Stabelcoin issuer Tether blacklisted 41 wallets controlled by people on the Office of Foreign Assets Control (OFAC) Specially Designated Nationals (SDN) List on Saturday.

Tether (USDT) Cap Approaches $90 Billion: Why This Affects Bitcoin

Data shows that the Tether (USDT) market cap is almost $90 billion. Here’s why this growth could matter for the price of Bitcoin.

Tether Market Cap Has Continued To Observe A Rise Recently

Tether is a cryptocurrency pegged to the US Dollar, meaning its price remains stable around the $1 mark. The asset is the most famous such “stablecoin” in the sector, with its market cap outstripping any other stable’s.

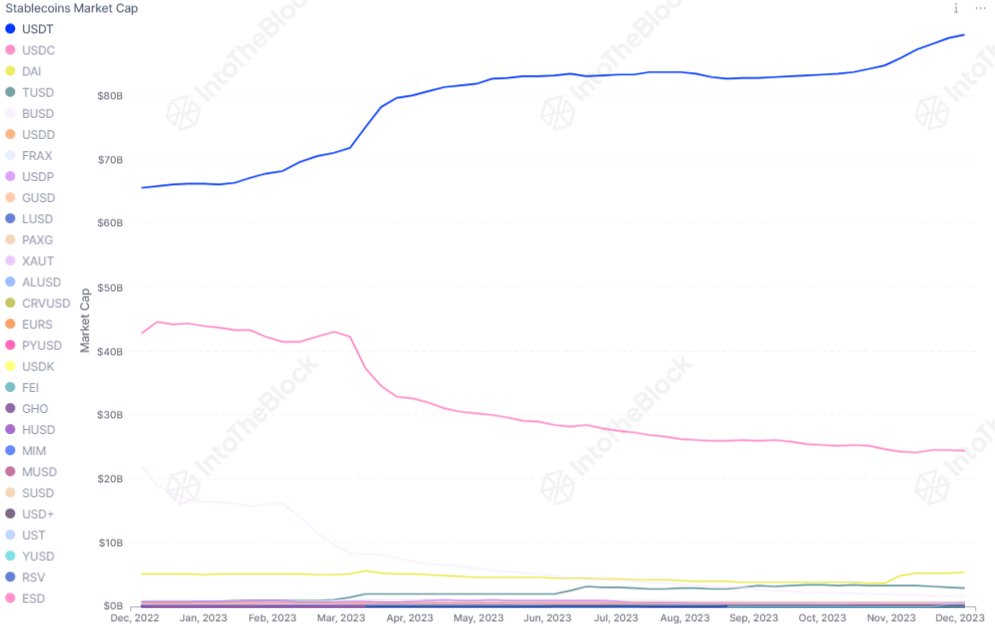

As the market intelligence platform IntoTheBlock pointed out, the largest stablecoin supply has only continued to grow recently. The chart below shows the trend in the market caps of the various stablecoins in the cryptocurrency sector over the past year.

As displayed in the above graph, Tether has observed an overall uptrend during the past year, while USD Coin (USDC), the next largest competitor, has observed outflows as its market cap has fallen.

The chart also puts into perspective how small the other stables are when compared to these two assets, making them perhaps insignificant for the wider market.

What relevance does a large stablecoin like Tether have for Bitcoin and other coins in the sector? The answer to that question lies in what the stablecoins represent.

Generally, investors make use of stables whenever they want to avoid the volatility associated with the other assets in the sector. The holders keeping their capital locked in these fiat-tied tokens usually plan to return towards the volatile side, however, as they would have gone for fiat itself if they wanted to keep away from cryptocurrency altogether.

When such investors finally move back towards coins like Bitcoin, they naturally put buying pressure on their prices. For this reason, the supply of stablecoins could be considered the “potential buying supply” for BTC and others.

There are two ways the USDT market cap grows. The first is an influx of fresh capital directly going to the asset, which is naturally a bullish development as it means the total capital in the sector goes up.

The second is through a swap from another coin like Bitcoin. In this case, the overall capital present in the sector wouldn’t change, as it’s just a reshuffling, but whatever asset is being sold in favor of the stablecoin would naturally see some decline.

The most bullish scenario for the market is, therefore, when both the BTC price and Tether market cap head up, as it implies, a fresh influx of capital is happening towards both the coins.

