Vitalik Buterin reveals X account hack was caused by SIM-swap attack

The Ethereum co-founder has regained control of his T-Mobile account, confirming that a SIM-swap attack resulted in the hack of his X account.

Hack of Vitalik Buterin’s X Account Leads to $691K Stolen

Hackers who took control of Ethereum founder Vitalik Buterin’s X account have stolen more than $691,000 after posting a malicious phishing link that gained access to people’s wallets.

Financial privacy and regulation can co-exist with ZK proofs — Vitalik Buterin

A new paper co-authored by Ethereum’s Vitalik Buterin highlights the use of zero-knowledge proofs as a tool for regulatory compliance and on-chain privacy.

The Protocol: Ethereum Learns of Potential Defector as ‘Supreme Court’ Mooted

What is a blockchain “sequencer?” Here’s why you need to know

Ethereum’s Vitalik Buterin Argues for Blockchain ‘Privacy Pools’ to Weed Out Criminals

The paper argues for “privacy pools,” a blockchain tech feature that would enhance the privacy of user’s transactions while also distinguishing criminal activity from innocent funds.

Vitalik Buterin on fix for Ethereum centralization — make running nodes easier

Ethereum co-founder Vitalik Buterin says node centralization is one of Ethereum’s main challenges but the perfect solution may not come for another 20 years.

No Vitalik, No Problem: Whale Sells Ethereum (ETH) For Maker (MKR)

Less than a week after Vitalik Buterin, one of the co-founders of Ethereum, sold his Maker (MKR) stash for ETH, one crypto whale has done the opposite. On-chain data on September 4 shows that one Ethereum holder sold 694 ETH, worth roughly $1.13 million when writing, for 1,010 MKR. At the time of the swap, MKR was changing hands at $1,122.

Whale Swaps ETH For MKR

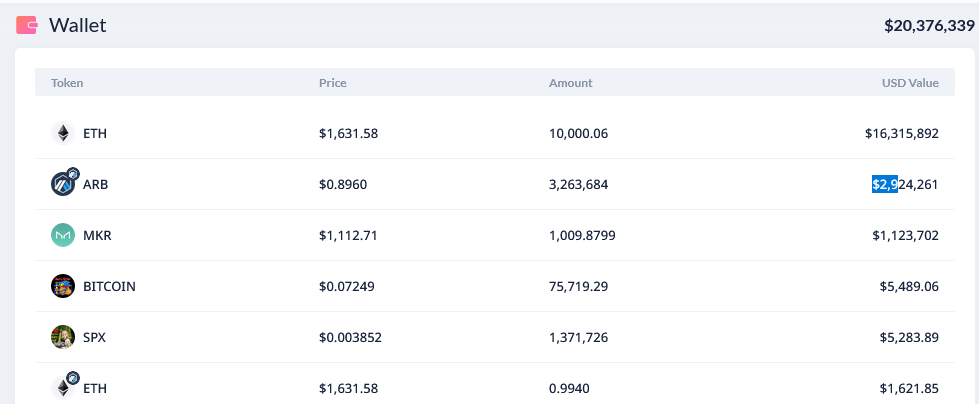

As of September 4, the address, “0x3737,” had over $20.37 million worth of assets. While the whale trades against Vitalik and doubles down on MKR, zooming in on the address’s portfolio shows that the largest holding is ETH.

The address holds 10,000 ETH worth $16.3 million at spot rates, representing over 75% of the total portfolio. Meanwhile, some of his other major holdings include Arbitrum (ARB), worth $2.9 million, and MKR, worth $1.1 million.

MKR, the token issued by MakerDAO, the decentralized autonomous organization (DAO) that controls the minting of DAI, a stablecoin on Ethereum, has been ripping higher in the last few months.

MKR plays a key role in stabilizing DAO and is used as a last resort. Holders participate in governance, voting on proposals that best stabilize the algorithmic stablecoin, deciding collateral types accepted, stability fee adjustments, and others.

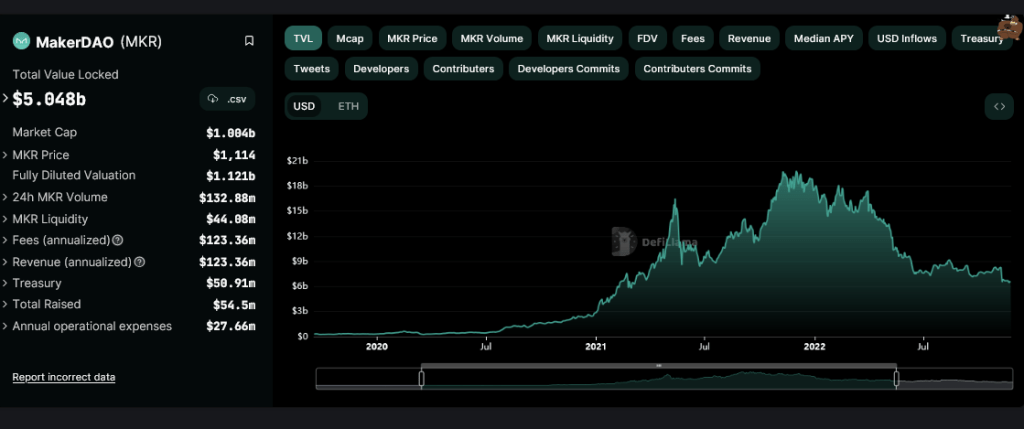

From June, MKR has more than doubled, rising 125% to peak at around $1,300 in early August. It is now trading at over $1,100, up 13% from August lows.

Maker Presents Endgame

The token’s surge has been attributed to multiple factors, specifically the release of the “Endgame” roadmap. Under this plan, MakerDAO plans to, among other things, release their blockchain, rebrand, and introduce two more tokens.

