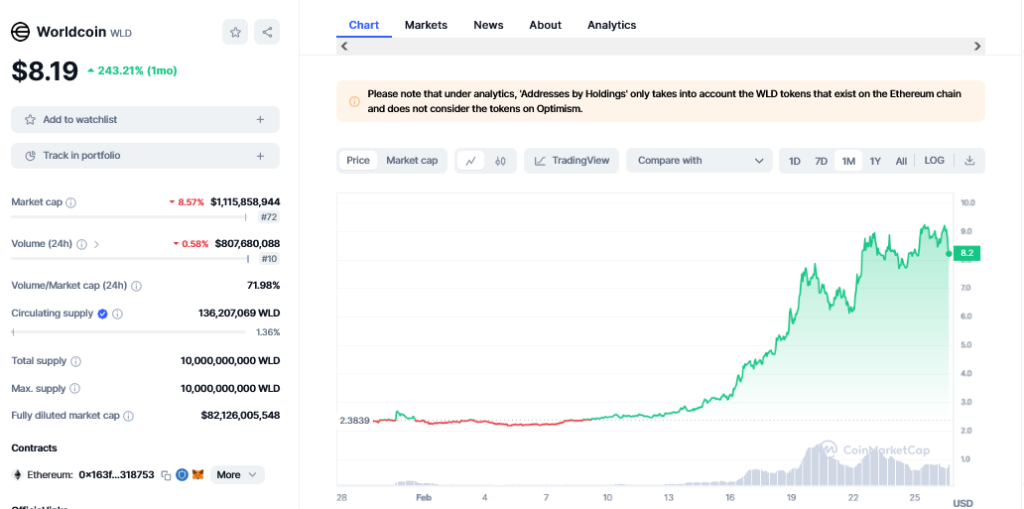

Worldcoin (WLD) has seen its value plummet by nearly 9% in just 24 hours, with the price settling at around $5.20. This decline aligns with a critical analysis issued by DeFi^2 (@DefiSquared), the current top trader on the crypt exchange Bybit, who has raised concerns about the potential for substantial inflationary pressures and misleading marketing associated with Worldcoin.

Notably, the WLD plunge comes just after OpenAI, the creator of ChatGPT, announced on Monday its plans to unveil a cutting-edge AI model named GPT-4o. This advanced model boasts the ability to engage in lifelike voice conversations and seamlessly interact across text and images. Worldcoin is usually a beneficiary of OpenAI announcements, but this time WLD price plunged.

Why Worldcoin Is Plummeting

In his analysis shared on X, DeFi^2 expounded on the mechanics behind the rapid devaluation of Worldcoin, emphasizing that the token is suffering from significant daily depreciation due to both emissions and strategic sales maneuvers by the Worldcoin Foundation.

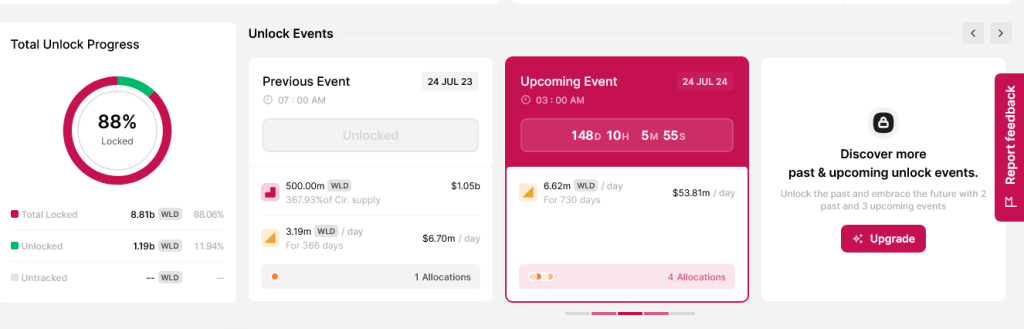

Specifically, the token’s value is deteriorating at a rate of 0.6% each day, driven by the emissions related to grant and operator claims. These tokens, as per DeFi^2’s observation of on-chain analytics, are predominantly sold off almost immediately upon issuance, adding to the downward pressure on Worldcoin’s price.

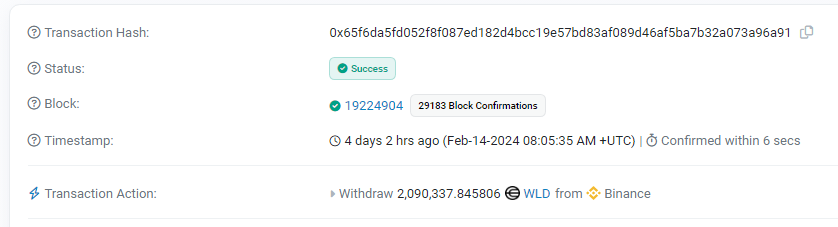

Adding to the supply concerns, the Worldcoin Foundation recently declared its intention to offload $200 million worth of Worldcoin to trading firms. This move will effectively increase the circulating supply by an additional 18%. DeFi^2 criticized this decision, pointing out that the tokens, misleadingly attributed to a “Community” allocation, are being sold at a discount to entities that may not prioritize the broader community’s interests, potentially diluting the value for existing holders.