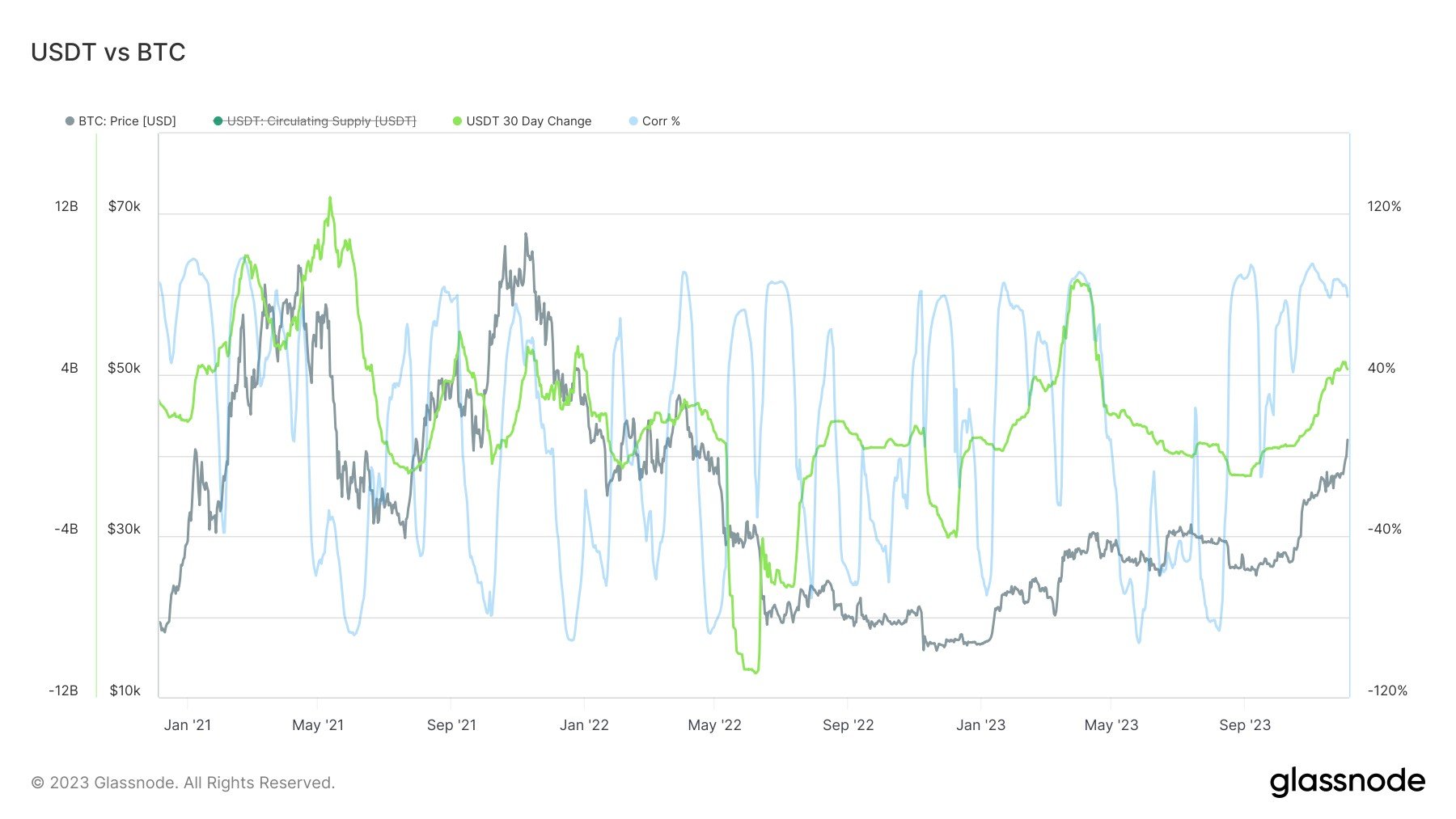

As analyst James V. Straten explained in a post on X, the correlation between the USDT market cap and BTC has almost hit 100% during this latest rally, as both have shot up.

The USDT market cap continuing to grow in these circumstances is certainly an optimistic sign for the current rally, as it means that all this dry powder that’s accumulating could potentially be deployed into Bitcoin should the surge slow down, helping extend the move further.

BTC Price

Bitcoin had breached the $44,000 mark earlier in the past day, but the asset has since seen some pullback as it’s now back around $43,800.

Bitcoin price hit 2023 high, so why are retail traders waiting on the sidelines?

Bitcoin price keeps going up, but retail traders are not piling in yet. Cointelegraph explores why.

Bitcoin price hit 2023 high, so why are retail traders waiting on the sidelines?

Bitcoin price keeps going up, but retail traders are not piling in yet. Cointelegraph explores why.

Tether Strikes Gold In Bitcoin: Profits Soar Above $1 Billion Amid Bull Market

Tether, known for its USDT stablecoin, has recently made headlines with its Bitcoin holdings soaring in value, generating a profit exceeding $1 billion.

Notably, this significant financial gain can be attributed to the stablecoin issuer’s approach of buying Bitcoin using a portion of its net profits. This move has proven highly lucrative amid the recent surge in BTC prices.

According to reporter Wu Blockchain, Tether’s holdings currently stand at 57,576 BTC, valued at an estimated $2.4 billion. These holdings were acquired at an average rate of $22,480 per BTC, reflecting a savvy investment strategy in the volatile crypto market.

Tether’s holdings of BTC currently have a profit of $1.1 billion (+85%). Tether currently holds a total of 57,576 BTC ($2.4B), with a cost of $22,480 per bitcoin. Among them, 53,492 BTC were reserved before March this year, and 4,083 BTC were purchased regularly using 15% of…

— Wu Blockchain (@WuBlockchain) December 5, 2023

The recent surge in Bitcoin’s value, which has surpassed the $41,000 mark, has been a major contributor to Tether’s significant profit margin, showcasing the potential of strategic crypto investments.

BTC Accumulation And Market Impact

The notable profit realized by Tether is the result of its investment strategy implemented in May 2023. The company began allocating up to 15% of its net realized operating profits towards Bitcoin purchases.

This strategic decision has not only diversified Tether’s investment portfolio but also aligned the company with Bitcoin’s potential as a “transformative” technology, according to Tether’s CTO Paolo Ardoino.

Paolo Ardoino noted that the choice to invest in Bitcoin was based on its decentralized nature, limited supply, and growing global adoption. Ardoino emphasized Bitcoin’s “resilience” as a “long-term store of value” and its potential to reshape business and lifestyle paradigms.

The Tether CTO stated:

Our investment in Bitcoin is not only a way to enhance the performance of our portfolio, but it is also a method of aligning ourselves with a transformative technology that has the potential to reshape the way we conduct business and live our lives.

As of the first quarter of 2023, Tether’s BTC reserves were valued at around $1.5 billion, a testament to the success of its Bitcoin accumulation strategy.

Bitcoin Rains Profits

The ongoing bull run in the crypto market has benefitted Tether and other prominent Bitcoin proponents. Max Keiser, a well-known trader and BTC supporter in the crypto community, recently revealed a significant surge in his Bitcoin holdings on X.

I’m up 20,000,000% since 2011 with my #Bitcoin https://t.co/nfj4AMSgmR

— Max Keiser (@maxkeiser) December 4, 2023

Keiser, who has been investing in Bitcoin since 2011, recognized the potential of BTC early on. While Keiser has not publicly disclosed the exact amount of BTC he owns, it’s clear that his early investment has paid off handsomely over the years.

Featured image from iStock, Chart from TradingView

Tether’s ‘new era for capital raises’ Bitfinex bond flops

The ALT2611 tokenized Tether bond from Bitfinex has only managed to raise 15% of its target two weeks after launch.

$3.1 Billion TUSD Stablecoin Shaky, Briefly Depegs—What’s Happening?

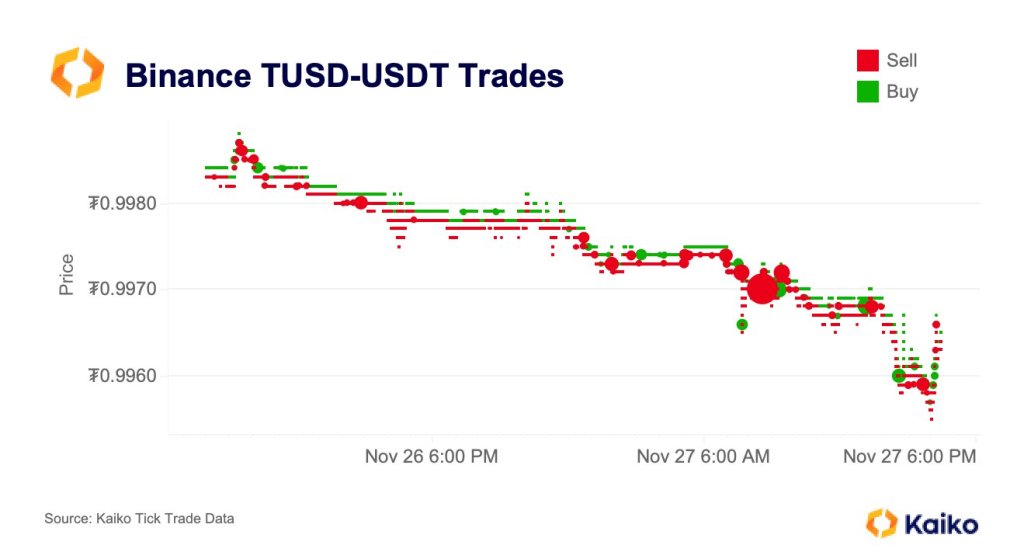

TrueUSD (TUSD), a stablecoin with a market cap exceeding $3.1 billion, appears “shaky” and briefly depegged on November 22, dropping to as low as $0.9976 before restoring its peg. The temporary depeg was attributed to a deluge of selling orders, according to Kaiko, a blockchain analytics firm.

