E-commerce giant Shopify (SHOP) is bringing stablecoin payments to its merchants over Base, crypto exchange Coinbase (COIN)'s Ethereum layer-2 network, the companies said on Thursday.

The integration is set to roll out on June 12 to a limited group of early access merchants, with broader availability expected later this year for all merchants using Shopify Payments, the companies said.

Once the rollout is complete, merchants will be able to accept payments of Circle's (CRCL) USDC token on-chain while receiving local currency settlements without incurring foreign transaction fees. Shopify said it plans to give 1% cash back to customers who pay with USDC. This feature that will launch later in the year.

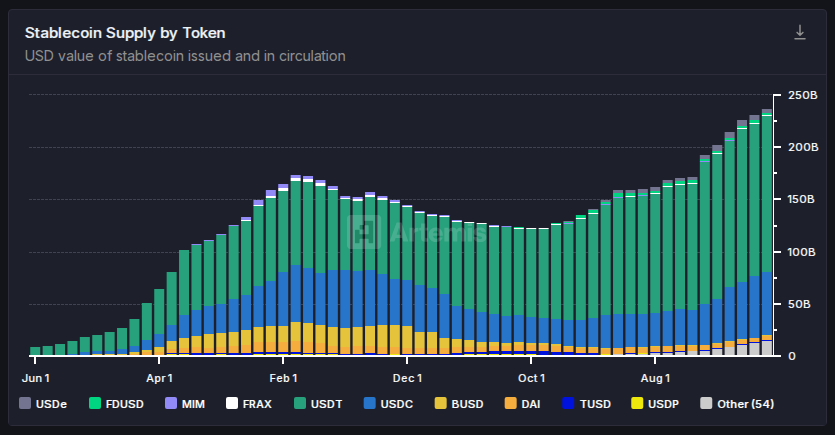

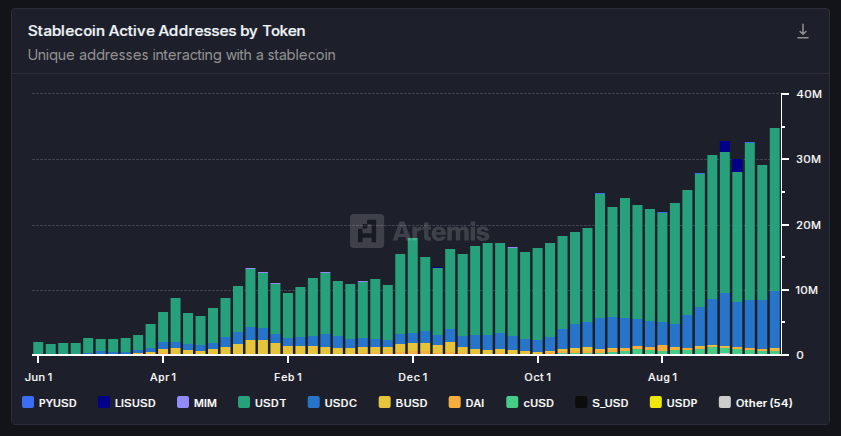

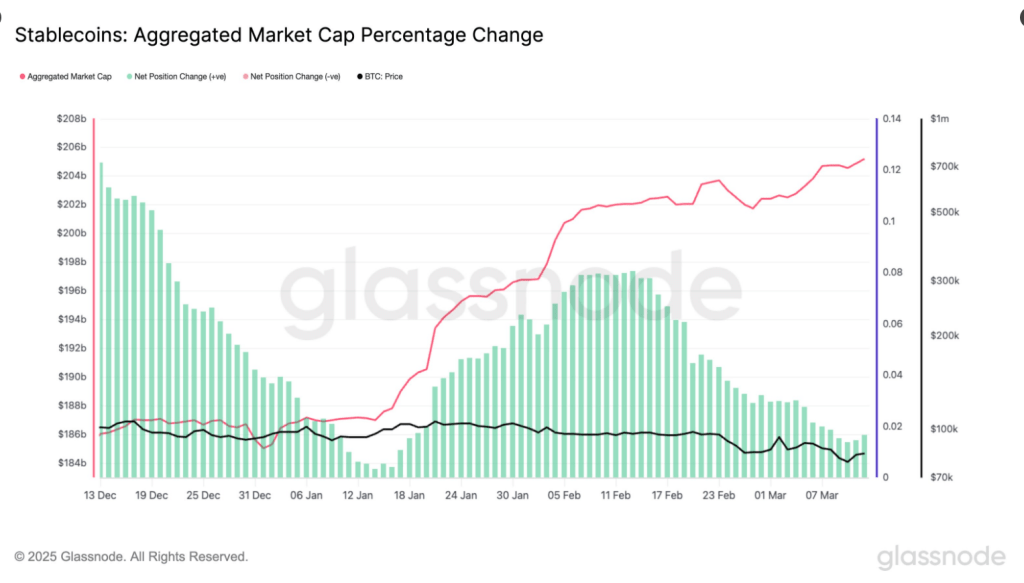

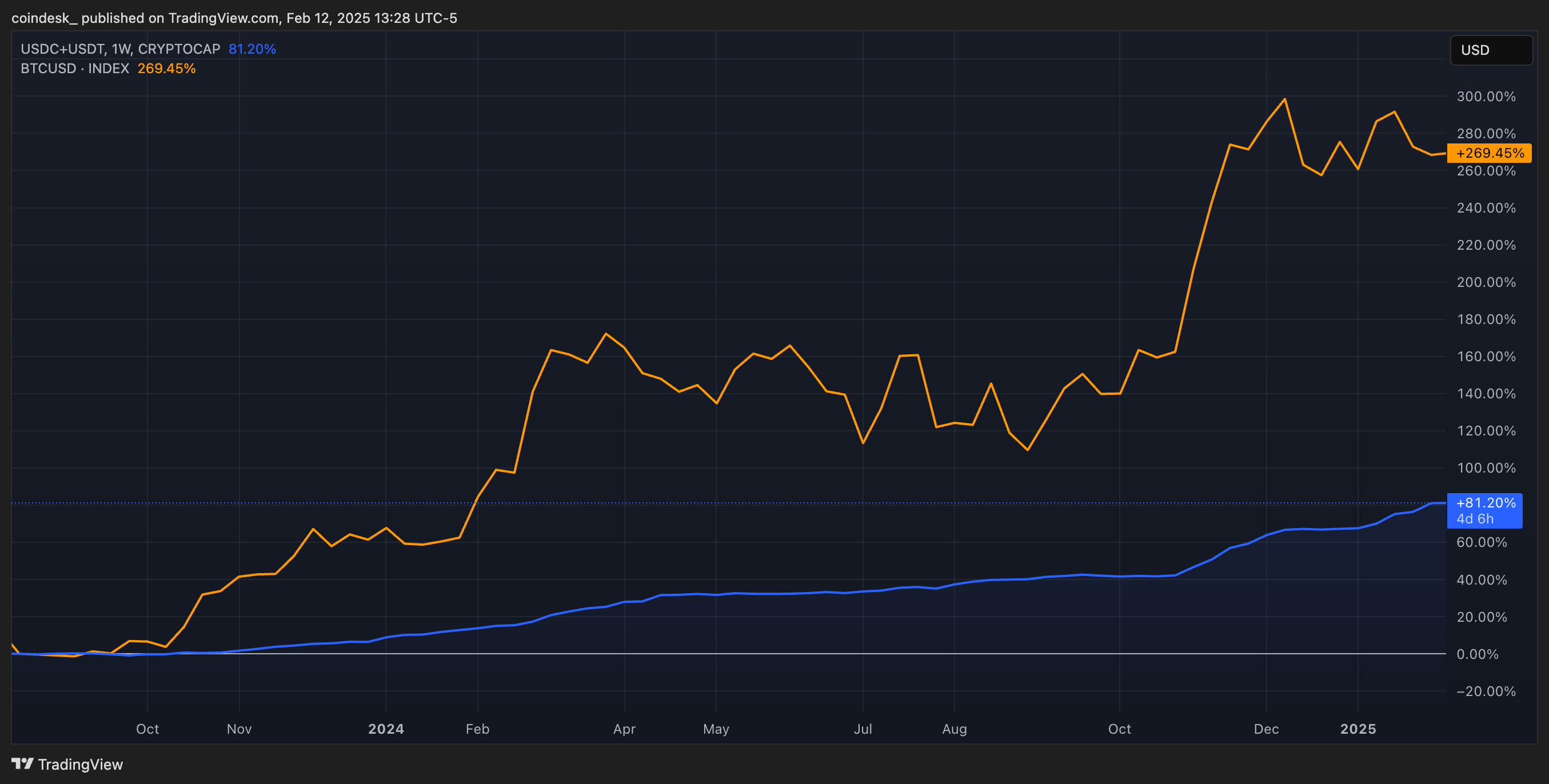

Stablecoins, digital tokens whose value is tied to a real-world asset, are finding a wider range of uses than simply allowing traders to move funds between cryptocurrencies without converting to fiat currency. Usage is exploding, with a 54% growth in supply year-on-year, and increased usage by companies such as PayPal (PYPL) and Grab (GRAB) for payments and international remittances.

The new initiative is designed to streamline global commerce with crypto-native infrastructure, lowering costs and boosting efficiency, and is underpinned by a new open-source payments protocol jointly developed by Coinbase and Shopify.

The smart contract and commerce payments protocol supports standard features such as delayed capture, tax calculation and refund processing, and is integrated directly into merchants’ existing order fulfillment systems, the companies said.

Shopify said it selected Base for its low-cost, high-speed, and secure transaction environment, aiming to help bring crypto payments into the mainstream retail experience.

Read more: Shopify Customers Can Now Pay In USDC Via Solana Pay