The most critical issue highlighted by DeFi^2, however, pertains to the near future, when unlocks for venture capital and team-related tokens are set to begin. He forecasts that in just 70 days, the supply of Worldcoin will start to inflate at an alarming rate of 4% per day due to these unlocks combined with ongoing emissions. This scenario could unleash nearly $50 million worth of sell pressure daily, profoundly impacting the token’s market price and stability.

DeFi^2’s analysis did not shy away from addressing the perceived misconceptions surrounding Worldcoin’s affiliation with notable tech personalities and organizations. He clarified that Sam Altman, known for his role with OpenAI, has no active involvement with Worldcoin, which operates as a completely separate entity. This point addresses a common misconception that potentially misled investors about the nature and backing of the token.

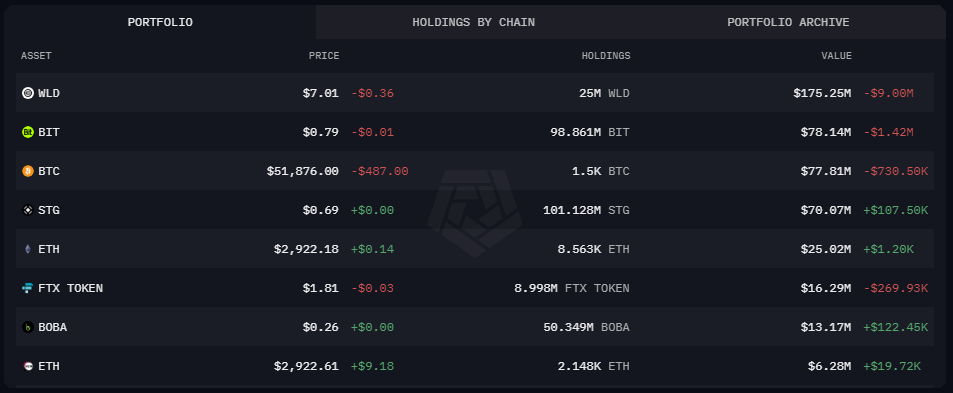

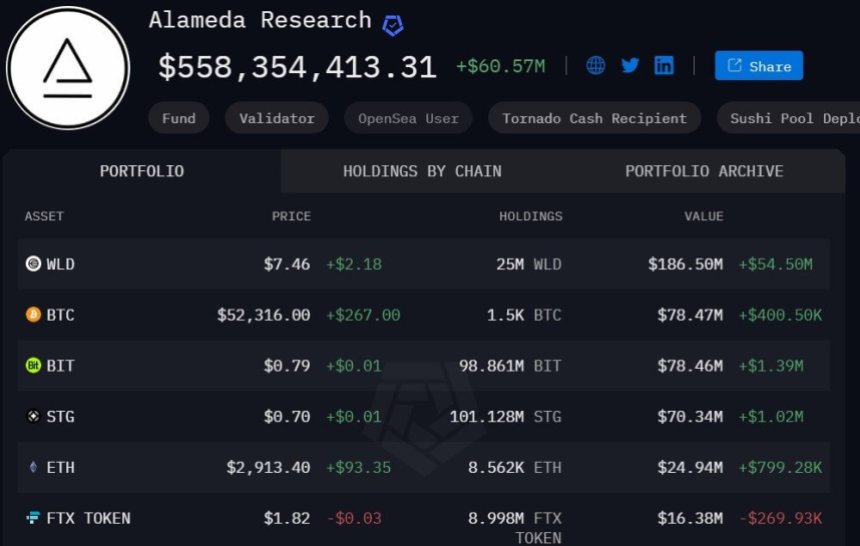

Moreover, DeFi^2 drew parallels between Worldcoin’s tokenomics and what he describes as “predatory” economic models that are engineered to disproportionately benefit early investors and insiders at the expense of general retail investors. He noted that similar strategies had been used in the past in the crypto industry, where the manipulation of token supply and market conditions facilitated significant gains for insiders while leaving regular investors exposed to heightened risks and losses.

“Worldcoin realistically might become the greatest transfer of wealth of this entire cycle. Unfortunately, this wealth transfer isn’t in the form of universal basic income as their mission suggests, but instead to the pockets of the team and insiders,” DeFi^2 stated. He added that “the manipulative low float / high FDV design is straight out of the SBF playbook, and directly enriches insiders as they hedge their locked allocations at high valuations pre-unlock via perps / OTC; yet retail somehow sadly still think they’re beating the system trying to push the price up.”

As the crypto community digests DeFi^2’s stark warnings, the immediate reaction has been a surge in trading activity to $666 million (up 104% in the last 24 hours), with investors and speculators likely reassessing their positions in Worldcoin in light of these revelations. At press time, WLD traded at $5.24.