TUSD Briefly Depegs, Large Selling Orders Rolling Through

Riyad Carey, a researcher at Kaiko, noted that large sell orders, including one for $3 million, triggered the turbulence that caused the stablecoin’s price to dip below the dollar peg. This brief deviation resulted in users who redeemed TUSD receiving less USD. Ideally, any redemption of a fiat-backed stablecoin should result in a 1:1 reception of the collateral.

The incident highlights the potential impact of large order blocks on liquidity and the potential for slippage. TUSD, theoretically backed by USD and issued by TrustToken, is popular in Binance, an exchange that delisted USDC and 2023.

Because of this limitation, TUSD is one of the most liquid stablecoins paired with leading coins like Bitcoin (BTC). However, despite its popularity, it trails Tether (USDT), the world’s largest stablecoin by market cap.

The TEURO Mystery

This depegging occurred a few weeks after tough security questions were raised about TUSD. In mid-October, the minter was forced to disclaim TEURO, a token deployed from the same address, suggesting that private keys associated with TUSD may have been compromised.

Curiously, funds tied to TEURO, the fake token, were also linked to the deployment of TCNY, another fake token unaffiliated with TrueUSD. Following these incidents, the community began raising questions about the security of the stablecoin and, more importantly, its underlying infrastructure.

This was expected, considering that a centralized entity issues TUSD though all transactions are on-chain.

Despite these challenges, TrueUSD maintains that its smart contracts are secure. The company emphasizes that it has gained ownership of the TUSD minting contract since the end of 2020.

In early May 2023, TUSD depegged, rising to as high as $1.20 on multiple exchanges, particularly on Binance. This was attributed to an increase in activity on the SUI farming pool.

Still, this is not the first time popular stablecoins have depegged. In March 2023, USDC and DAI, two of the world’s largest stablecoins, depegged, leading to widespread fear in the market. However, the team restored parity. Moreover, to improve confidence, stablecoin issuers regularly publish attestation reports.

Santiment Reveals Trigger Behind Bitcoin Rally: Will This Signal Reignite?

The on-chain analytics firm Santiment has explained how Tether (USD) and USD Coin (USDC) exchange inflows preceded the recent Bitcoin rally.

Bitcoin Rally May Restart If Stablecoins See Further Exchange Deposits

In a new post on X, Santiment discussed the trend in the supply of exchanges of various assets in the cryptocurrency sector. The “supply on exchanges” is an indicator that keeps track of the percentage of the total circulating supply of the given coin currently sitting in the wallets of all centralized exchanges.

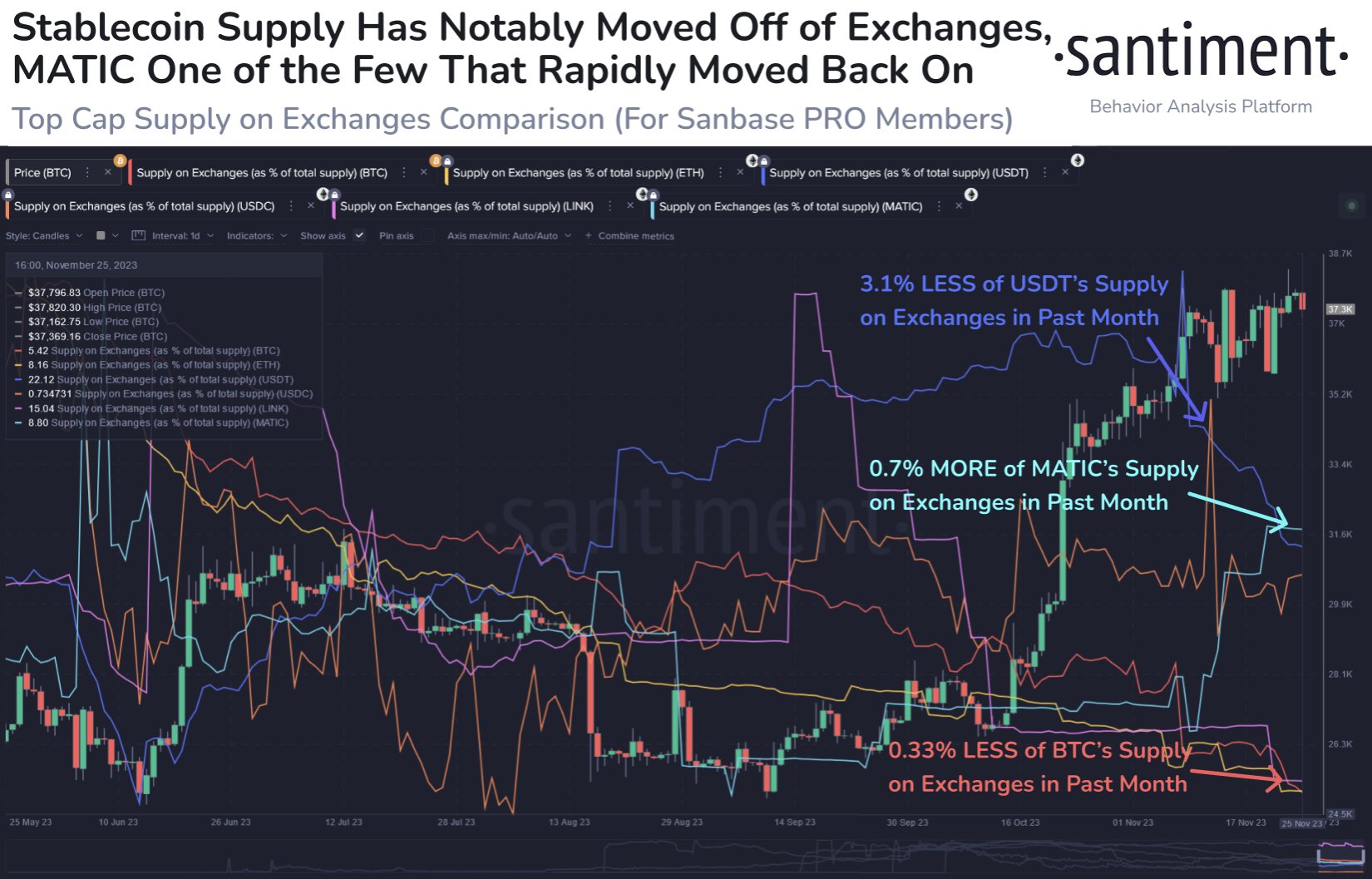

The below chart shows the trend in this indicator for Bitcoin (BTC), Ethereum (ETH), Chainlink (LINK), Polygon (MATIC), Tether (USDT), and USD Coin (USDC) over the past few months.

