTRE Consortium with Coinbase to govern USDC.

What USDC Interest Rates Can You Earn?

Interest rates for USDC vary by platform. DeFi protocols and crypto lending platforms often offer competitive rates for lending USDC.

What Is True About USDC?

USDC, a stablecoin, maintains a 1:1 peg to the US dollar. Equivalent assets back the value of USDC.

What Is USDC Crypto?

USDC Crypto refers to the USDC stablecoin. It serves various purposes in the cryptocurrency market, including transactions, trading, and acting as a stable store of value.

Who Owns USDC?

Circle issues USDC, and the CENTRE Consortium, a collaboration between Circle and Coinbase, governs it.

What Are The Latest USDC News?

For the latest USDC news, check NewsBTC.com and Bitcoinist.com.

What Is The USDC Contract Address?

The USDC contract address varies by blockchain. For Ethereum, it’s 0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48.

What Is The USDC Token Address?

The USDC token address refers to the specific address for USDC on various blockchains, like the ERC-20 address on Ethereum. It’s: 0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48.

Can You Borrow And Lend USDC?

Yes, you can use USDC for borrowing and lending on various DeFi platforms.

What Can You Do With USDC?

You can use USDC for transactions, trading, staking, lending, and as a stable store of value in digital finance.

What Is The USDC Meaning?

USDC stands for USD Coin, signifying its peg to the US dollar.

How Does USDC Work?

USDC works by maintaining a stable value pegged to the US dollar. Equivalent reserves back it, and it operates on blockchain technology.

Where Can You Check The USDC Reserves?

You can check USDC reserves through Circle’s transparency reports and independent audit statements.

Circle Internet Financial continued to build out the USDC stablecoin network, spreading access and inclusion to new corners of the world.