This move is significant because MakerDAO is among the first decentralized finance (DeFi) protocols. According to DeFiLlama data, the protocol has a total value locked (TVL) of over $5 billion. It is the largest decentralized money market in the world.

Meanwhile, DAI, its algorithmic yield-earning stablecoin, has been stable recently and is the largest in Ethereum. At press time, DAI had a market cap of $5.3 billion, perched at 12th on the leaderboard. At this pace, DAI is the third-largest stablecoin after USDT and USDC.

Vitalik Buterin, despite the stellar performance of MKR relative to the broader crypto market, liquidated $580,000 worth of MKR after MakerDAO’s co-founder, Rune Christensen, said it was considering launching a new blockchain bridging to Ethereum that’s based on Solana’s code. The new blockchain, dubbed NewChain, is part of MakerDAO’s roadmap, “Endgame”.

The Protocol: Friend.tech Fades as Crypto Craze, but Ethereum Is Scaling

This week in blockchain tech: Polygon’s new “chain development kit,” Farcaster’s move to Optimism, Shibarium’s return and Interlay’s new Bitcoin layer-2 network, and Pancake Swap expands to Consensys’s Linea.

Is Vitalik Buterin Selling His ETH Stash? Let’s Take A Look At His Transactions

Ethereum founder Vitalik Buterin has multiple public wallets that carry a significant amount of ETH and these wallets are religiously tracked by on-chain sleuths. This is why whenever the founder makes a withdrawal, the destination of the ETH being sent is closely followed and recent reports reveal that Buterin has been sending significant amounts of ETH out to different wallets.

Two Vitalik Buterin Transactions Spark Speculations

In the early hours of Monday, the on-chain data tracking platform PeckShieldAlert took to X (formerly Twitter) to share some interesting movements that have been taking place in wallets said to belong to Buterin. This time around, the tracker flagged a single transaction carrying 3,000 ETH.

The 3,000 ETH, worth roughly $4.95 million at the time of the transfer was sent out from the well-known Vitalik.eth wallet to another wallet identified publicly as Vb2. This brought the latter’s balance to 3,017 ETH, worth a little over $4.95 million.

#PeckShieldAlert vitalik.eth labeled-address has transferred 3K $ETH (~$4.95M) to Vb 2 labeled-address pic.twitter.com/f8ETU42TrD

— PeckShieldAlert (@PeckShieldAlert) August 28, 2023

The speculations of whether the Ethereum founder is offloading some of his stash come in relation to an earlier transaction made by him. The transaction which was also reported by PeckShield alert showed that Buterin had sent 600 ETH worth around $1 million at the time to the Coinbase crypto exchange.

#PeckShieldAlert vitalik.eth labeled-address has transferred 3K $ETH (~$4.95M) to Vb 2 labeled-address pic.twitter.com/f8ETU42TrD

— PeckShieldAlert (@PeckShieldAlert) August 28, 2023

For many, however, this transaction was insignificant in the grand scheme of things and did not lead to a cause for alarm. The most recent transaction also follows in the same vein since it looks like the billionaire founder is just redistributing his assets to other wallets.

Is This Why ETH’s Price Is Struggling?

So far, there is no indication that Buterin’s wallet movements have anything to do with the ETH price decline. As already mentioned above, the ETH liquidity is too deep for a $1 million sell to trigger such a decline, which would suggest something else is behind the coin’s struggles.

The most obvious factor is that the broader crypto market has been taking a hit and ETH has not been left out. Bitcoin fell from $28,000 to below $26,000, taking the majority of the market down with it. As a result, investor sentiment swung far into the negative which is preventing new money from coming into the market.

With the bear market waxing strong, there could be more decline to come for the digital asset until investor sentiment improves and the market starts to recover once more. For now, ETH is still ranging above $1,640 as bears and bulls are locked in a tug-of-war for control.

Ethereum co-founder Vitalik Buterin moves $1M of ETH to Coinbase

Onchain data shows that Ethereum co-founder Vitalik Buterin moved 600 ETH to U.S. exchange Coinbase amid ongoing market woes.

Ethereum Co-Founder Vitalik Buterin Sends $1M ETH to Coinbase

Vitalik Buterin transferred over $1 million worth of ether to crypto exchange Coinbase on Monday.

Ethereum Co-Founder Vitalik Buterin Sends $1M ETH to Coinbase

Vitalik Buterin transferred over $1 million worth of ether to crypto exchange Coinbase on Monday.

Vitalik Buterin Has Thoughts on Social Media Fact Checking

Vitalik Buterin calls X’s Community Notes an example of ‘crypto values’

The Ethereum co-founder said the algorithm behind X’s tool to rate content as helpful and provide context was “surprisingly close to satisfying the ideal of credible neutrality.”

Crypto and the Real Meaning of ‘Radicalism’

The right-wing economics that shaped crypto doesn’t determine its future, argues a new book by Joshua Dávila – A.K.A. The Blockchain Socialist.

Ethereum’s Buterin Expresses Concerns Over Sam Altman’s Worldcoin

Worldcoin’s identity system, “Proof-of-Personhood,” faces issues with privacy, accessibility, centralization, and security, according to Buterin.

Worldcoin token launch sparks response from Vitalik Buterin

The Ethereum co-founder released a long-form response to the launch of Worldcoin’s decentralized human identity verification system.

Vitalik Buterin shares account abstraction challenges in Ethereum: EthCC

Vitalik Buterin explained how an account abstraction extension called “paymasters” can allow users to pay for gas fees using “whatever coins that they are transferring.”

Vitalik Buterin wants Bitcoin to experiment with layer2 solutions just like Ethereum

Buterin also lauded the recent rise of Ordinals and believes it has brought the builder culture back to the Bitcoin ecosystem.