Depending on what type of asset it is, the significance of the supply on exchanges can differ. In the case of volatile assets like Bitcoin, the supply being stored on these platforms may be considered the available selling supply of the asset, as one of the main reasons investors may deposit their coins to the exchanges is for selling.

Thus, when this indicator trends up for these cryptocurrencies, it’s a potential sign that selling pressure in the sector is going up. The graph shows that Polygon has seen 0.7% of its supply move to exchanges in the past month, which could be a bearish sign for its price.

On the other hand, Bitcoin has observed withdrawals equivalent to 0.33% of its supply during the same period. Such a decline in the indicator can suggest that investors may participate in accumulation, as they are taking their coins off towards self-custodial wallets.

As for the stablecoins, an increase in the supply on exchanges also suggests that investors wish to swap these tokens. This selling of stables, though, actually provides a buying boost to the volatile side of the market, as the investors may use these assets to shift into Bitcoin and others.

As the chart shows, both Tether and USD Coin saw the exchange supply rise between August and October. More specifically, USDT and USDC observed 3.54% and 0.72% of their supplies moving into these platforms, respectively. “These transfers were the predecessor to the crypto-wide rally from late October to mid-November,” explains Santiment.

In the past month, however, 3.1% of the Tether supply has left these platforms, while the USD Coin has observed the metric move sideways. This would suggest that buying pressure has stopped rising, and the opposite may occur.

“After a cooldown, USDT & USDC returning to exchanges will be crucial to seeing market caps continuing to increase for a big final 5 weeks of 2023,” notes the analytics firm.

BTC Price

Bitcoin has registered some drawdown today as the asset’s price has now slipped under the $36,800 mark.

Rethinking Bitcoin ‘dominance’ at 51% — A misleading metric?

Bitcoin dominance is a largely redundant metric — if you believe BTC and crypto “altcoins” should be in the same category at all that is.

Tether Deposits of $1B With UK Financial Firm Are at Center of High Court Battle: FT

Tether deposited the funds with a subsidiary of investment bank Britannia Financial, according to the report, which cited filings made in the High Court.

Tether Freezes $225M Linked to Human Trafficking Syndicate Amid DOJ Investigation

Stablecoin issuer Tether has frozen $225 million worth of its stablecoin following an investigation by the U.S. Department of Justice (DOJ) into an international human trafficking syndicate in Southeast Asia.

Ethereum price hits 6-month high amid BlackRock spot ETF buzz, but where’s the retail demand?

ETH price finally polevaulted the $2,000 resistance, but will retail demand and network use support the current bullish momentum?

A Chat With Paolo Ardoino: What’s Behind The Bitcoin Price Rally, New Role As CEO, And Adoption

A year ago, our team sat down with Paolo Ardoino, CTO at crypto exchange Bitfinex, to talk about the Bitcoin price and the events that, for many, triggered the long crypto winter: the FTX collapse, and the downfall of major companies in the space.

Now, we sat down with Ardoino once again to talk about the underlying reasons fueling the current Bitcoin price rally, Bitfinex’s partnership with El Salvador, their ambition for the long term, and his new position as CEO at Tether, the company behind stablecoin USDT.

Ardoino draw a parallel between Bitcoin adoption and the legacy financial market, saying that adoption happens “slowly” but much more in the traditional system. In addition, he claims to be unbothered by his new role to focus more on the work. This is what he told us:

Q: What does your new position mean for you personally and for Bitfinex as a company? Will there be any changes for the users?

Paolo: No changes at all. I mean, I think on the Bitfinex side, again, my role didn’t change, and so things are progressing at the same pace, with the same attention to our user base. Same excitement for Bitcoin adoption and building Bitcoin infrastructure. So, absolutely no changes on the side. And also on the other side, I’ve been involved in strategy decisions for the last few years. I have always been excited to not just do development but also work on the strategy and the business side. So, also no changes there (…) Given the fact that I’ve been, anyway, leading the strategy made sense to just adjust the title on the Tether side as well.

For me. I mean, I’m the same guy that keeps working, keeps coding, keeps doing things that he likes all day long (…) So I like to think that for me, nothing changes. I’m not the type of guy that goes around with fanfare for title changes. I just like to work. I like the two companies that I’m working in. My passion is my work; it is my hobby.

Q: Having celebrated two years since the Bitcoin Law made BTC legal tender in El Salvador, do you believe it has significantly impacted the population? Are more people using Bitcoin now compared to 2021?

Paolo: So that’s a good question. So first of all, I am always carefully explaining that while we all want change, that is fast change can never be fast. People are historically by nature are reluctant to change. So I think it’s important that people keep that in mind because. I lived part of my time in Switzerland and I was talking to a few banks and local administrations in Switzerland and they were confirming that even for the credit cards and debit cards, it took 15 years to be widely used because people the first time they had the debit cards and credit cards in their pockets, and we are talking about Switzerland, that is basically the country of finance and banks, yet the adoption was so low because people didn’t trust that the piece of plastic that they have in their pockets. So with Bitcoin it’s the same, right?

So it’s about earning trust over time. I don’t think Bitcoiners need to push Bitcoin down people’s throats. I think Bitcoiners have to be patient, to explain things in a way that is simple to understand. Sometimes we bitcoiners are a bit too hard to comprehend or too hard to follow just because we like to use big words and complex explanations but that is not what we should be doing. We should be crafting education that is good for a kindergarten teacher or a taxi driver, school bus driver who is selling groceries. That is the real adoption takes time to understand, to get this type of feedback and to adapt the educational processes for that. So I’m sure that the Bitcoin adoption will come. There is a lot of new companies that I’m meeting this, that are moving here in El Salvador to help with the process, to provide further infrastructure, to invest themselves in education. So it’s just a process that takes time and sometimes you have mainstream media trying to demonize the work, pace, and speed at which things are moving here. But again, they are always forgetting that in traditional finance things always move even slower than these. So, I would say that Bitcoin adoption in Salvador is a success and will be even more successful in the next years.

Q: Could you share details about Bitfinex’s partnership with El Salvador? What initiatives are you currently working on, and what projects do you hope to develop in the coming years?

Paolo: We partnered with two educational projects. One is called Torogoz Dev, which focuses on leveraging the expertise of developers here to instruct and teach other developers. And so to create a community of developers that understand really well Bitcoin, the importance of that is that we want El Salvador to be able to grow its internal knowledge and internal infrastructure and software development base. It’s fine to bootstrap it with people coming from that side, but it’s more and more important to have knowledge and a strong base of developers drawing from the inside. And then also Mi Primer Bitcoin is another partnership that we achieved for a location that is more suitable for the broader public.

Then we obtained a securities license so that our goal there is to make sure that El Salvador will become the central financial hub for Central and South America. And I think it has all the chances to do that because the local administration, the president, the government are really forward looking. They seem to think things are on the right track to bring companies or have companies that can leverage securities here in El Salvador to raise capital for their companies, for their enterprises. And it’s quite unique because imagine the United States, if you are a small company that has around between $500,000 and $10 million of market cap, it’s almost impossible to get a loan or to raise capital publicly because then you would need to go to a bank. But the banks are extremely expensive and they will take huge fees and it would cost too much in lawyers for you. So people don’t do that, small companies don’t do that, but Bitfinex Securities aims to create a more democratic access for companies that want to raise capital through securities.

Q: Turning to Bitcoin’s current market activity, there’s a widespread belief that the potential approval of a spot Bitcoin ETF has bolstered the rally. What is your perspective on this? Do you sense a shift in the market dynamics?

Paolo: So I think that since 2022 after FTX, Bitcoin has been extremely oversold. So I think that slowly but steadily it has recovered over the last months. We don’t see much Bitcoin (supply) the sell side right now. Institutions are accumulating Bitcoin left and right. So that is also one of the reasons, in my opinion, why the price is going up. And even with the Bitcoin ETF even further, you can argue easily that that will drive Bitcoin adoption. So I think it’s normal to see the price moving also considering the Halving next year.

I think people started to realize that there is a big difference between Bitcoin and everything else, every other token. So people are going for something that maybe doesn’t do 100x in a few days as some random tokens, but is a certainty, right? Is something that is stable, has a strong user base, has strong fundamentals, and that cannot be said for all the other tokens. So that’s why we are seeing this growing excitement around Bitcoin.

As of this writing, Bitcoin trades at $36,400 after cooling off during the day. The cryptocurrency reached a yearly high north of $38,000.

Cover image from Unsplash, chart from Tradingview

Tether Reports $3.2B Excess Reserves, but Lags in Reducing Secured Loans

Tether reported $3.2 billion of excess reserves backing the value of its stablecoins including USDT, according to its Q3 attestation released Wednesday.

XRP Price Crosses $0.53 But These Factors Suggests Rally Is Far From Over

The XRP price saw an impressive run over the last day after news broke that the US Securities and Exchange Commission (SEC) was dropping its lawsuit against Ripple’s executives. This surge carried on into Friday as the altcoin’s price was able to clear the $0.53. Naturally, there has been a pullback from this price level, but whale transactions suggest that the rally may not be over.

Crypto Whales Flex Their Buying Power

In the last day, crypto whales have been showing their buying power as the price of cryptocurrencies such as XRP saw a recovery. The first indication of this was a number of large USDT transactions that were making their way toward centralized exchanges.

The first of these reported by whale tracker Whale Alert was $100 million in USDT transferred to Binance. Then two other transactions carrying the same amount of tokens followed suit, all headed for the Binance exchange as well. Another 50 million USDT would make their way to the exchange just a couple of hours later.

Then the minting of $1 billion USDT at the Tether Treasury took place as Thursday drew to a close. What followed was a number of transactions carrying USDT in 50 million tranches headed for Binance. The transactions continued into Friday, with the most recent being two hours old, at the time of this writing.

What This Means For XRP Price

The continuous transfer of stablecoins to centralized exchanges can often signal a willingness to purchase cryptocurrencies. Mostly, these purchases are in Bitcoin but the buying power tends to have a trickle-down effect. Meaning, that as the price of Bitcoin goes up, so will the XRP price.

In this case, if whales continue to buy and push the Bitcoin price past $30,000, then the XRP price is likely to follow suit and break the $0.55 resistance while at it. However, the XRP price also faces strong resistance as whales have taken to selling.

As Whale Alert shows, there were a number of large XRP transactions headed toward centralized exchanges. The most notable of these are the 32.3 million XRP worth $15.79 million at the time sent to the Bitso exchange, as well as the 31.1 million XRP worth $15.2 headed to the Bitstamp exchange.

These whale movements suggest a battle between bulls and bears as they struggle for dominance. But XRP price continues to show strength with 7.44% gains in the last 24 hours, and up 6.94% in the last seven days.

What is USDT? All About Tether Stablecoin Cryptocurrency

USDT, also known as Tether, has become an integral part of cryptocurrency markets since its launch in 2014. Pegged 1:1 to the US dollar, it is the most widely used stablecoin with a market capitalization of over $83 billion as of October 2023. But it is also controversial, with opaque reserves and questions around its long-term viability.

Here is an in-depth look at how USDT works, its importance in crypto, and the risks it presents.

What is USDT? Overview of Tether Stablecoin Cryptocurrency

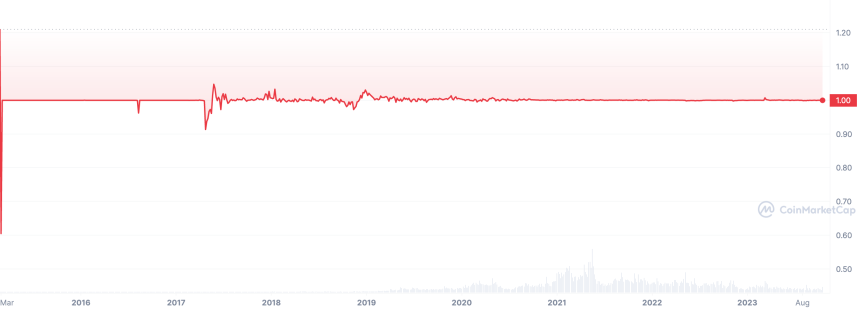

At its core, Tether functions as a stablecoin, meaning each token is backed by an equivalent amount of traditional fiat currency.

This peg to the dollar aims to minimize volatility compared to other cryptocurrencies like Bitcoin and Ethereum. USDT operates on different blockchains like Bitcoin, Ethereum, Tron and others, allowing it to be transferred seamlessly between different networks.

Crypto traders rely on USDT as a stable store of value when trading between different digital assets. It is also widely used on decentralized finance (DeFi) platforms for lending, borrowing, and making payments.

USDT price: $1

USDT Market Cap: ~$83 billion (as of October 2023)

Key Features of USDT Crypto

The key features that define Tether include:

- Pegged 1:1 to the US dollar – USDT aims to maintain parity with the dollar

- Operates on different blockchains – Enables transfer between networks

- Hedges against crypto volatility – Acts as a stable haven when markets are fluctuating

- Wide adoption – Used extensively in crypto trading and DeFi protocols

How Does USDT Maintain Its Dollar Peg?

According to Tether Limited, the company behind USDT, every token in circulation is backed 1:1 by their reserves, which include both traditional currency and cash equivalents. When buyers purchase USDT by depositing $1 per token, new tokens are issued while the dollars are held in reserves.

This mechanism theoretically allows users to redeem each USDT to USD. By allowing two-way convertibility between USDT and dollars, the supply can adjust to maintain the 1:1 parity.

However, Tether’s reserves have been shrouded in secrecy over the years, leading to allegations that the company does not hold sufficient dollar reserves to back all USDT in circulation. Tether settled a case with the New York Attorney General in 2021, agreeing to release periodic reports on its reserves.

So far, the redemptions have generally maintained the dollar peg. But questions linger over the breakdown of reserves and their adequacy as USDT supply has ballooned.

USDT Price Chart from CoinMarketCap

The Role and Importance of USDT in Crypto

Despite the opacity, USDT continues to play a hugely important role in cryptocurrency markets. It is one of the most widely traded crypto assets, with daily trading volumes in the billions of dollars against assets like Bitcoin.

Exchanges rely on stablecoin trading pairs like BTC/USDT to enable traders to hedge risk during times of high volatility.

USDT is also widely integrated into DeFi protocols like lending and borrowing platforms, decentralized exchanges, yield farms, and more. It provides stability in an otherwise volatile environment for decentralized finance.

The demand for USDT trading, transactions, and parking value in a stable asset continues to drive increasing adoption.

Future Outlook for Tether Stablecoin

Going forward, the biggest threat to USDT is the risk of losing its 1:1 dollar peg and collapsing in value if its reserves are inadequate. Tether also faces potential regulatory crackdowns from authorities who may threaten its viability. Competing stablecoins like USDC and BUSD are more transparent about reserves and could gain share.

However, USDT retains first-mover advantage and the network effects of wider integration in crypto infrastructure. It continues to maintain peg stability through redemptions so far. If Tether can provide greater transparency and embrace compliance, USDT may retain its dominant position for some time. But traders should exercise caution and understand the risks of relying too much on USDT long-term.

Despite controversies around reserves and regulation, Tether remains an integral cog in the crypto economy machine. But as the market matures, stablecoins built on greater transparency and compliance are likely to emerge as leaders.

How Does USDT Work?

There are a few key mechanisms that enable USDT to function as a stablecoin pegged to the US dollar:

Minting and Issuing New USDT

Tether mints new USDT when buyers deposit $1 per token with the company. The dollars are added to reserves, while an equivalent amount of USDT is issued on the blockchain ledger. This USDT enters circulation when transferred to the buyer’s wallet address. The minting helps adjust supply to match demand.

Sending and Receiving USDT Transactions

Once issued, USDT can be transacted between addresses on its supported blockchains like any other cryptocurrency. Senders can broadcast transactions and pay small network fees to send USDT to recipients’ wallet addresses. These peer-to-peer transactions are recorded transparently on public blockchain explorers.

Trading USDT on Exchanges and DeFi

USDT is listed as a trading pair on most major centralized crypto exchanges as well as decentralized exchanges. Traders can use USDT to buy and sell other cryptos like Bitcoin in a stable manner when volatility is high. In decentralized finance, USDT also serves as a stable currency for lending, borrowing, liquidity provision, and more.

Redeeming USDT for Dollars

In theory, USDT holders can redeem each token for exactly 1 US dollar from Tether Limited. This is made possible by the underlying reserves that back each token. Redemptions help maintain the 1:1 peg when USDT falls below $1 on exchanges. However, Tether reserves the right to delay or deny redemptions in some circumstances.

Pros and Cons of USDT Stablecoin

USDT provides stability amid crypto volatility but also carries risks:

Pros

- Avoid volatility by parking value in USDT

- Seamless transfers between blockchains

- Wide acceptance in crypto ecosystem

- Useful for decentralized trading and finance

Cons

- Opaque reserves raise viability concerns

- Regulatory crackdowns could threaten operations

- Reliant on Tether’s redemption policy to maintain peg

- Vulnerable to bank runs if reserves are inadequate

Tether pioneered stablecoins in crypto but transparent alternatives like USDC are emerging. Regulatory direction will play a key role in determining whether USDT maintains dominance long-term.

In conclusion, USDT remains indispensable for crypto trading and finance today. But prudent users should assess risks of relying extensively on USDT if its opaque operations and reserves raise too many questions about its sustainability. As the sector develops, the stability and transparency offered by its competitors could make them a safer bet over the coming years

USDT FAQ: Tether Frequently Asked Questions & Answers

What is USDT TRC20?

USDT TRC20 is the version of Tether stablecoin issued on the Tron blockchain as a TRC20 token. It allows faster transactions and lower fees compared to USDT on Ethereum. USDT ERC20 is available only on Ethereum.

What does USDT mean?

USDT stands for United States Dollar Tether. It is a cryptocurrency issued by Tether that is pegged 1:1 to the US dollar. Each USDT token is backed by $1 in reserves according to Tether Limited.

What is the difference between USDC and USDT?

USDC is issued by Circle while USDT is issued by Tether. USDC has greater transparency on reserves and audits compared to the more opaque USDT. However, USDT currently has wider adoption in crypto trading and DeFi applications.

What is Tether USDT?

Tether USDT is a stablecoin cryptocurrency whose value is pegged to the US dollar on a 1:1 basis. It allows crypto traders and users to avoid volatility by storing value in USDT tokens backed by equivalent USD reserves.

What does USDT stand for?

USDT stands for United States Dollar Tether. It is the ticker symbol used to designate the Tether stablecoin whose value is pegged to the US dollar.

Is USDT a cryptocurrency?

Yes, USDT is a cryptocurrency token issued on various blockchains. However, unlike volatile cryptos, USDT is a stablecoin designed to have a stable value through US dollar reserves.

What is the USDT token contract address?

The USDT token address allows users to verify USDT transactions on block explorers. For example, the USDT Ethereum contract address is 0xdac17f958d2ee523a2206206994597c13d831ec7.

What is the current price of USDT?

The price of USDT is pegged to $1.00 USD. It aims to maintain parity with the dollar through Tether Limited’s dollar reserves that back each USDT token 1:1.

What is USDT crypto used for?

USDT provides stability versus volatile crypto assets. It is used for trading, payments, earning yield, loans, and other financial activities where dollar-pegged stability is preferred.

Where can I buy USDT coins?

USDT can be purchased on most major crypto exchanges like Binance, Coinbase, Kraken, KuCoin etc. You can trade dollars or cryptos like BTC for USDT tokens on these centralized platforms.

Is it safe to invest in USDT stablecoin?

USDT does carry risks related to transparency and reserves that should be considered. Stablecoins like USDC with more transparency could potentially be safer long-term investments.

Tether freezes $873K USDT linked to terrorist activity in Ukraine, Israel

The stablecoin issuer freezes addresses containing $873,000 USDT linked to illicit activity in Israel and Ukraine.

Tether Continues To Flow Into Exchanges: Why This Is Bullish For Bitcoin

Tether (USDT) has continued to move into exchanges recently. Here’s why this can be a positive development for Bitcoin.

Tether Supply On Exchanges Is Now Highest In 7 Months

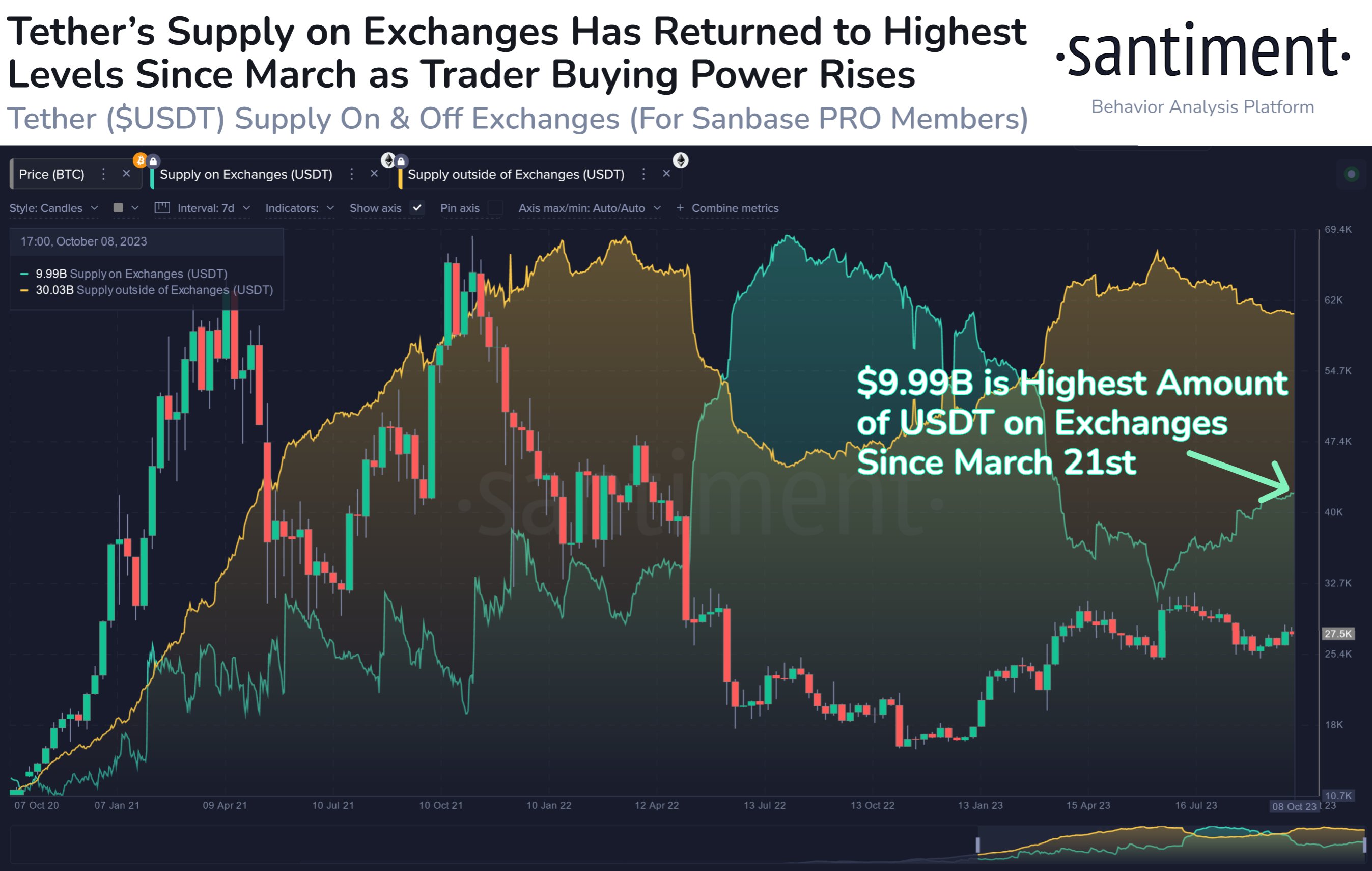

According to data from the on-chain analytics firm Santiment, $9.99 billion worth of USDT is now on exchanges. The indicator of relevance here is the “supply on exchanges,” which keeps track of the total amount of a cryptocurrency being stored in all centralized exchanges’ wallets.

The interpretation of this metric can differ depending on the type of asset that’s being discussed. In the case of Bitcoin, for example, the exchange reserve may be considered a measure of the potential selling pressure, as one of the reasons investors may deposit the coin is for selling-related purposes.

Thus, the cryptocurrency’s supply on exchanges going up could be a sign that selling is increasing in the sector, and hence, the asset’s price may be heading towards a bearish outcome.

In the context of the current discussion, BTC’s supply on exchanges isn’t the one of interest, but rather the metric for Tether is. USDT is a popular stablecoin (the largest one based on market cap) that always has its value pegged to the US Dollar.

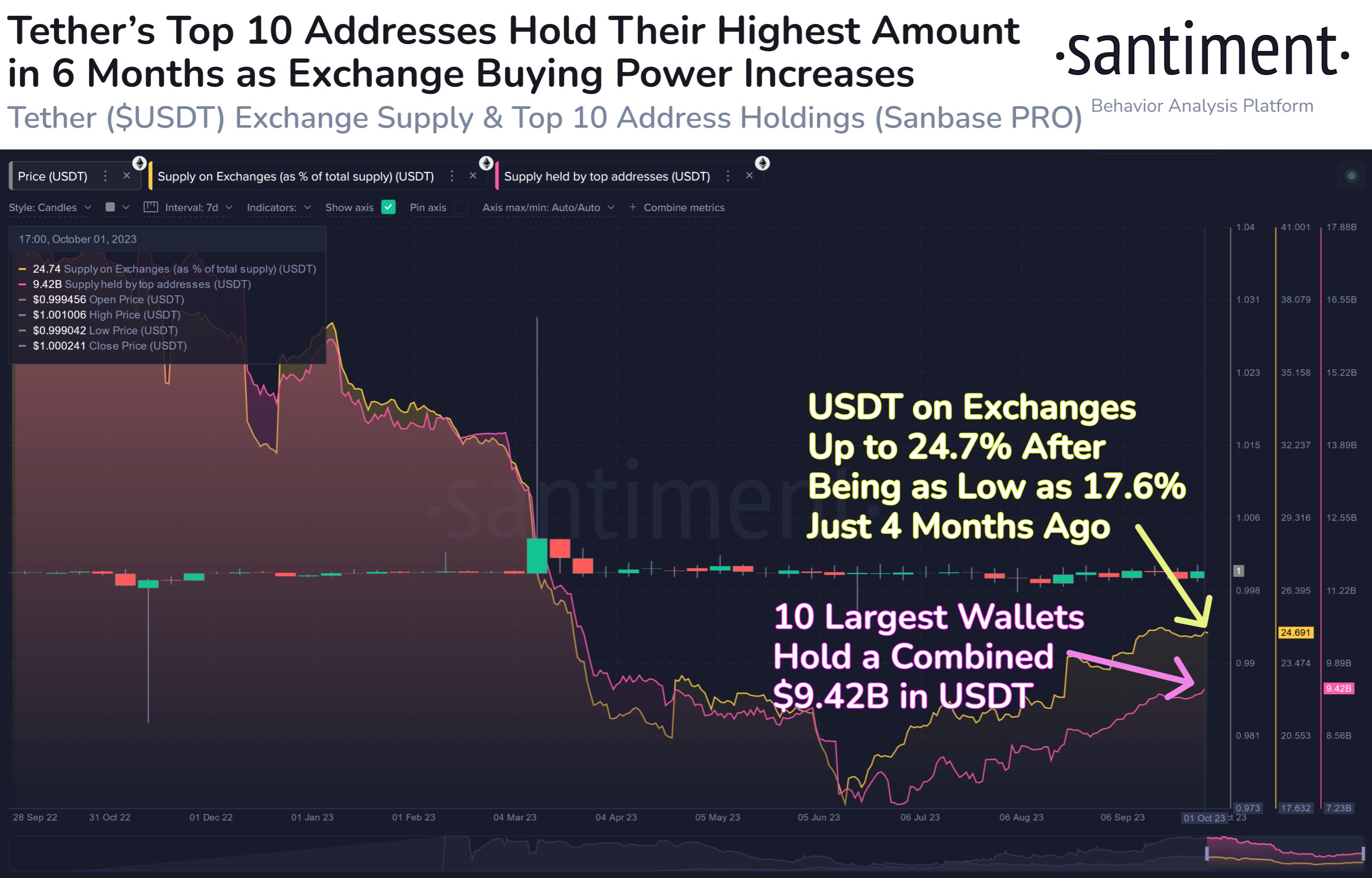

Here is a chart that shows the trend in the supply of exchanges for Tether over the past few years:

Usually, an investor may want to hold their capital as a stablecoin like USDT to keep it away from the volatility associated with other assets in the cryptocurrency sector.

However, many such stablecoin holders use these assets as a temporary safe haven, as they eventually wish to return to the volatile market.

When these investors finally find the time to jump back into cryptocurrencies like Bitcoin, they swap their USDT for them. These traders may use exchanges to make this shift, so a rise in the supply on exchanges of the stablecoin can be a sign that investors are looking to swap into volatile coins.

Such buying using Tether can naturally cause a bullish effect on the prices of BTC and others. So, in this way, the exchange supply of the stablecoin can be considered the opposite of the metric for BTC.

The above graph shows that the indicator’s value has increased in the last few weeks. “The $9.99B worth of Tether sitting on exchanges is the highest level of buying power for crypto’s top stablecoin in approximately seven months,” notes Santiment.

It should be kept in mind that the rise in the Tether supply on exchanges only implies an increase in the available dry powder. Whether Bitcoin would benefit from a boost depends on whether this dry powder is used to buy the asset or not.

BTC Price

Bitcoin has declined in the past couple of days as the asset now trades around the $27,600 level.

SBF’s Alameda minted $38B USDT to profit off arbitrage trading: Coinbase director

Coinbase director Conor Grogan has flagged on chain data that highlights massive USDT mints ordered by Sam Bankman-Fried’s Alameda Research in 2021.

Can Bitcoin Continue Its Run? These Factors Could Suggest So

Bitcoin has observed a pullback in the past day, but these factors may imply that the cryptocurrency’s rally can continue.

These Factors Could Suggest A Bullish Outcome For Bitcoin

A couple of days back, Bitcoin had started observing some sharp upward momentum, and by yesterday, the cryptocurrency had managed to breach the $28,500 level. In the past day, however, the asset has registered a decline, falling below the $27,500 mark.

While it’s uncertain whether the rally is over or not, some signs can be optimistic for the investors. As explained by the on-chain analytics firm Santiment, two positive developments have occurred related to Tether (USDT), the largest stablecoin in the cryptocurrency sector.

The first indicator of relevance here is the “USDT supply on exchanges,” which measures the percentage of the total circulating supply of the stablecoin in the wallets of all centralized exchanges.

Here is a chart that shows the trend in this Tether metric over the past year:

Usually, investors store their capital in the form of a stablecoin like USDT whenever they want to avoid the volatility associated with the other assets in the sector. Such investors generally plan to go back into the volatile side of the market eventually, though, as they would have instead gone for fiat if they didn’t.

Once these holders feel the time is right to dive into Bitcoin and other coins, they trade their stables for their desired cryptocurrencies. Naturally, such a shift provides a bullish boost to whatever assets they buy using their stablecoins.

Investors generally use exchanges for conversions like these, so the current supply on these platforms can be considered potential dry powder ready to be deployed into BTC and others.

The graph shows that the Tether supply on exchanges had plunged to a low of 17.6% a few months back, implying that the available buying pressure from the stablecoin had run out.

Interestingly, this low in June had occurred in the leadup to a sharp Bitcoin rally, implying that the plunge in the exchange reserve of the stablecoin was, in fact, because of it being converted into the asset, thus providing the fuel for the surge. However, the rally back then couldn’t be sustained, as BTC eventually faced a struggle.

In the months since this low, USDT reserves have slowly built back up on exchanges, as 24.7% of the stablecoin’s supply is now sitting on these platforms. Unlike that previous rally, it would appear that this latest surge has a store of potential buying power available that may be deployed at any time.

In the chart, Santiment has also attached the data for another metric: the combined supply of the ten largest Tether whales. It would appear that these humongous investors have also increased their holdings during this period, implying that they also carry significant dry powder now.

It now remains to be seen whether this stored-up USDT will be converted into the cryptocurrency to provide support to the surge in the coming days or not.

BTC Price

At the time of writing, Bitcoin is trading at around $27,400, up 5% in the last week.